On January 13th was launch “The Little Book of Investing in Nature“, ten years after the introduction of “The Little Biodiversity Finance Book” at Nagoya’ COP 10.

First introduced during the One Planet Summit hosted by French President Emmanuel Macron, the UN and the World Bank on the 11th of January, “The Little Book of Investing in Nature” aims to energise the dialogue to meet the targets negotiated within the post 2020 Biodiversity framework in preparation for COP 15 by clearly laying out options for financing biodiversity conservation.

Rémy Rioux, the CEO of the French development bank AFD and Bérangère Abba, the French Secretary of State for Biodiversity, both stressed the importance of investing in biodiversity by underlying the commitment of the French Government and the French Development Agency to nature conservation. The AFD notably committed to make 30% of their climate finance nature positive by 2025, doubling their current budget for nature from EUR 500 million to EUR 1 billion in 5 years.

How to pay for biodiversity conservation – a annual gap of more than EUR 550 billion

As a study from the World Economic Forum pointed out that more than half of the World’s total GDP is moderately or highly dependent on nature. The question therefore shifted from “Should we save nature?” to “How do we pay for it?”

We are all under lockdown due to a tiny speck of nature (…) it is an example of how nature can turn upside down the whole economy

Andrew Mitchell (Founder and Senior Adviser, Global Canopy), the moderator of the panel discussion.

While global investments were about EUR 4-5 trillion, biodiversity finance only brought in EUR 100-120 billion per year. With biodiversity finance needs much bigger, the global shortfall in biodiversity finance has been estimated to be around EUR 550 to 750 billion.

The Little Book of Investing in Nature

“The Little Book of Investing in Nature” aims to be the guidance on how to change the flow of money toward the conservation of biodiversity and its services that our economies rely upon. It aims to help governments, NGOs, the private sector and others compare existing and future options for financing conservation in a clear and consistent way and overcome the biodiversity finance gap.

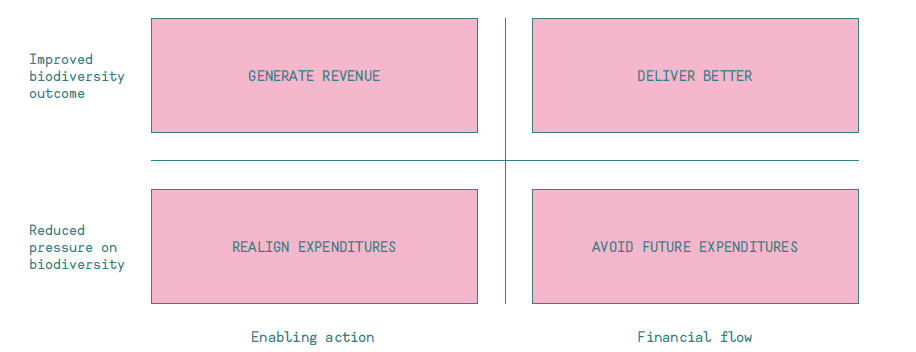

The publication introduces an overarching framework, used by UNDP BIOFIN, that organises biodiversity financing mechanisms into the following categories: revenue generation, better delivery, expenditure realignment, and avoidance of future expenditures, supplemented by catalysts to organize effort to finance biodiversity protection.

Furthermore, the book presents more than 40 mechanisms already providing finance for nature and 25 case studies showing how these examples are supporting biodiversity around the world.

During the launch event on January 13, John Tobin De La Puente, Professor at Cornell University and co-lead editor of the book, presented insightful case studies from the book, which businesses could refer to when applying the framework. He showed for instance that a realignment of expenditures is possible through the reform of harmful subsidies, as it was the case when the Kyrgyzstan government reformed their support to agrochemicals and water usage with the help of the UNDP BIOFIN.

However, while most of the mechanisms within the book are geared towards mitigating the current biodiversity funding gap, the authors pointed out that mechanisms for avoiding expenditures into nature-negative is equally important.

Thus, the last part of the handbook presents solutions to avoid investments in environmental harmful projects. The authors hope that green infrastructure, environmental impact bonds, among others, are tools that will take a growing importance for the actors in helping prevent biodiversity loss and expenditures work. But they need to be complemented by financial and regulatory structures.

Biodiversity finance for the Belt and Road Initiative (BRI)

As recalled during the One Planet Summit, the Chinese government plays a key role in supporting the international ambition for climate and biodiversity. The Belt and Road Initiative (BRI) is becoming a global project to achieve the 2030 Agenda for Sustainable Development. “The Little Book of Investing in Nature” therefore becomes a guidance and support tool for the project’s future and current green investments and can support the large ambition of building a green BRI. The little book can provide tools for the BRI investors to identify the best path for reducing the environmental impact of BRI projects, and levers for action.

Four key points for future biodiversity finance

Rémy Rioux (CEO of AFD) pointed out four key points for accelerating biodiversity finance:

- There must be a public signal, given to the actors by reducing or reorienting public subsidies from harmful activities towards biodiversity conservation, notably nature-based-solutions, agroforestry, agro-ecology industry etc…

- We need to look upon the TNFD and other incentives to increase private investment to nature (as of now, 80% of all flows are public) in order to close the biodiversity gap.

- There is a necessity to turn to the South, as most biodiversity finance happen in OECD country, while the richness of biodiversity lies in emerging countries

- Public development banks, the 450 institutions that amount to 10%, or EUR 1.9 trillion of total global investment each year, can have a crucial role in linking public and private, global and local interests for biodiversity conservation.

About the Little Book of Investing in Nature

The publication of “The Little Book of Investing in Nature” is coordinated by Global Canopy and supported by the French Development Agency (AFD), Cornell Atkinson Center for Sustainability, Crédit Suisse, The Sustainable Trade Initiative, Mirova, UNDP BIOFIN, WWF and the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety.

Download the “The Little Book of Investing in Nature” in English.

Aurélie Chane-Yook was a researcher at the Green BRI Center at IIGF.

Comments are closed.