On June 22, the International Energy Agency (IEA) with the support of the International Institute of Green Finance, CUFE (IIGF) launched the IEA World Energy Investment 2020 Report.

Experts from IEA, the Chinese Renewable Energy Industries Association (CREIA), the Energy Committee of China Investment Association, Goldwind Technology Co., Ltd., China New Energy Power Investment and Financing Alliance, and the Asian Infrastructure Investment Bank were invited to attend the webinar.

Professor Yao Wang, General Director of IIGF, and Tim Gould, Head of the Energy Supply and Investment Outlook Division of IEA gave welcome speeches. Professor Wang stressed that now is the turning point for energy transition to renewable energies. Tim Gould expressed that this year’s world energy investments are strongly influenced by the Covid-19 pandemic. He suggested that the energy industry is undergoing a structural transformation. Accordingly, the World Energy Investment report discusses how to cope with pandemic and develop a sustainable recovery strategy.

Renewable and fossil fuel energy investment trends 2020

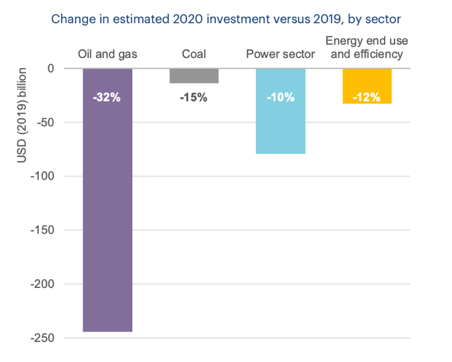

Michael Waldron, author of the report and Senior Energy Investment Analyst of Energy Supply and Investment Outlook Division of IEA, introduced the content of the report. The report finds that global energy investment is set to fall by 20% due to COVID-19 – the absolute greatest decline since statistical data are available.

An important reason for the investment decline, particularly in oil and gas, are falling revenues and reduced energy demand due to the lockdowns of multiple economies as a consequence of the corona pandemic. It is estimated that spending on oil will plummet by more than USD 1 trillion in 2020, while the power sector revenues will drop by USD 180 billion.

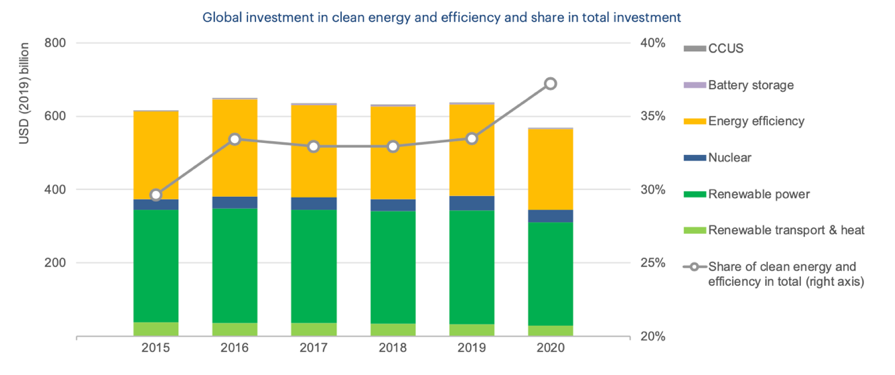

On the other hand, investment in clean energy are expected to be relatively resilient at around USD 600 billion per year. Even though renewable energy investment is predicted to also decline in 2020, its share in total energy investment is set to rise. However, these investment levels remain far short of what would be required to put the world on a more sustainable pathway, particularly to achieve the Paris Climate Accord’s commitment of a net zero-emission economy by 2050. In IEA’s sustainable development scenario, for example, spending on renewable power would need to double by the late 2020s.

Who are the investors

To finance energy investments, sustainable debt flows have surged, particularly through green bonds (which have increased tenfold since 2014 to reach about 250 USD billion in 2019 and about 50 USD billion in Q1 2020). Governments have also increased their energy R&D spending in 2019, which grew by 3% to USD 30 billion. Governments use 80% of their R&D spending on low-carbon technologies –– energy efficiency, CCUS, renewables, nuclear, hydrogen, energy storage and cross-cutting issues such as smart grids. With 6% growth, spending on low-carbon technologies rose faster than total public energy R&D spending, reaching USD 25 billion in 2019.

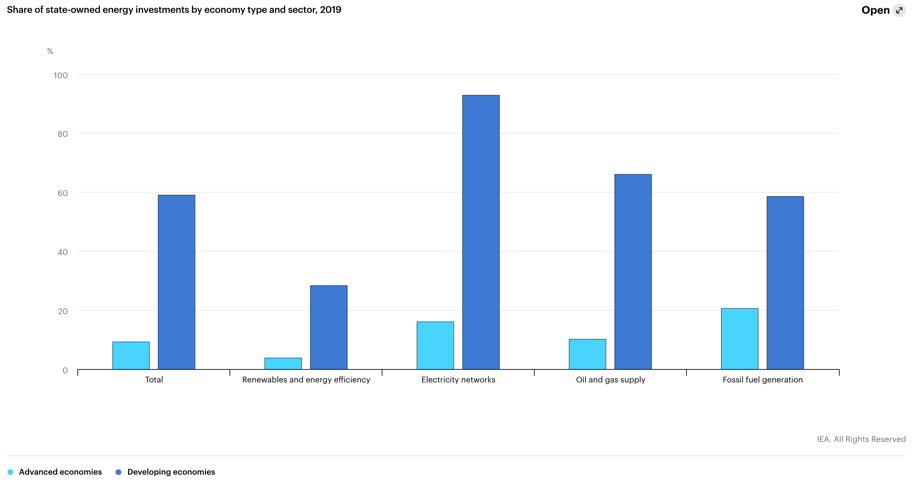

Overall, the role of state-owned energy investments is particularly relevant in developing economies, where SOEs contributed to 59% of energy-related investments (compared to 9% iin advanced economies). Particularly electricity networsk, oil and gas supply and fossil fuel generation are driven by SOEs in emerging economies, while renewables and energy efficiency is driven by private companies also in developing economies.

Energy investment trends in China and the Belt and Road Initiative (BRI)

Hongfeng Xu, Associate Director General of IIGF and Head of Energy Finance, and Christoph Nedopil Wang, Director of the Green BRI Center of IIGF, shared their views and research results on Chinese energy investment in China and the Belt and Road Initiative (BRI).

Professor Xu shared IIGF’s progress in publishing the China Energy Finance Development Report over the past and indicated IIGF’s energy finance database to provide further support for energy finance and research on energy projects.

Christoph Nedopil Wang introduced the Chinese financing condition in countries involved in Belt and Road Initiative. He pointed out that China’s BRI energy investments have peaked in 2018 at about US$45 billion, while 2019 has already seen a strong decline in BRI energy investments. Particularly Pakistan and the Russian Federation have seen energy investments from China in the years 2013 to 2019. The share of non-fossil fuel energy investments has grown from about 25% in 2014 to 48% in 2019.

Christoph Nedopil Wang also elaborated on current research comparing Chinese BRI investments in fossil fuel (coal) power plants and solar power plants. In the presentation, he compared two successful green investments, such as Kenya’s Garissa Solar Power Station invested by EXIM Bank of China, the Noor II PV and Noor III concentrated solar power projects in Morocco to two non-green investments: the 1.3 GW Hunutlu coal-fired power plant in Turkey financed by China Development Bank (CDB) and Bank of China (BOC), and the ICBC financed 2.8 GW coal-fired Sengwa Power Station in Zimbabwe. According to the research, the levelized cost of energy (LCOE) per kWh is about 25% cheaper for the solar projects compared to the coal-fired projects: 26.5 US$/kWh for solar compared to 32.4 US$/kWh for coal. At the same time construction time is also shorter for solar power plants, making them the more interesting investment option if financing conditions allow for the higher upfront investment cost.

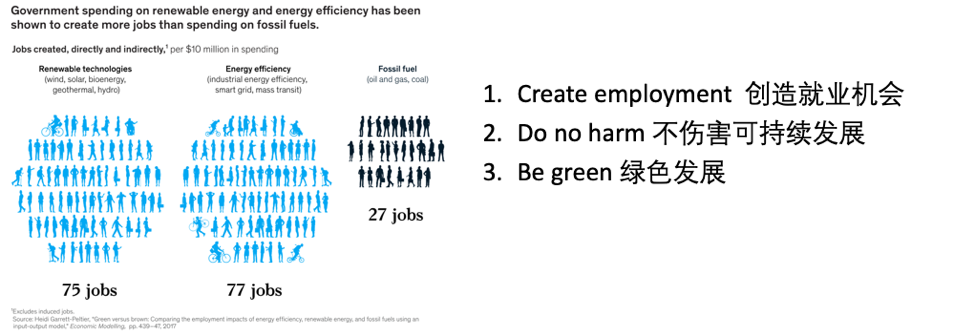

Accordingly, Christoph Nedopil Wang stresses that post-pandemic energy investments should centralize around three topics — “create employment”, “sustainable development”, and “green development”.

Other speakers at the IEA World Energy Investment launch event

Other speakers of the IEA World Energy Investment launch event (China) included

- Junfeng Li, President of the Chinese Renewable Energy Industries Association (CREIA), First Director and Chairman of the Academic Committee of the National Center for Climate Change Strategy and International Cooperation (NCSC),

- Yaowei Sun, President of the Energy Committee of the China Investment Association, special researcher of the Institute of Resources and Environment of Development Center of the State Council,

- Jinshan Gao, Vice President & Head of the Finance of Goldwind Technology Co., Ltd.,

- Peng Peng, Secretary General of the China New Energy Power Investment and Financing Alliance

- Ziwei Liao, Senior Private Sector Operations Specialist of the Asian Infrastructure Investment Bank

Most speakers highlighted that the share of Chinese renewable energy investments has been growing in recent years, great achievements have been made in energy transition, and the Chinese energy investment area looks promising. The general trend of the energy transition will not be changed because of Covid-19; conversely, it might provide greater opportunities for energy investment. Financial institutes are encouraged to play a more influential role, expand access to energy financing, prompt renewable energy development, and create a wider space for energy investment.

Comments are closed.