*updated on April 26, 2022 to correct an error of overstating China’s debt suspension in 2020.

Key findings

- The debt burden of the world’s low-income countries rose 12% to a record US$860 billion in 2020;

- About 60% of low-income countries are at high risk or already in debt distress, up from 30% in 2015;

- Overall, the largest increases in outstanding public external debt from 2019 to 2020 were with the IMF (plus US$18.3 billion), the World Bank (plus US$17.1 billion), the Asian Development Bank (ADB) (plus US$6.1 billion) and Japan (plus US$5.3 billion);

- By the end of 2020, total outstanding public external debt owed to China (as an official bilateral creditor) in 68 analyzed countries eligible under the debt service suspension initiative (DSSI) increased from US$105 in 2019 to US$110 billion;

- Countries with the largest increases of Chinese debt were Guinea (+94.8% total, or +0.7% of GNI), Lesotho (+60.3% total, or +2.9% of GNI). At the same time, most countries’ debt exposure to non-Chinese lenders increased at a faster pace;

- In the 68 countries, China debt exposure was larger than the combined debt of all other official bilateral creditors and is only surpassed by the World Bank;

- China was the biggest single creditor in 17 of the DSSI countries, with the largest share in Tonga (55% of all public external debt), Djibouti (55%), Lao PDR (52%), Cambodia (44%), Republic of Congo (42%), Kyrgyz Republic (40%);

- It is estimated that 26% of the total debt service paid by the 68 DSSI countries in 2022 would go to China (compared to 17% to bondholders, and 9% to the World Bank-IDA).

- To deal with debt issues in DSSI countries, China had deferred payments of US$2.1 billion, compared to US$2.5 billion by Paris Club members by the end of 2020;

- In 2021,China promised to redistribute US$10 billion, or 23% of its IMF Special Drawing Rights (SDR) to African countries (compared to about 20% of SDR redistribution to emerging markets committed by other G20 countries, such as France, Italy, the US and the UK);

- Addressing the debt challenge is complex and requires higher transparency, clarity and trust on a multilateral basis, and should consider possibilities to restructure debt without losing access to future loans;

- New solutions for debt restructuring, such as debt-for-nature swaps, are being deployed, for example a US$553 million debt restructuring in Belize in exchange for its commitment for marine protection in November 2021, however have not been scaled-up for larger implementation.

1. Introduction

In December 2021, the IMF sounded the alarm bells when its Managing Director Kristalina Georgieva wrote that “about 60% of low-income countries are at high risk or already in debt distress”, up from 30% in 2015.Equally, the World Bank noticed that the debt burden of the world’s low-income countries “rose 12% to a record US$860 billion in 2020”.

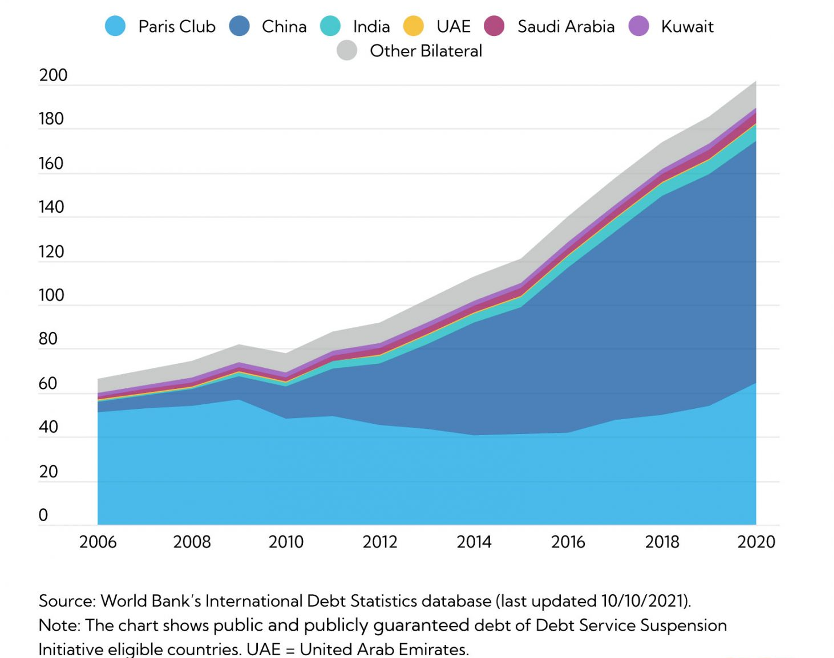

With COVID-19 still hampering economic activities requiring higher public spending, e.g., on health and other public services, paired with decreasing tax revenues, outstanding public external debt in most countries considered vulnerable and part of the multilateral debt service suspension initiative (DSSI) has increased from the end of 2019 to the end of 2020, except for a few countries such as Republic of Congo and Mozambique (who saw a slight 3.5% and 2.2% drop of the outstanding debt respectively). Such increases in outstanding public external debt are driven for example by emergency assistance from multilateral financial institutions to cover health and social expenditure (e.g., COVID-19 vaccines) and stimulate economic activity. For example, in 2020, Bangladesh got a US$250 million loan from AIIB to mitigate the impact of the pandemic on SMEs and the informal sector, a US$732 million disbursement from IMF to address the balance-of-payments and fiscal needs amid the pandemic. However, also bilateral debt continued to increase from about US$182 billion to over US$200 billion, for example through a US$3.2 billion loan package comprising assistance of seven projects from Japan (see Figure 1).

Figure 1: Public external debt of low-income countries to bilateral lenders (Source: IMF)

While new borrowings during the pandemic support countries with securing public health and stimulating the economy, they also create new pressure on debt repayment. Since the end of 2019, six countries – Argentina, Belize, Ecuador, Lebanon, Suriname, and Zambia have defaulted on their sovereign debt, of which only Zambia belongs to the DSSI countries group.

In this brief, we analyze the latest World Bank IDS data and examine the recent developments on public external debt in 68 out of 73 DSSI eligible countries (Data for South Sudan, Micronesia, Tuvalu, Kiribati, and Marshall Islands are not available in the IDS Database), with a focus on debt to China and how it developed from 2019 to 2020.

For this, in Section 2, we present a comprehensive picture of China’s exposure to debt in these countries, including the current state of China’s lending, a comparison between China and other multilateral and bilateral creditors, and debt repayment projection in 2022; in section 3, we discuss current and potential strategies for tackling the debt issues and finally, in section 4, we conclude the brief with the outlook for next steps.

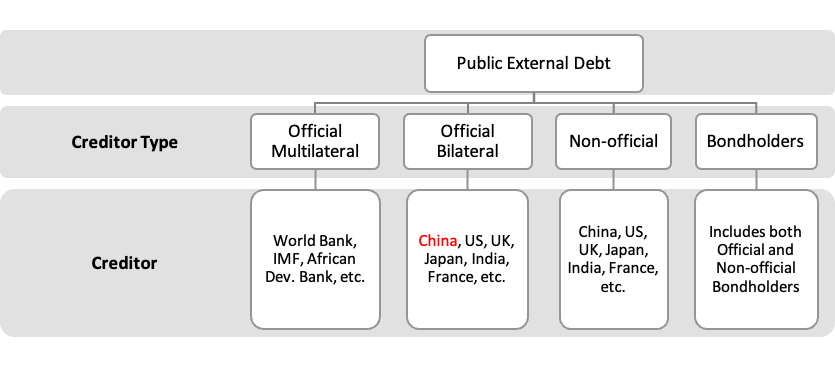

| A note on the data Similar to the previous report published in October 2020, this updated brief is based on the latest version of the World Bank’s International Debt Statistics (IDS). IDS include self-reported public debt data from 68 out of 73 eligible countries to the Debt Service Suspension Initiative (DSSI). For a specific debtor country, IDS measure the overall aggregates and the composition of public external debt stocks by creditor type and by creditor (Figure 2). In the following analysis, we focus especially on public external debt owed to Chinese official creditors (as marked in red in Figure 2), i.e. lending by Chinese governments and all public institutions in which the government share is 50 percent or above. Although a debtor country can also borrow from Chinese non-official lenders or by issuing bonds, they are both smaller in size and less affected by the debt restructuring or relief policies of the Chinese government. Figure 2: Structure of the World Bank International Debt Statistics (IDS)  |

2. China’s Exposure to Public External Debt in the DSSI

2.1 State of China’s Lending in the DSSI

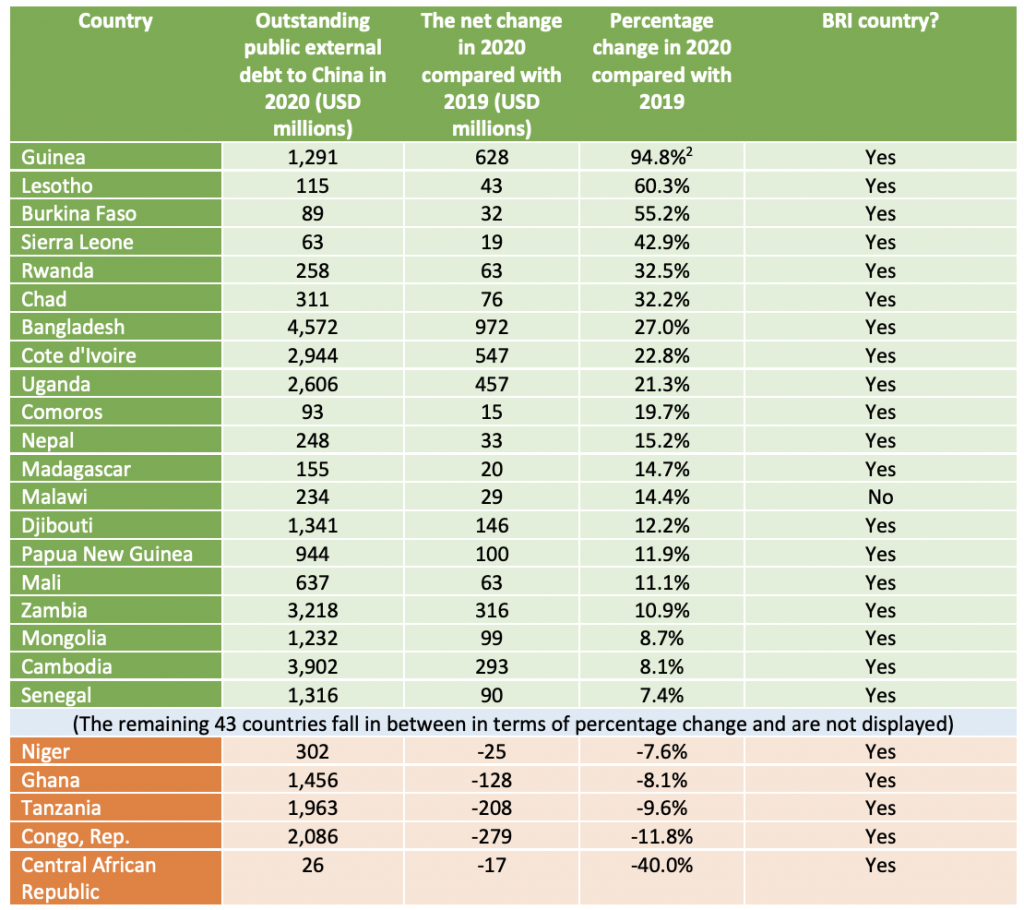

By the end of 2020, the total outstanding debt owed to China (as an official bilateral creditor) in the 68 DSSI countries increased from US$105 in 2019 to US$110 billion. While debt to China dropped in some countries, most DSSI countries saw an increase, especially in Bangladesh (an increase of US$972 million), Guinea (US$628 million), Cote d’Ivoire (US$547 million), and Uganda (US$457 million) (Table 1).

Table 1 Absolute value of outstanding debt to China by the end of 2020 and net change from 2019 in DSSI countries (Top 20 with highest percentage increase and top 5 with highest percentage drop compared with 2019)

Source: Authors’ depiction based on World Bank International Debt Statistics

From 2019 to 2020, the relative sizes of total debt and debt to China in DSSI countries compared with their GNIs also increased in DSSI countries. As Figure 3 shows, while most countries are scattered around the lower left corner (which means a very low or even negative net change), some outliners stand out. Countries like Angola, Maldives, Cabo Verde, Zambia, Lesotho, Djibouti, Guinea had seen a higher increase in debt-to-GNI ratios from 2019 to 2020.

Besides a general increase in the absolute values of their outstanding debt in 2020, such noticeable changes also result from a significant drop of GNI due to the pandemic, making it even harder for debt repayment. In 2020, The GNIs in 24 out of the 68 DSSI countries dropped by less than 10%, while for 13 out of the 68 DSSI countries, their GNIs dropped by over 10%.

Figure 3: Changes in Debt to GNI Ratio in 68 DSSI Countries from 2019 to 2020

Note: X-axis denotes net change in (public external debt to China as % of GNI) from 2019-2020; Y-axis denotes net change in (total public external debt as % of GNI) from 2019-2020

Source: Authors’ depiction based on World Bank International Debt Statistics

2.2 China in Comparison with International Creditors

The year 2020 saw an increase of over $70 billion in total public external debts in the 68 DSSI countries compared to 2019. Looking at individual creditors, the most important ones include (Figure 4):

- Total debt outstanding to World Bank-IDA in these 68 DSSI countries increased from US$111 to US$128 billion by the end of 2020, accounting for 21% of total public external debt outstanding and 43% of the debt owed to all multilateral lenders;

- In 2020, debt outstanding to China (official bilateral) rose by US$5 billion to US$110 billion, accounting for 18% of total public external debt outstanding and 64% of the outstanding debt owed to official bilateral creditors;

- In 2020, debt owed to bondholders in the 68 DSSI countries increased by US$4 billion to US$71 billion, about 12% of total public external debt in DSSI countries.

Overall, the largest increase in outstanding debt from 2019 to 2020 was with the IMF (plus US$18.3 billion), followed by the World Bank (plus US$17.1 billion), the Asian Development Bank (ADB) (plus US$6.1 billion), and Japan (plus US$5.3 billion).

Figure 4: Official External Debt Outstanding in 68 DSSI Countries by Creditors, 2016-2020

Source: Authors’ depiction based on World Bank International Debt Statistics

A closer examination of the composition of outstanding debt to different creditors in the different DSSI countries by the end of 2020 is shown in Figure 5. Accordingly, depending on the country, different compositions of multilateral, bilateral, and private lenders have emerged.

Figure 5: Official External Debt in 68 DSSI Countries by Individual Creditors in 2020

Source: Authors’ depiction based on World Bank International Debt Statistics

In 2020, multilaterals continue to be the major lender to DSSI countries. Multilateral creditors are the biggest lender in 37 out of the 68 DSSI countries:

- Asian Development Bank is the biggest creditor in 6 countries including Timor-Leste (61% of total public external debt outstanding), Fuji (45%), Solomon Islands (44%), Papua New Guinea (35%), Nepal (33%), Uzbekistan (28%);

- IMF is the biggest creditor in 4 countries including the Central African Republic (44%), Sierra Leone (34%), Kosovo (29%) and Chad (19%);

- World Bank-IDA is the biggest creditor in 18 countries, such as Tanzania (46%), Burkina Faso (45%), Rwanda (43%);

- In the remaining 9 countries (Burundi, Dominica, Gambia, Guyana, Honduras, Mauritania, Moldova, Nicaragua, St. Vincent and the Grenadines), the biggest lender is “other multilaterals”, showing a debtor country’s confidentiality obligations to a single creditor entity.

Official bilateral creditors are the major lender category to 24 out of the 68 DSSI countries:

- China is the biggest creditor in 17 countries, including Tonga (55%), Djibouti (55%), Lao PDR (52%), Cambodia (44%), Republic of Congo (42%), Kyrgyz Republic (40%), Vanuatu (39%), Samoa (35%), Angola (34%), Tajikistan (34%), Guinea (32%), Comoros (31%), Maldives (31%), Cameroon (29%), Zambia (25%, and the share of total bondholders is 23%), Pakistan (24%), Togo (24%);

- India is the biggest creditor in Bhutan (69% of its total public external debt outstanding);

- Japan is the biggest creditor in Myanmar (32%);

- In the remaining 5 countries (Afghanistan, Haiti, Sao Tome and Principe, Somalia, Yemen, Rep.), the biggest lender is “other official bilateral”, showing a debtor country’s confidentiality obligations to the creditor entity.

Bondholders are the biggest lender in 6 countries: Ghana (39%), St. Lucia (38%), Mongolia (38%), Cote d’Ivoire (37%), Guinea-Bissau (28%) and Senegal (25%).

Non-official lenders are the biggest creditors in Cabo Verde (27% of total public external debt owed to Portugal).

2.3 Debt Service Projections for 2022

Based on the estimates for debt repayment by the World Bank for 2022, total spending in the 68 DSSI countries on debt service will be US$ 52.8 billion.

Looking at specific countries share of debt service to their overall economy (i.e., Gross National Income/GNI), multiple DSSI countries have to pay a share of more than 10% of their GNI as debt service in 2022, including Maldives (18.3%), Mongolia (17.7% of GNI), Zambia (12.9%), and Angola (11.6%) (Figure 6).

Figure 6: Projected debt service in 2022 as percentage of GNI (2020 value)

Source: Authors’ depiction based on World Bank International Debt Statistics

The most important recipient of debt service from the DSSI countries would be China, which would expect 26% of the total debt service expected to be paid by the 68 DSSI countries in 2022. This is followed by 17% of the debt service going to bondholders, and 9% to the World Bank-IDA.

In 2022, eight countries are expected to spend over 2% of GNI on debt repayment to official Chinese creditors: Angola (4.9%), Djibouti (3.8%), Tonga (2.8%), Lao PDR (2.8%), Maldives (2.7%), Zambia (2.6%), Congo, Rep. (2.4%), Samoa (2.3%) (Figure 7).

Figure 7: Projected debt service in 2022 to China in 68 DSSI countries (countries with share of GNI over 2%)

Source: Authors’ depiction based on World Bank International Debt Statistics

3. Approaches and Challenges to Deal with Debt Issues

For sustainable domestic development as well as for global trade, it is considered of great importance to deal with existing and accelerating debt issues. Dealing with the sovereign debt issues has been on the agenda since the outbreak of COVID-19 both on the multilateral and bilateral levels, but has so far not yielded sufficient results and needs to be accelerated.

3.1 Current Approaches for Debt Relief with China’s Participation

On the multilateral level, the G20 Debt Service Suspension Initiative (DSSI), initiated by the World Bank and IMF and in effect from May 2020 to December 2021, was the earliest effort to tackle debt issues in the face of COVID-19. To access the DSSI, countries also needed to commit to limiting their non-concessional borrowing to levels agreed under the World Bank’s non-concessional borrowing policies and the IMF programs. By the end of 2021, the DSSI provided a temporary suspension of debt-service payments owed to official bilateral creditors for 40 of the 73 eligible countries worth US$ 10.3 billion. Countries particularly utilizing the DSSI were Pakistan (about US$ 5.2 billion in potential savings in 2021 alone), Angola (about US$2.9 billion in potential savings in 2021), and Kenya (about US$ 1.2 billion in potential savings in 2021).

In the year 2020, as one participant in the DSSI, China has deferred payments of US$2.1 billion (with about US$1.353 billion of debt suspension from CIDCA and China Exim, and US$748 million voluntary debt suspension from China Development Bank). This compares to US$2.5 billion by Paris club members by the end of 2020 (which deferred an additional US$2 billion in 2021).

However, participation in the DSSI was lower than expected, with DSSI eligible countries fearing to be shut out of future lending by creditors should they defer payments. The chair of the Paris Club and head of the French Treasury Emmanuel Moulin is quoted as saying that “some countries have decided not to apply for the final [DSSI] extension as they didn’t want to create difficulties with China (…) [and] preferred to talk to China and other creditors about new money rather than requesting help under the DSSI”. Furthermore, despite the extension of original suspension period from December 31, 2020 to the end of 2021, the DSSI was not yet extended into the year 2022.

Building on the DSSI, the G20 Common Framework for Debt Treatments was launched in late 2021 to incentivize participation from private creditors and improve the scale of debt relief through collective action. The Common Framework provides debt treatment on a case-by-case basis driven by voluntary requests from debtor countries. However, so far only three countries had participated (i.e., Chad, Ethiopia, and Zambia), but have yet to receive relief.

The IMF is also providing debt service relief to the poorest and most vulnerable countries through various lending facilities (e.g., rapid credit facility RCF, rapid financing instrument RFI), financed by the Catastrophe Containment and Relief Trust (CCRT) which was originally established in 2015. By March 2022, the IMF made approximately US$250 billion available to member countries, for example about US$730 million to Bangladesh, US$610 million to Nepal. China has contributed US$8 million to support the CCRT.

Furthermore, in August 2021, the IMF made available the largest Special Drawing Rights (SDR) allocation in IMF’s history, equivalent to US$650 billion. These SDRs were not targeted specifically at DSSI countries but were distributed to all 190 members participating in the Special Drawing Rights Department in proportion to their existing quotas in the fund. Accordingly, the US with its allocation of 82,994 million SDR (17.43% of the total) would have received US$113 billion, China with its 30,482 million SDR would have received US$42 billion, and, for example, Pakistan with its 1,946 million SDR only US$2.7 billion. At the end of November 2021, President Xi pledged at the Forum on China Africa Cooperation (FOCAC) to redistribute about US$10 billion worth of SDRs to African countries. Several other G20 countries, such as France, Italy, the US and the UK committed to redistribute about 20% of their SDR to emerging markets.

Meanwhile, some debtor countries have sought to restructure their external debt in innovative ways: in November 2021, for example, Belize entered a debt-for-nature swap agreement with The Nature Conservancy (TNC), Credit Suisse and the U.S. International Development Finance Corporation to restructure US$553 million of its debt in exchange for its commitment for marine protection.

3.2 Challenges with Current Approaches for Debt Relief

The current debt relief strategies have not effectively solved debt issues. The DSSI’s influence had been modest in providing real debt relief: in 2021, the estimated deferrals of debt service accounted for less than 2% of their GDP in most DSSI participating countries. With its expiration in December 2021, the DSSI is currently not in a position to provide eligible countries with new options to reduce debt service repayment options.

The Common Framework was designed to overcome the limitations of DSSI and bring in non-Paris club official creditors and non-official lenders, but so far has been slow in progress—of the three countries (Chad, Ethiopia, and Zambia) that applied for debt relief, none have completed the process.

Several reasons can be found:

- One challenge is a greater complexity of sovereign liabilities, where creditors, compared to a decade ago, include a larger share of commercial and nontraditional lenders. Furthermore, “potential off-balance-sheet and often unrecorded public sector borrowing from state-owned enterprises and special-purpose vehicles have also trended higher”.

- Furthermore, transparency of debt exposure (e.g., with hidden debt) may risk both willingness of creditors to engage in debt restructuring and the access to new credit from the capital market. For example, seniority of creditors and, therefore, debt service and default procedures remain unknown. Studies by authors working for the World Bank found that “50% China’s official lending to developing countries is not reported in the most widely used official debt statistic” and “that close to three-quarters of the debt contracts in the Chinese sample contain what we term “No Paris Club” clauses (…) to exclude the debt from restructuring in the Paris Club of official bilateral creditors”.

- Additionally, debt classification remains a challenge, especially with non-Paris club creditors including China. For example, some financial institutions could be seen as official bilateral lenders according to their legal status (e.g., development banks), but in some cases are categorized as commercial lenders based on their lending terms, rather than their sovereign governance structures or the ability to raise money on public markets with sovereign guarantees.

- China has held firm that for any multilateral debt relief, the multilateral lenders, such as the IMF and World Bank, would need to lead the way and potentially equally contribute to debt relief rather than insisting on seniority in debt repayment. While original intentions to provide such debt swaps through multilateral institutions were floated by, for example, IMF’s managing director Kristalina Georgieva, its implementation has not taken off.

- Finally, while new forms of debt relief were initated, including debt-for-nature swaps and nature-performance securities, their scalability to provide significant debt relief is yet to be proven due to high negotiation, governance and social inclusion challenges.

4. Recommendations for Accelerating Debt Relief Action

To accelerate debt relief and avoid further deterioration of sustainable development potentials in many of the DSSI countries, we developed the following perspectives for improving the current strategies of debt relief and enhancing China’s role.

- Improve the consistency of debt classification

The classification of lending to DSSI eligible countries, from both the creditor’s and debtor’s sides, should be improved. On the creditor side, for example, the World Bank IDS classifies creditor type based on the source of financing rather than the legal status of the lender. In that case, loans extended on commercial terms by a policy bank using funds raised in commercial markets might be classified as non-official debt. On other occasions (e.g., DSSI and Common Framework), the obligation of creditors seems to be dependent on their legal status. On the debtor side, some debts that the debtor government does not directly owe, but has contingent liabilities for (e.g., state guarantees, the default of sub-national government or state-owned companies) should be properly considered and calculated.

Reaching a consensus on the classification of debt among multilateral and bilateral lenders is key to addressing the transparency issue. In cases where debtor countries are in urgent debt relief needs, creditors could consider lifting some of the confidentiality agreements in exchange for efficient collective action.

2. Increase political willingness and coordination between bilateral and multilateral creditors

Despite bilateral creditors’ willingness to engage and IFIs’ increased efforts to support least-developed countries within their own frameworks, tackling debt issues during and after the pandemic would need more systematic and coordinated collective action of public and private, bilateral and multilateral actors. For instance, a “Guarantee Facility” to incentivize private creditor participation as proposed by Boston University Global Development Policy Center, the Heinrich Böll Foundation and the Centre for Sustainable Finance at SOAS in 2021, or a G20 agreement to combine both national and multilateral efforts. The international pledge to fight against climate change has yielded meaningful results and thus brought experience in mobilizing political will to not only promise but also act.

3. Accelerate innovative and unconventional solutions for debt swaps

Creditors and debtors should explore and accelerate innovative and unconventional solutions to swap portions of debt that would most likely never be paid back to be used for environmental protection (e.g., debt for nature-swaps), health-related purposes (e.g., debt-for-health swaps), or broader development (e.g., debt for SDG swaps). Some solutions have already been applied with proven success, such as the Seychelles debt-for-nature swap in 2015 to restructure US$ 21.6 million debt and Belize’s debt-for-nature swap to restructure US$553 million debt in 2021. Similarly, in 2021, Germany and Indonesia signed a deal for a US$50 million debt for health swap supported by the Global Fund.

4. Utilize capital markets with sustainability-linked debt instruments and public guarantees

Contrary to debt swaps, sustainability-linked debt instruments issue new debt on the capital markets and provide investment opportunities in domestic economies without reducing current debt levels. For highly indebted countries with little access to capital markets or with high borrowing costs to issue new debt, they could issue sustainability-linked debt instruments to attract patient capital, where interest rates would decrease or increase depending on the agreed sustainability performance of the country (e.g., nature protection, education of children,…).

These sustainability-linked debt instruments could further be enhanced through public guarantees and/or default insurances in partnership with development partners (e.g., special funds, developed countries’ development financial institutions). This should further reduce borrowing costs and improve access to capital markets (the Belize debt restructuring was made possible by a US$610 million political risk insurance by the U.S. International Development Finance Corporation DFC). The development partners should similarly link the guarantee and support to the debtor government’s delivery of sustainability outcomes.

5. Utilize project-specific loan restructuring

Particularly for Chinese infrastructure construction in the countries of the Belt and Road Initiative (BRI), project-based loans have played a large role, many of which had been supported through local government guarantees or had been paid through government-to-government loans. Currently, these loans might be labelled as non-official debt, or their guarantees are invisible in the debt statistics. In such cases, project-specific loan restructuring measures could be considered. For example, banks and investors could consider the securitization infrastructure projects through pooling and selling the securities on a secondary market (e.g., one similar to Singapore’s Bayfront asset-backed infrastructure securitization platform) or through a national/multilateral project securitization fund. This would allow raising more capital from the capital markets through asset-backed securities while reducing the debt burden for the debtor countries.

5. Conclusions and Outlook

The global economic outlook continues to be most difficult than ever with an unresolved COVID-19 crisis and a war in Ukraine sending shockwaves throughout the world.

To avoid further deterioration of the global economy and to provide a possible trajectory for a sustainable recovery in many of the hardest-hit emerging economies, financial independence is necessary that requires a solution to the debt crisis. Economies need significant fiscal space for enabling investment in a green transition that reduces carbon emissions and biodiversity loss while providing public services like education and health, as well as job opportunities for social mobility. Failing to solve the debt crisis risks exacerbating social problems and inequality, reducing access to global capital and technology, as well as driving bilateral dependencies rather than providing choices for international cooperation.

Tackling the debt crisis requires multilateral and bilateral efforts. Debt transparency through a multilateral framework is a prerequisite to reducing distrust and gridlock as creditors would fear that any debt restructuring might only benefit the nontransparent creditor rather than the debtor country. Yet, both small and large creditors can provide bilateral debt restructuring options as well, ideally with sustainable development “strings” attached. Also, bilaterally, countries can support through guarantees to restructure current debt or issue new debt.

China, as the largest bilateral creditor in most of the emerging countries, has taken on a special role: it considers itself an emerging economy and has provided billions for financing infrastructure projects, especially through the Belt and Road Initiative (BRI). It has engaged actively in debt relief, particularly for interest-free loans. However, at this time, China’s coherent strategy of dealing with debt and collaborating on a multilateral basis still requires more clarity. As mutual trust and transparency are crucial ingredients for debt restructuring, China should equally understand the concerns of international partners on providing more transparency and clarity on Chinese loans, and it should communicate and negotiate its requirements for engaging in debt restructuring. As the main bilateral creditor in DSSI eligible countries, China has more responsibility and opportunities to provide bilateral and multilateral support for debt restructuring than other countries. As such, work by the China Council for International Cooperation on Environment and Development (CCICED) and others can provide a basis for ideas and international collaboration.

Please cite as:

Yue, Mengdi and Nedopil, Christoph (March 2022): “China’s Role in Public External Debt in DSSI Countries and the Belt and Road Initiative (BRI) in 2020”, Green Finance & Development Center, FISF Fudan University, Shanghai; DOI: 10.13140/RG.2.2.33997.72169

Mengdi Yue is a visiting researcher at the Green Finance & Development Center and previously was a researcher at the Green BRI Center at IIGF. She holds a Master in International Relations from School of Advanced International Studies (SAIS) and has worked with the American Enterprise Institute (AEI), European Union Chamber of Commerce in China and the China-ASEAN Environmental Cooperation of the Ministry of Ecology and Environment. She is fascinated by green energy finance in China and the Belt and Road Initiative and data analysis.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.