The Green Finance Guideline (Baseline) for the China Pakistan Economic Corridor (CPEC) incorporate 12 recommendations to accelerate green finance to support Pakistan’s green transition with a focus on collaboration and finance mobilization.

Greening finance in the China Pakistan Economic Corridor (CPEC) is a unique opportunity to accelerate the green transition of Pakistan, for example in the energy, transport, and agricultural sector. Pakistan requires billions of dollars not only to transform its energy system, but to build resilience against the consequences of climate change.

China and Pakistan have closely worked together in investing and financing soft and hard infrastructure through the CPEC – one of the corridors of China’s Belt and Road Initiative (BRI). Both countries have made significant progress of improving the foundations for green finance. Pakistan has issued several key documents, including green banking guidelines, green bond guidelines and providing refinancing facilities. China has not only pushed for green finance domestically, but more importantly has provided key policy documents to accelerate green finance in the Belt and Road Initiative (BRI). It has also developed a traffic light system to evaluate projects for their environmental impacts and to accelerate green projects.

This document analyzes the financing needs and potentials of Pakistan for a green transition and espouses to accelerate green finance within CPEC. It further analyzes relevant green finance documents from Pakistan, China and internationally.

Based on this analysis, the researchers in collaboration with local stakeholders in government, finance and developers through workshops and interviews suggests 12 recommendations for greening finance for CPEC that could be relevant for Chinese, Pakistani and international financial institutions, project developers and policy makers.

CPEC Green Financing Recommendations

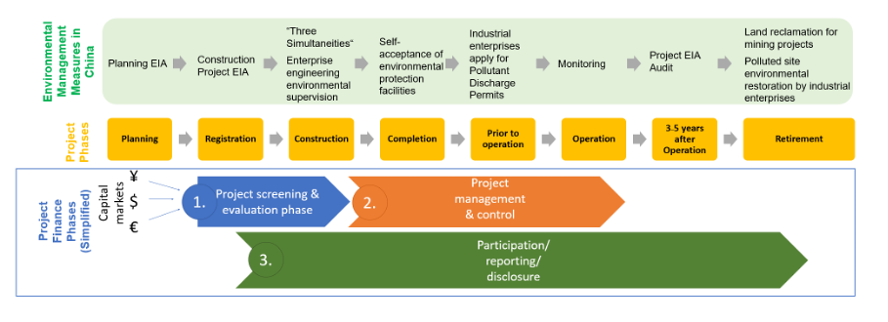

Recommendation 1: For project finance, green investment practices address all project phases: To accelerate green overseas investments, environmental concerns during the whole project lifecycle must be addressed. The project life cycle includes multiple phases. For investors the phases can be divided into project screening and evaluation, project monitoring and control, and public participation—reporting and information disclosure. Engaged stakeholders should take responsibilities to enhance the green development of project throughout the lifecycle.

Note:EIA = environmental impact assessment; the “Three Simultaneities” refers to the China’s requirement that pollution prevention facilities in construction projects should be designed, constructed and put into use at the same time as the main project.

Recommendation 2: Exclusion List[1]: Agree on an exclusion list of environmentally harmful projects that must not receive investment in CPEC. Projects on Exclusion Lists include those that have severe and irreversible negative impacts on ecological development goals without feasible possibilities for mitigation.

Recommendation 3: Accelerate green investment: Financial institutions, developers, and regulators should focus on developing green investment opportunities and strive to prefer green investments over other investments according to local conditions. such green investments could be evaluated according to the Traffic Light System of the BRIGC Green Development Guidance.

Recommendation 4: Environmental Impact Assessment: For projects, project developers must obtain an independent Environmental Impact Assessment (EIA) for each project, which should be overseen by financial institutions involved in project finance. According to Equator Principles, low-risk projects require at least a locally required EIA. For medium- and high-risk projects, the standards are more stringent and should be compatible with international best practice (e.g., World Bank Environmental and Social Standards [ESS] or International Finance Corporation [IFC] Performance Standards), which include disclosure and public participation and industry-specific EIAs.

Recommendation 5: Differentiated and risk-adjusted financing conditions and green financial instruments: Financial institutions consider environmental risks in their financing conditions (i.e., better financing conditions and fast-track approval for green projects, restraining the approval for red projects). Financial institutions should also aim to offer – in collaboration with policy and development financial institutions – a variety of instruments to allow for risk mitigation and improve risk-adjusted returns (e.g., bonds, facilities, commercial guarantees, insurances).

Recommendation 6: Environment and Social Management System: Financial institutions require an Environment and Social Management System (ESMS) from their clients for all medium- and high-risk projects. The ESMS includes environmental (and social) mitigation measures that are measurable and need to be reported at least every six months to the financial institution.

Recommendation 7: Grievance redress mechanism: Financial institutions provide an easy-to-access and transparent grievance redress mechanism for people and NGOs that are potentially negatively affected by projects throughout the project phases, starting during the project evaluation. Contact information is made readily available for affected persons, NGOs, and others who wish to contact the financial institution to express concerns or objections to a new or existing project in the institution’s portfolio. The grievance redress mechanism must be available in local language(s).

Recommendation 8: Covenants: Financial institutions include covenants in their investment agreements that allow them to work with clients to rectify breach of environmental and social agreements and, if need be, to exercise remedies, including calling events of default.

Recommendation 9: Public environmental reporting: Financial institutions provide independent reporting on the environmental performance of projects in their portfolio, including details on emissions, pollution, and biodiversity targets and impact; risk management; strategy; and governance. They use both required and applicable internationally recognized standards.

Recommendation 10: Adopting green and circular supply chain management: Supply chains should support green development patterns with low carbon footprint, no negative biodiversity impact, and no pollution, while ideally a circular supply chain management should be envisaged to not only reduce, but eliminate waste and maximize resource utilization, recycling, and re-use.

Recommendation 11: International cooperation: Financial institutions can share environmental data with relevant global authorities to support global data repositories on climate and biodiversity. For example, the Equator Banks share both climate and biodiversity data of their investments.

Recommendation 12: Building capacity through collective action: Capacity building on environmental (and social) risk evaluation, risk management and relevant international reporting should be strengthened through international collaboration and digital and offline knowledge sharing for financial institutions, policy makers and developers, as well as affected communities.

>> download the full document here

[1] The Exclusion List is different from the red categorization of projects.

The Green Finance Guidelines (Baseline) for the China Pakistan Economic Corridor (CPEC) were developed in cooperation between Sustainable Development Policy Institute (SDPI) in Islamabad, Pakistan, the Pakistan-China Institute (PCI) in Islamabad, Pakistan, and the Green Finance & Development Center at FISF Fudan University in P.R. China.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.