On May 15, 2023, the Vietnamese government released Vietnam’s Eight Power Development Plan (PDP8) for the period of 2021-2030, with a vision to 2050. The release was severely delayed due to disagreements in the authorities regarding the country’s future power mix, particularly the pace of the phase down of coal-fired power generators and the expansion of renewable energies (RE).

The PDP8 encompasses the planning of Vietnam’s future power sources and the planning of the national transmission grid infrastructure. The planning is based on the assumption that Vietnam’s GDP will grow at a rate of 6.5 to 7.5 percent annually from 2021 to 2050.

After several years of elaboration and consultations, Vietnam seems to have reached a politically feasible vision for Vietnam’s power sector that serves as a compromise between the coal-oriented national utility and decarbonisation-focused international partners. Yet, it falls short in terms of environmental ambition and runs the risk to engender stranded assets.

The future of coal in Vietnam – some green progress, some entrenched interest

Within the PDP8, Vietnam cancels around 13GW of planned coal capacity from the pipeline, while keeping a pipeline of new coal projects to around 13GW. In other words, the PDP8 still allows the completion of eleven coal-fired power plants that were already included in the revised PDP7 published in 2020 and which are scheduled to be constructed before 2030. Six out of these eleven power stations are currently under construction while the remaining five projects are still in the process of negotiating financial arrangements with investors and shareholders. If capital arrangements for a project cannot be finalized before June 2024, their construction must be terminated according to PDP8.

To further ensure coal supply, PDP8 encourages measures to step up the search and exploration of new reserves of domestic coal (and oil).

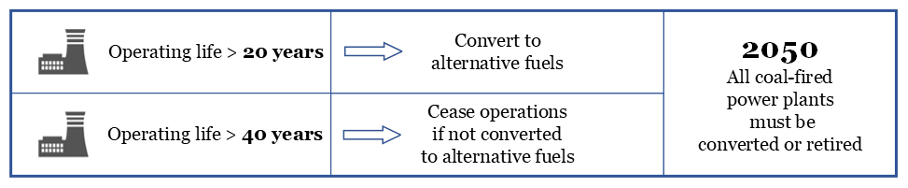

The PDP8 also sets Vietnam on the path towards the decommissioning of power plants that do not meet environmental standards: Coal plants that have been in operation more than 20 years should convert to alternative fuels such as biomass or ammonia once the use of alternative fuels becomes economically viable (figure 1). If conversion is not possible after a lifespan of more than 40 years, the coal station should cease operations. By 2050, all coal plants must be converted to alternative fuels or cease operation. The PDP8 projects that most coal stations can be converted to alternative fuels by 2050 and that only few power stations must be decommissioned.

Figure 1: Vietnam’s strategy for the retirement of its coal station fleet

Gas power in Vietnam’s PDP8

Gas-fired thermal power should play a key role in the transition to RE and the retirement of coal. PDP8 puts a focus on power stations fired with domestic gas rather than the expansion of the infrastructure serving imported LNG. LNG thermal power plants should be largely converted to hydrogen once the technology is commercialized.

Renewable Energy and electricity grids in Vietnam’s PDP8

The PDP8 presents Vietnam’s long-term objective to form an energy ecosystem based on renewable energies. The development of wind and solar power should be further prioritized in accordance with the absorptive capacity of Vietnam’s grid system while ensuring reasonable electricity prices. Renewable energy sources should allow Vietnam to produce new forms of energy carriers such as hydrogen or green ammonia.

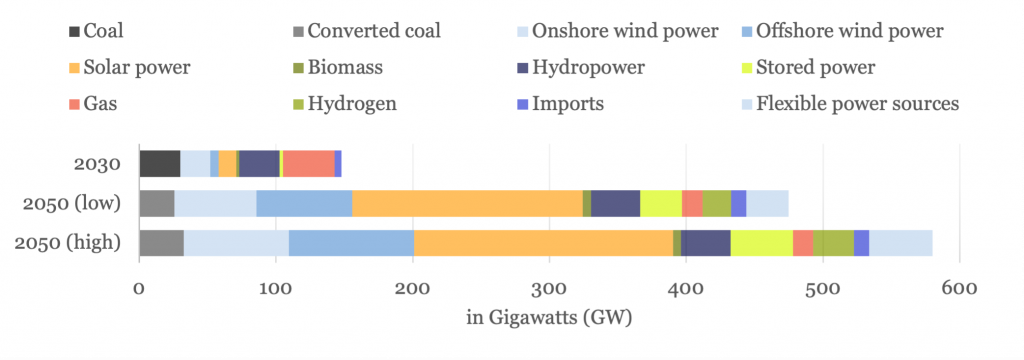

The PDP8 puts a high emphasize on building a smart grid system that can integrate and safely operate large-scale renewable energy installations. To expand RE without straining the electricity grid, self-sufficient rooftop solar power is encouraged. 50% of office and residential buildings should be covered by rooftop solar by the end of the decade. In 2030, wind, solar, hydropower and biomass will provide 48% of Vietnam’s installed capacity, this share will rise to around 63% in 2050.

As seen in figure 2, solar power will become the dominant energy source in Vietnam’s energy mix in 2050 when the Vietnamese economy is set to be decarbonized. The energy mix will become more diversified thanks to new energy sources such as hydrogen, stored power, and flexible power resources.

Figure 2: Projected installed capacity for electricity generation in Vietnam by source in GW, PDP8

It is important to note that the PDP8’s projected RE share and greenhouse gas emission targets are conditional on the materialization of the financial support pledged by international partners in the Just Energy Transition Partnership (JETP) agreements.

Open questions and recommendations of PDP8 operationalization

- Clarify strategy for the retirement of Vietnam’s coal station fleet: Vietnam’s oldest power station (Uong Bi power station) has passed a lifespan of 40 years already. The power units of the Pha Lai Power Complex started operations in the 1980s and will exceed 40 years of operation within this decade. It remains unclear whether these power stations will be decommissioned within the next years based on the 40-year rule or whether a grace period is granted to allow for an improvement in the financial viability of alternative fuels. Furthermore, coal power station operators might want to fully exploit 40 years of coal operation before converting to alternative fuels considering Vietnam’s domestic coal resources and low coal prices set by the authorities. Vietnam’s policy makers should therefore refine the mechanism and legal framework for the decommissioning of coal plants. This mechanism should ensure that coal station operators convert power stations as soon as economically feasible without delaying the conversion process. Operators should also be supported to apply available fuel conversion technologies.

- Improve investment conditions for renewable energy: According to the PDP8, Vietnam faces immense investment needs of USD 135 billion (2021 to 2030) and USD 400-520 billion (2031-2050) to expand power sources and enhance the power grid. The country should present a reasonable set of policies that incentivizes domestic and international independent power producers to invest in RE stations. While the PDP8 provides an overall orientation for Vietnam’s energy system, it must be underpinned by ambitious energy policies and investment incentive schemes. After the expiry of feed-in-tariffs for solar and wind-generated electricity in 2021, the government has yet to issue new guidelines for purchases and sale contracts for electricity generated by RE sources in an amended version of the Electricity Law. The current lack of a clear legal and financial framework discourages private investors from investing into RE projects in Vietnam. This puts at risk the goal to achieve high shares of RE in the future.

- Galvanize international support for energy transition: Vietnam should make active and effective use of the support provided through international agreements in terms of technology transfer, management, human resource training, and financial supports. The USD 7.75 billion of public sector finance provided by international partners should be employed strategically to mobilize additional private capital. Vietnam’s JETP Resource Mobilisation Plan that is expected by the end of 2023 should present measures to facilitate the deployment of support and overcome barriers to clean energy investment.

In summary, the PDP8 represents a paradigm shift in Vietnam’s energy sector away from carbon intensive fossil fuels towards clean energy. All stakeholders, including government agencies, public energy companies, investors, NGOs, international partners, and others, should work together to ensure that coal phase out can be achieved as soon as possible and that energy supply can be largely covered by renewable and new forms of energy soon.