The world faces a dual environmental crisis through climate change and biodiversity loss. State-owned enterprises (SOEs) are in a unique position to take a leading role in confronting these challenges and shifting economic activity from polluting to green. This requires a shift in existing business models, particularly in the energy, finance, transport, and water sectors, which in Asia are traditionally dominated by SOEs. This shift requires billions of (United States) dollars in financing, and will unleash investments in green and resilient economies, innovation, and jobs. However, a failure to green SOEs risks climate and natural catastrophes. To move to the core of the green transition, SOEs can utilize an ever-broader sustainable finance toolbox, which is becoming necessary to reduce government borrowing in tight sovereign debt markets. In particular, green bonds, blue bonds, and transition bonds can become an important source of capital for SOEs in many countries around the world. So far, however, the potential of sustainable finance and, in particular, green bonds for SOEs remains mainly untapped, particularly in the emerging economies of Asia. This report provides an overview of the role and use of sustainable financial instruments for SOEs in emerging countries of Asia. It shows how SOEs can address specific governance and capacity gaps resulting from their (part) ownership by governments to successfully prepare to access green capital markets. Five points stand out with regard to the effort to improve SOE governance and green bankability:

- SOEs need to establish sound governance systems in relation to their government owner to give them the permission to raise funds from capital markets and to improve risk management, transparency, and accountability to fulfill basic investor requirements.

- SOEs need to establish a credible green strategy, with a strong project pipeline to attract investors.

- SOEs need to improve the bankability of their projects and ideally of the whole SOE through improved financial management and operational efficiency to reduce costs and improve delivery as well as cash flows to reduce financial risks for investors.

- SOEs need to build capacity and knowledge on green bond issuance according to domestic and/or international green bond standards.

- SOEs need to build relevant monitoring, reporting, and verification capacity to provide information in a timely manner on the use of proceeds (or the impact of the sustainable-linked instrument) to investors.

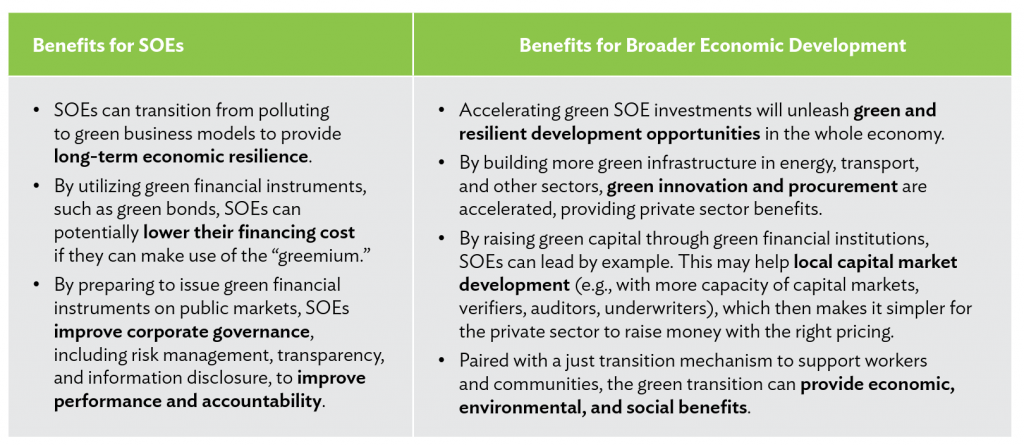

By accelerating the use of green finance, SOEs generate multiple benefits for long-term sustainable development for the SOE itself as well as for the broader economic development (as summarized in the following table).

Beyond reforms to make SOEs more bankable and better able to access green finance, the enabling environment for SOE green finance can also be improved. Specific actions on this include

- improving policy frameworks for the green transition through road maps and binding regulations (e.g., climate targets), reducing non-green incentives, and supporting the development of carbon pricing —or other policies that help internalize negative externalities, such as emissions—to provide credible signals to private and public companies for future investment directions;

- addressing real economic barriers for green development, e.g., through supporting the development of local green manufacturing and research and development capacity;

- developing local capital market capacity and structures, including frameworks for green finance and disclosure, that are attractive and trustworthy to international investors;

- improving SOE governance and management from the regulator or owner aspect, including the autonomy of SOEs to raise funds, bankability, transparency, and disclosure;

- developing green banking capacity for a responsible banking regulator to provide green credit frameworks, including green credit statistics frameworks (e.g., the Sustainable Banking and Finance Network provides such tools with the support of the International Finance Corporation); and

- improving green finance (environmental, social, and governance) disclosure through support to disclosure requirements and disclosure capacity.

The report is consistent with the Asian Development Bank (ADB) goal under Strategy 2030 of supporting SOE reform to help SOEs “access financing on commercial terms and conditions” and in “attracting private investors and bringing in commercial cofinanciers.” It builds on previous ADB reports, such as the Detailed Guidance for Issuing Green Bonds in Developing Countries and The Bankable SOE, both published in 2021.

The report is intended for stakeholders in Asian SOEs, and those facilitating green finance for SOEs.

Acknowledgements:

This study was published by the Asian Development Bank (ADB) and was prepared by Christoph Nedopil, consultant, under the supervision of David Robinett and the Asian Development Bank’s State-Owned Enterprise Working Group, chaired by Hiranya Mukhopadhyay. The authors would like to thank the following people for their helpful comments and insights: Rafael Abbasov, Giacomo Giannetto, Anjum Israr, Andrew McCartney, and Kosintr Puongsophol.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.