“He is my best and bosom friend. I cherish dearly our deep friendship”, said Chinese President Xi on about Russian President Vladimir Putin after China and Russia agreed to upgrade their relations to a “comprehensive strategic partnership of coordination for a new era” during the Annual St. Petersburg International Forum from June 6-8.

Country Overview

Russia with its capital Moscow is the largest country on earth with 17 million sq km and a population of 143 million (China, in comparison, covers about 9.6 million sq km and has 1.4 billion people). Since 2000, Vladimir Putin has been Russia’s dominant political figure (serving two terms as president, then four years as prime minister in 2008 to become president again in 2012).

Russia’s economy is the 12th largest in the world. Russia’s exports depend 80% on oil, natural gas, metals and timber. The economy is forecast to grow by about 1-2% in 2019, and could be accelerated through improvements in economic structural (e.g. promotion of R&D, innovation and entrepreneurship), higher investment levels and improvements in public health.

Major Environmental and Economic Indicators

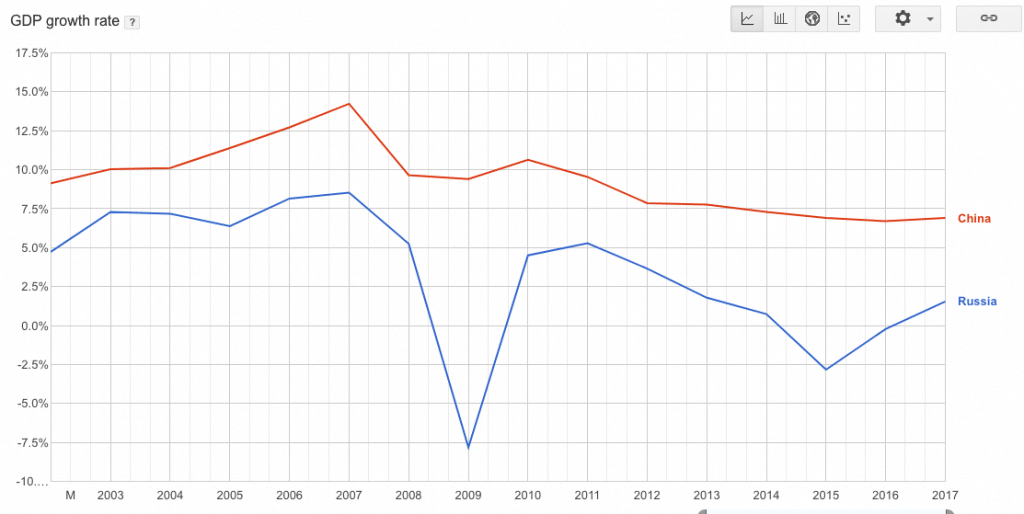

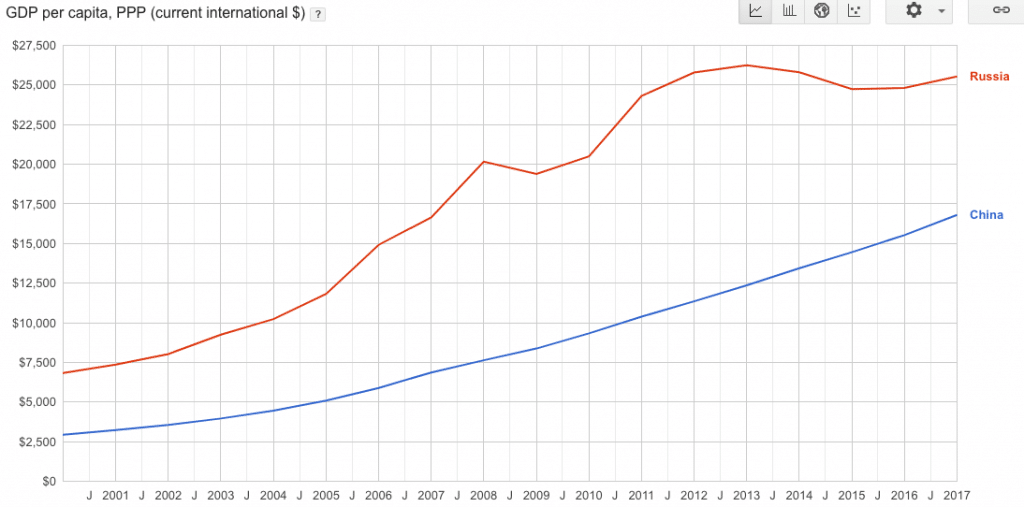

In 2018, Russia saw its fastest GDP growth in 6 years with 2.3%. With a declining population, Russia’s GDP per capita at purchasing power parity grew from 6,825 USD in 2000 to 25,533 USD in 2014. Its unemployment rate has been decreasing from about 10% in 2000 to about 5% in 2019. It is thus a growing consumer market.

Figure 1: GDP Growth in China and Russia 2002-2017 (Source: World Bank)

Figure 2: GDP per Capita (PPP) in China and Russia 2000-2017 (Source: World Bank)

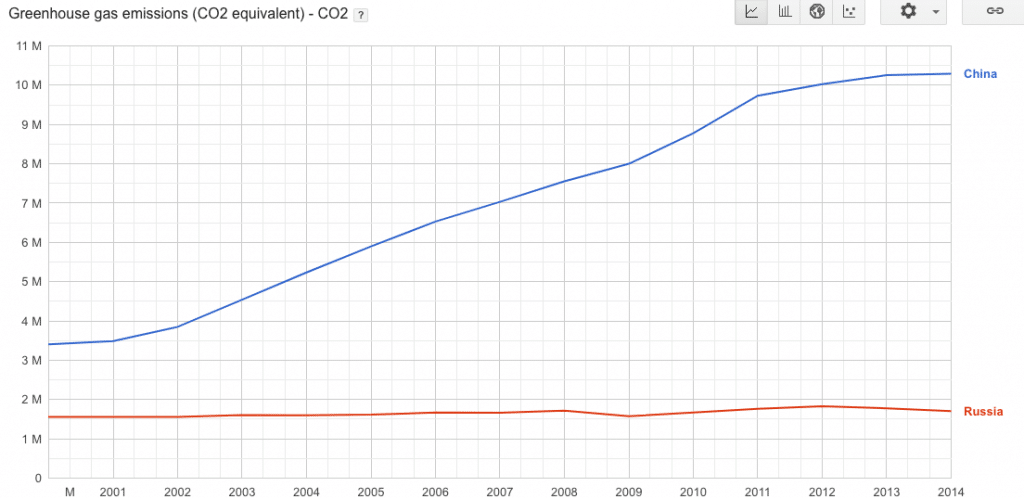

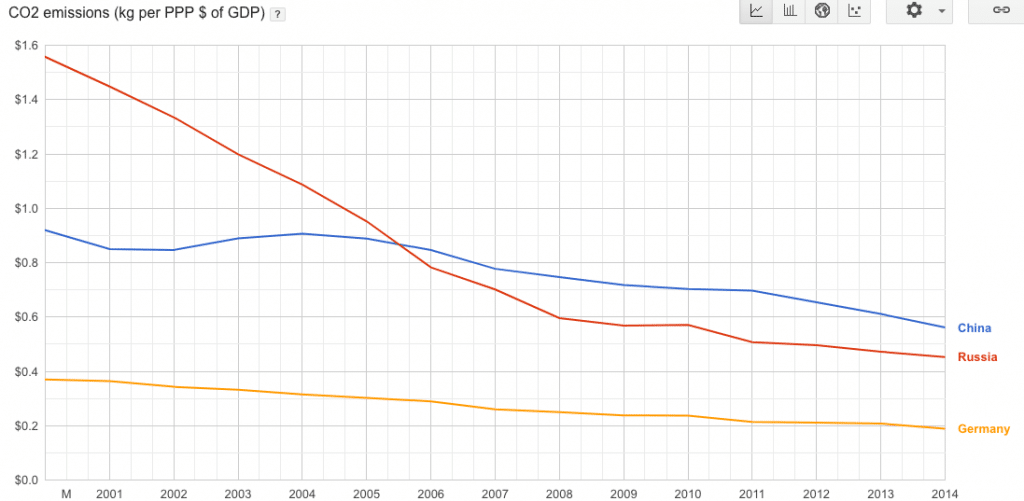

Russia’s kept its CO2 equivalent emissions steady over the past two decades at around 1.7 million tons (Figure 3). This also means that Russia could improve its emission efficiency from about 1.6 USD per kg of CO2 emissions to 0.5 USD (see Figure 4).

Figure 3: Greenhouse gas emissions (CO2 equivalent) in China and Russia (2000-2014) (Source: World Bank)

Figure 4: CO2 emissions (kg per PPP % of GDP) in China, Germany and Russia (2000-2014) (Source: World Bank)

Russia has also taken leaps in terms of green finance. According to the expert council under the Central Bank of the Russian Federation, approximately 50 Russian companies “that are somehow active in the field of sustainable development and green investment” made 420 issues of corporate or concession bonds worth 6.5 trillion RUR (about 100 billion USD)[1]. However, according to 2018 World Bank Report[2], Russia’s need to accelerate green finance is massive.

International economic integration

Russia is the founding member of the Eurasian Economic Union (EAEU), which in 2015 introduced the free movement of goods, capital, services and people within its 5 member states Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia. Some goods (e.g. unprocessed precious metals) still require special permissions or are prohibited from exports from Russia, even within the EAEU.

In addition, Russia has free trade agreements and trade pacts with the Commonwealth of Independent States (CIS), Serbia and Egypt.

Russia is a WTO member since 2012, but with high tariffs and duties on imports (e.g. an average of 23.1% on animal products, 22.1% on beverages and tobacco and 8.9% on transport equipment), not all WTO agreements are implemented.

Due to disagreements in the international community, the EU, the US, Canada and other allies imposed sanctions against Russia in 2014. These sanctions were intensified in 2018, restricting access to Western financial markets for selected Russian state-owned enterprises in the banking, energy and defense sector.

To attract more international investment, the Russian government provides incentives for investors and companies through tax, property tax, VAT tax exemptions, reduced social contribution rates, special customs regimes. The incentives are available, for example, for new product development in energy efficiency, nuclear engineering, space technology, medicine and IT.

Possibly as a consequence, Russia has improved its business climate and ranked 31st rank of the Doing Business Index in 2018 – having climbed 80 spots from rank 111 in 2012.

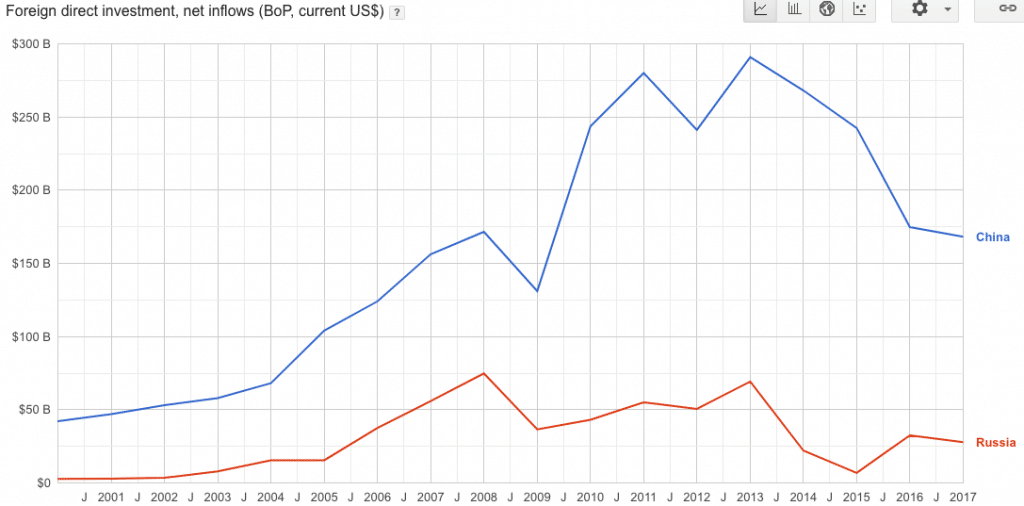

However, foreign direct investment (FDI) remains restricted in several sectors, such as defence, media, natural resources with a strong state-owned enterprise sector.

As such, FDI into Russia has been fluctuating around 27 billion USD per year (see Figure 5)

Figure 5: Foreign direct investment (net inflows in BoP, current US$) (Source: World Bank)

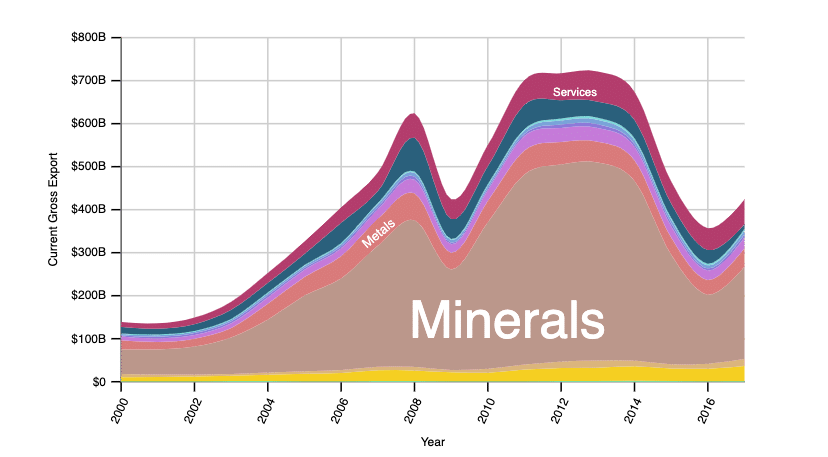

In regards to trade, Russian exports are heavily focused on minerals, that is crude and refined petroleum oils and gases (see Figure 6). As a consequence, Russia’s economy is heavily dependent on global oil and mineral prices – leading to big fluctuations in export values.

Figure 6: Exports from Russia 2000-2017 (Source: Atlas of Economic Complexity)

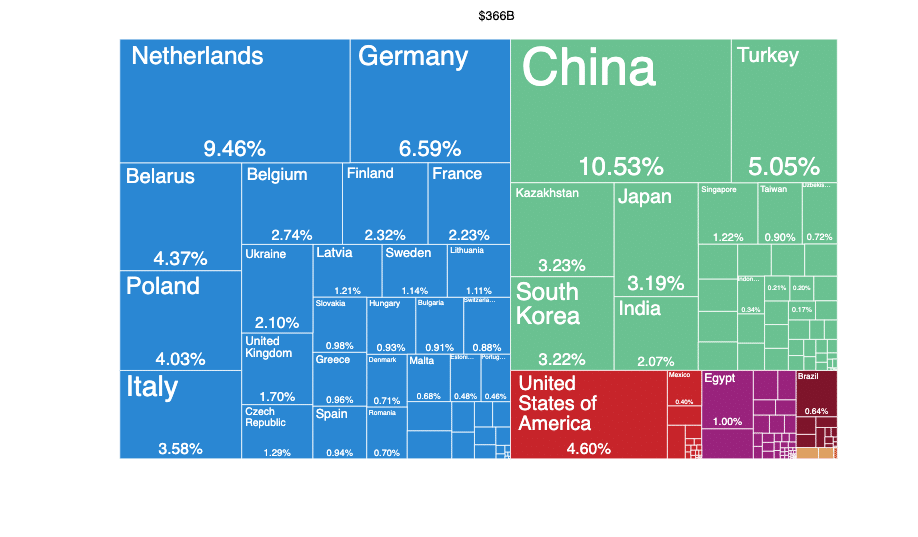

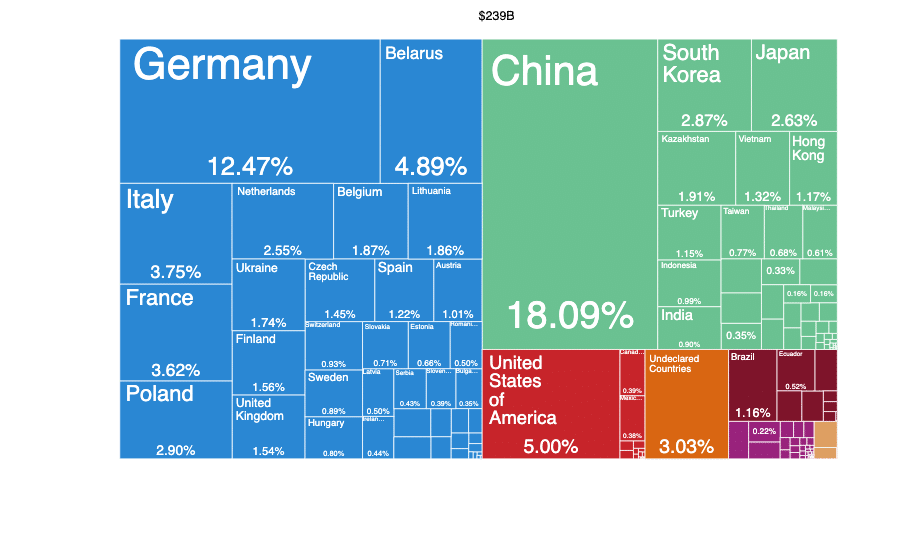

Russia’s most important trading partners for exports are China, Netherlands and Germany (see Figure 6), accounting for 10.5%, 9.5% and 6.6% respectively. In regards to imports, Russia buys most from China, Germany and the US, accounting for 18.1%, 12.5% and 5% respectively (see Figure 7). Overall, Russia exported/imported goods and services worth around 366/239 billion USD in 2017.

Figure 7: Russia’s exports in 2017

Figure 8: Russia’s imports in 2017

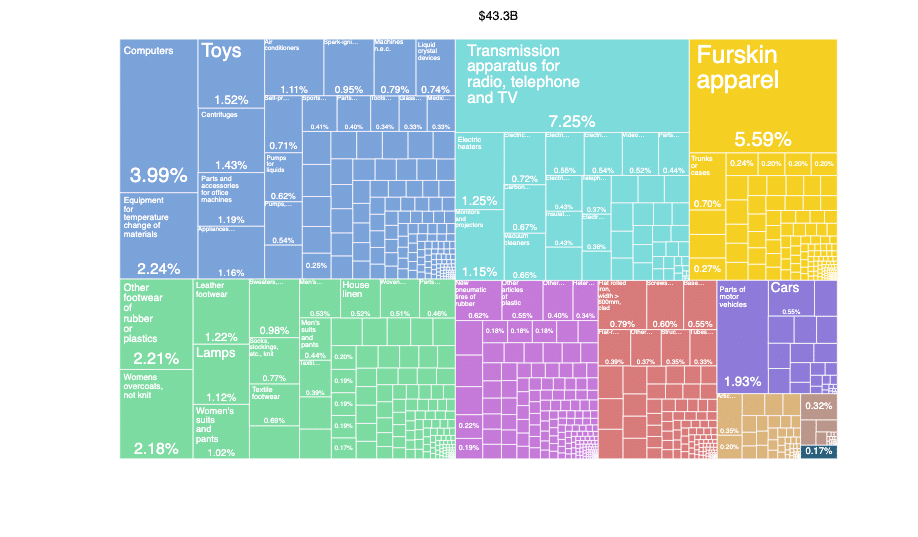

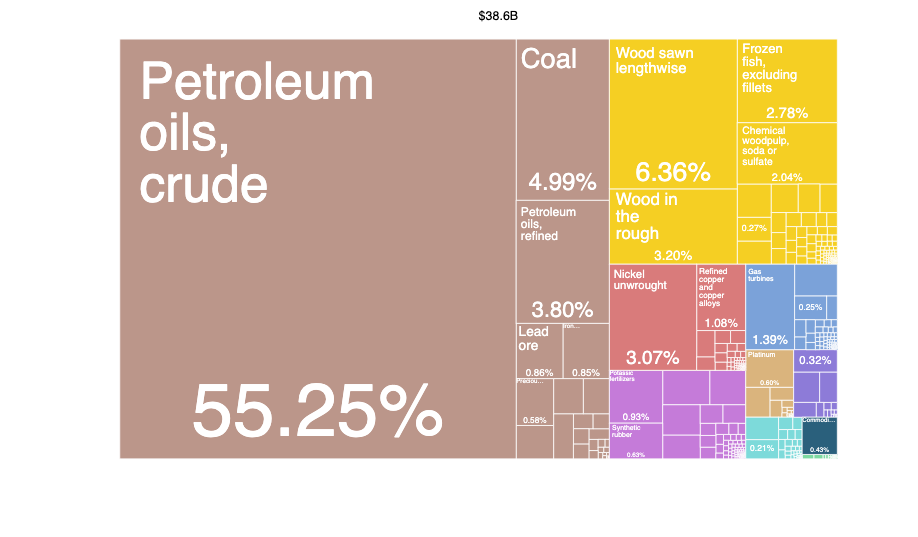

Economic relations with China and the BRI

China currently exports goods and services worth about 43 billion USD per year to Russia. China’s exports to Russia are highly diversified with many processed and high quality goods being exported, such as electronics, processed natural products furskin apparel and computer equipment (see Figure 9). Russia exports about 38 billion USD per year to China, leaving a trade imbalance of about 5 billion USD per year with China. Crude petroleum accounts for 55% of Russia’s exports to China and other minerals for about 15% (see Figure 10). Upgrading its export structure into more processed goods could potentially allow Russia to export more value to China.

Figure 9: China’s exports to Russia in 2017

Figure 10: China’s imports from Russia in 2017

In terms of investment, China invested around 47 billion USD in the timeframe 2006-2018 in Russia, particularly in few large energy related investments led by Chinese state-owned companies (see Figure 11). Apart from energy investments, which accounted for about 56% of Chinese investments in Russia, Chinese companies also invested in metals (12.2%), real estate (10.5%) and agriculture (6.1%).

Figure 11: Chinese investments with size >100 million USD in Russian Federation 2006-18 (Data Source: American Enterprise Institute)

Figure 11: Chinese investments with size >100 million USD in Russian Federation 2006-18 (Data Source: American Enterprise Institute)

Major BRI related projects and policies

Specific BRI related projects include, for example, Moscow’s Metro Line 3, which is the first subway project undertaken by Chinese enterprises in Moscow (China Railway Construction Corporation – CRCC). The building of the 4.6 kilometer subway commenced in 2017 and will be completed by the end of 2020. In April 2019, CRCC signed a contract to build a further 6.4 kilometer line in Moscow. Another deal was signed during the second Belt and Road Forum in Beijing in April 2019: China National Offshore Oil Corp. (CNOOC) and China National Oil and Gas Development Co. (CNODC) (a subsidiary of China National Petroleum Corporation (CNPC)) acquired a combined 20% of Novatek’s Artic LNG 2 project in Northern Russia. The project will cover three production trains, each with 6.6 million tons per year worth of capacity – with first delivery expected at the end of 2023. This project is thus slightly bigger than the Yamal LNG plant with 16.5 million tons, which over the last years also saw investments by CNPC (20%) and Silk Road Fund (9.9%).

In order to speed up imports and exports of non-energy products, The Eurasian Economic Union (EAEU) and China signed an agreement on exchanging information about goods and transport vehicles on June 6, 2019. Its goal is to speed up customs operations with goods supplied through the customs borders of the EAEU and the PR China. Furthermore, the cross-border bridge linking China and Russia – the Heihe-Blagoveshnchensk Heiloangjiang River Bridge was joined in May 2019. It aims to increase people flows to 1.4 million and cargo flows to 3 million tons per year between the two countries by 2020.

Environmental points

According to a 2019 survey by the Moscow Higher School of Economics[3], 94% of respondents in Moscow see environmental pollution as a pressing concern, particularly landfills, air pollution (in bigger cities) and a proposed water bottling plant at Lake Baikal[4]. While Russia’s CO2 emissions have been stable at around 10t CO2 per capita, according to the International Energy Association – IEA, upgrading energy sector equipment to increase production and use efficiency could further cut carbon emissions by 25%, according to the Russian Ministry of Energy. With climate change, Russia will be able to better explore the Artic circle in terms of mineral resources, but risks releasing possibly hundreds of gigatons of greenhouse gases that is currently stored in the permafrost (particularly methane).

Pathways forward

The Russian economy is more intertwined with the Chinese economy than vice versa. However, Russia’s economy, due to its dependence on oil exports, is at risk of being too dependent on global oil prices and thus hardly predictable. While Russia blames some of its economic woes on fraught relations with the USA, more investment also from China in a diversified economy (e.g. technology, agriculture, IT) could help Russia’s economy:

- accelerate investments to upgrade Russia’s economy, e.g. in technology, agriculture, IT

- invest in infrastructure that allows for better transport of products within the country and to neighboring countries

- support development of national green finance markets to accelerate local green investments

[1] “The Diagnostic Overview ‘Green Finance: the Agenda for Russia’ is presented at the expert site of the Bank of Russia,” October 12, 2018, https://investinfra.ru/gchp-kontsessii-i-investitsii/the-diagnostic-overview-green-finance-the-agenda-for-russia-is-presented-at-the-expert-site-of-the-bank-of-russia.html.

[2] Adriana Jordanova Damianova et al., “Russia Green Finance: Unlocking Opportunities for Green Investments” (Washington: World Bank, October 1, 2018), http://documents.worldbank.org/curated/en/103531540924946297/Russia-Green-Finance-Unlocking-Opportunities-for-Green-Investments.

[3] The Moscow Times, “94% of Russians Are Concerned About the Environment, Poll Says,” The Moscow Times, March 25, 2019, https://www.themoscowtimes.com/2019/03/25/1-of-russians-happy-with-environment-poll-a64946.

[4] The Moscow Times, “Siberian Authorities Halt Construction of Lake Baikal Bottling Plant After Backlash,” The Moscow Times, March 15, 2019, https://www.themoscowtimes.com/2019/03/15/siberian-authorities-halt-construction-of-lake-baikal-bottling-plant-after-backlash-a64818.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.