Introduction

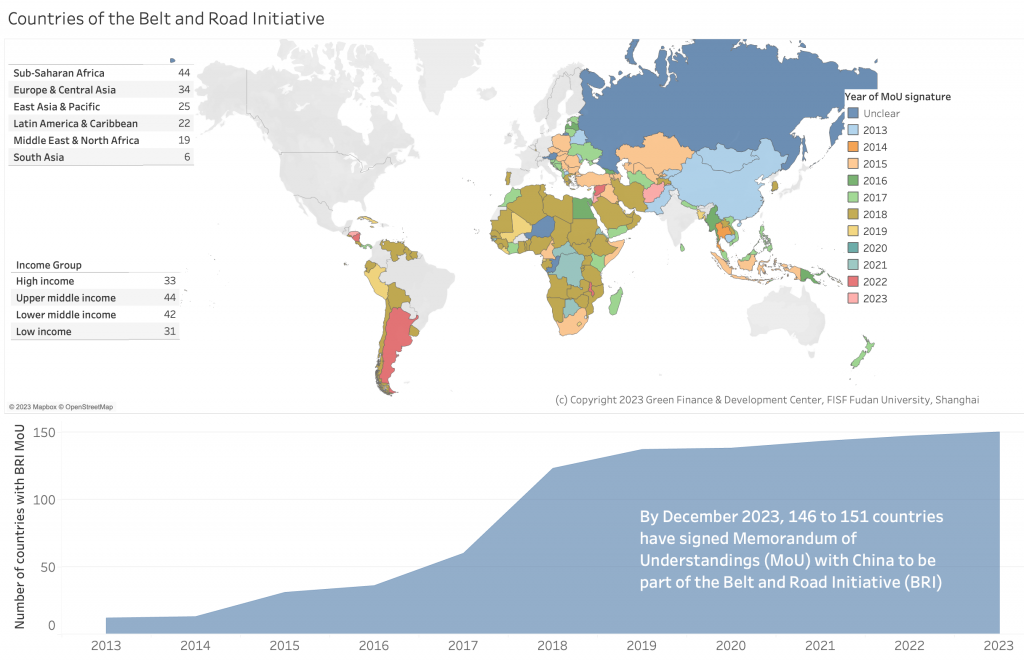

In September 2013, China’s President Xi announced the One Belt and One Road Initiative (OBOR). Initially, few observers paid it much attention. A decade later, the English name has evolved to the Belt and Road Initiative (BRI) (though in Chinese, ‘yi dai yi lu’ still translates to ‘One Belt One Road’). The BRI has emerged as one of the world’s most ambitious and debated development initiatives. As of now, 148 countries have signed memorandums of understanding (MoUs) with China regarding the BRI. These agreements indicate a desire to collaborate with China on the initiative’s five pillars, which include investment, trade, and ‘people-to-people’ exchanges. Despite Italy’s 2023 announcement to exit the BRI, most of Asia, Africa, and significant parts of Latin America remain steadfast in their support.

| This is a Joint Working Paper published by Green Finance & Development Center at FISF Fudan University and Griffith Asia Institute at Griffith University. |

To date, with an investment surpassing USD 1 trillion, the BRI has been a pivotal force in infrastructure development in emerging economies. A large portion of these funds has been directed towards traditional infrastructure, including transport (e.g., roads, railways) and energy.

One aspect of particular interest is how China’s investment strategy within the BRI has transformed over the past decade, and the implications this holds for the near future. Five dominant trends are evident: the greening of the BRI, a shift from grandiose projects to smaller, more refined ones, mounting concerns regarding debt sustainability, an increasing presence of private enterprises, and varied international responses.

Greening of the BRI

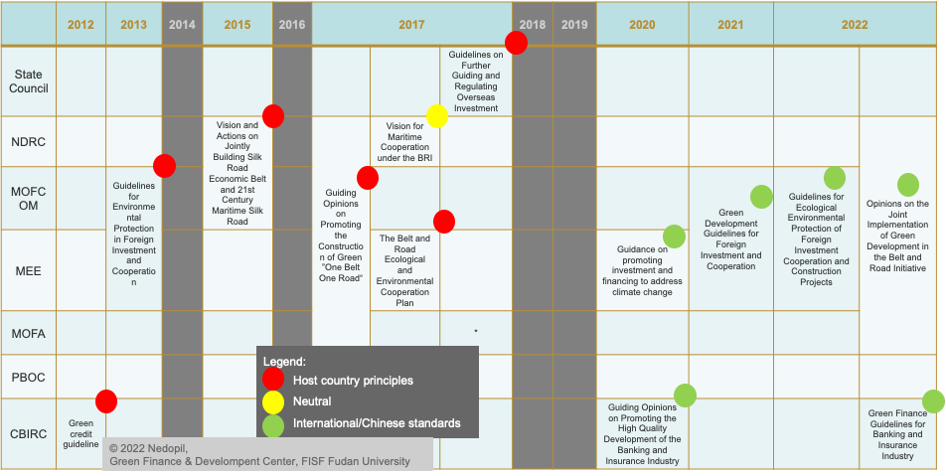

Since the second Belt and Road Forum in 2019, the BRI has shown a growing commitment to environmental concerns, symbolised by its ambition to establish a “green BRI”. This shift was a response to global anxieties over the swift proliferation of Chinese-backed coal-fired power plants in BRI countries. Between 2013 and 2020, BRI nations saw the commissioning of over 50 GW of such plants. Additional environmental concerns arose in the construction of other large scale infrastructure plants with significant social resistance against various infrastructure projects due to the destruction of nature from Myanmar to Kenya, from Indonesia to the Amazon, from Serbia to Papua New Guinea. A major issue leading to this situation was that Chinese financial institutions and regulators only required adherence to national environmental regulations and licenses. In weak governance and corrupt countries, such licenses could be too easily obtained without due diligence. This procedure was different for international financial institutions, which in weak governance countries required the application of international best standard environmental and social impact assessments to understand and reduce related risks to the environment and populations.

Significant regulatory changes came under way in China in 2020. In December 2020, the Belt and Road Initiative Green Development Coalition (BRIGC) published the Green Development Guidance with support from various Chinese ministries that emphasised the importance of adhering to international best practices in environmental risk management. It also published a ‘traffic light system” that provided an ambitious environmental evaluation framework for all types of overseas projects regarding their climate, pollution, and biodiversity impact. It consequently put coal and most other fossil fuel projects in a “red” category. Also, the China Council for International Cooperation on Environment and Development (CCICED) supported an exit of coal and application of international environmental standards in BRI projects.

Real regulatory responses followed in 2021 with significant upgrade of policy guidelines issued by the Ministry of Commerce (MOFCOM) and others to adhere to international environmental standards in overseas projects. Also, in September 2021, China announced to stop building new coal fired power plants overseas.

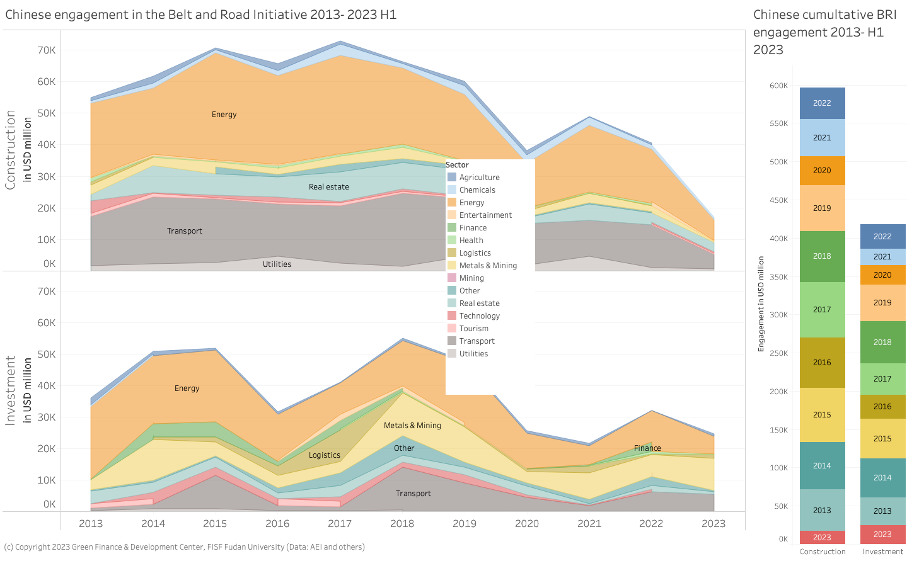

In practice, China’s engagement in the BRI has shifted to support the green economy: not only did energy-related investments become greener, but Chinese companies significantly expanded interests in metals related to the energy transition, such as lithium, and invested in manufacturing in green industries, such as batteries.

This is not to say that China does not engage in fossil-related investment anymore (quite the opposite with significant Chinese interests in Middle Eastern countries’ fossil fuel infrastructure), nor that its green economy related investments, e.g., in mining, are without environmental concerns or controversies.

Accordingly, the next years need further improvements in environmental management stipulated government guidance, capacity and improved oversight as well as accountability from the Chinese side. Similarly, it requires better international engagement including improved local capacity in BRI countries to negotiate contracts with environmental standards and the ability to monitor and enforce performance.

From largesse to small and/but/or beautiful

The BRI has caught global attention due to the largesse of many projects: multi-billion-dollar investments in rail in Kenya, Laos or Indonesia, billions in coal plants in Bangladesh, Pakistan, Zimbabwe, to name a few. Before, many of these BRI recipient countries often struggled to receive any investments in these critical sectors from either the more traditional Western private or public investors. Meanwhile Chinese policy banks, such as China Development Bank and China Exim Bank, together with China’s state-owned commercial banks (e.g., ICBC, Bank of China) were willing to support these infrastructure projects, likely based on the perceived success of infrastructure-led growth within China.

With growing understanding of local needs and risks, however, a new mantra for BRI projects was announced in November 2021i: small and beautiful (the Chinese 小儿美 might also be translated as small but beautiful or small or beautiful). One interpretation is that BRI projects should reduce wasteful investments and focus on smaller projects that are beautiful, or, alternatively “beautiful” (geo-)strategic projects, e.g., in ports and rail. As Ye Yu from Shanghai Institutes for International Studies arguedii, such limits on external lending represented a shift in Chinese BRI lending at that time.

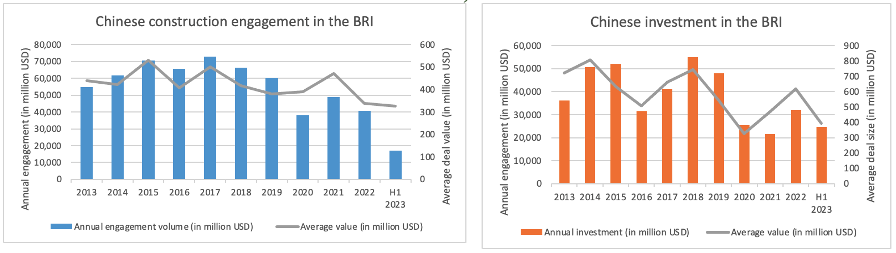

This shift is also evident in data: while in the earlier part of the BRI, average deal size was more than USD500 million, this number dropped continuously to below USD400 million in 2022.

The advantage of such smaller projects is obvious: they tend to be faster to implement and have overall lower risks. Future opportunities lie especially in local co-financing of such projects to ensure that financial gains are shared also within the host country.

Improved debt sustainability in the BRI

The decreasing deal size is also a result of sovereign debt issues in many of the BRI countries that became increasingly evident already before the COVID crisis and were exacerbated by the COVID crisis.

Many BRI infrastructure projects have traditionally relied on sovereign debt guarantees of the recipient countries. For example, if Chinese banks agreed to finance the construction of a power plant or railway the Chinese bank and China’s insurance company Sinosure that provides insurance against political risks would require for the recipient country to guarantee the payment of interest and debt through the national budget. At the same time, China’s Export Impact Bank provided direct bilateral sovereign loans to BRI countries to finance infrastructure projects. This model has increased China’s sovereign debt exposure in BRI countries significantly and China became the largest bilateral creditor for emerging economies.

To reduce sovereign debt risks for Chinese investors and sovereign debt distress risk for recipient countries, China issued a debt sustainability framework for overseas investments in 2019iv. As data published in January 2023 by Boston University showsv, China’s overseas development finance (i.e., policy bank lending) shrunk from about USD90 billion in 2016 to about USD 5 billion in 2021.

Source: Boston University Global Development Policy Center, 2023.

However, in the wake of the COVID pandemic urgency of sovereign debt distress risk in emerging economies increased and China joined the debt service suspension initiative (DSSI) and the Common Framework in 2020—the first time for China to work on sovereign debt relief in a multilateral rather than bilateral setting. As a result, China and France worked together to restructure USD 6.3 billion of Zambia’s debt in June 2023vi. China also reduced its debt exposure in the 67 DSSI eligible countries from USD 110 to USD 104 billion from 2021 to 2022.vii

Importantly, China also engaged in research in alternative debt relief mechanisms, such as debt for nature swaps. In November 2022, China’s Green Finance Committee presented a study on debt for nature swaps to the Research Bureau of the Central Bank, and in July 2023 UNDP China published a study on debt for nature swapviii with a focus on China’s potential role, which was co-developed with researchers affiliated to the Ministry of Commerce and which was introduced with a keynote by the Vice President of China’s EXIM Bank. Whether China will engage in such non-traditional forms of debt re-organisation, however, remains to be seen and likely depends much on the active engagement of BRI partner countries.

Looking forward, it is likely that China will monitor the debt sustainability of BRI countries more closely. Chinese financial institutions will likely limit their exposure to projects that do not have stable cash flows from within the project (e.g., reduction of exposure to public infrastructure, such as roads, while infrastructure like gas pipelines would provide stable cash flows). That being said, “beautiful” strategic projects, such as strategic railways or ports, will still find Chinese financial creditors with top-down support.

From State-owned companies to private sector green field engagement

China’s early engagement in the Belt and Road Initiative countries was mainly driven by state-owned enterprises (SOEs), such as Power China, Three Gorges, China Communications Construction and many others (it is important to note that Chinese SOEs are not monopolies and often in competition with each other). These SOEs had big financial balance sheets to allow for more risky investments, they had some levels of overcapacity that could be exported, and they typically held strong connections with Chinese financial institutions to provide financing also in more challenging BRI countries. For BRI recipient countries, this model seemed very advantageous as these arrangements provided not only engineering and construction services, but also operational capacity and financing in a project development model called “BOTF”—or “build, operate, transfer, finance”. On the contrary, while many smaller Chinese private companies invested in local manufacturing or distribution networks with projects worth a few million USD, only few private Chinese companies had the capacity or need to invest in BRI countries on a larger scale.

Again, this changed significantly within the last three years: while in 2020 all the top partners for BRI engagement were SOEs, since 2022 private sector companies lead BRI investments. These companies include CATL, the world’s largest battery producers, Alibaba, a major tech and fintech company, and private mining companies such as Zijin mining.

Two major developments could be the underlying cause of this growing interest of private companies to engage in the BRI: on the one hand, a growing competitive edge of Chinese private companies compared to 2013. Particularly Chinese technology driven companies significantly expanded their technological capacities and multiple Chinese companies became leaders in their respective fields, particularly in sectors related to new energy vehicles such as Build Your Dreams Auto Company (BYD) and Contemporary Amperex Technology Company Limited (CATL), and alternative energy production like Jinko Solar and Goldwind. These companies have a strategic interest to produce closer to their major clients, which drove, for example, several battery manufacturers to set up factories in the European Union. On the other hand, risks of trade barriers between China and major other economies have spurred investments by Chinese producers outside of China to reduce the risk of restrictions or extra tariffs.

This engagement is also vastly different from the original Chinese going out strategy that involved the purchase of overseas companies (e.g., the hostile take-over of German robot manufacturer Kuka, or the acquisition of the Swiss pharmaceutical company Syngenta – both in 2016). Rather, Chinese companies engage in green field investments to build new manufacturing capacity abroad.

Over the next years, this trend will likely accelerate with more Chinese companies moving up the value chain particularly in the green economy and continuing risks of escalating trade sanctions.

BRI countries should further expand their capacity to attract such investments, while safeguarding their local social and environmental standards to ensure that not only employment is generated, but that long-term knowledge capacity is created through training and promotion of local management, and local investors can participate in the deals to ensure that the economic value is not exclusively re-patriated to China.

International collaboration and alternatives

China portrayed the BRI as an open and inclusive platform for cooperation. Accordingly, it not only encouraged countries to sign MoUs, but also international organisations. While countries like the United States were opposing any such moves, various multilateral organisations were keen to work with China on the BRI and signed MoUs as early as 2014, including various United Nations organisations including UN Environmental Programme (UNEP), UN Development Programme (UNDP), the Asian Development Bank (ADB), and the World Bank. By June 2019, 14 countriesix such as France, the United Kingdom, Japan, Italy had also signed agreements to work on the BRI as third-parties to support development in emerging economies.

However, with increasing great power competition and values misalignment, Western countries started to develop and announce alternatives. In 2019, The US together with Japan and Australia also launched the Blue Dot Network (BDN) with initial funding of USD60 billion. The BDN has moved to become a quality standard for infrastructure to attract international financing rather than a direct support mechanism. In 2021, the leaders of the G7 nations (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) then announced the Build Back Better World (B3W) initiativex, to provide support for infrastructure development in low- and middle-income countries that are democratic. However, one year after the B3W’s announcement, a mere USD6 million were committed.xi The initiative was then renamed Partnership for Global Infrastructure Investment (PGII).xii However, still little was achieved. Later in 2021, the European Union (EU) announced its own BRI competitor—the Global Gateway. It aims to mobilise USD300 billion between 2021 and 2027 with three core areas: renewable energy, IT infrastructure, and resilient critical minerals supply chains. While some projects have seen interests, too few projects have so far materialised. In 2023 then, the US announced another initiative at the G20 summit, the India-Middle East-Europe Economic Corridor (IMEC)xiii to link India, the Arabian Gulf, and Europe.

At this point, however, all these bilateral and “minilateral” alternatives to the BRI face similar challenges: who is financing them, what is the timeline, and what is the appetite in the host countries. Compared to the BRI, none of these initiatives have seen framework agreements with the beneficiary countries, most of them are focused on aid and not on economic cooperation, none have the capability to aptly combine financing and project delivery, and all seem to copy the BRI in infrastructure development where China seems to enjoy a clear competitive advantage in efficient and affordable delivery.

While there is a clear need for more infrastructure finance and real alternatives for development partners are essential to enable an open world economy, Western-led alternatives should ideally focus on three things. First, provide a clear multilateral alternative delivered through trusted albeit reformed multilateral institutions such as the World Bank Group rather than more bilateral or minilateral minions. Second, provide offers based on expressed real needs of partner countries for sustainable growth, which might not only include financing and capacity development, but also access to better trade conditions. And thirdly, provide offers that are credible and distinct based on the capabilities of the development provider to create a value add for all. This could include projects in improving the financial sector in the partner countries based on the EU’s or US’s strong domestic financing sector. This could include providing technical capabilities, equity investments and foreign exchange risks insurance to allow emerging economies to mobilise domestic finance to better support own development goals.

Summary and outlook

Some serious publications have written about the demise of the BRI over the past years.xiv This seems premature, wishful, or possibly really looking at different data. What I observe over the past years is a rapidly emerging BRI adapting to China’s domestic challenges and opportunities such as China’s growing competitiveness of private companies, global power competition challenges driving non-domestic investments of Chinese companies, and a growing strategic focus on green development and other major technologies opportunities. If the three major themes Belt and Road Forum that will take place in Beijing from October 17 to 18 are any yardstick, future topics for the BRI are green development, connectivity, and digital economy.

It is hard to deny that—despite Italy’s expressed interest in leaving the BRI—over 140 countries have actively joined the BRI hoping to benefit from cooperating with China. Clearly not all of them will be always satisfied with the outcomes, but a lack of credible alternatives often leads to the conclusion that a delivered infrastructure project through the BRI is always better than a promised infrastructure project through a different program.

Yet, to meet global infrastructure needs that allows us to reduce the risks of climate change, biodiversity loss and ensures a just transition, trillions more are needed and cooperation in technical standards and planning are essential to use the existing money smartly. It seems many mindsets need to change to achieve this goal.

About the Griffith Asia Institute

The Griffith Asia Institute (GAI) is an internationally recognised research centre in the Griffith Business School. We reflect Griffith University’s longstanding commitment and future aspirations for the study of and engagement with nations of Asia and the Pacific.

At GAI, our vision is to lead new ideas, knowledge and networks that contribute to an inclusive, sustainable and prosperous Asia-Pacific region.

We do this by delivering research excellence on the politics, security, trade and business, governance and economic development of the region. We build partnership for policy and impact outcomes in the region. We shape the next generation of Asia-Pacific leaders through learning experiences.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.