This article is the first of a series of posts on green finance trends in China. Green Finance Trends in China (1) focusing on China’s green finance policy and system is available here.

The work was prepared with support from the International Institute for Sustainable Development (IISD) as a scoping study for the China Council for International Cooperation on Environment and Development (CCICED). The report does not reflect official positions from either of the organizations.

China has multiple green financial instruments, dominated by green credit and green bonds. In this article, we analyze the development of these green finance instruments focusing on:

- Green credit

- Green bond

- Sustainability linked bonds

- Green funds

- ESG investments

- Transition finance and transition bonds

- Green index

- Green insurance

- Carbon finance and emission trading

- Biodiversity finance

Green credit

Green credit is the earliest, largest, and most mature green instrument in China. By the end of the third quarter of 2022, the total green loan balance in the domestic and foreign currencies of China was RMB 20.9 trillion (about USD 3 trillion)[1], an increase of about 31% compared to the previous year[2]. Green loans constitute about 10% of China’s total loan market (see Figure 1).

The development has been made possible due to China’s bank-dominated structure with strict state control that has continued to help China’s mobilization of capital for top-down goals (e.g., recovery during the COVID-19 pandemic). To what extend the traditional bank-dominated and the highly regulated system is suitable for a growth model that needs shifting from mobilizing inputs to relying on innovation, including for a green transition, is under discussion [3]. The Chinese authorities have realized this problem and recognized the importance of developing a “multi-layered capital market”, and providing more diverse financing channels for market players. The decision-makers are also promoting “supply-side reform” [4], which highlights the role of the market in resource reallocation. The regulator claims that the green credit of the 21 major banks can save more than 400 million tons of standard coal and reduce carbon dioxide equivalent by more than 700 million tons each year [5].

Particularly the June 2022 Green Finance Guidelines issued by CBIRC have the potential to bring green lending into the core of banks. It stipulates that banks would gradually and orderly reducethe carbon intensity of the asset portfolio, and finally achieve carbon neutrality of the asset portfolio.[6]

Green bond

Within six years (after China launched its green bond market in 2016), China has built one of the world’s largest green bond markets, with a continuously growing trend in 2022. By November 23rd, 2022, the issuance scale of green bonds reached RMB744.6 billion (USD 106 billion), with a year-on-year increase of 46.5%, exceeding that of the entire 2021. And the number of issuances was 590, an increase of 13.7% over the same period of the previous year [7]. Despite the current rapid expansion of green bond issuance, the proportion of labeled green bonds in China’s overall bond market is still limited, less than 2% [8], and there is still space for growth.

The development of China’s green bond market so far can be distinguished into two major phases: the early phase with issuances dominated by financial institutions and the current phase with mixed issuance by financial and commercial institutions. Issuances are dominated by state-owned enterprises (including financial and non-financial enterprises), which accounted for 97% of domestic green bonds issued in terms of the number of green bonds issued, and close to 99% in terms of issuance amount.

The majority (88.3%) of funds raised in China’s green bond market were invested in renewable energy, low-carbon transport, and low-carbon buildings.

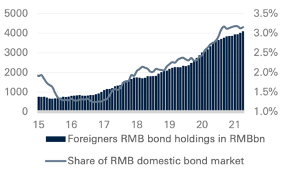

Foreign participation in the bond (and green bond) market in China remains low at 3.2% in China’s bond market (see Figure 6) [9], [10] due to low liquidity and market barriers. In November 2022, OCBC Wing Hang Bank Co., Ltd. successfully issued a green financial bond with a total scale of RMB 500 million. This was the first green financial bond issued by a foreign bank in the Chinese domestic market [11].

In September 2022, after putting forward China’s green bond principles in July 2021, the Green Bond Standards Committee designated 18 agencies as China’s first batch of officially approved green bond evaluation and certification institutions [12]. The goal is to expand independent, professional, and market-reputable third-party institutions to help the market better identify green economic activities and regulate the conduct of assessment and certification bodies.

Green funds

Green funds play an important role in China to provide access to equity finance for select green industries.

In 2020, China established National Green Development Fund, with a capitalization of RMB 88 billion (USD 14 billion) to provide equity financing in support of decarbonization. Also, provinces set up green development funds or environmental protection funds, including Beijing set up a green infrastructure investment fund with RMB4.5 billion [13], Shandong established a green climate fund with a total scale of RMB10 billion [14], Liaoning aimed at environmental protection areas and arranged RMB 3 billion funds for it, and Zhejiang put up RMB 6 billion to support various green industries development such as environmental protection and rural revitalization [15].

According to the Asset Management Association of China, there are 1,178 public and private equity funds with green and sustainable ESG investment directions, with a total scale of RMB 882 billion, an increase of 34% compared with 2020. Among them, there are 242 public funds with a management scale of more than RMB442 billion, and 936 private equity funds with a management scale of more than RMB400 billion. Equity venture capital funds account for more than 90% of them [16]. Also, traditional fossil or heavy-emitting enterprises set up such funds. In Nov 2022, the Aluminum Corporation of China joined hands with the Agricultural Bank of China to invest and set up an RMB 6 billion green low-carbon private equity fund [17].

ESG investment

Chinese ESG fund launches surged in 2021, as China announced its carbon neutrality goal. By June 2022, the total scale of public and private equity funds with green and sustainable ESG orientation was RMB 882 billion (USD 126 billion) distributed over 1178 funds [18]. While the number of ESG funds had grown, over the past years, 2022 saw a slowdown with only 89 new funds issued in 2022 [19]. Meanwhile, assets managed in ESG funds in China were about USD48.8 billion by the first quarter of 2022, which was a 14% decrease compared to the previous year. This was due to a market downturn, as well as a 95% reduction of net inflows into China’s sustainability-themed funds from USD4.1 billion in the fourth quarter of 2021 to USD$214.9 million in the first quarter of 2022 [20].

Of more than 170 ESG funds domiciled in China, about 15% are invested in coal companies, by far the biggest source of GHG emissions in China. And more than 60% have holdings in the steel industry, a massive consumer of coal [21].

Overall, similar to bonds, foreign participation in the Chinese stock markets are low at 4.2%. To expand the market, the NDRC released the Several Policy Measures to Stabilize Foreign Investment Stocks and Spur Foreign Investment Quality and Quantityin October 2022, with the goal to guide foreign investment to actively participate in carbon peaking and carbon neutrality, and equally participate in the formulation and revision of relevant standards in the green and low-carbon field [22].

Sustainability-linked bonds and loans

In April 2021, China’s National Association of Financial Market Institutional Investors (NAFMII), a self-regulatory body of China’s interbank bond market under the central bank, first introduced sustainability-linked bonds (SLB) and drafted the regulations [23] based on Sustainability-Linked Bond Principles (SLBP) issued by International Capital Market Association (ICMA) [24]. In May 2021, China issued its first batch of SLB by seven issuers including China Huaneng Group Co., Ltd. The amount was RMB 7.3 billion. The coupon rate was preferential compared to vanilla bonds [25].

In August 2022, the regional lender Shanghai Pudong Development Bank (SPDB) underwrote the first issue of carbon asset bonds. The “22 Anhui Energy SCP004 Carbon Asset” raised RMB 1 billion for Anhui Province Energy Group Company Limited with a floating rate component pegged to carbon emissions abatement returns, and a fixed rate component of 1.8% [26].

Transition finance and transition bonds

By the first half year of 2022, 23 transition bonds were issued from 17 issuers globally, worth USD 2.1 billion. All but one of them are first-time issuers under the transition label, and they were mainly dominated by China and Japan’s steel, chemical, electricity, etc. high emission sectors [27].

Green index

According to the data of China Securities Index Company, by the end of Q3 2022, the scale of domestic green index investment funds exceeded RMB 130 billion, an increase of 16% compared to the same period last year. Green index investment funds with themes such as clean energy and green transportation dominate [28].

The first carbon-neutral exchange-traded funds (ETF) (CSI-SEEE Carbon Neutral ETFs) were launched in April 2022 and listed in Shanghai and Shenzhen Stock Exchanges respectively. The eight ETFs in this offering were all based on the CSI-SEEE Carbon Neutral Index developed by Shanghai Environment and Energy Exchange [29].

Later, in August 2022, the Bank of China (HK) and S^P Dow Jones indices launched the first climate transition index targeting the greater bay area with the goal to reorient capital flows toward low-carbon companies [30].

Green insurance

Green insurance in China mainly focuses on environmental pollution liability insurance. Other innovations in green insurance, such as the public area environmental pollution cleanup expense insurance and green building have also been explored. Yet the size of green insurance is comparably small within the insurance industry. In 2020, the insured amount of green insurance reached RMB18.3 trillion, with a year-on-year increase of 24.9%. And this is the latest update from the Insurance Association of China. No further data were released for 2021 or 2022, with improvements possible based on the statistical guideline released in 2022.

Carbon finance and emission trading

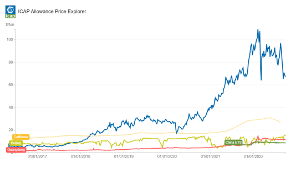

During the first compliance circle of China’s national ETS (by the end of 2021), the cumulative transaction volume of carbon emission allowances was 179 million tons, the cumulative transaction value was 7.661 billion yuan, the average transaction price was 42.85 yuan/ton, and the monthly price was between 40-60 yuan/ton. The compliance rate is at 99.5%, according to MEE. 32.73 million tons of CCERs (registered before the 2017 CCER suspension) have been used to offset emissions. The overall transaction price has not fluctuated significantly [31].

In 2022, the average monthly trading volume of the national ETS was about 1.94 million tons, with the daily closing price between RMB 56 to RMB 62 per ton [32], slightly higher than that of 2021. By the end of November 2022, the cumulative trading volume of carbon emission quotas in the national ETS exceeded 200 million tons, with a turnover of RMB 8.8 billion. More than half of the key emission units participated in transactions [33]. Meanwhile, there was still an obvious trading cycle in the market – the trading volume and transaction value tend to increase when the compliance period is approaching [34].

China’s carbon price has been lower than the EU (see Figure 3). According to China Carbon Price Survey Report, as other high-emission industries such as steel, construction material, etc. might enter the market, the average carbon price could rise to RMB 87 per ton by 2025, and RMB 139 per ton by 2030 [35].

Biodiversity Finance

Biodiversity finance has gained momentum, partly due to China’s hosting of the biodiversity COP15. Yet, in 2022, biodiversity finance remains in its infancy with few or no Chinese financial institutions participating in the development of international standards, such as TNFD.

A driver might be that ecological conservation is seen as a role of the government (either through public finance or regulation) rather than market mechanisms.

Nevertheless, some developments can be noted: In Apr 2021, the General Office of the State Council issued Opinions on Establishing and Improving the Value Realization Mechanism of Ecological Products(关于建立健全生态产品价值实现机制的意见), emphasized the development of ecological value accounting, and promoted its applications in business development financing, environmental resource rights and interests’ transactions, and so on. During the “13th Five-Year Plan” period (2016-2020), the central government arranges an annual amount of nearly RMB200 billion for various types of ecological protection compensation funds [36].

In October 2021, during CBD COP15, 60 banking financial institutions (36 Chinese, 24 foreign) jointly issued a declaration to support biodiversity conservation [37] by developing relevant investment mechanisms. Meanwhile, China also established the Kunming Biodiversity Fund (RMB 1.5 billion). In November 2022, the Bank of China successfully issued the world’s first biodiversity-themed green bond on an RMB 1.8 billion equivalent scale [38].

In February 2022, the Green Finance Committee (GFC) initiated the “Financial Support for Biodiversity Research Group”, which included i.a., the development of a biodiversity green bond catalog. In November 2022, the research results were published [39].

In August 2022, the Industrial Bank became the first Chinese bank to develop a biodiversity financial plan [40] while the Bank of Qingdao developed a Blue Finance programme together with ADB and IFC (which provided technical support and USD150 million in a syndicated loan)[41].

Furthermore, several pilots have been established to support Gross Ecosystem Product (GEP) evaluations, including in Shenzhen, Beijing, Pu’er, and Hainan. GEP is based on an expansive catalogue of indicators and tools for measurement, which include material ecosystem services (e.g., food, water), regulating services (e.g., water retention, water quality improvement), and cultural services (e.g., recreation, tourism) [42].

Sources

[1] 中国人民银行, 2022年三季度金融机构贷款投向统计报告 (Statistical Report on Loan Direction of Financial Institutions in the Third Quarter of 2022), October 28, 2022, http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4692500/index.html.

[2] 21世纪经济报道, “三季度绿色贷款余额超20万亿 五家大行绿色贷款增幅亮眼 (The balance of green loans in the third quarter exceeded RMB 20 trillion, and considerable growth of green loans by five major banks),” October 2022, https://m.21jingji.com/article/20221029/herald/1cb2ae1ffda8019a2d62477765b55d05.html.

[3] Yiping Huang and Tinging Ge, “Assessing China’s Financial Reform: Changing Roles of the Repressive Financial Policies,” Cato Journal, February 25, 2019, https://www.cato.org/cato-journal/winter-2019/assessing-chinas-financial-reform-changing-roles-repressive-financial.

[4] Bank of China, “金融供给侧结构性改革的背景、内涵 及影响 (The Background, Connotation and Impact of Financial Supply-Side Structural Reform and Impact)”, April 22, 2019, https://pic.bankofchina.com/bocappd/rareport/201904/P020190424383785607033.pdf.

[5] Ibid.

[6] 中国银保监会, “关于印发银行业保险业绿色金融指引的通知 (Notice on Issuing the Green Finance Guidelines for the Banking and Insurance Industry),” June 2022, http://www.gov.cn/zhengce/zhengceku/2022-06/03/content_5693849.htm.

[7] 中国新闻网, “我国年内已发行绿债7445亿元 规模超去年全年 (China has issued green bonds of RMB 744.5 billion this year, exceeding the scale of last year),” November 24, 2022, https://chinanews.com.cn/cj/2022/11-24/9901050.shtml.

[8] 中国社会科学院经济研究所等, 中国上市公司蓝皮书 中国上市公司发展报告(2022)(Blue Book of Chinese Listed Companies: Development Report of Chinese Listed Companies), November 23, 2022, http://ie.cass.cn/academics/academic_activities/202211/t20221123_5566122.html.

[9] NATIXIS Corporate & Investment Banking, “China Faces More Challenges in Attracting Securities Investment,” March 31, 2022, https://research.natixis.com/Site/en/publication/IChakZU58MbfNJW8jmuMlA%3D%3D?from=share.

[10] Evelyn Cheng, “Overseas Investors Are Snapping up Mainland Chinese Bonds,” CNBC, May 21, 2021, https://www.cnbc.com/2021/05/21/overseas-investors-buy-up-mainland-chinese-bonds-in-a-search-for-yield.html.

[11] 和讯网, “华侨永亨银行发行境内首单外资银行绿色金融债 (OCBC Wing Hang Bank issued the first green financial bond of a foreign bank in China),” accessed November 16, 2022, http://bank.hexun.com/2022-11-17/207115737.html.

[12] 中国经济网, “18家机构通过绿标委注册——绿色债券市场强化行业自律 (18 institutions have passed the registration of the Green Standard Committee – the green bond market strengthens industry self-discipline),” September 2022, http://www.ce.cn/xwzx/gnsz/gdxw/202209/29/t20220929_38134392.shtml.

[13] “首期规模45亿!北京绿色基础设施投资基金成功设立 (The scale of the first phase is 4.5 billion! Beijing Green Infrastructure Investment Fund was successfully established),” December 31, 2021, https://www.chinalifeinvest.com/html1/report/22011/6-1.htm.

[14] 中国政府网, “首笔绿色气候基金花落山东 (The first green climate fund was awarded to Shandong),” December 2019, http://www.gov.cn/xinwen/2019-12/12/content_5460516.htm.

[15] 中央财经大学绿色金融国际研究院, “2020年绿色基金市场进展及相关建议 (2020 Green Fund Market Progress and Related Suggestions),” May 2021, https://www.hbzhan.com/news/detail/141663.html.

[16] 21世纪经济报道, “ESG投资基金规模8821亿元, ‘双碳’转型构建生态权益价值实现机制 (The scale of ESG investment funds is RMB 882.1 billion, and the transformation of “dual carbon” builds a mechanism for realizing the value of ecological rights and interests),” November 28, 2022, http://www.21jingji.com/article/20221128/herald/5a75ff0b4f921b4a703de0bd37f3055a.html.

[17] 新浪网, “中铝绿色低碳基金完成备案 (Green and Low Carbon Fund of Aluminum Corporation of China completed the filing),” November 2022, https://finance.sina.com.cn/tech/roll/2022-11-11/doc-imqmmthc4190892.shtml.

[18] 21世纪经济报道, “ESG投资基金规模8821亿元, ‘双碳’转型构建生态权益价值实现机制 (The scale of ESG investment funds is RMB 882.1 billion, and the transformation of “dual carbon” builds a mechanism for realizing the value of ecological rights and interests),” November 28, 2022, http://www.21jingji.com/article/20221128/herald/5a75ff0b4f921b4a703de0bd37f3055a.html.

[19] 中信证券,2023年ESG投资策略:立足中国市场,聚焦实体投资,创新企业服务(ESG investment strategy for 2023: Based on the Chinese market, focus on physical investment, and innovate corporate services), Nov 2022.

[20] Martin Choi, “ESG Inflows Take a Hit in China as Investors Turn Pessimistic: Morningstar,” South China Morning Post, May 2022, https://www.scmp.com/business/china-business/article/3177395/investors-shun-chinese-esg-funds-first-quarter-markets-take.

[21] Ibid.

[22] 中国政府网, “国家发展改革委等部门印发《关于以制造业为重点促进外资扩增量稳存量提质量的若干政策措施》的通知 (NDRC et al, Several Policies and Measures Concerning Promoting Foreign Capital Expansion, Stabilization, and Quality Improvement by Focusing on the Manufacturing Industry),” Oct 2022, http://www.gov.cn/zhengce/zhengceku/2022-10/25/content_5721563.htm.

[23] 中国银行市场间交易商协会, “交易商协会推出可持续发展挂钩债券 (NAFMII Launches Sustainability-Linked Bonds),” April 2021, http://www.nafmii.org.cn/xhdt/202104/t20210428_197371.html.

[24] ICMA, “Sustainability-Linked Bond Principles (SLBP),” accessed November 15, 2022, https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/sustainability-linked-bond-principles-slbp/.

[25] 中国货币市场, “可持续发展挂钩债券的发展现状与政策建议 (Development Status and Policy Suggestions of Sustainable Development Linked Bonds),” accessed November 14, 2022, https://cj.sina.com.cn/articles/view/6314832590/http%3A%2F%2Fcj.sina.com.cn%2Farticles%2Fview%2F6314832590%2F17864b2ce0010117qt.

[26] China Banking News, “Shanghai Pudong Development Bank Underwrites China’s First ‘Carbon Asset’ Bonds,” August 9, 2022, https://www.chinabankingnews.com/2022/08/09/shanghai-pudong-development-bank-underwrites-chinas-first-carbon-asset-bonds/.

[27] CBI, Sustainable Debt Market Summary H1 2022, Aug 2022, https://www.climatebonds.net/files/reports/cbi_susdebtsum_h1_2022_02c.pdf

[28] 中国清洁发展机制基金, “绿色指数化投资基金规模超1300亿元 同比增长16% (The scale of green index investment funds exceeded RMB 130 billion, a year-on-year increase of 16%),” October 2022, https://www.cdmfund.org/index.php/31830.html.

[29] Yahoo, “China’s First Carbon Neutrality ETFs Raise More than US$1.9 Billion as Appetite Grows for Sustainable Investing,” July 2022, https://www.yahoo.com/now/chinas-first-carbon-neutrality-etfs-093000244.html.

[30] 标普道琼斯指数, “中银香港携手标普道琼斯指数推出首个聚焦粤港澳大湾区的气候转型指数 (BOCHK and S&P Dow Jones Indices launched the first climate transition index focusing on the Guangdong-Hong Kong-Macao Greater Bay Area),” July 2022, https://www.spglobal.com/spdji/zh/index-launches/article/bochk-and-sp-dow-jones-indices-launches-the-first-climate-transition-index-targeting-the-greater-bay-area/.

[31] “生态环境部发布《全国碳排放权交易市场第一个履约周期报告》(MEE released ‘National ETS first compliance circle’ report),” January 1, 2023, https://www.mee.gov.cn/ywdt/xwfb/202301/t20230101_1009228.shtml.

[32] 生态中国网, “全国碳市场成交量突破2亿吨大关 专家预计我国碳价将逐步走高 (The transaction volume of the national carbon market has exceeded 200 million tons. Experts predict that the carbon price will gradually rise),” November 28, 2022, https://www.eco.gov.cn/news_info/60191.html.

[33] Ibid.

[34] Ibid.

[35] IFC, 中创碳投, “中国碳价调查报告 (China Carbon Price Survey Report),” February 2022, https://finance.sina.com.cn/esg/investment/2022-02-24/doc-imcwipih5030603.shtml.

[36] 国家发展和改革委员会, “国家发展改革委新闻发布会 介绍生态文明建设有关工作情况 (National Development and Reform Commission: press conference to introduces the work related to the construction of ecological civilization),” September 21, 2022, https://www.ndrc.gov.cn/xwdt/wszb/stwmjsyggzqk/?code=&state=123.

[37] 生态中国网, “《银行业金融机构支持生物多样性保护共同宣示》发布 (“Joint Declaration of Banking Financial Institutions Supporting Biodiversity Conservation” Released),” October 25, 2021, https://www.eco.gov.cn/news_info/50155.html.

[38] 中国银行, “中行成功发行全球金融机构首笔生物多样性绿色债券 (Bank of China successfully issued the first biodiversity green bond of a global financial institution),” September 29, 2021, https://www.boc.cn/aboutboc/bi1/202109/t20210930_20119935.html.

[39] 中国金融学会绿色金融专业委员会, “绿金委金融支持生物多样性保护研究组成果发布 (Green Finance Committee Financial Support Biodiversity Conservation Research Group Releases Results),” November 12, 2022, http://greenfinance.org.cn/displaynews.php?id=3920.

[40] 兴业银行, “绿色金融再创先!兴业银行首家推出生物多样性保护金融方案 (Industrial Bank is the first to launch a financial plan for biodiversity protection),” August 2022, https://www.cib.com.cn/cn/aboutCIB/about/news/2022/20220811.html.

[41] Asian Development Bank (ADB), “Bank of Qingdao Blue Finance Project: Report and Recommendation of the President,” Text, Asian Development Bank (ADB), January 31, 2022, China, People’s Republic of, https://www.adb.org/projects/documents/prc-55246-001-rrp.

[42] Shenzhen Government online, “City Unveils GEP System for Sustained Development_Latest News-Shenzhen Government Online,” March 24, 2021, http://www.sz.gov.cn/en_szgov/news/latest/content/post_8645665.html.

Comments are closed.