Highlights

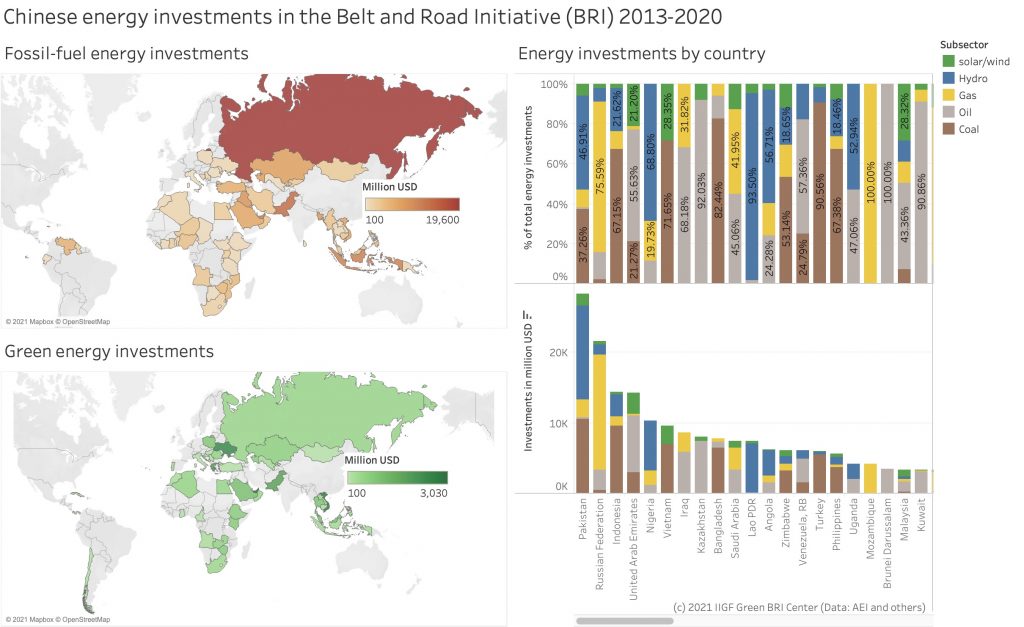

Renewable energy investments (solar, wind, hydro) constitute majority of Chinese overseas energy investments – increasing their share from 38% in 2019 to 57% in 2020 – amid a total decrease of BRI investments of 54%

Key findings

- Chinese overseas investments into countries of the BRI were about US$47 billion in 2020, about 54% less than in 2019

- Several countries, such as Vietnam, saw an increase in BRI investments in 2020 compared to 2019.

- Countries of the Belt and Road Initiative (BRI) were less affected by the slow-down of Chinese overseas investments compared to non-BRI countries: Chinese investments in non-BRI countries dropped by 70% compared to 2019 to about US$17 billion in 2020.

- BRI investments slowed in all sectors, except logistics.

- Renewable energy investments (solar, wind, hydro) for the first time were the majority of Chinese overseas energy investments – increasing their share from 38% in 2019 to 57% in 2020

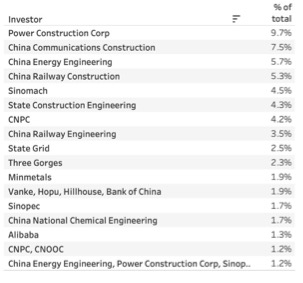

- SOEs are the dominant partner for investments in the BRI – with only Alibaba as a non-SOE being a major investment partner in 2020

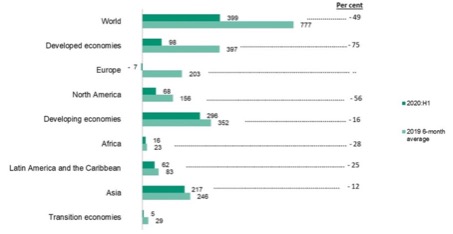

- China’s BRI investments in 2020 declined faster than global FDI flows, which were expected to decline by 16% into emerging economies

Key recommendations

- For 2021, we expect Chinese BRI investments to focus on strategic assets (e.g. ports) as well as regional transport infrastructure investments in Asian countries to utilize the new trade agreement RCEP.

- For 2021, we see less demand for Chinese overseas energy investments due to declining GDPs and thus declining electricity demand.

- For 2021, we see opportunities in investing in more bankable smaller projects that are quicker to implement (e.g. solar, wind) and an opportunity to cut losses in large and often loss-making projects (e.g. coal).

- For 2021, tripartite cooperation and tripartite financing of projects could offer more opportunities for BRI countries and Chinese stakeholders.

- To accelerate tripartite cooperation, Chinese investors could benefit from further improving their alignment with international environmental standards, for example in line with the “Green Development Guidance for BRI Projects” published in December 2020 by the BRI Green Development Coalition BRIGC and backed by relevant Chinese Ministries.

Chinese investments in the Belt and Road Initiative 2020

This report analyses the 2020 trends in Chinese investments in the Belt and Road Initiative (BRI). It analyzes overall trends, regional and country investments, investments trends in different sectors, such as energy and renewable energy, transport, and provides and overview of the major players.

The report also compares China’s investments in the BRI with global foreign direct investment trends.

The report finishes with 5 key recommendations:

- Focus on projects that are financially sustainable and cut losses in non-profitable projects now

- Support partner-countries and partner businesses in dealing with (sovereign) debt-repayment of already invested BRI projects, e.g. through debt-for-nature swaps.

- Increase international cooperation for BRI projects to allow existing and useful projects to go ahead also in difficult times.

- Increase use of common environmental and social standards in project evaluation (e.g. environmental impact assessment EIA) and for environmental and social risk management (ESMS)

- Develop socially and environmentally conscious phase-out strategies for non-performing investments

2020 overall investment trends in the Belt and Road Initiative (BRI)

Data for Chinese investments in the 138 countries of the Belt and Road Initiative show that overall investments in the BRI in 2020 were about US$47 billion. This is equal to a decline of 54% to investments in 2019 and about US$78 billion less than in the peak year of BRI investments 2015. Possibly due to the COVID-19 pandemic, BRI investments were at its slowest pace since China’s overseas investment strategy was coined “Belt and Road Initiative” in 2013.

| About the data On December 31, 2020, the Chinese Ministry of Commerce (MOFCOM) released its investment data for “China’s investments with countries along the “Belt and Road”” covering the period January to November 2020. According to these data, Chinese enterprises invested RMB110.7 billion (about US$17 billion) in non-financial direct investments in countries “along the Belt and Road”. The MOFCOM data focus on 57 countries that are “along the Belt and Road” – meaning on a corridor from China to Europe including South Asia. For this report, the definition of BRI countries includes 138 countries that had signed a cooperation agreement with China to work under the framework of the Belt and Road Initiative by 2020. MOFCOM also provides a database on BRI investment projects. As the data in this database include fewer projects that were reported in international media, we used the MOFCOM database to expand other databases available. Our data use a mix of various data source including confirmed media reports on investments, Chinese databases and it is based on the China Investment Tracker. |

Compared to non-BRI countries, the decline of Chinese investments was more moderate in BRI countries: The decline of Chinese investments in BRI countries was about 54%, whereas countries that have not signed MoUs to work with China under the BRI framework saw a decline of 70% of Chinese investments. The decline for the whole year is more pronounced than we expected in the brief of BRI investments for the first half of 2020 (the decline in the first 6 months of 2020 was “only” 49% compared to the first months of 2019).

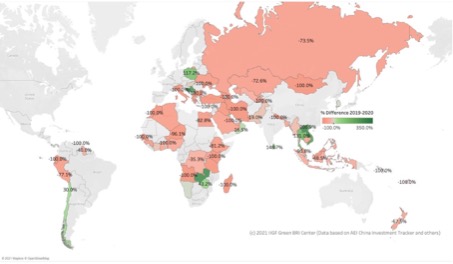

Regional and country analysis of Chinese BRI investments

BRI investments were not evenly distributed among all regions. Asia continued to receive the largest share of Chinese BRI investments (about 54% in 2020), while Africa received about 27% of BRI investments. Investments into European BRI countries were least affected by COVID-19, declining by 36% only (BRI investments in North America only include investments into Mexico, which tend to be low and thus are not as volatile). In contrast, investments into African regions (Sub-Saharan Africa, Arab and Middle East) were most heavily impacted by COVID-19 and declined by 69% and 66% respectively from 2019 to 2020.

Among the BRI countries, investments were spread broadly across the continents. The countries that received most investments were Vietnam, Indonesia, Pakistan and Chile. Particularly Vietnam saw a strong increase of Chinese investments – an increase of over 200% compared to 2019, possibly driven by near-shoring to avoid American sanctions. Other BRI countries that saw increases of Chinese investments despite the COVID-19 pandemic include Poland, Bulgaria, Serbia, Zimbabwe, Zambia and Chile, as well as Thailand.

BRI investments trends in different sectors

BRI investments in 2020 went into all relevant sectors. The focus of BRI continued to be in infrastructure, particularly energy and transport with the share of investments in transport and energy infrastructure increasing from about 70% in 2019 to almost 80% in 2020.

Against the trend, the logistics sector experienced 25% more investments in 2020 than in 2019 (albeit at overall low levels). Surprisingly, investments into the health sector did not increase despite the COVID-19 pandemic (which might be due to data omission, as many of the health investments might fall below the threshold of investment tracking)

Energy related investments in the BRI

Energy investments constitute the majority of all large BRI investments volume (energy investments also constitute the largest amount of deals). In 2020, energy investments were about US$20 billion. This compares to more than US$40 billion investments in 2016 and 2017.

In 2020, the majority of energy investments went into hydro power (35%), followed by coal (27%) and solar (23%). Accordingly, investments into renewable energies constituted the majority of energy investments in the BRI in 2020.

Accordingly, investments into renewable energies constituted the majority of energy investments in the BRI in 2020.

The trend of increasing shares of renewable energy investments in the BRI has accelerated since 2017, when only 35% of BRI investments went to hydro and solar and wind projects. By 2020, 56% of BRI investments went into these sectors – a strong relative increase. Within the renewable energy sector, solar, wind and hydro all increased their relative share of the total energy investments.

Coal investments have steadily declined from their peak in 2015. At the same time, however, coal investments have seen a relative resurgence in 2020, moving from 15% of coal-related investments in 2018 to 27% in 2020.

Coal investments have seen a relative resurgence in 2020, moving from 15% of coal-related investments in 2018 to 27% in 2020.

Analyzing Chinese energy investments in different countries, we find that Pakistan was the country, which received most energy investments from 2013 to 2020, followed by the Russian Federation and Indonesia. Pakistan is both the largest recipient of coal-related investments and also the largest recipient of investments in hydropower. Overall, Pakistan attracted more than 50% of renewable energy investments (47% of which in hydropower), while Russia and Indonesia received predominantly fossil fuel related energy investments.

In 2020, it was promising to see that several countries received 100% of green energy investments from China, including Qatar and Oman, as well as Egypt (after it postponed the construction of a US$4.4 billion, 6 GW coal fired power plant at the beginning of 2020).

Transport investments in the Belt and Road Initiative

Transport-related investments are key for trade between China and the BRI countries. Accordingly, China has invested in road, rail, aviation, shipping and logistics across the World.

Aviation investments (about US$600 million in 2020) were mostly focused on building airports in Africa, but also included the extension of the upgrade of the Osmani International Airport in Sylhet city, some 241 km northeast of the Bangladeshi capital Dhaka.

Rail: Rail investments included high-speed rail projects connecting China through Thailand and Malaysia to Singapore (Kunming-Singapore rail). A deal of the first 40km segment of the China-Thailand high-speed rail linking Bangkok to Thailand’s border with Laos was signed in December 2020. China is also building a US$6 bn high-speed rail connecting 142 km between Jakarta and Bandung in Indonesia. Furthermore, China has been engaged in building several railway projects on the African continent (e.g. Standard Gauge Railways in Kenya and Ethiopia). China also invested in rail in Europe, such as the Budapest-Belgrade railway. China also invested in several urban rail transport projects, such as US$900 million in a subway in Hanoi, Vietnam (which has been delayed) or the US$1.6 billion metro line in Lahore, Pakistan opened in October 2020.

Road-transport: China invested across all countries with investments including road construction in Pakistan (e.g. Karakoram Highway connecting China and Pakistan all the way to Pakistan’s Gwadar Port). In 2020 investments in road infrastructure decreased by close to 70% to about US$4 billion.

Ports: Pakistan is also one of the largest recipients of Chinese investments in port infrastructure, such as the Gwadar port operated by China Overseas Port Holding Company, which is a strategically important and also contested investment for China. Other strategic port investments can be found in Piraeus, Greece or in Lamu and Mobasa, Kenya, as well as in Djibouti. A recent US$3 billion agreement to commission Croatia’s largest port (Rijeka Port) to a consortium of three Chinese contractors has been cancelled at the beginning of 2021.

Major players in BRI investments

Among the major players for BRI investments in 2020 were almost exclusively Chinese SOEs. The first non-SOE investor was Alibaba on 15th rank. The largest investor was the Power Construction Corporation (POWERCHINA) followed by China Communications Construction Company (CCC).

Among the major players for BRI investments in 2020 were almost exclusively Chinese SOEs. The first non-SOE investor was Alibaba on 15th rank. The largest investor was the Power Construction Corporation (POWERCHINA) followed by China Communications Construction Company (CCC).

With a renewed emphasis of SOEs in China, the role of SOEs in BRI construction is unlikely to change in favor of non-SOEs.

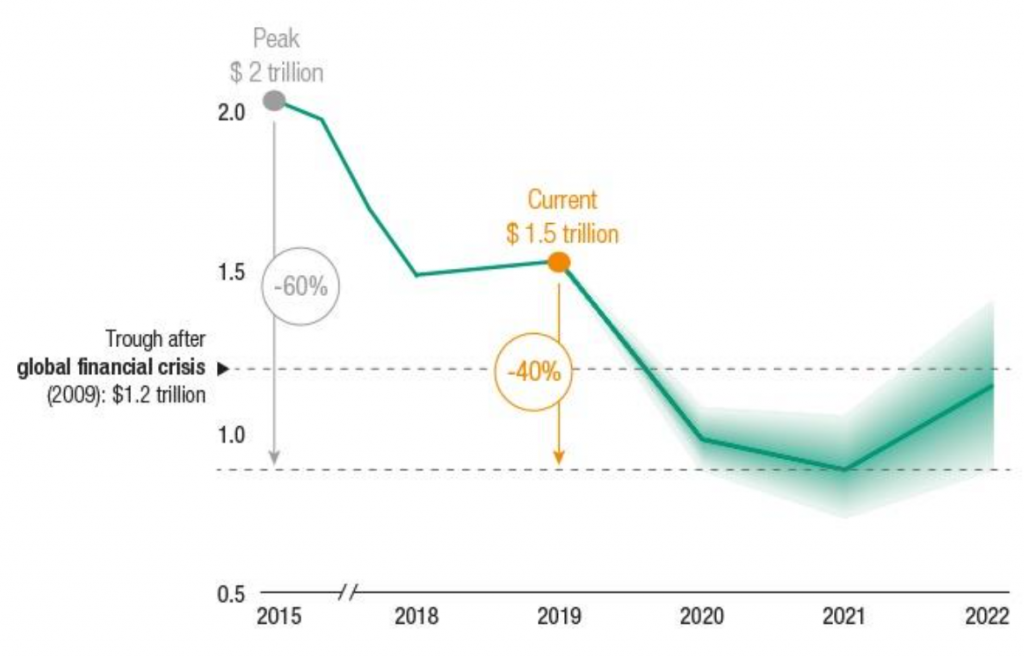

BRI investments in a global comparison

Globally, FDI data for the first half of 2020 show a decline of 49% from their 2019 value of US$1.54 trillion. This brings global FDI flows below US$1 trillion for the first time since 2005.

This decline of global FDI was particularly relevant for developed countries, whose FDI fell by 75%. Developing countries (including many BRI countries) saw a total decline of FDI by 16% compared to the 2019 6-months average.

These data were confirmed by a later study published by UNESCAP analyzing FDI flows into Asia and Pacific: the study found that FDI flows had dropped from about US$300 billion in 2019 to about US$100 billion in the first 9 months of 2020.

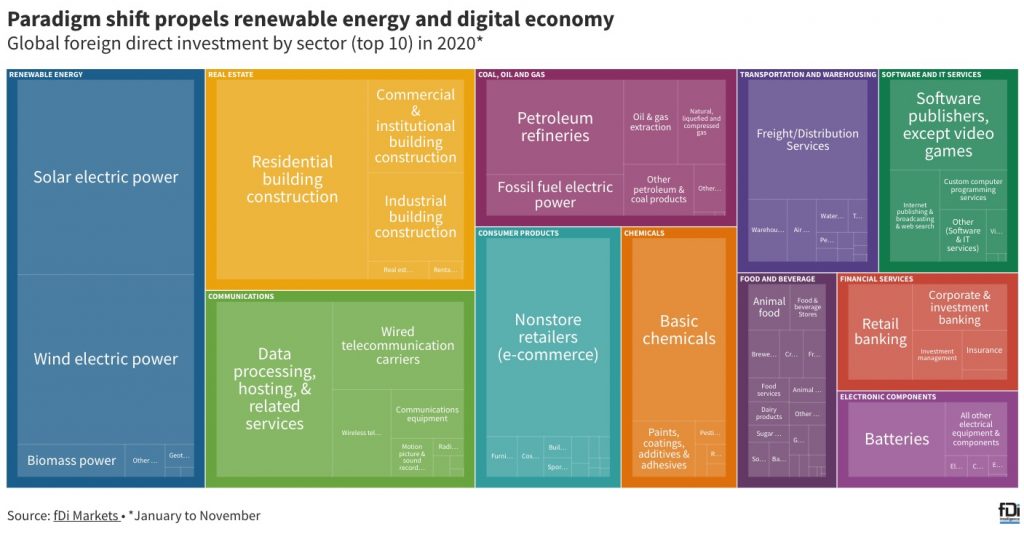

When looking at the sectors that received most global FDI, fDI Markets provides a first glimpse into announced projects for 2020 until November. The data show that global foreign investors announced renewable energy projects worth a total $91.5bn between January and November 2020, twice as much as foreign investments into coal, oil and gas. Other relevant global sectors were in residential building construction and information technology.

Outlook for 2021 foreign direct investments

According to UNCTAD, the outlook for FDI in 2021 is “bleak” with an expected further decrease of 5-10% of FDI[1]. The COVID-19 crisis is still not under control in most countries, having led to massive declines in GDP. Accordingly, investment needs, for example, in energy are lower due to less energy demand, while local governments particularly in developing countries are struggling to raise capital for further investments. Rather, many are struggling with servicing existing debt (you can find detailed information and interactive graphics on this topic on our Brief on Debt in the Belt and Road Initiative).

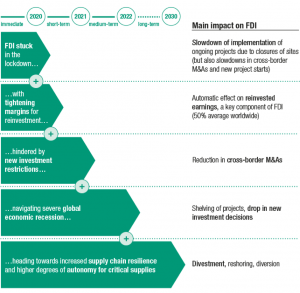

Outlook for Belt and Road Investments

The COVID-19 crisis is a risk for all investors. In its report, UNCTAD elaborated on five interrelated issues that could see a further decline in all types of cross-border investments:

- FDI is slowing as ongoing projects are stuck in implementation (e.g. due to lock-downs)

- With less FDI, less projects will be completed that could earn money for investors, which in turn leads to less money being reinvested

- Global investment restrictions (e.g. due to political reasons) can further add to the problems

- Investors are tightening their budget due to broader economic recessions

- Investors and companies are aiming to nearshore to increase supply chain resilience and thus avoid investing (far) abroad

Outlook for successful Belt and Road Initiative investments

Chinese investments into the Belt and Road Initiative countries in 2020 have declined by 54% in comparison to 2019, while Chinese investments in non-BRI countries have declined by 70%. With continued lock-downs and issues of debt, we do not see a fast recovery of overseas investments in 2021. Rather, we see specific strategic investments (such as in ports) going ahead, while road and energy investments will focus on countries in Asia (particularly after the conclusion of the RCEP trade agreement in November 2020). As a case in point, China announced in January to evaluation investing into a freight rail project Mandalay-Kyaukphyu railway in Myanmar “to allow merchants from China’s Yunnan Province to look for business opportunities on the Indian Ocean at Kyaukphyu economic zone”.

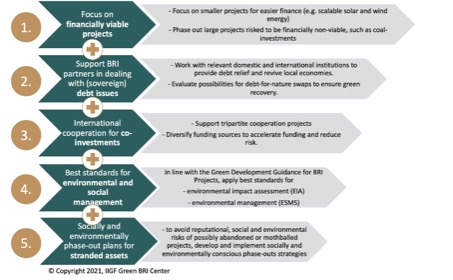

In order to ensure a continued success of BRI investments, the following recommendations should be considered:

1. Focus on projects that are financially sustainable and cut losses in non-profitable projects now

BRI investors should focus on smaller projects that are easier to finance and faster to implement. Particularly in regard to infrastructure and energy investments, scalable solar and wind investments seem viable, as long as local conditions provide the relevant grids to handle renewable energy supply

We also see an opportunity to immediately phase out new and stop ongoing construction of coal-fired energy investments, which still take up 26% of energy-related BRI investments even in 2020. Coal-investments will with all likelihood be stranded assets before they are operational, as renewable electricity is already cheaper than coal-fired electricity in most cases. At the same time, McKinsey found that renewable energy investments provide for 3 times more jobs than investments into fossil fuels.

2. Support partner-countries and partner businesses in dealing with (sovereign) debt-repayment of already invested BRI projects, e.g. through debt-for-nature swaps.

Debt is a major concern for future growth in many BRI countries. As we found in our in-depth analysis of debt in BRI countries, China has a unique opportunity to support BRI countries in dealing with their debt both bilaterally and multilaterally. Dealing with the debt issue is crucial for providing BRI countries with the necessary fiscal space for future investments.

While debt-for-resource or debt-for-equity swaps might seem beneficial for China in the short-term to reduce debt burden in the BRI countries, these swaps tend to undermine future domestic growth opportunities for BRI countries. Rather, Chinese relevant stakeholders together with international partners through multilateral frameworks should support green recovery by swapping part of the debt for nature and providing necessary frameworks to increase transparency and accountability of the use of funds.

3. Increase international cooperation for BRI projects to allow existing and useful projects to go ahead also in difficult times.

Tripartite cooperation with international financial and implementation partners can support BRI projects through better access to financial resources, risk sharing and knowledge sharing. Particularly non-SOEs that often have a higher burden of accessing investments from Chinese large financial institutions could benefit through broader access to finance. Also, Chinese financial institutions could benefit as they broaden their cooperation.

Tripartite cooperation is in line with the White Paper on China’s International Development Cooperation in the New Era” published in January 2021 by the State Council Information Office under the State Council[3], which highlights China’s willingness for tripartite cooperation under the condition of China’s status as developing country.

4. Increase use of common environmental and social standards in project evaluation (e.g. environmental impact assessment EIA) and for environmental and social risk management (ESMS)

The “Green Development Guidance for BRI Projects Baseline Study” backed by various relevant Chinese ministries published by the BRI Green Development Coalition in December 2020 calls for Chinese overseas investors to apply independent environmental impact assessments (EIA) and strict environmental and social risk management (ESMS) to ensure projects and investments are minimizing environmental harm and maximizing environmental benefits. Also, the Green Investment Principles (GIP) integrate sustainability into corporate governance, requiring boards to understand environmental, social and governance risks, as well as disclosing environmental information.

By applying international standards, Chinese financial institutions can more easily raise capital on the global capital markets, accelerate co-financing with international partners and take responsibility to fulfill the goal of building a “Green Belt and Road”.

5. Develop socially and environmentally conscious phase-out strategies for non-performing investments

Several investments in the Belt and Road Initiative have had to be stopped, mothballed or cancelled due to financial (e.g. difficulties in financing or servicing debt) and operational reasons (e.g. due to travel restrictions or problems in supply chains). In order to avoid reputational, social and environmental risks arising from stopped, mothballed or cancelled projects, plans should be developed and implemented by financial institutions including insurance companies, developers, local governments and relevant Chinese authorities that compensate any losses to workers and companies up to a specific extent, and that ensure that nature around mothballed and particularly stopped projects can be remediated. This also helps avoid having skeleton constructions serve as a reminder of unfinished projects.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.