In a new report, Ziying Song, Christoph Nedopil (both GFDC), Haneea Asad (IEEFA Pakistan) and Muhammad Basit Ghauri (Renewables First Pakistan) analyze the opportunities for accelerated coal phase-down and green energy expansion in Pakistan.

Executive Summary

Pakistan like many nations, faces the urgent need to mitigate climate change and reduce dependence on fossil fuels. The potential coal-phase out and renewable energy development offer Pakistan substantial prospects for enhancing energy accessibility, affordability, and fostering green growth. However, these long-term green benefits have been superseded by Pakistan’s short-term concerns regarding energy security, a persisting energy crisis, intricate political-economic circumstances, and vested interests. As a result, the overall progress towards a green transition has thus far been limited.

Pakistan’s coal expansion is primarily driven by support from the China-Pakistan Economic Corridor (CPEC). Its coal capacity has rapidly grown from 0.15 GW in 2015 to over 7 GW by June 2023, with China backing 90% of the current capacity. An important aspect of Pakistan’s coal and fossil fuel-based generation is its reliance on imported fuels, which has threatened fuel supply and caused significant power shortages. However, through enhanced mining capabilities in the local Thar coal region facilitated by CPEC, Pakistan envisions overcoming its energy crisis by leveraging its vast Thar coal reserves and indigenous solar and wind sources over the next decade.

Despite the massive potential, support from Pakistan government and China, and favorable cost of generation and tariffs (which are already cheaper than coal and other conventional forms), the development of solar and wind capacity in Pakistan has remained slow. As of June 2022, solar and wind sources contribute only 6% to the overall capacity. It is evident that some non-economic factors have impeded the progress of renewable development and the phase-down/out of coal in Pakistan. Achieving transformative change and diminishing the role of coal in the medium to long term requires a deep understanding of the local political economy.

This policy brief conducts a comprehensive political-economic analysis to examine the objectives and interests of key stakeholders and their intricate interplay, which significantly influence the formation of barriers and drivers associated with Pakistan’s prospective phase-down/out of coal and the parallel expansion of renewable energy sources.

The major barriers to coal phase-out and renewable scale-up point to political, economic, and legal factors.

- Politically, the coal mining and coal power generation industry, with stake from local governments and state-owned companies, have become symbols of resource nationalism and the preservation of vested interests. Instability in the central government has led to policy inconsistency, and slow implementation. For example, competitive bidding and trading mechanisms, which could serve as boosters for renewable energy expansion, have been under discussion for several years without much progress.

- Economically, Pakistan struggles with circular debt issues within the power sector exacerbated by exchange rate risks and price increases of fuel imports. These factors strain Pakistan’s ability to allocate fiscal and financial resources to transform the current electricity structure.

- Legally, the young, long-term contracted, sovereign-guaranteed coal fleets in Pakistan not only add to debt issues but would require complex re-negotiations of existing contracts with investors and owners, such as Chinese state-owned enterprises and financial institutions.

At the same time, key enabling factors for an accelerated energy transition in Pakistan exist. Several global initiatives are active in Pakistan, particularly the Energy Transition Mechanism (ETM). They focus on the phase-out of fossil fuel-based power and provide essential transition mechanisms and financing tools while engaging in principles of a just transition. Notably, the ongoing research conducted by the ETM on the phased closure of coal and other fossil fuel-based plants in Pakistan represents a potential avenue for piloting a coal phase-out project.

Simultaneously, China’s increasing adoption of sustainable practices in their overseas investments signals the potential for constructive dialogues regarding debt and contract restructuring to repurpose existing coal projects in Pakistan. Moreover, Pakistan’s clear targets for renewable energy development, coupled with the evolving landscape of renewable energy policies and green finance frameworks, further solidify the foundation for a comprehensive green transition.

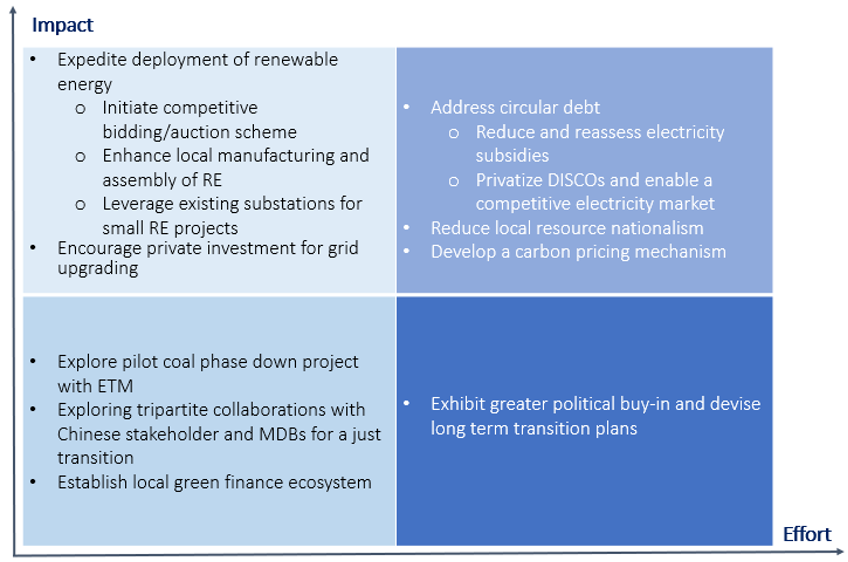

Building upon the political and economic analysis, this brief presents actionable policy recommendations (simplified below) to harness enabling factors and navigate barriers particularly with Pakistan being a core Belt and Road Initiative country:

To accelerate the energy transition over the next 2-5 years, several recommendations seem relevant:

- Expedite the deployment of renewable energy to diversify power mix, restrain additional coal-fired power plants, and pave the way for coal power to assume a diminished role.

- Encourage private sector investment in upgrading grid infrastructure to catalyze energy transition. Pakistan should ensure that the transmission investments required to integrate renewable sources into the grid are realized and carefully coordinated with generation-expansion plans.

- Leverage the Energy Transition Mechanism (ETM) to explore a piloting project for the flexibilization of the operation coal units and its potential phase down. The overcapacity issue could create an opportunity for Pakistan’s phase down coal without compromising energy security.

- Exploring tripartite collaborations with Chinese stakeholder and Multilateral Development Banks for concessional and innovative financing tools that could provide more opportunities for a just transition.

- Establish local green finance ecosystem to support greater uptake of renewable energy and transition away from emission-intensive power sources.

In the long term (over the next 7-10 years), further recommendations can be taken under consideration:

- Drive necessary reforms in the power sector to reverse the course of circular debt and restore a healthy energy economics. This includes reducing and reassessing electricity subsidies, catalyze the long-discussed privatization of DISCOs, and enable a competitive electricity market.

- Move away from resource nationalism through repurposing coal subsidies, diversifying economics, and improving transparency and accountability for coal rich provinces.

- Develop carbon pricing mechanism to rationalize implicit cost for coal power generation.

- Demonstrate stronger political buy-in and devise long-term transition plans to effectively leverage international public and private financing support.

Acknowledgements

We appreciate the support from our partner organizations Renewable First (Pakistan) and Institute of Energy Economics and Financial Analysis (IEEFA) in bringing their detailed feedback, suggestions and comments. We extend our sincere gratitude to the ten anonymous interviewees for generously sharing expertise, experiences, and perspectives, thereby enriching our understanding of the subject matter. Lastly, our study benefited from helpful discussions at a closed-door online workshop with stakeholders across Asia organized by the partners together with the Centre for Sustainable Finance at SOAS, University of London on 3 August 2023.

This report was prepared with generous support by the World Resource Institute (WRI). The report does not reflect official positions from the organization.

Comments are closed.