Key findings

- 10 years after the announcement of the Belt and Road Initiative (BRI), cumulative BRI engagement breached the USD 1 trillion mark (USD1.016 trillion), with about USD596 in construction contracts, and USD420 in non-financial investments;

- China’s energy related engagement in the first half of 2023 were the greenest in any 6-month period since the BRI’s inception in 2013;

- BRI finance and investments is picking up in the first half of 2023 with about 103 deals worth USD43.3 billion compared to about USD35 billion in the first half of 2022;

- Investments as a share of BRI engagement reached record levels at 61% – the first time that it constitutes more than 50% of total BRI engagement;

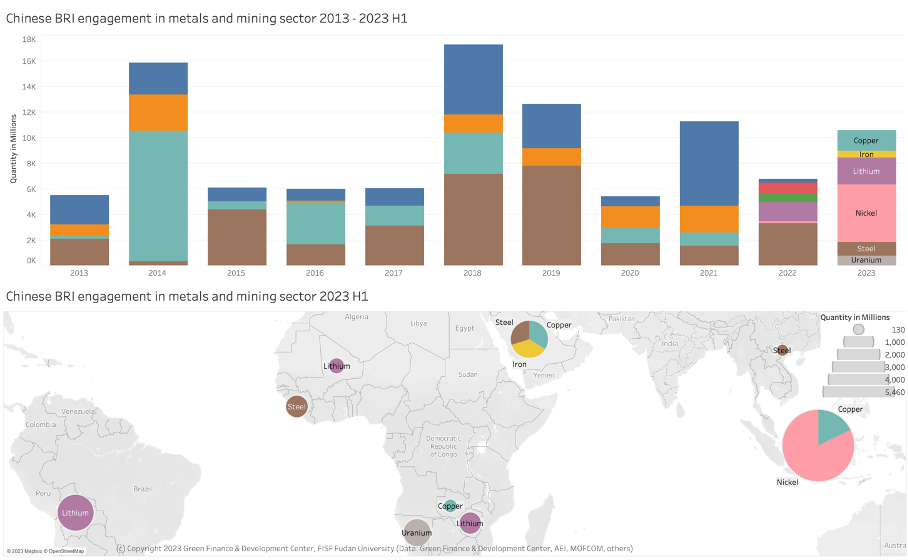

- A growth area of strategic importance is metals and mining through Chinese investment for ownership. Engagement in the sector has grown by 131% compared to the first half of 2022. The minerals and metals are particularly relevant to the green transition (e.g., lithium) and batteries for electric vehicles.

- Major growth countries of Chinese engagement were Bolivia, Namibia, Eritrea, and Tanzania – making Sub-Saharan Africa the fastest growing area of BRI engagement.

- 26 countries saw a 100% drop in BRI engagement, including Turkey, Poland and Kenya; Russia continued to see no public engagement from China;

- BRI investments in the first half of 2023 were for the second time after 2022 dominated by private sector enterprises, including Huayao Cobalt and CATL, whileconstruction contracts were dominated by state-owned enterprises (SOEs);

- In global comparison, global FDI into emerging economies developed similar toChina’s BRI engagement – with a mixed bag of growth and decline;

- For the rest of 2023, further rebound of Chinese BRI engagement is possible with a strong focus on BRI country partnerships in renewable energy and related technologies;

- Potential future engagements can be expected in six project types: manufacturing in new technologies (e.g., batteries), renewable energy, trade-enabling infrastructure (including pipelines, roads), ICT (e.g., data centers), resource-backed deals (e.g., mining, oil, gas), high visibility or strategic projects (e.g., railway).

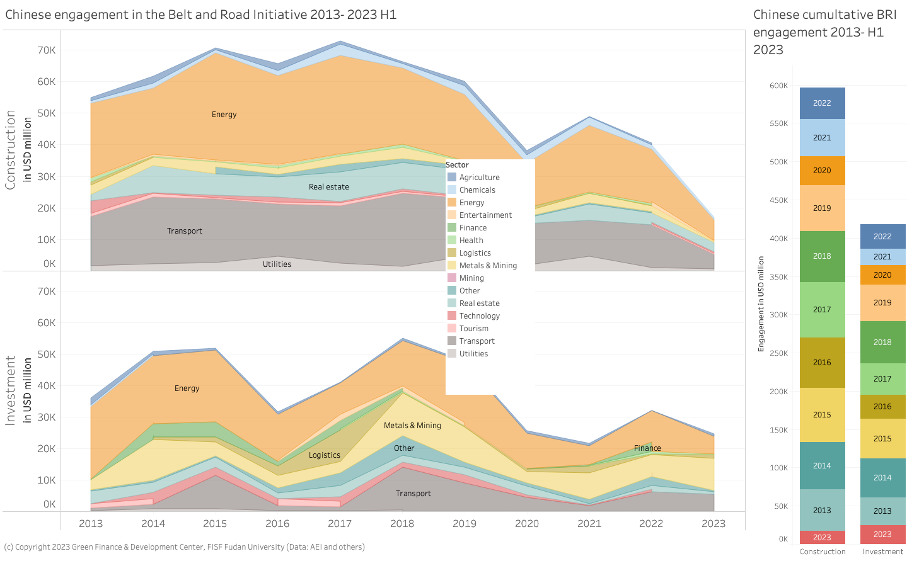

China’s finance and investments in the Belt and Road initiative (BRI)

Cumulative BRI engagement in the 10 years since the announcement of the BRI in 2013 breached the USD1 trillion mark to reach USD1.014 trillion, about USD596 in construction contracts, and USD418 in non-financial investments.

Preliminary data on Chinese engagement through financial investments and contractual cooperation for the first half of 2023 in the 148 countries of the Belt and Road Initiative show about 102 deals worth USD43.3 billion. This equals to about 60% of China’s BRI engagement in all of 2022 (USD72.6 billion).

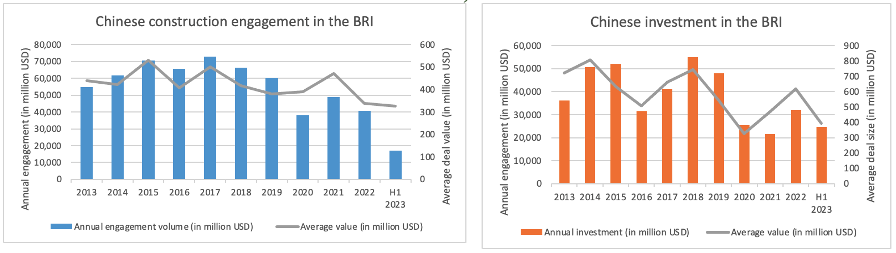

Of this engagement, about USD24.1 billion through investment and USD16.3 billion through construction contracts (partly financed by Chinese loans). China’s overall engagement shows a steady development since 2020 from the onset of COVID-19.

| About the data: In April 2023, the Ministry of Commerce (MOFCOM) released new BRI engagement statistics covering the period of January to March 2023. According to these data, Chinese enterprises invested about 5.76 billion in non-financial direct investments in countries “along the Belt and Road” in the first quarter of 2023 (a year-on-year increase of 9.5%). For this report, the definition of BRI countries includes 148 countries that had signed a cooperation agreement with China to work under the framework of the Belt and Road Initiative by June 2023. We base our data on the China Global Investment Tracker and our own data research at the Green Finance & Development Center affiliated with FISF Fudan University, Shanghai. The data mostly includes deals with a size of over USD100 million and we count BRI engagements as those in countries that had an MoU with China to cooperate under the BRI (thus, if the Syrian Republic signed a BRI MoU in 2022, we also count prior investments into Syria as BRI investments). As with most data, they tend to be imperfect and need regular updating. |

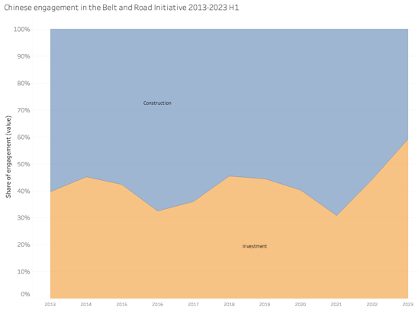

Share of investments in China’s BRI highest on record

The share of Chinese engagement in the BRI through investments compared to construction has seen its highest levels in the first half of 2023: investments reached about 59% of BRI engagement compared to 29% in 2021.

2023 is the first time that more than 50% of the BRI engagement is through investments where Chinese investors take equity stakes with higher risks. This compares to construction contracts that are typically financed through loans provided by Chinese financial institutions and/or contractors with the project often receiving guarantees through the host country’s government institutions.

Deal sizes are getting smaller, potentially following “small or beautiful” ambitions

The average deal size for investments has decreased from about USD617 million in 2022 to USD392 million in the first half of 2023. Compared to the peak in 2018, the investment deal size is 48% smaller.

For construction projects, the deal size in the first half of 2023 was the lowest since the BRI was announced in 2013, with about USD327 million compared to USD338 million in 2022. Compared to the peak in 2017, this is a 35% decrease. This tendency is likely in line with the ambition to have “small or beautiful projects” in the BRI propagated through official channels. Another reason is that China adjusted its risk management strategies to adjust for BRI country risks that are more pronounced and challenging in large scale projects with more social, environmental and governance (ESG) requirements and issues.

Regional and country analysis of Chinese BRI engagement

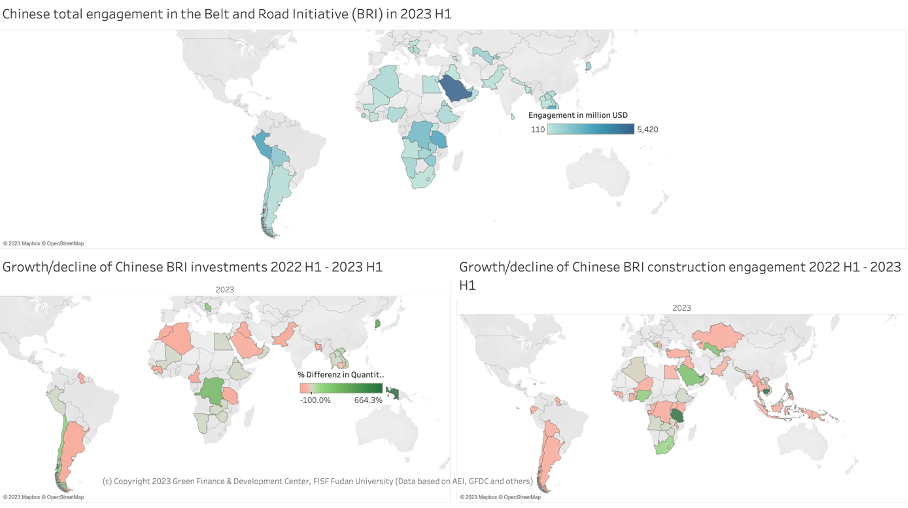

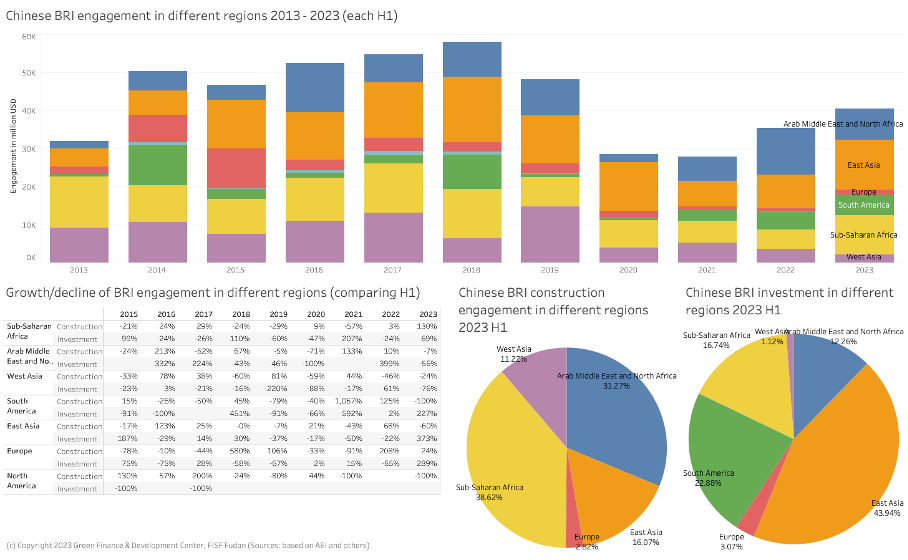

Strong growth in most regions led by Sub-Saharan Africa and South America, after years of mixed developments

Chinese BRI engagement was not evenly distributed among all regions. BRI countries in Sub-Saharan countries saw a 130% increase in Chinese investments and 69% increase in construction contracts. The region became dominant for construction engagement and the second most important target region for BRI investments (after East Asia).

Middle Eastern countries continued to be a major recipient of Chinese engagement, receiving USD8.1 billion in total engagement, yet significantly less than the USD12.3 billion in the first 6 months of 2022.

East Asian BRI countries, meanwhile, expanded cooperation with China from USD8.84 billion to USD13.2 billion in the first 6 months of 2022 and 2023, respectively. Interestingly, South American BRI countries saw no construction engagement in the first 6 months of 2023, but significant growth (+227%) in investments, receiving overall the highest level of Chinese engagement in the region since 2018.

China’s financing and investment spread across 45 BRI countries in 2023, with 24 countries receiving investments and 29 with construction engagement.

The country with the highest construction volume in the first half of 2023 was Saudi Arabia, with about USD3.8 billion, followed by Tanzania (about USD2.8 billion) and UAE (USD1.2 billion).

Regarding BRI investments, Indonesia was the single largest recipient with about USD5.6 billion in investments, followed by Peru (USD2.9 billion) and Saudi Arabia (about USD 1.6 billion).

26 countries saw a 100% drop of BRI engagement compared to 2022, including Turkey, Poland, and Kenya. China’s engagement in Pakistan for the China Pakistan Economic Corridor (CPEC) dropped by about 74%. The countries with the largest growth of BRI engagement were Bolivia (+820 %), Namibia (+457%), Eritrea (+359%), Tanzania (+347%), and Cambodia (+230%).

Sector trends of BRI engagement

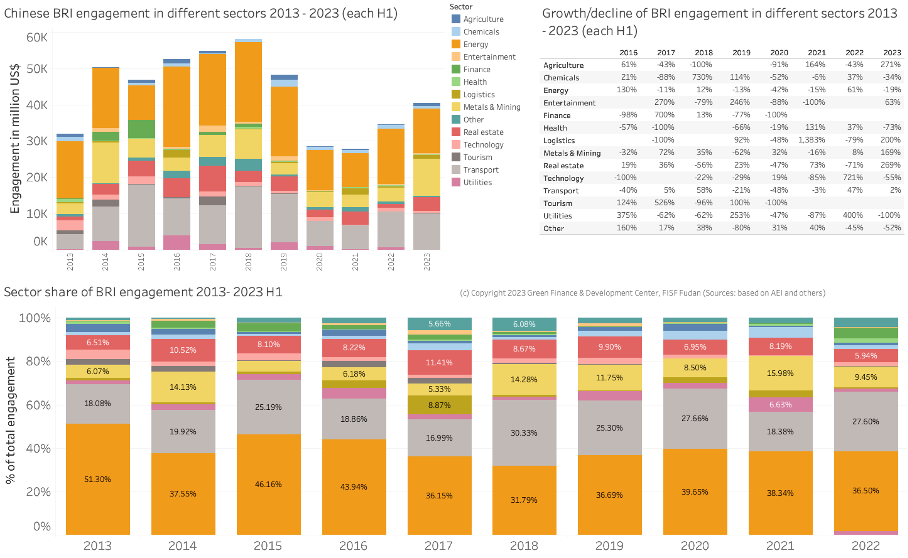

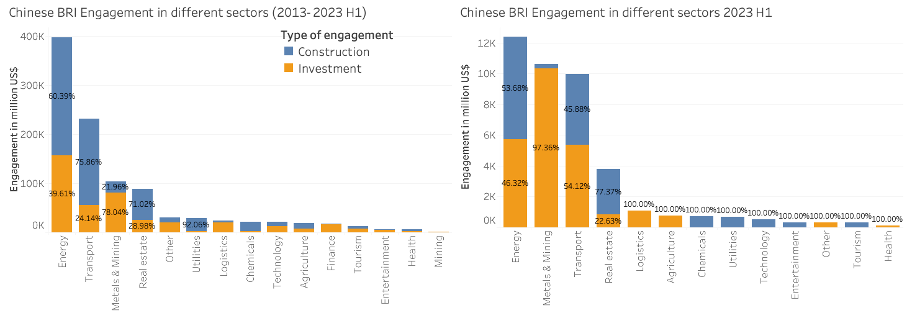

The focus of China’s overseas BRI engagement continued to be in infrastructure, particularly in energy (36%) and transport (28%), expanding these sectors’ significance from a combined value of 57% in 2022.

In the first 6 months of 2023, particularly the agriculture (+271%) and real estate (+269%) grew compared to the first half of 2022.

Technology saw a significant drop, compared to the announcement of the USD7.6 billion investment by China’s largest battery producer CATL battery plant in Hungary in 2022.

Some noteworthy engagements include manufacturing facilities, such as two automotive production capacity in Serbia through Minal Europe Green Material and Jiangsu Liango Precision, as well as manufacturing of chemical materials (e.g., chlorine and derivatives) in Saudi Arabia.

Only one manufacturing plant related to renewable energy technology could be found: the Goldwind agreement for the implementation of a wind turbine industrial unit worth around USD36 million, which will generate about 1,100 direct and indirect jobs.

When looking at China’s engagement strategy in these sectors distinguished by construction and investment, it becomes clear that investment with equity shares and thus higher risk within the Chinese organizations becomes an increasingly important strategy in all strategic sectors (energy, transport, metals & mining).

An important growth area of strategic importance is China’s engagement in metals and mining. Engagement in the sector has grown by 131% compared to the first half of 2022. The minerals and metals are particularly relevant to the green transition (e.g., lithium) and batteries for electric vehicles. Engagement has been strong in African and Latin American countries. China already holds significant shares of global mining sources (e.g., over 80% of global graphite resources), and even more control in material processing (where across lithium, nickel, cobalt and graphite, China owns more than 50% of global capacity). Examples include significant expansion of lithium and copper mining (both mines and processing), for example within the last 6 months through Hainan Mining’s acquisition of Kodal Minerals part of a lithium mine in Mali, a copper processing plant agreement in Saudi Arabia, and a commissioning of a lithium processing plant in Zimbabwe.

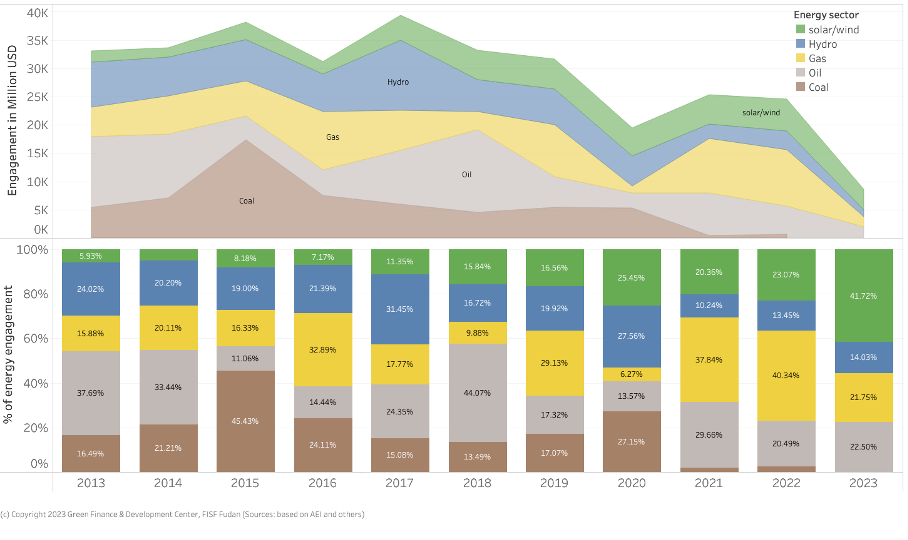

Energy-related engagement in the BRI greenest and at their lowest level

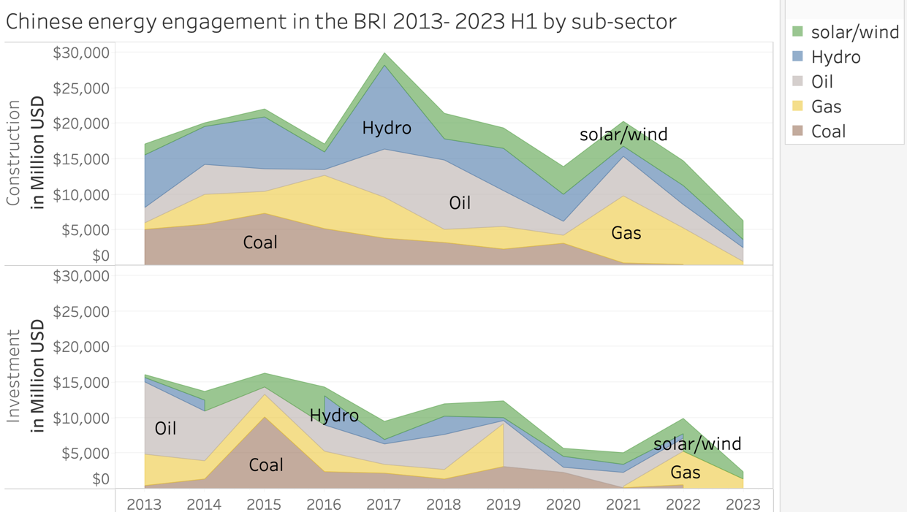

Disclaimer: all energy subsector calculations exclude energy engagements with unknown use, for example investments into local energy providers with diverse portfolio, or transmission lines.

China’s energy related engagement in the first half of 2023 were the greenest in any 6-month period since the BRI’s inception in 2013: in the first 6 months of 2023, about 41% of energy engagement went into solar and wind, plus an additional 14% into hydropower.

Chinese engagement related to the energy sector constitutes the largest share of China’s BRI engagement. In the first half of 2023, total engagement in the energy sector reached USD12.3 billion – which is on par with the first half year of 2022. However, compared to e.g., 2019, when it reached about USD20 billion in the first six months, the engagement in energy is down by 40%. An important reason for this green performance in 2023 is a drop in gas- and oil related projects that dominated in 2022 and 2021, respectively.

Coal

Following China’s announcement in September 2021 to not to build new coal fired power plants, select new coal-fired power projects seem to progress.

While we reported last year about the 1.5 GW of new coal-fired power plants announced in 2022 in Indonesia, the Pakistan government approved a 300 MW of coal fired power in Gwadar, Pakistan in January 2023 to be constructed by China. While Pakistan had announced in December 2020 to not build new coal-fired power plants, various sources report that China was interested in providing financial and technical support for the project – including the design that requires import of coal (rather than using possibly more affordable domestic coal in Pakistan). However, no financial closing has been announced, which is why this project is not included in the 2023 H1 dataset.

Oil and gas

Oil and gas engagement fell to USD3.8 billion (45% of Chinese overseas energy engagement), USD1.4 billion through investment, and USD2.4 billion in construction contracts.

Rumors of an 8 GW gas power plant in Yakutia, Russian Far East, with China’s Power China from June 2023 have not yet been confirmed.

Oil-related investments reached their lowest level in the history of the BRI as they dropped to zero after several higher profile projects in the previous years inside and outside the BRI (e.g., China’s CNOOC engaged in a USD1.9 billion production sharing deal with Petrobras to explore Brazil’s Buzlos field).

At the same time, BRI partners invested in China to support oil development, such as Aramco’s investment in a petrochemical complex in Panjin City, Liaoling Province.

Green energy/hydropower

China’s total engagement in green energy (solar and wind) and hydropower amounted to about USD4.8 billion in the first half of 2023. This compares to USD3.8 billion in the first half of 2022.

Looking at investment only, Chinese green energy and hydropower investment decreased to USD990 million in the first half of 2023 from USD1.3 billion in the first half of 2022. Meanwhile, construction projects related to green energy (including hydropower) increased from 1.6 billion in the first half 2022 to USD2.6 billion in the first half of 2023.

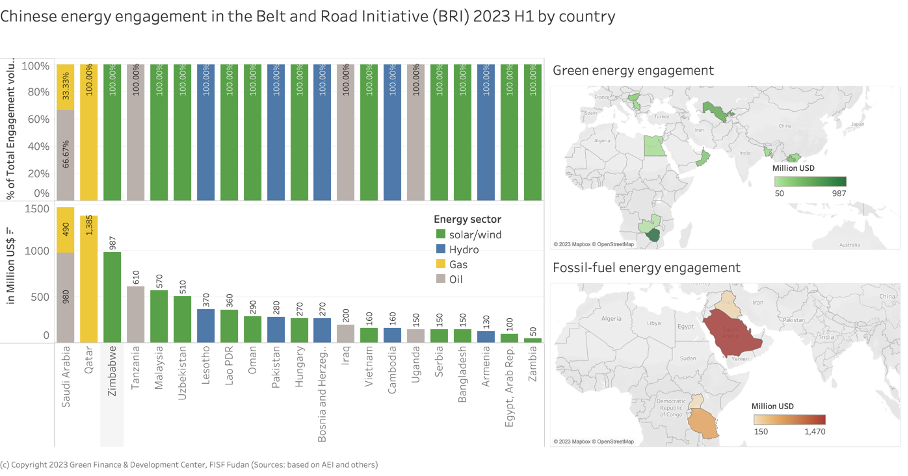

Energy engagement in different countries

Analyzing Chinese energy engagement in different BRI countries, we find that, similar to 2022, Saudi Arabia was the country that received the most energy engagement in the first half of 2023 (USD1.5 billion), followed by Qatar (USD1.4 billion). Both countries received all of their engagement in fossil fuels (see Fehler! Verweisquelle konnte nicht gefunden werden.).

Overall, the most important partners for China’s BRI energy engagement since the BRI’s initiation in 2013 remains Pakistan, which has received close to USD30 billion through investment and construction contracts (most of which in hydropower and coal). Pakistan is followed by Russia and Saudi Arabia. An interesting case for China’s energy investment is Zimbabwe: after a cancelled coal-fired power plant in 2021, Zimbabwe saw strong engagement in green energy through an agreement on a 1GW floating solar station.

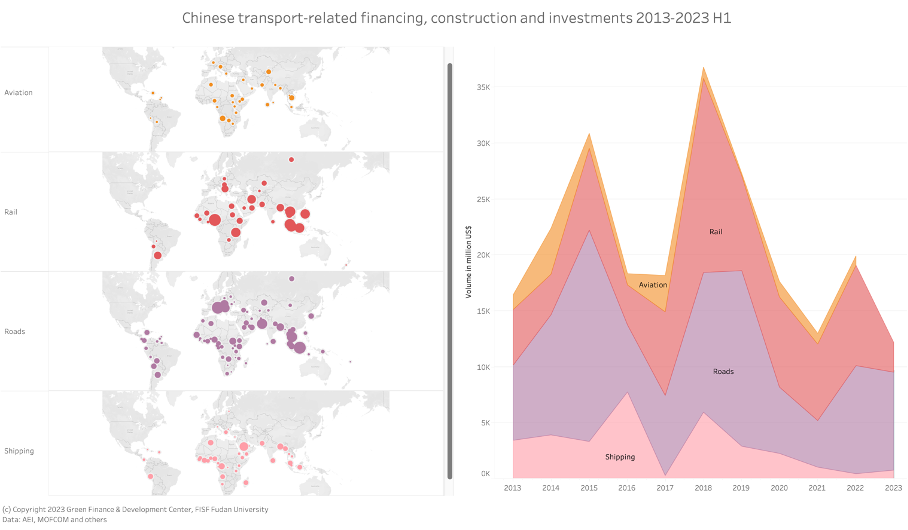

Transport engagement in the Belt and Road Initiative

Transport-related engagement is key to providing the means to trade between China and the BRI countries – where trade is a core component of the BRI. Accordingly, China has invested in and constructed projects in road, rail, aviation, shipping, and logistics across the world.

Aviation: No aviation related contracts were announced in the first half of 2023.

Rail: Total rail engagement was worth USD5.6 billion (all through construction contracts).

A particularly interesting case is the USD2.2-billion contract with a Chinese company to build the final section of a railway line aimed at linking the Tanzania’s main port with its neighbours as part of a broader regional, 2,561-kilometre line that aims to link the Indian Ocean port of Dar es Salaam to Mwanza on Lake Victoria, with eventual spurs to Burundi, Democratic Republic of Congo (DRC), Rwanda and Uganda.

Other noteworthy projects include an agreement on the tram project in Colombia.

Road-transport: China continues to engage in road construction projects across many countries. Examples include a toll road in Cambodia worth about USD1.6 billion. Ports: Some shipping and port-related projects investments were announced in the first half of 2023, such as an agreement with Saudi Arabia to support Aramco’s corporations shipping projects.

Major players in BRI investments

Among the major players for BRI investments in the first half of 2023 were – contrary to most years before – not exclusively Chinese SOEs, but private enterprises (see Fehler! Verweisquelle konnte nicht gefunden werden.).

For investment projects, Zhejiang Huazou Cobalt led ahead of battery producer CATL. The Chinese companies most prominently featured in construction projects in the BRI in 2022 was China Railway Construction, followed by Power Construction Corporation (PowerChina), and China National Petroleum Corp (CNPC). This is in line with previous years’ trends.

China’s BRI investments in a global comparison

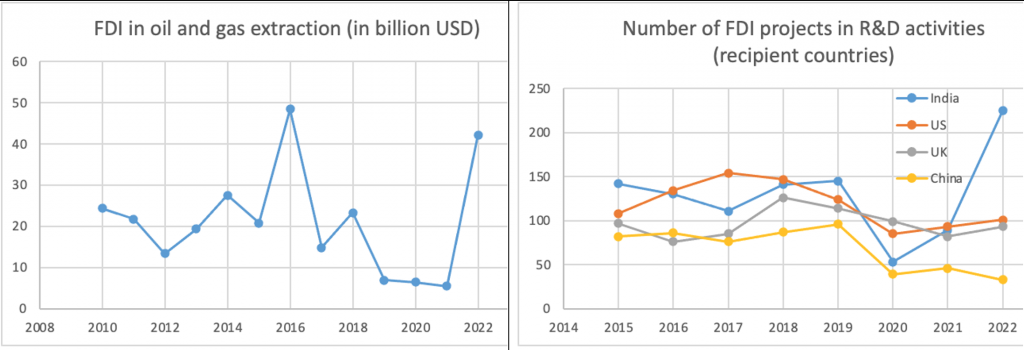

After foreign direct investment (FDI) rebound to pre-pandemic levels in 2021 and saw further growth in the first quarter of 2022, a multitude of crises on the global stage (e.g., debt pressure, invasion of Ukraine) led to a slower growth of FDI in the following quarters resulting in a 12% decline of global FDI in 2022.

According to UNCTAD, project finance and mergers and acquisitions (M&A) “were most affected by deteriorating financing conditions, rising interest rates, and growing uncertainty in financial markets”. International project finance values shrunk by 30% in 2022.

Yet, effects of lower FDI were most prevalent in developed countries, while ASEAN economies saw a 21% increase in greenfield project announcements. Similarly, Brazil saw an increase of 30% of greenfield announcements. Another winner was India, which attracted as many R&D projects as the US, UK, and China combined. It also outpaced China to become the largest destination and source of Greenfield FDI in Asia and the Pacific in 2022. India received USD60 billion in inward greenfield FDI and invested USD35 billion in other countries.

Regarding greenfield project numbers, developing countries saw an increase by 26%, particularly countries in Africa, while international project finance deals were down by 6%. Similarly, the value of cross-border M&A sales were down by 6% in developing countries, particularly in Central Asia, South-East Asia and South Asia.

A particular focus of global FDI in 2022 was in semiconductors (e.g., a USD28 billion investment by Taiwan Semiconductor Manufacturing (TMSC) in the United States) and in renewable energy (e.g., a USD13 billion investment by India’s ACME Group in Egypt). Europe was the main source and destination of FDI for wind energy projects, with USD55 billion pledged by Western European wind developers, of which USD23 billion went to places like North America, Latin America, Africa, and Asia Pacific.

Another focus of FDI, however, was in oil & gas extraction, which by August 2022 had reached USD42.15 billion – the same as the cumulative FDI between 2018 and 2021.

Outlook for 2023 foreign direct investments

According to OECD, cross-border M&A and FDI in 2023 is facing a “gloomy outlook”, also in emerging markets and developing economies. Reasons for challenges include high inflation and interest rates (depressing financing opportunities in projects and M&A), as well as geopolitical tensions and soaring protectionism.

However, some optimism has returned with inflation levels sinking and overall economic activity showing stronger resilience than expected.

Countries that are expected to perform well and attract FDI include those with relevant natural resources to finance the green transition (e.g., lithium), as well as those with relevant markets or technical capacity to warrant a supply chain localization (e.g., for semiconductor manufacturing). African countries would perform very differently among each other, depending on their governance, debt levels, and opportunities (e.g., as a market or as a source for commodities). Developing Asian countries are expected to grow by 4.9% in 2023, possibly also due to shifts from investments into China into neighboring economies, particularly from those companies that depend on Western markets.

With much needed green energy transition and political willingness and direction, also FDI in renewable energies should further accelerate.

Outlook for Belt and Road Initiative (BRI) Finance and Investments

Chinese finance and investments into the Belt and Road Initiative countries in the first half of 2023 have remained steady and partly increased.

For the rest of 2023, with China’s COVID-related lockdowns fully lifted, a broader recovery of BRI investments and construction contracts seems possible. On the one hand, there is clear need for investments to boost growth in the post-COVID19 world supported by global financial institutions, including developing finance institutions (such as the World Bank, Asian Development Bank, AIIB), from which Chinese contractors can benefit. On the other hand, with travel restrictions lifted, Chinese developers are able to travel freely to negotiate, plan, and implement new projects.

We do not expect Chinese BRI engagement to reach levels as in 2018-2019. This is also a recognition of the Chinese Ministry of Commerce (MOFCOM), which put a break on fast overseas expansion in its 14th Five-Year Plan (FYP) for 2021 to 2025: it plans for China to invest USD550 billion (that includes non-BRI countries), down 25% from USD740 billion in the 2016-2020 period. Also, Chinese contracting volume is planned to decrease from USD800 billion in the previous FYP to USD700 billion in this FYP. However, with relatively low levels of BRI engagement in 2021 and 2022, more acceleration should be possible.

In line with our previous predictions, this should mean that deal number is increasing. As we have been seeing in 2021 and early 2022, many smaller projects have been financed even in more difficult economic circumstances and often provide both the means to boost sustainable economic development, provide employment and are better able to protect the environment.

At the same time, we see two types of large projects to continue: strategic engagements (such as in strategic transport infrastructure in the region), and resource-backed deals (such as in mining, oil, gas).

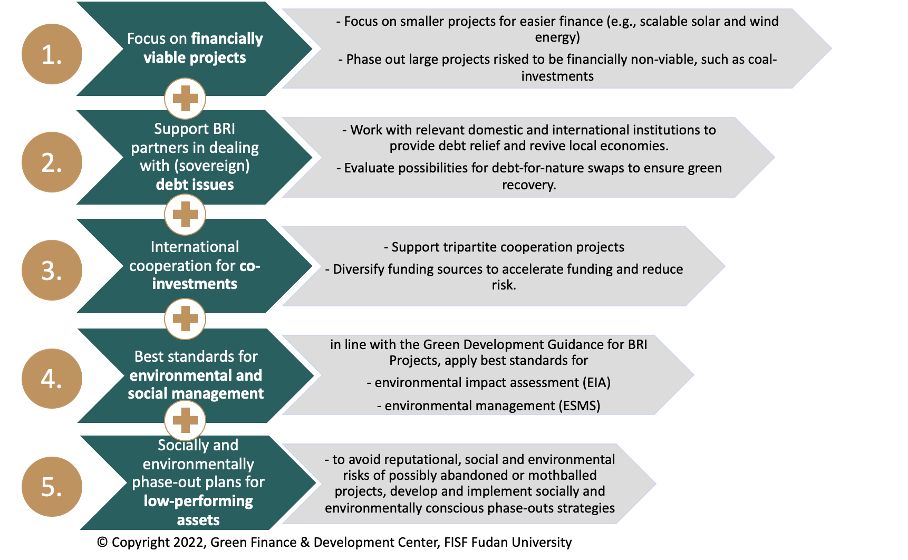

To move the BRI investments forward, we expand our recommendations from the previous reports:

1. Focus on projects that are financially sustainable and cut losses in non-profitable projects

Investors in BRI projects within China and outside China should focus on smaller projects that are easier to finance and faster to implement. Particularly in infrastructure and energy investments, scalable solar and wind investments seem viable, as long as local conditions provide the relevant grids to handle renewable energy supply.

With decreasing energy cost for renewable energy, we also see an opportunity to invest in early phase-out of existing older coal projects, which would be both economically and environmentally relevant.

2. Support partner-countries and partner businesses in dealing with (sovereign) debt-repayment of already invested BRI projects, e.g., through debt-for-nature swaps and nature performance bonds.

Debt is a major concern for future growth in many BRI countries. As we found in our in-depth analysis of debt in BRI countries, China has a unique opportunity to support BRI countries in dealing with their debt both bilaterally and multilaterally. Dealing with the debt issue is crucial for providing BRI countries with the necessary fiscal space for future investments.

While debt-for-resource or debt-for-equity swaps might seem beneficial for China in the short-term to reduce the debt burden in the BRI countries, these swaps tend to undermine future domestic growth opportunities for BRI countries. Rather, Chinese relevant stakeholders together with international partners through multilateral frameworks should support green recovery by swapping part of the debt for nature and providing necessary frameworks to increase transparency and accountability of the use of funds.

Furthermore, sustainable debt instruments could be applied to raise more funds, e.g., through nature performance bonds.

3. Increase international cooperation for BRI projects to allow existing and useful projects to go ahead also in difficult times.

Tripartite cooperation with international financial and implementation partners can support BRI projects through better access to financial resources, risk sharing and knowledge sharing. Particularly non-SOEs that often have a higher burden of accessing investments from Chinese large financial institutions could benefit through broader access to finance, as witnessed for example in the Zhanatas wind farm in Kazakhstan, co-financed by EBRD, AIIB, GCF and ICBC, while it was build and is operated by China International power Holding. Also, Chinese financial institutions could benefit to de-risk project finance by broaden their international cooperation. A report “China Third-Party Market Cooperation for Infrastructure Finance Financing Mechanism Handbook” had been released in September 2021 to accelerate tri-partite project finance.

In addition, with European Union (EU) launching its “Global Gateway” and the US pushing its “Build Back Better World” (B3W) initiative, competition for the BRI is increasing. However, if cooperation for project finance and development in emerging markets is the goal, Chinese investors and developers can accelerate their cooperation with both public and private financial institutions from various economies, particularly if they manage to share standards.

4. Increase use of common environmental and social standards in project evaluation (e.g., environmental impact assessment EIA) and for environmental and social risk management (ESMS)

In July 2021, the Ministry of Commerce (MOFCOM), together with the Ministry of Ecology and Environment, issued the Guidelines for Greening Overseas Investment and Cooperation and in January 2022, the Guidelines for Ecological Environmental Protection of Foreign Investment Cooperation and Construction Projects”[5]. Within these Guideline, Chinese developers are encouraged to adhere to international or Chinese environmental standards, particularly in countries whose domestic environmental standards and governance does not meet international standards.

This is a formalization of a number of previous Guidances, including the “Green Development Guidance for BRI Projects Baseline Study” and the “Application Guide for Enterprises and Financial Institutions” backed by various relevant Chinese ministries published by the BRI Green Development Coalition (BRIGC) in December 2020 and October 2021 respectively. These guidances calls for Chinese overseas investors to apply independent environmental impact assessments (EIA) and strict environmental and social risk management (ESMS) to ensure projects and investments are minimizing environmental harm and maximizing environmental benefits. Also, the Green Investment Principles (GIP) integrate sustainability into corporate governance, requiring boards to understand environmental, social and governance risks, as well as disclosing environmental information.

By applying international standards, Chinese financial institutions can more easily raise capital on the global capital markets, accelerate co-financing with international partners and take responsibility to fulfill the goal of building a “Green Belt and Road”.

5. Develop socially and environmentally conscious phase-out strategies for non-performing investments

Several investments in the Belt and Road Initiative have had to be stopped, mothballed or cancelled due to financial (e.g., difficulties in financing or servicing debt) and operational reasons (e.g. due to travel restrictions or problems in supply chains). According to our study, over 50% of announced coal fired power plants have been mothballed. In order to avoid reputational, social and environmental risks arising from stopped, mothballed or cancelled projects, plans should be developed and implemented by financial institutions including insurance companies, developers, local governments and relevant Chinese authorities that compensate any losses to workers and companies up to a specific extent, and that ensure that nature around mothballed and particularly stopped projects can be remediated. This also helps avoid having skeleton constructions serve as a reminder of unfinished projects.

Please quote as:

Nedopil, Christoph (July 2023): “China Belt and Road Initiative (BRI) Investment Report 2023 H1 – the first ten years”, Green Finance & Development Center, FISF Fudan University, Shanghai; doi: 10.13140/RG.2.2.13892.19841

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.