Many countries of the Belt and Road Initiative are among the world’s major energy producing and consuming countries. At the same time, they are mostly developing countries, with the requirement to continue expanding its energy markets. As many of China’s investment and financing projects along Silk Road have climate effects, China plays a major role in supporting BRI countries in adjusting their energy structure and build climate resilient infrastructure, reduce carbon emissions and be more adaptable to climate change. This article will introduce the Dawood Wind Power project in Pakistan, one of 14 Priority Energy Projects under the China-Pakistan Economic Corridor (CPEC). By analyzing the construction characteristics of this project, it will put forward some suggestions for China’s climate investment and financing.

The Dawood Wind Power Station

The Dawood wind power station is located on 1,720 acres of tidal flats 70 km east of Karachi in Sindh province, Pakistan. Pakistan is a country with a land area of 796,095 square kilometers (excluding the Pakistan-administered Kashmir region), a population of 208 million, a coastline of 980 kilometers, and subtropical climate except the tropical in the south.[i] The annual Report of the Global Climate Risk Index 2020 shows that from 1999 to 2018, 152 extreme weather events occurred in Pakistan, resulting in 9,989 deaths and economic losses of USD 3.8 billion[ii].

Power shortages have been a major constraint on the entire Pakistani economy. Pakistan’s power gap is between 4 and 6 gigawatts, with daily blackouts of up to 12 hours in some cities and up to 18 hours in rural areas. Besides, Pakistan’s electricity structure is unsound, with about 60% of the country’s electricity supply coming from oil and gas. The electricity structure dependent on fossil fuels brings a variety of problems to the local government[iii]. On the one hand, due to the shortage of domestic oil and natural gas resources, production of its electricity needs to rely on the long-term import of foreign oil and natural gas in large quantities, resulting in a heavy financial burden on the government. On the other hand, in Pakistan, for every 1% increase in the use of fossil fuels such as oil and natural gas, the total carbon emissions of the whole country will increase 0.226%, which has a significant negative impact on the climate and environment[iv], and is therefore not conducive to sustainable development.

At present, Pakistan’s renewable energy (excluding hydropower) generation volume is small, accounting for only 0.4% of the country’s total electricity generation[v]. In the future, the local government hopes to boost hydropower and other renewable energy sources, such as wind and solar, to increase the whole energy supply and optimize the structure of electricity. Sindh province is rich in wind energy reserves. Its southern wind field covers an area of 9,700 square kilometers. With good wind power condition, the potential of wind energy development is about 11,000 megawatts, and the wind direction is stable, the wind speed is up to 7 meters/second. That means, if properly developed, it can meet 5%-10% of the national power demand[vi].

Dawood Wind power project overview

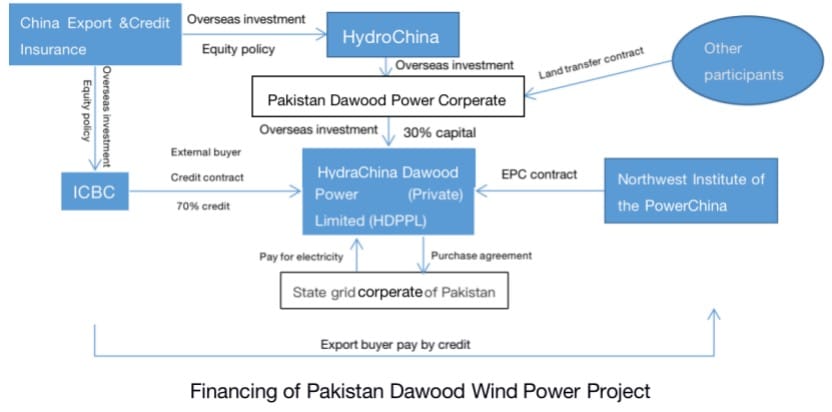

The Dawood wind power project in Pakistan is one of the first 14 priority energy projects under the “Belt and Road Initiative” of the China Pakistan Economic Corridor (CPEC). It is also the first Chinese investment project to complete financing closure and achieve commercial operation under the corridor framework. HydroChina, a subsidiary of PowerChina, acquired 93.89% of the equity of Pakistan Dawood power company, and set up a China-Pakistan joint venture, HydroChina Dawood Power (Private) Limited (HDPPL), registered in Karachi to develop the Dawood wind farm. Dawood has an installed capacity of 49.5 megawatts and a total investment of 115 million dollars, with a debt-to-capital ratio of about 7:3[vii]. Northwest Institute of PowerChina is the EPC general contractor, responsible for the project design, procurement and integration management of construction. The project adopts the BOO (Build-Own-Operate) pattern, and has signed a 20-year power purchase agreement with the Pakistan Power Grid Corporation. It takes the “cost + return” method to price the electricity, and the expected internal return rate on capital is 15%-17%. [viii]

Financing structure of the Pakistan Dawood Wind Power Project

The Dawood wind power project in Pakistan provided 200 new jobs for local residents during its construction. After completed, the project will generate 130 million kilowatt-hours of electricity a year, which can meet 100,000 Pakistani homes’ need and ease the country’s electricity shortage. At the same time, compared with thermal power generation, the renewable electricity produced by wind power station has no direct greenhouse gas emission, while promoting sustainable development [ix].

Project Feature

Take full advantage of government support for renewable energy

The electric power industry is an important area which affects the national energy security as well as national economy so that it is highly valued by the local government. Pakistan relies mainly on oil and natural gas for thermal power generation, with a minimal share of electricity generated from renewable sources other than hydropower. In order to improve the power structure, the Pakistani government has released a series of supporting policies to stimulate and regulate the renewable energy investment market.

- In the wind power industry, BOO (Build-Own-Operate) or BOOT (Build-Own-Operate- Transfer) pattern is allowed, and the government promises that the franchise shall not be less than 20 years. By giving investors more independent management rights, it is expected to mobilize the enthusiasm of enterprises’ production innovation and bring greater benefits.

- The Pakistan government guarantees that all electricity will be purchased by national grid NTDC and priced with a “cost + return” method, and guarantees investors a 15%-17% return on capital. At the same time, the government also provides preferential tax policies, such as exemption from customs duties and consumption taxes, exemption from resource usage fees, land collection and low rent. By reducing project development cost and enhancing project revenue, these policies attract more capital inflows.

- The government will guarantee the wind resources according to their benchmark evaluation value, and share the risk with the investors. Pakistan’s sovereign credit rating is B- only, which largely discourages foreign investors’ investing, while with the additional collateral policy the negative impact of a lower rating can be offset, then attracts more investors[x].

During the construction of Dawood wind power project in Pakistan, it has made full use of support from local government. On one hand, it ensures that the government has the right to speak and capable to control the power resources. On the other hand, it stabilizes the country’s economic development, and results in a win-win situation between enterprises and the country.

Adopt hybrid financing model to raise funds for projects

In the Dawood wind power project, HydroChina Dawood Power (Private) Limited (HDPPL) leveraged the loan investment of about $78.8 million with its own capital of about $31.2 million to complete the capital preparation for the project. HydroChina initiated the project through equity investment, provided limited guarantee for the project, and used China Export & Credit Insurance Corporation’s investment equity policy to transfer the policy proceeds right to the bank, in order to obtain the loan fund of ICBC. Risk is shared among HydroChina, ICBC, China Export & Credit Insurance Corporation and the Pakistani government. The development cost of renewable energy projects is high and the return cycle is long, with this interactive linkage between multiple enterprises, the limited investment amount and the leverage method are used to obtain sufficient funds for project development, which can relieve the investment pressure of investors. In this way, investors can reduce the investment risk, use the limited funds to achieve higher returns at the same time.

Significant climate and social effects

Dawood wind farm generates about 130 million kilowatt-hours a year. The electricity generated by the power station brings good effects to the society, it alleviates the electricity problem of the residents of Karachi to a certain extent, brings light to the local residents, improves the quality of life of the residents, and promotes the development of the local economy. At the same time, the clean energy generated by the power station replaces part of the traditional fossil fuel power generation, improves the power structure of the Pakistan, reduces local carbon emissions, and has a significant climate mitigation effect. The selection of materials and construction process strictly follow the principles of environmental protection to minimize the negative impact of construction and subsequent operation to the local environment.

Suggestions on climate investment and financing in China

Have a thorough understanding of host country’s climate financing policies and risk assessment to the project before entering the market

When conducting international climate investment and financing, enterprises are usually faced with greater uncertainties, and these uncertainties often have a significant impact on the implementation of the projects. A lack of understanding of the host country’s investment policy and climate-related financial support circumstances may bring policy risks and financial risks to the project’s implementation. Chinese companies should build perfect framework in investment activities in the Belt and Road Initiative , emphasize on the early stage of researching the project, fully understand renewable energy, infrastructure and other related climate policy, social environment and the corresponding investment risk and so on where the project will be implemented. In view of the investment risk, draft corresponding assessment, develop solutions to effectively avoid it and then reasonable plan how to raise and effectively use the project funds.

Apply innovate financing modes and establish risk sharing mechanism

Climate investment and financing projects tend to have high early-stage investment cost and long project return cycle, which may easily lead to the problem of poor capital liquidity, then leads to great investment pressure of investors and thus inhibiting investment preference. Through innovating the financing mode, we can promote the cooperation among different types of institutions, expand the scope of financing, reduce financing cost and strengthen the liquidity of capital. In addition, multi-party cooperation can also effectively play the role of diversification of investment risk. For example, in the case above, the borrowing method of overseas credit insurance of China Export & Credit Insurance Corporation as the intermediary can help investors use different financing modes in different periods compared with traditional preferential loans, which can not only reach the expectation of deferred payment of investors, but also meet the demand of immediate payment of contractors. Healthy project fund flow is conducive to the sustainable development of climate financing projects.

Strengthen the guidance role of Chinese government in climate investment and financing

Climate investment and financing are public

and positive external investment and financing activities, which need to be

promoted by national policies to standardize the investment environment and

attract more social capital. Based on its own situation, the Pakistan

government has formulated support policies for renewable energy, especially

wind power, to solve investors’ concerns and increase their investment

confidence by optimizing investment environment construction, providing fiscal

and tax support and sharing risk. China already has a good foundation for the

development of green finance. At this stage, the government should focus on

promoting the development of climate investment and financing in correspondent,

formulate clear and unified standards for climate investment and financing,

specify financial incentives and support measures, and fully mobilize the willing

of social capital for climate investment and financing. In external investment,

climate risks should be fully considered and countermeasures should be taken.

Only through the concerted efforts of the government and enterprises as well as

the combination of support from financial system enhancement of construction capacity

can China achieve long-term development of climate investment and financing, be

capable to more effectively promote the implementation of the “One Belt and

One Road” initiative and help countries along the “One Belt and One

Road” achieve a clean, low-carbon and safe economic development .

[i] ① Belt and Road Initiative:

[ii] Pakistan ranks fifth on global climate risk index:https://www.dawn.com/news/1520535

[iii] 刘志栋.巴基斯坦风电项目开发[J].国际工程与劳务,2017(08):63-65.

[iv] 张庆宇,张雨龙,潘斌斌.巴基斯坦碳排放的影响因素[J].南亚研究季刊,2019(02):50-57+5.

[v] 何智超.巴基斯坦电力市场现状及发展的研究[J].中国市场,2019(15):133-134.

[vi] 刘志栋.巴基斯坦风电项目开发[J].国际工程与劳务,2017(08):63-65.

[vii] Dawood 50MW Wind Farm Project Special Report on CPEC Projects (Energy: Part 1):http://pk.china-embassy.org/eng/zbgx/CPEC/t1627097.htm

[viii] 刘志栋.巴基斯坦风电项目开发[J].国际工程与劳务,2017(08):63-65.

[ix] 中国能源报:http://paper.people.com.cn/zgnyb/html/2017-06/05/content_1780480.htm

[x] 维基百科: https://zh.wikipedia.org/wiki/%E5%A4%A7%E6%B2%83%E9%A3%8E%E7%94%B5%E9%A1%B9%E7%9B%AE, https://baijiahao.baidu.com/s?id=1655866108518512891&wfr=spider&for=pc

Ruichen Hong is a research assistant at the International Institute of Green Finance (IIGF). He received a Master of Accounting from the University of Glasgow, UK, and is in the process of receiving the certification by the Association of Chartered Certified Accountants (ACCA) . He is a main author of the 2018 China Climate Financing Report and Establishing China’s Green Financial System: Progress Report 2018. His research areas are climate finance, carbon finance, environment accounting and carbon accounting.

Comments are closed.