This article is the first of a series of posts on green finance trends in China. The work was prepared with support from the International Institute for Sustainable Development (IISD) as a scoping study for the China Council for International Cooperation on Environment and Development (CCICED). The report does not reflect official positions from either of the organizations.

China’s Top-Down Green Finance System

The development of green finance in China is rooted in China’s top-down political economy mode [1], where central governments and regulators (compared to e.g., financial associations or markets) play a guiding role by

- Setting the direction for green financing development through policies, guidance, and regulations, including top-level design, evaluation system, taxonomies, and disclosure;

- Leveraging public finance’s support, such as establishing green development fund, etc.; and

- Creating an enabling environment for the market such as incentive policies.

China’s top-down market steering approach [2] can be contrasted with a bottom-up market facilitation approach in the EU [3] and the US. As a result, for example, Chinese institutions had not issued any green bonds before 2015, but once relevant regulations supporting green bonds were issued by the central government, China became the world’s largest issuer in 2016.

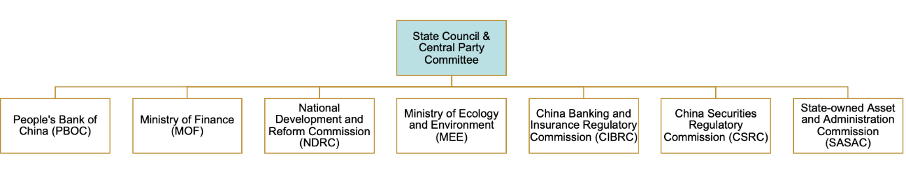

Multiple ministries and regulators are responsible for green finance (see Figure 1), where green finance leadership tends to fall to the People’s Bank of China (PBOC). The ministries involved in China’s green financial development and their responsibilities are described in the following figure:

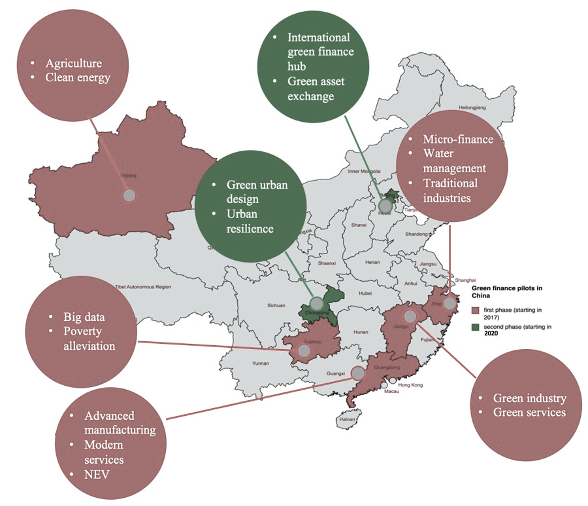

Furthermore, pilots are being set up under the central level top-design. Pilot local governments developed their own green finance ecosystem and implemented detailed policy/regulations based on a central policy framework with localization and innovative practices, which greatly led the green finance development across the country. The goal of these pilots is ultimately to determine the effectiveness of different green finance policies and then implement these at the national and international levels. This enabled, for example,

- the city of Shenzhen in March 2021 to implement China’s first green finance law [4], requesting listed financial companies registered in Shenzhen to disclose environmental information from the beginning of 2022.

- In July 2022, Shenzhen issued disclosure guidance [5] to further facilitate unified environmental disclosure work of financial institutions; Guangdong’s government issued a plan for developing green finance to support carbon peak and neutrality [6];

- The city of Chongqing established itself as a green finance pilot zone with the goal to create a “Yangtze River Green Finance Corridor” [7];

- The city of Huzhou issued a guideline [8] on financing biodiversity with the goal to establish more innovative financing tools and relevant targets for biodiversity conservation; and

- In September 2022, Beijing issued an action plan to accelerate the construction of a global green finance and sustainable financial center with full-service research, decision-making, and market operation. [9]

The next figure provides an overview of green finance pilot zones of the first and second batches and their focus for accelerating green finance.

As work on tackling climate change had been partly designated to the Ministry of Ecology and Environment (MEE), MEE established separate climate finance pilot zones (distinct from green finance pilots). This overlap can possibly create extra learning and inefficiencies. In August 2022, 23 cities were approved as the first batch of pilot cities [10].

Provincial and city government offices support and partly implement national green finance policies through local DRCs (development of reform commission, the local level ministry of the NDRC), the Bureau of Finance, or the Bureau of Ecology and Environment. Furthermore, non-government stakeholders implemented and support the green financial system (see Table below)

| Financial institutions | Market exchanges | Financial associations | Service providers |

| main bodies for the effective execution of green finance policies in China based on green loans;implement policies through capacity building, establishing concrete rules of green finance; working with different stakeholders to release green finance products;Some banks perform stress tests and scenario analysis (for climate risks). | provide limited guidelines to steer green finance, e.g., ESG disclosure regulations (e.g., Shanghai Stock Exchange, Shenzhen Stock Exchange, and Beijing Environmental Exchange) | Associations, such as the National Association of Financial Market Institutional Investors (NAFMII), explore rules and principals for innovative green finance products, provide capacity and standards. | Provide services, including assessment and certification work of green bonds. Their role has been elevated in November 2022 to take more responsibility in reducing greenwashing |

Recent Green Finance Policies in China

The following sections highlight and analyze recent green finance policy developments in China based on the five pillars [11] for green finance development promulgated by PBOC in early 2021:

- Improve the green finance standard system;

- Strengthen regulation and disclosure requirements;

- Enhance the incentive and restraint mechanisms;

- Enrich the product and market system; and

- Expand international cooperation and lead the setting of international standards for green finance.

Standard system

At the beginning of 2022, PBOC, State Administration for Market Regulation (SAMR), China Banking and Insurance Regulatory Commission (CBIRC), and China Securities Regulatory Commission (CSRC) issued the Fourteenth Five-Year Plan for Financial Standardization Development [12]. The Plan identifies key tasks and goals over the next five years, including setting up “domestic united, international aligned”, clear and enforceable green finance standards on ESG disclosure and assessment, carbon accounting for financial institutions, loan statistics, carbon finance, and transition finance.

Noteworthy developments in green finance standard systems include:

- For banks: In June 2022, the CBIRC issued the Guidelines for Green Finance in the Banking and Insurance Industry (银行业保险业绿色金融指引), raising green finance in the banking and insurance industry to a strategic level. This guideline brings the non-credit business of banking institutions, the insurance industry’s underwriting, and asset management business into the green finance scope, which will ideally mobilize more green finance. The Guidelines also require that environment, social, and governance (ESG) factors shall be included in the management process and comprehensive risk management system.

- For green taxonomies: In July 2022, the Green Bond Standards Committee officially released the China Green Bond Principles (中国绿色债券原则) [13]. The new principle further unified the domestic green bond market and was designed to be more aligned with international standards. A noteworthy enhancement is that it requires 100% of the proceeds to fund green projects, instead of 50-70% previously, which is a positive signal to attract foreign investors that are concerned about potential greenwashing. This comes after China was the first country to launch a green bond taxonomy in 2015 by the PBOC [14]. In 2019, the NDRC [15] released Green Industry Catalogue relevant for green credit and SOEs. Later, the PBoC, NDRC, and CSRC updated and joint Green Bond Project Endorsed Catalogue (2021 version) in 2021 [16]. The new catalogue brought some important changes to China’s taxonomy of sustainable finance – clean use of coal and several fossil fuel (gas and liquefied natural gas (LNG)) projects were removed from the definition of ‘eligible green project’. This was noticeably different from the European Union (EU)’s green taxonomy, which classified gas as a sustainable investment [17].

In general, the green industry catalogue serves as a unified standard blueprint for green classification at the Chinese ministries and commissions level. Based on the green industry and green bond catalogues, sub-level governments especially pilot zones have developed localized taxonomies and project databases to facilitate green finance. Their international alignment has also been explored (see next section).

| Positive trends: | Other trends: |

| More detailed standards for green bonds in line with international standards (e.g., less fossil fuel, 100% of proceeds must be used for green);More detailed standards for green banking, including improved governance requirements and green banking evaluation systems. | No acceleration of standards for non-aligned projects;Absence of the technical path, entry threshold, and financial standards for transition finance;Overlap between responsible entities in developing green finance – government (including banks and financial institutions) with experience (mostly in pilot or initiatives). |

Disclosure Policy

Environmental, social, and governance (ESG) information disclosure of enterprises and financial institutions reduces information asymmetries to ideally reduce greenwashing and accelerate financing for green development. MEE and PBOC are key policy stakeholders promoting disclosure policies for corporations and financial institutions, respectively. Local exchanges also provide mandatory disclosure requirements for listed companies.

- For corporations, MEE released two documents in May and Dec 2021: the Reform Plan for Mandatory Environmental Disclosure System and the Administrative Measures for Enterprise Environmental Disclosure [18]. The former serves as a systematic roadmap for the construction of China’s mandatory environmental disclosure system in the next five years; the latter further clarified disclosure entity, content, format, and procedures. One of the disclosure focuses is carbon emission data. This could be a tentative attempt and a policy signal for a further step toward mandatory climate disclosure in the future.

- For state-owned enterprises (SOEs), the State Council’s Assets Supervision and Administration Commission (SASAC) established the Social Responsibility Bureau and issued a workplan to stipulate SOEs achieve ESG disclosure by 2023 [19]. It also stressed the requirement to establish and improve statistical accounting and information disclosure for carbon emissions, and effective measures to control carbon emissions for state-owned enterprises at a meeting in September 2022 [20]. As the main players in economic activities, SOEs serve as a focal point for government to accelerate progress on carbon reduction, ESG disclosure, and green finance.

- For listed companies

- CSRC issued revised guidelines for the format and content of annual reports and semi-annual reports of listed companies in June 2021, requiring setting up a separate section of “Environmental and Social Responsibility” in the reports It further encourages the disclosure of carbon emission reduction measures and results [21].

- In January 2022, Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) both updated guidelines for listed companies, proposing that certain companies (i.e., SSE: listed companies, SZSE: “Shenzhen 100” sample companies and Growth Enterprise Market (GEM) listed companies) “should” publish environmental and social responsibility report together with annual reports [22],[23].

- SSE also released an internal notice, mandating Science and Technology 50 sample companies to disclose ESG reports along with their annual reports and shall highlight its actions to support the goal of “carbon peak and carbon neutrality” [24].

- For financial institutions:

- In early 2021, the PBOC began trial implementation of financial institutions’ environmental disclosure guidelines, work plans, and operating manuals in the “six provinces and nine places” of green finance pilot zones. As part of this, PBOC required financial institutions to disclose all scope 1, 2, and 3 emissions. Financial institutions in Guizhou, Zhejiang, the Guangdong-Hong Kong-Macao Greater Bay Area, as well as all legal city commercial banks in Jiangxi have successively released disclosure reports. The total number of disclosing financial institutions in pilot zones surpassed 200 by Mar 2022 [25].

- In July 2021, the PBOC officially issued the Guidelines for financial institutions Environmental Information Disclosure(金融机构环境信息披露指南), rolling financial institutions’ environmental and climate disclosure from pilot cities to a wider range-encompass all commercial banks, asset management institutions, trust companies, and insurance companies, but it did not require disclosure for scope 3, i.e., financial institution portfolio carbon emission. The Guideline promotes on a voluntary basis financial institutions’ ESG disclosure.

| Positive trends | Other trends |

| Increasing relevance and provision of policy signals for disclosure standards across various asset classes from various regulators;Promoting a unified reporting format for certain corporates (MEE’s new rule on corporate disclosure);Adding/encouraging aspects of climate-relevant disclosure in the policies. | Overall slow progress in putting forward the mandatory disclosure for all listed companies;Lack of coherent non-financial disclosure standards;Lack of enforcement and relevant penalties for lack of disclosures. |

Incentive and restraint mechanisms

Incentive and restraint mechanisms for green finance support financial institutions to accelerate the use of green finance and restrain the use of non-green finance. PBOC and CBIRC are leading policy development in this field.

- In June 2021, PBOC officially issued Green Finance Evaluation Plan for Banking financial institutions (银行业金融机构绿色金融评价方案) [26], aiming for green finance evaluation of 24 major banking financial institutions. This Plan is an upgrade of the 2018 Notice on Conducting Green Credit Performance Evaluation of Banking Depository Financial Institutions: the new Plan enlarged the green finance product spectrum to include green bonds, and expanded evaluation subjects from larger banking entities such as large commercial banks, joint-stock banks, and policy banks to smaller city commercial banks. The Plan also supplements to overall green finance statistical system. The Plan was an initial step towards a more comprehensive green finance evaluation and meanwhile improved incentives and constraints policy system.

- In Nov 2022, the CBIRC issued the Notice on the Statistical System for Green Insurance Business (绿色保险业务统计制度的通知) to collect and summarize green insurance data of insurance companies. According to CBIRC, the next step will be to study and issue relevant guidance on green insurance and establish a sound green insurance policy system. This has partially complemented the overall green finance statistical system.

- PBOC utilized the dual-pillar framework of “macro-prudential policy + monetary policy” to promote the growth of green finance [27]. Banks are rewarded for their performance on green credit through higher scores (already since 2017). The practice for the monetary policy aspects allows PBOC to accept green loans and bonds as collateral to grant banks increased access to PBOC’s Short-term Standing and Medium-term Lending Facilities (since 2018). 2021 marked important progress in relending instruments of the monetary policy: On Nov 8th, 2021, PBOC launched a carbon-reduction supporting tool[ 28] to provide low-cost loans to financial institutions for lending to enterprises in priority carbon-reduction industries. The PBOC identified 21 policy banks to support and has imposed stringent requirements.

Furthermore, as of the end of Sep 2022, PBOC supported the use of RMB240 billion (USD 33.8 billion) and more than RMB400 billion (USD 56.3 billion) in total of carbon-reduction supporting finance through the Carbon Emission Reduction Facility (CERF). CERF aims to promote carbon reduction and support the development of clean energy and energy conservation and allows financial institutions to provide loans to borrowers, 60% of which will be refinanced by PBOC at 1.75% – less than half of the Loan Prime Rate (LPR). PBOC claims a reduction of more than 80 million tons of carbon emissions [29]. Moreover, PBOC added two foreign lenders, Deutsche Bank (China) Co Ltd and Société Générale (China) Ltd, to the list of financial institutions within the supporting tool in August 2022, illustrating a willingness on China side to further cooperate with foreign financial institutions on green finance development.

Besides the national level, provincial-level incentive systems have been established through preferential interest rates for green credits and bonds, green special re-lending through local government or PBOC, and through risk guarantee or compensation funds. For instance, Beijing, Guangzhou [30], Jiangsu [31], Shenzhen [32], Hong Kong, etc. have introduced subsidies for green bonds: Shenzhen offers subsidies of up to RMB500,000 per project per enterprise that successfully issues green bonds in Shenzhen. Meanwhile, the use of re-lending mechanisms to promote green initiatives is prevalent throughout the seven pilot provinces.

Contrary to green incentives, also incentives for fossil fuel have been expanded:

- On November 21st, PBOC introduced an RMB 200 billion (USD31 billion) relending program for clean coal [33].

- In April 2022, the PBOC introduced special products for rediscounting energy supply protection and provided RMB 890 million (about USD 150 million) of note financing support for 10 thermal power enterprises in the first batch.

- A second batch was announced worth RMB 100 billion (about USD 15 billion) “to support the clean and efficient use of coal” in May 2022. [34]

| Positive trends | Other trends |

| Increased incentive mechanisms for green bond issuance;Improved incentive mechanism for green lending. | Increased incentives for fossil-related investments;Lack of disincentives for brown investments;Overall insufficient coverage and unclear effect of incentives (i.e., for smaller banks to carry out green finance at city/county level). |

Product and market system

In July 2021, PBOC released the standard for Environmental Equity Financing Instruments [35]. The standard clarified the classification and stipulated the overall requirement of environmental equity financing instruments. It also put up the implementation process for current typical environmental equity financing instruments, providing guidance for enterprises and financial institutions to carry out environmental equity financing activities.

In April 2022, the CSRC issued the “Carbon Financial Products” standard [36], putting forward normative requirements and providing guidance for the classification and implementation of carbon financial products. This can regulate and enrich trading instruments in China’s emission trading system (ETS).

China’s national Emission Trading System (ETS) was launched in July 2021 after 10 years of piloting. It obliged 2,225 large emitters in the power sector with total annual emissions of close to 4.5 billion tons of CO2 per year, or around 40% of China’s total. Allowances are given out for free.

China offers three main types of transactions, whereby only the first two can be traded on the national ETS:

- carbon spot trading products that contain carbon emission allowance (CEA)

- carbon spot trading of Chinese Certified Emission Reduction (CCER), and

- carbon derivative trading products, where CEA makes much of the trade and is supplemented by the other two.

It should be noted that the CCER approval process has been suspended since 2017, and as a beneficial complement to the mandatory market, it is anticipated to be re-initiated soon albeit the exact time is not clear [37]. The city of Beijing announced the establishment of a national voluntary emission reduction trading center in February 2022 [38] (which may be a positive sign although the actual starting time remains uncertain).

Other derivative instruments such as carbon long-term, carbon futures, carbon periods, carbon options, carbon asset securitization, and indexed carbon trading products are traded at low levels in pilot carbon markets, which are operating in parallel with the national ETS [39]. Pilot local carbon markets have explored different instruments to diversify product types and promote flexibility and liquidity of trading, but they have not become major tools in use yet. There is no public announcement on how these eight local pilots will evolve, i.e., whether or when they might be phased into the national market.

In addition to compliance trading, Shanghai Environment and Energy Exchange released the first corporate carbon credit evaluation standards (CCCES) in June 2022 and announced that they would start the development of the carbon price index. CCCES provides companies with a tool to comprehensively demonstrate their carbon emission reduction capabilities. [40]

Blue carbon credits have seen a rise through the approval of the Hainan International Carbon Emissions Trading Center in March 2022 [41]. The Center aims to make blue carbon a globally recognized standard through market-oriented trading of marine carbon sinks (or “blue carbon”) products.

In July 2022, HKEX established the Hong Kong International Carbon Market Committee to lay out the development of a unified carbon market for the Greater Bay area [42].

Moreover, new products, such as transition bonds are intended to supplement existing green bonds and whereby proceeds should go toward companies’ green transition projects, such as cleaner coal production, use of natural gas, and application of green technologies. Just as green bonds, transition bonds have requirements on the use of proceeds, disclosure, third-party assessment, certification, etc.

China launched a pilot program for companies to issue transition bonds in June 2022 and required that transition bonds should focus on traditional industries’ upgrading and transformation. Companies in eight sectors — electricity, construction materials, steelmaking, nonferrous metals, petrochemicals, chemicals, papermaking, and civil aviation — were allowed issue bonds to help them shift to greener modes of operation, according to the NAFMII [43]. In the meantime, the Shanghai Stock Exchange revised its guideline [44] for corporate bonds, including a new variety of low-carbon transition (linked) corporate bonds, “Belt and Road” corporate bonds, which will further boost the development of transition bonds.

| Positive trends | Other trends |

| Launch of ETS and increased trading;Issuance standards of new products for carbon/environmental equity finance;Launch of transition bonds;Ideas of linking carbon markets explored. | Lack of roadmap and timeline for carbon market development;Lack of market mechanism of the ETS (i.e., to incorporate more diversified carbon products and derivatives);Continued high share of free allowances on carbon market reducing the efficiency of trading;Continued existence of parallel pilot carbon markets leads to potential confusion. |

International Green Finance Cooperation and Standards

China is active internationally to set and shape green finance standards. The PBOC is co-leading the G20 Sustainable Finance Working Group (SFWG), initiated the Network for Greening the Financial System (NGFS), and China collaborates with the EU to lead the International Platform for Sustainable Finance (IPSF) to develop the Common Ground Taxonomy published in its updated version in June 2022 (first published in 2021) [45]. This Taxonomy was developed based on the EU and China’s past work on taxonomy, with the purpose of building greater comparability and interoperability among different national taxonomies to support common or converging practices of financial institutions and companies on green activities. This is essential in promoting domestic and overseas market recognition of China’s green financial products, reducing certification costs, and attracting more international investors.

China has also worked with the United States on transition finance. In Nov 2022, the two parties jointly issued the “G20 Transformational Finance Framework”, to guide G20 members to formulate specific policies for transition finance, including the introduction of transitional finance standards, information disclosure requirements, incentive mechanisms, etc.

Furthermore, China has been actively supporting the work of the International Sustainability Standards Board (ISSB) which was founded and oversight by the International Financial Reporting Standard (IFRS), e.g., one of the four members of the new inaugural members of the ISSB is Leng Bing, director of the Accounting Regulatory Department of the Ministry of Finance (MOF). ISSB’s most influential work will be to initiate a global baseline framework for non-financial sustainability disclosure, and this is a “must do” to build an accessible, traceable, verifiable green finance working system. And once implemented, it will impact disclosure behavior, especially for China’s overseas listed companies.

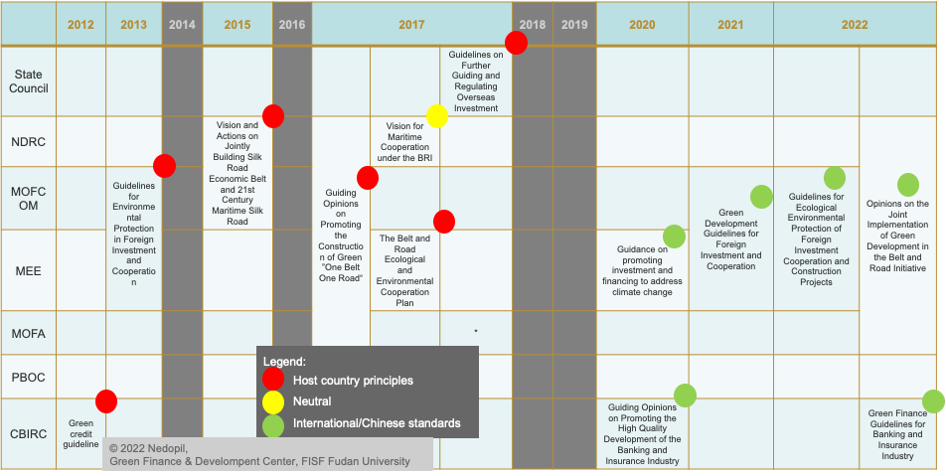

As a major international financier, e.g., through its Belt and Road Initiative (BRI), China supports overseas green finance standard setting, for example through the Green Development Guidance with the Traffic Light System [46], the Green Investment Principles (GIP) [47], in addition to several green finances and green cooperation government-issued documents [48]. By September 2022, 44 financial institutions across 17 countries (within USD41 trillion assets under management) have joined the Principles, which are the most important stakeholders to drive works and leverage funds for the Belt and Road.

In its policy guidelines, China has moved towards recommending international green finance standards in lieu of host country rules for overseas projects and finance in countries with weak environmental laws, for example through the CBIRC Green Finance Guidelines for Banking and Insurance Industry and the Opinions on the Joint

Implementation of Green Development in the Belt and Road Initiative (2022) (see Figure 3). At the core of this new Opinion is the requirement to advance green development throughout BRI cooperation.

Additionally, as a member of the Shanghai Cooperation Organization (SCO), China supported a joint statement on climate change response in September 2022, that included aspects of experience exchange on investment criteria and sustainable projects including green classification, studying the prospect of deepening cooperation in the field of fund raising to prevent and adapt to climate change, conducting dialogues on carbon markets among SCO member states which includes dialogues on entering and participating in international carbon markets. [49]

| Positive trends | Other trends |

| Strong participation of China in international regulatory green finance institutions (e.g., IPFS, ISSB, G20);Strong policy support for green finance in the BRI through both regulatory and voluntary standards (e.g., BRIGC, GIP);Recommendations for Chinese financial institutions and developers in international projects to apply international project finance standards. | Low levels of participation of Chinese financial institutions in voluntary international associations and standard setters (e.g., GFANZ, PRI);Continued support for multiple fossil finance projects (e.g., gas, oil), versus no new coal. |

References

[1] Barry Naughton, “Grand Steerage,” in Fateful Decisions: Choices That Will Shape China’s Future (Stanford University Press, 2020), 51–81.

[2] Yao Wang, “China’s Green Finance Strategy: Much Achieved, Further to Go,” Grantham Research Institute on Climate Change and the Environment, 2018, https://www.lse.ac.uk/granthaminstitute/news/chinas-green-finance-strategy-much-achieved-further-to-go/.

[3] Mathias Lund Larsen, “Intersecting Interests and Coincidental Compatibility: How China, the EU, and the United States Can Coordinate Their Push for Globalizing Green Finance,” Georgetown Journal of International Affairs (blog), July 15, 2021, https://gjia.georgetown.edu/2021/07/15/intersecting-interests-and-coincidental-compatibility-how-china-the-eu-and-the-united-states-can-coordinate-their-push-for-globalizing-green-finance/; Christoph Nedopil, Truzaar Dordi, and Olaf Weber, “The Nature of Global Green Finance Standards—Evolution, Differences, and Three Models,” Sustainability 13, no. 7 (March 26, 2021): 3723, https://doi.org/10.3390/su13073723.

[4] 深圳市人民代表大会常务委员会, “深圳经济特区绿色金融条例–深圳市法规及规章[Shenzhen Special Economic Zone Green Finance Regulations–Shenzhen City Laws and Regulations],” November 2020, http://www.sz.gov.cn/cn/xxgk/zfxxgj/zcfg/szsfg/content/post_8290626.html.

[5] 深圳市地方金融监督管理局等, “关于印发《深圳市金融机构环境信息披露指引》的通知[Notice on Issuing the “Guidelines for Environmental Information Disclosure of Financial Institutions in Shenzhen”],” September 30, 2022, http://jr.sz.gov.cn/sjrb/ydmh/isz/zcfg/szsjrzc/jrfzzc/content/post_10150984.html.

[6] 广东省人民政府办公厅, “关于印发广东省发展绿色金融支持碳达峰行动实施方案的通知(Notice on Issuing the Implementation Plan of Guangdong Province to Develop Green Finance to Support Carbon Peak Action),” July 2022, https://www.gd.gov.cn/zwgk/wjk/qbwj/ybh/content/post_3972447.html.

[7] 人民网, “绿色金融改革创新试验区再扩容 积累我国绿色金融体系-重庆经验(The Green Finance Reform and Innovation Pilot Zone will be expanded again to Chongqing to accumulate experience of China’s green finance development),” August 2022, http://finance.people.com.cn/n1/2022/0828/c1004-32513183.html.

[8] 湖州市人民政府, “关于金融支持生物多样性保护的实施意见(Huzhou Municipal Government: Implementation Opinions on Financial Support for Biodiversity Protection),” August 2022, http://www.huzhou.gov.cn/art/2022/8/15/art_1229561845_1667141.html.

[9] 北京市地方金融监督管理局等, “《‘两区’建设绿色金融改革开放发展行动方案》(Beijing Local Financial Supervision and Administration Bureau: “Action Plan for Reform and Opening-up Development of Green Finance in ‘Two Districts'”),” August 2022, http://www.igea-un.org/cms/show-6669.html.

[10] 23 pilot cities: Miyun District and Tongzhou District of Beijing, Baoding City of Hebei Province, Taiyuan City and Changzhi City of Shanxi Province, Baotou City of Inner Mongolia Autonomous Region, Fuxin City and Jinpu New District of Liaoning Province, Pudong New District of Shanghai City, Lishui City of Zhejiang Province, Chuzhou City of Anhui Province, Sanming City of Fujian Province, West Coast New District of Shandong Province, Xinyang City of Henan Province, Wuchang District of Wuhan City of Hubei Province, Xiangtan City of Hunan Province, Nansha New District of Guangdong Province, Futian District of Shenzhen City, Liuzhou City of Guangxi Zhuang Autonomous Region, Liangjiang New District of Chongqing City, Sichuan Province Tianfu New District, Xixian New District of Shaanxi Province, Lanzhou City of Gansu Province, Baoding City of Hebei Province, 生态环境部等, “关于公布气候投融资试点名单的通知(Mnistry of Ecology and Environment:Notice on Publishing the List of Climate Investment and Financing Pilots),” August 2022,https://www.mee.gov.cn/xxgk2018/xxgk/xxgk04/202208/t20220810_991388.html.

[11] 人民网, “陈雨露:绿色金融‘三大功能’‘五大支柱’助力碳达峰碳中和 (Vice governor of PBOC Chen Yulu: Green Finance’s “Three Functions” and “Five Pillars” Help Carbon Peak Carbon Neutralization),” March 2021, http://finance.people.com.cn/n1/2021/0307/c1004-32044837.html.

[12] 中国政府网, “四部印发《金融标准化‘十四五’发展规划》(PBOC, SAMR, CBIRC, CSRC issed the “Fourteenth Five-Year Development Plan for Financial Standardization”),” February 2022, http://www.gov.cn/xinwen/2022-02/09/content_5672688.htm.

[13] “Chinese Green Bonds Required to Use 100% of Funds for Green Purposes,” China Dialogue (blog), August 2022, https://chinadialogue.net/en/digest/chinese-green-bonds-100-percent-funds-for-green-purposes/.

[14] PBoC. Green Bond Endorsed Project Catalogue (人民银行:绿色债券支持项目目录), 2015.

[15] NDRC et al. Green Industry Guiding Catalogue (2019 version) (国家发展和改革委员会,工业和信息化部,自然资源部,生态环境部,住房城乡建设部,人民银行,国家能源局: 绿色产业指导目录(2019年版)). https://www.ndrc.gov.cn/fggz/hjyzy/stwmjs/201903/W020200217416444788586.pdf.

[16] PBoC. Green Bond Endorsed Project Catalogue (中国人民银行, 发展改革委, 证监会《绿色债券支持项目目录(2021年版)》). http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4236341/index.html.

[17] Catherine Clifford, “Europe Will Count Natural Gas and Nuclear as Green Energy in Some Circumstances,” CNBC, July 6, 2022, https://www.cnbc.com/2022/07/06/europe-natural-gas-nuclear-are-green-energy-in-some-circumstances-.html.

[18] Ministry of Ecology and Environment. Measures for the Administration of Legal Disclosure of Enterprise Environmental Information (生态环境部: 企业环境信息依法披露管理办法), 2021.

[19] 生态中国网, “国资委:力争2023年央企上市公司ESG专项报告披露‘全覆盖 (SASAC: Strive to achieve ‘full coverage’ on ESG disclosure of listed companies of state-owned enterprises in 2023),’” May 2022, https://www.eco.gov.cn/news_info/55577.html.

[20] 中国政府网,“国资委要求中央企业”一企一策”制定碳达峰行动方案 (SASAC requires central enterprises to formulate carbon peak action plan “one enterprise, one plan”)”, October 2022, http://www.gov.cn/xinwen/2022-10/07/content_5715977.htm.

[21] 中国证券监督管理委员会, “证监会发布修订后的上市公司年度报告和半年度报告格式准则 (CSRC: the revised guidelines for the format of annual reports and semi-annual reports of listed companies),” June 2021, http://www.csrc.gov.cn/csrc/c100028/cb25156c4913f4c9ea6b658cad8011f17/content.shtml.

[22] 上海证券交易所, “关于发布《上海证券交易所上市公司自律监管指引第1号——规范运作》的通知 (Shanghai Stock Exchange Guidelines No. 1 for Self-Regulatory Supervision of Listed Companies—Standardized Operation),” January 7, 2022, http://www.sse.com.cn/lawandrules/sselawsrules/stock/main/listing/c/c_20220107_5679270.shtml.

[23] 深圳证券交易所, “关于发布《深圳证券交易所上市公司自律监管指引第1号——主板上市公司规范运作》 的通知 (Shenzhen Stock Exchange Guidelines for Self-Regulatory Supervision of Listed Companies No. 1—Standardized Operation of Companies Listed on the Main Board),” January 7, 2022, http://www.szse.cn/lawrules/rule/stock/main/t20220107_590547.html.

[24] 界面新闻, “科创板年报新要求确认:公司需增加ESG相关信息披露 (New Requirements for Sci-Tech Innovation Board Annual Report Confirmed: Companies Need to Increase ESG-related Information Disclosure),” January 19, 2022, https://www.163.com/dy/article/GU3EQEK20534A4SC.html.

[25] 中国金融, “提升金融机构环境信息披露能力 (Improving the ability of financial institutions to disclose environmental information),” May 2022, https://finance.sina.com.cn/money/bank/yhpl/2022-05-12/doc-imcwiwst6974348.shtml.

[26] Jingyun Liu, “PBoC Issues Green Finance Assessment Plan for Banking Institutions,” Seneca ESG (blog), June 11, 2021, https://www.senecaesg.com/insights/pboc-issues-green-finance-assessment-plan-for-banking-institutions/.

[27] 21世纪经济报道, “四大绿色金融激励措施将出,宏观审慎政策侧重防范气候风险 (Four major green financial incentives will be launched, and macro-prudential policies will focus on preventing climate risks),” April 20, 2021, https://finance.sina.com.cn/tech/2021-04-20/doc-ikmxzfmk7964944.shtml.

[28] 中国政府网, “人民银行推出碳减排支持工具 (PBOC launches carbon reduction support tool),” November 18, 2021, http://www.gov.cn/xinwen/2021-11/08/content_5649848.htm.

[29] 新浪财经, “易纲:截至今年9月末碳减排支持工具累计使用2400多亿元 支持碳减排贷款超过4000亿元 (Yi Gang: As of the end of September this year, more than RMB 240 billion of CERF have been used, which supported more than RMB 400 billion loans),” November 21, 2022, https://finance.sina.com.cn/china/gncj/2022-11-21/doc-imqmmthc5424081.shtml.

[30] 广州市黄埔区人民政府, “《广州市黄埔区 广州开发区促进绿色金融发展政策措施实施细则(修订)》(Implementation Rules for Policies and Measures for Promoting Green Finance Development in Huangpu District, Guangzhou City and Guangzhou Development Zone (Revised)),” November 2022, http://www.hp.gov.cn/zwgk/zcjd/zcjd/content/post_8673588.html.

[31] 中国政府网,“江苏:发绿色债券贴息30% 绿色企业上市奖励200万元 (Jiangsu: Issuing green bonds with a discount of 30% and rewarding green enterprises with RMB 2 million for listing),” 2019, http://www.gov.cn/xinwen/2019-08/17/content_5421985.htm.

[32] 深圳市政府, “深圳市人民政府关于构建绿色金融体系的实施意见 (Shenzhen Municipal People’s Government: Implementation Opinions on Building a Green Financial System),” January 2019, http://www.sz.gov.cn/zwgk/zfxxgk/zfwj/szfwj/content/post_6577287.html.

[33] Bloomberg. China’s Coal Support Continues With $31 Billion Finance Promise, 2021.

[34] Xinhua, “China’s central bank steps up support for clean, efficient coal use, 2022 http://english.www.gov.cn/statecouncil/ministries/202205/05/content_WS627305b2c6d02e533532a3d2.html

[35] 全国金融标准化技术委员会, “《环境权益融资工具》金融行业标准正式发布 (The financial industry standard of “Environmental Equity Financing Instruments” was officially released),” August 2022, https://www.cfstc.org/jinbiaowei/2929436/2980681/index.html.

[36] 资本市场标准网, “碳金融产品 (Carbon Financial Products),” April 2022, http://www.csisc.cn/zbscbzw/wg61hh/202204/3fc33d5207ee452bbc48c457a8de681c.shtml.

[37] 生态环境部, “生态环境部召开10月例行新闻发布会 (MEE held a regular press conference in October),” October 27, 2022, https://www.mee.gov.cn/ywdt/zbft/202210/t20221027_998163.shtml.

[38] 京报网, “北京将承建全国自愿减排交易中心,探索与国际碳交易机制接轨 (Beijing will construct a national voluntary emission reduction trading center to explore the integration with the international carbon trading mechanism),” February 2022, https://news.bjd.com.cn/2022/02/16/10043380.shtml.

[39] Chongqing, Fujian, Guangzhou, Wuhan, Shanghai, Tianjin, Shanghai, Shenzhen

[40] China Development Brief, “Carbon Price Index Announced in Shanghai,” 25 2022, https://chinadevelopmentbrief.org/reports/carbon-price-index-announced-in-shanghai/.

[41] 海南省人民政府网, “海南国际碳排放权交易中心获批设立 (Hainan International Carbon Emissions Trading Center Approved to Establish),” March 2022, https://www.hainan.gov.cn/hainan/tingju/202203/19eaf1b283004947874d696d1e20fda9.shtml.

[42] 新浪财经, “香港交易所成立香港国际碳市场委员会 布局发展碳市场 (HKEX Establishes Hong Kong International Carbon Market Committee to Develop Carbon Market),” July 2022, https://finance.sina.com.cn/stock/hkstock/hkzmt/2022-07-05/doc-imizmscv0193682.shtml.

[43] National Association of Financial Market Institutional Investors (NAFMII). Notice on Launching Innovation Pilot Programs Related to Transition Bonds (中国银行间市场交易商协会: 关于开展转型债券相关创新试点的通知), 2022, http://www.nafmii.org.cn/ggtz/tz/202206/P020220606608323917589.pdf.

[44] 上海证券交易所, “关于发布《上海证券交易所公司债券发行上市审核规则适用指引第2号——特定品种公司债券(2022年修订)》的通知 (Notice on Issuing the “Shanghai Stock Exchange Guidelines No. 2 for the Applicability of the Review Rules for the Issuance and Listing of Corporate Bonds – Specific Types of Corporate Bonds (Revised in 2022)”) ” June 2, 2022, http://www.sse.com.cn/lawandrules/sselawsrules/bond/review/c/c_20220602_5703022.shtml.

[45] In September 2022, Trina Solar became the world’s first green syndicated debtor (commercial loan) under the Common Ground Taxonomy (https://www.trinasolar.com/cn/resources/newsroom/mon-09262022-1536)

[46] Nedopil, C. et al. Green Development Guidance for BRI Projects Baseline Study Report, 2020.

[47] Green Finance Leadership Program. Green Investment Principles (GIP) for the Belt and Road, 2018.

[48] Nedopil, C. Green finance for soft power: An analysis of China’s green policy signals and investments in the Belt and Road Initiative. Environ. Policy Gov. eet.1965 (2021) doi:10.1002/eet.1965.

[49] 上海合作组织成员国元首理事会关于应对气候变化的声明 (Statement of the Council of Heads of State of the Shanghai Cooperation Organization on Addressing Climate Change), Sep 2022, http://eng.sectsco.org/load/914639/

Comments are closed.