This is an extended version of the China Daily’s article from April 26.

In 2017, the Chinese Ministry of Environment together with 4 other ministries released the “Guidance on Promoting Green Belt and Road”. Realizing this ambition requires green finance – the full range of financial services that support the transformation to an environmentally and climate-friendly economy.

Green Finance in China has seen a strong development based on the “Guidelines for Establishing the Green Financial System” published by The People’s Bank of China and six other government agencies in 2016. In 2018, the Chinese green bond market became the second largest in the world after the United States with issuances of USD30 billion.

Scaling and accelerating these experiences to greening the Belt and Road Initiative (BRI) is a long-term, but achievable goal. Failing to green the BRI would have potentially catastrophic climate impacts around the World. Using green finance to green the BRI, however, is a unique opportunity to scale green technological development in the almost 100 BRI countries.

BRI Investments and their Impact on Emissions

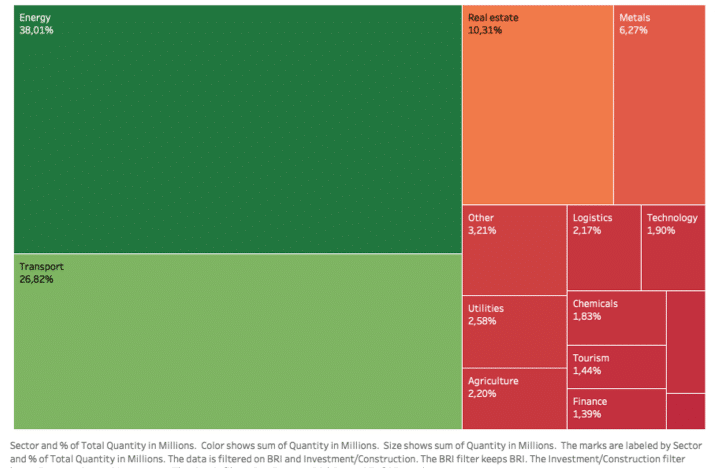

Since its inception in 2013, the BRI saw investments in many sectors, particularly in energy (about 38%) and transport (about 27%), according to data by the American Enterprise Institute (see Figure 1).

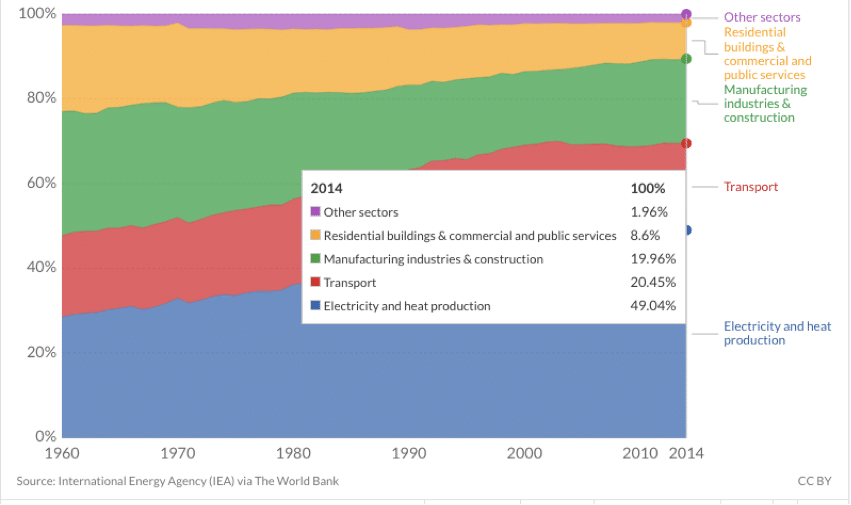

Since the energy and transport sectors are the two main emitters of greenhouse gases in the World, accounting for about 50% and 20% in 2014 according to the IEA – the International Energy Association (see Figure 2), reducing emissions from these two sectors, while providing new economic growth opportunity, is one of the main challenges and opportunities for green finance in the BRI.

Green energy finance

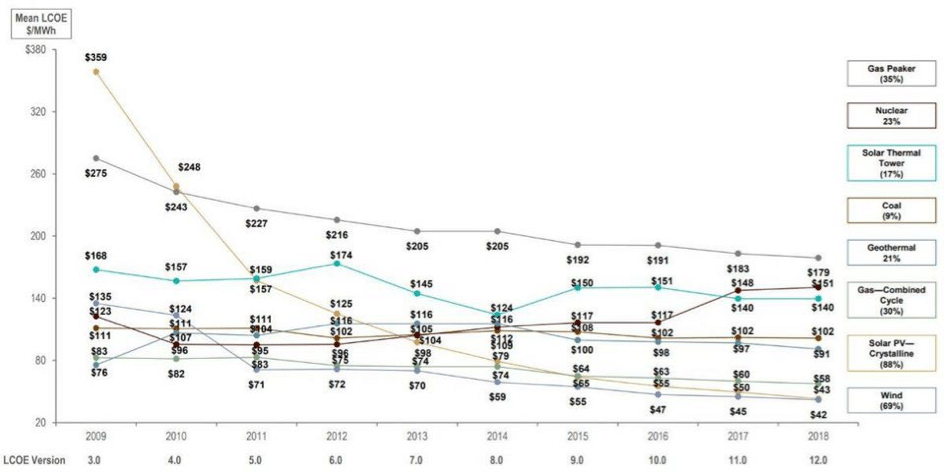

With significant investments in green energy technology, energy production has seen a green revolution. According to a study by Lazard, annualized levelized cost of energy (LCOE) for solar photovoltaic and wind energy have dropped by 88% and 69% respectively from 2009 to 2018, while these costs for coal and nuclear have increased by 9% and 23% respectively (see Figure 1).[3]

Chinese investments have contributed to the technological advances and price drops in green energy with companies like Goldwind and United Power in wind turbines, Trina Solar, Yingli Solar in solar energy, BYD and Huawei in energy storage and management. Investing in green energy technologies and making them available in BRI economies would thus not only allow the expansion of green energy technology companies, but also generate green energy at affordable prices in BRI economies.

Green transport finance

Similar to successful financing of green energy, investments in the transport sector are leading to a green mobility revolution: Electrification, automation, sharing mobility and digitalization is already changing the way people and goods are transported.

However, compared to energy, green finance for transportation in the BRI is more complex, for two reasons:

- First, green mobility still has a higher price tag than traditional mobility: Paved roads are cheaper than subway tunnels, investments in private mobility companies have higher financial returns than in public transportation, and freight companies make money by delivering billions of packages from online shopping.

- Second, investing in green transport involves more complex stakeholder interactions: creating policy incentives for green finance in mobility involves not only investors and operators, but impacts every-day consumer choices. While consumers don’t experience the difference between green and traditional energy when powering their refrigerator, they need to make a choice every day between a greener bus and a less green car – which directly impacts risks and returns for green investments.

Greening transport therefore requires a complex mixture of green finance and green policy. According to the World Bank, combining finance and policy would make green transport investments both cheaper and less risky, lowering green transport investment needs from about 1,060 billion to about USD 417 billion USD per year in emerging economies[5].

China has created valuable experience in mixing policy and finance for green transport and has developed leading green mobility technologies, particularly in electric mobility. These experiences, for example from Shenzhen that financed and operates 17,000 electric buses and 4,600 electric taxis, or from China Railway that invested in the construction and operation of 30,000 kilometer Chinese high-speed rail network, can be useful for greening the BRI.

Challenges in Green Finance for a Green BRI remain

Many investors to date have more experiences in evaluating risks and returns of older rather than new technologies. Accordingly, a World Resources Institute study found that between 2014 and 2017 about 60% of energy projects in BRI countries financed by the China Development Bank and the China Exim Bank went to traditional coal and gas-fired power plants, and only 15% to renewable energy projects (the remaining money went to investments in nuclear energy and energy transmission).

Another challenge to finance a Green BRI is disparities on green and sustainable finance taxonomy. For example, while NDRC’s Chinese green industry catalogue includes green coal and Chinese BRI investments adhere to the host country principal that let’s BRI countries decide on their own energy generation technologies, Westerngreen finance principles don’t include coal.

Finally, many government policies don’t fully incentivize green finance. For example, governments in China, Russia, or Egypt continue to subsidize fossil fuel consumption, while incentives for green technologies are often changing short-term and pricing mechanisms for greenhouse gas emissions are mostly lacking.

A Greener BRI

Greening the BRI is a long-term goal that

requires immediate action. If Chinese and international finance in the Belt and

Road countries is deployed with greater priority on green technologies, they

would without a doubt have an enormous positive impact on green growth. These green

investments would allow BRI countries to avoid the brown trap of

emission-intense infrastructure, and help them to leapfrog to a green and more

prosperous development.

[1] Data Source: China Investment Tracker by Derek Scissors, American Enterprise Institute, 2019

[2] Source: https://ourworldindata.org/co2-and-other-greenhouse-gas-emissions

[3] Megan Mahajan, “Plunging Prices Mean Building New Renewable Energy Is Cheaper Than Running Existing Coal,” March 12, 2018, https://www.forbes.com/sites/energyinnovation/2018/12/03/plunging-prices-mean-building-new-renewable-energy-is-cheaper-than-running-existing-coal/#554c1c331f31.

[4] Lazard, “Levelized Cost of Energy Analysis – Version 12.0” (Lazard, 2018), https://www.lazard.com/media/450784/lazards-levelized-cost-of-energy-version-120-vfinal.pdf.

[5] Julie Rozenberg and Marianne Fay, Beyond the Gap: How Countries Can Afford the Infrastructure They Need While Protecting the Planet., Sustainable Infrastructure Series (Washington, D.C.: World Bank Group, 2019), http://search.ebscohost.com/login.aspx?direct=true&scope=site&db=nlebk&db=nlabk&AN=2031024.