This new handbook, developed in cooperation between the Green Finance & Development Center, FISF Fudan University, ClientEarth, the Green Investment Principles (GIP), and the Institute for Finance and Sustainability (IFS), supports environmental risk mitigation through information disclosure, public consultation and grievance mechanism.

You can download the English report here and the Chinese report here.

Executive summary

China’s Belt and Road Initiative (BRI) is continuously developing to integrate green development concepts. Multiple guidelines, guidance, and opinions have been issued by Chinese regulators (e.g., CBIRC, Ministry of Ecology and Environment, NDRC) as well as adjacent institutions (e.g., BRIGC, GIP) to support this development and provide knowledge products as well as regulatory stipulations for improved environmental and social risk management for financial institutions and developers engaged in the BRI.

This document fills a specific gap and provides guidance for financial institutions on how to engage in responsible public participation and non-financial environmental disclosure as an institution itself and vis-à-vis their clients – that is the project developers. Public participation and environmental disclosure refer to engaging and informing the public about the project’s environmental risk identification and reporting, as well as providing avenues to deal with grievances.

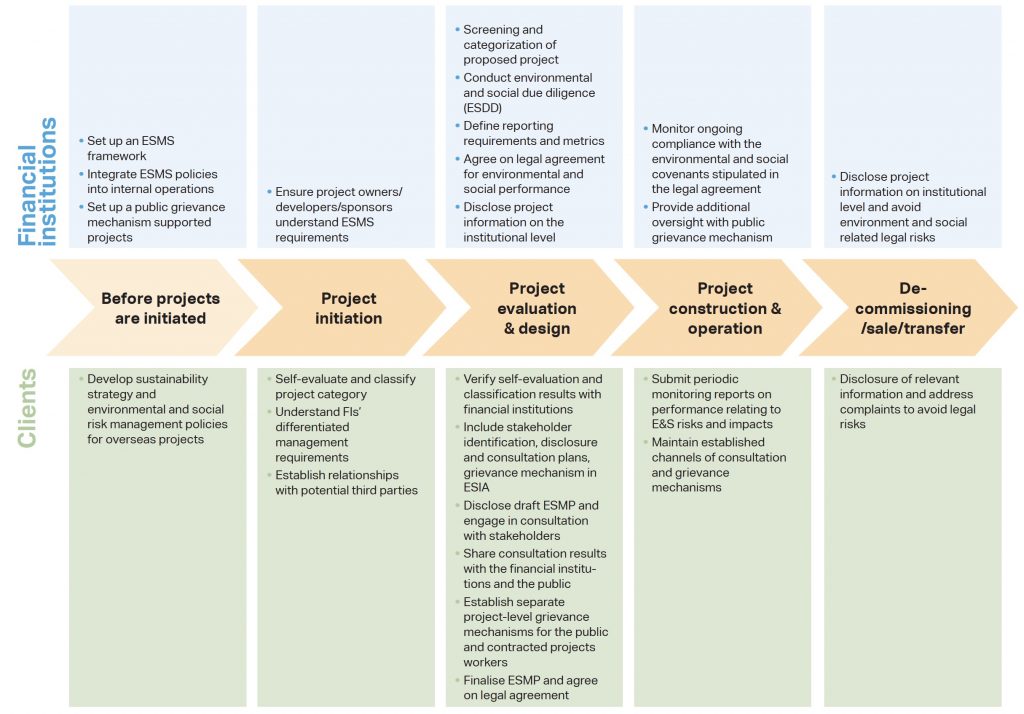

For example, in the project development phases, local stakeholders’ participation in the project evaluation can lead to earlier recognition of environmental risks. This avoids and reduces environmental risks, and improves support from local communities in the implementation of the project. Similarly, through public reporting on environmental performance, both the project company and the financial institution are encouraged to increase internal capacity to monitor and manage environmental risks. At the same time, environmental reporting improves public trust in the project as information is more readily available. Finally, through grievance mechanisms, stakeholders have an opportunity to voice concerns with the project company and even directly with the financial institution.

This allows for quicker recognition and management of environmental (and social) risks. At the same time, it reduces the risks of public grievances to be solved through more public campaigns that negatively influence a project’s or even the financial institution’s public reputation. The following figure highlights various aspects of what financial institutions and their clients should and can do to improve public participation throughout the project phases.

By improving stakeholder engagement for environmental performance, Chinese financial institutions and their clients improve opportunities for international financial and project development cooperation: Active environmental information disclosure and public participation in the investment portfolio have become common practices in many international commercial banks and development finance institutions. Chinese financial institutions benefit by understanding or matching international practices to reduce transaction cost when working with international counterparts on large projects in emerging markets.

In summary, the advantages and benefits of implementing measures of disclosure and public participation for environmental risks and performance most often outweigh the risk-adjusted cost of environmental violations. This is particularly relevant in countries with weaker environmental and social laws and implementation of laws.

This guidance is written to support Chinese financial institutions engaged in overseas project finance, especially in developing economies in the BRI, in understanding good practices of environmental information disclosure, including the preparation, process, and data to acquire from project developers, as well as public participation throughout the entire project lifecycle. As every financial institution has its specific risk profile and strategy, every financial institution will have to develop its processes based on both regulatory requirements and applicable best practices. This document aims to provide a solid overview of these practices, particularly in an international context applied to China’s ambition to build a green Belt and Road Initiative.

The authors of the report are

- YUE Mengdi, Research Fellow, Green Finance & Development Center, FISF Fudan University, Shanghai

- Christoph NEDOPIL WANG, Associate Professor and Director Green Finance & Development Center, FISF Fudan University, Shanghai

- CHENG Lin, Secretariat of the Green Investment Principles for the Belt and Road Initiative

- FAN Danting, Green Finance and Climate Lawyer, China Office, ClientEarth

Advisors:

- MA Jun, Chairman of Green Finance Committee of China Society of Finance and Banking, President of Beijing Institute of Finance and Sustainability

- Dimitri DE BOER, Regional Director of Programmes for Asia, Chief Representative of China Office, ClientEarth

- XIAO Jianliang, Principal Professional, Environmental, Social and Governance, New Development Bank Headquarters

Comments are closed.