On February 2, 2021, the British government published a review of “The Economics of Biodiversity” by academic Sir Partha Sarathi Dasgupta. In it, the authors point out the “collective failure” of humanity to preserve nature, due to a “widespread and deeply rooted institutional failure”. Accordingly, Dasgupta calls for a transformative change of our economy, a change more ambitious than the Marshall Plan.

In the 600-page report, international specialists coordinated by Cambridge University economics professor Partha Dasgupta draw up a worrying assessment of the economic, health and social aspects of economic growth.

Economy’ reliance and impact on Nature

While humanity has prospered immensely in recent decades, the way we have achieved this prosperity has come at a devastating cost to nature – the authors said.

The authors estimate that while the world’s per capita gross national product (GNP) has doubled since 1992, the benefits humans derive from the services provided by nature, or “natural capital,” have fallen by 40 % on a per capita basis worldwide. The authors further find that current extinction rates are around 100 to 1,000 times higher than the baseline rate, undermining nature’s productivity, resilience and adaptability. This decline poses the extreme risk and uncertainty for the global economy, financial sector and society’s well-being.

Currently, economic and financial models do not incorporate the benefits of biodiversity nor the risks of biodiversity loss. This is one of the causes for the underfunding of nature conservation programs, and the continued provision of subsidies to sectors such as fossil fuels or intensive agriculture with negative impacts on biodiversity and global warming. Accordingly, governments currently support investors on a much larger scale to exacerbate the problem of biodiversity loss rather than to provide sufficient financial incentives to protect it.

Three options for change

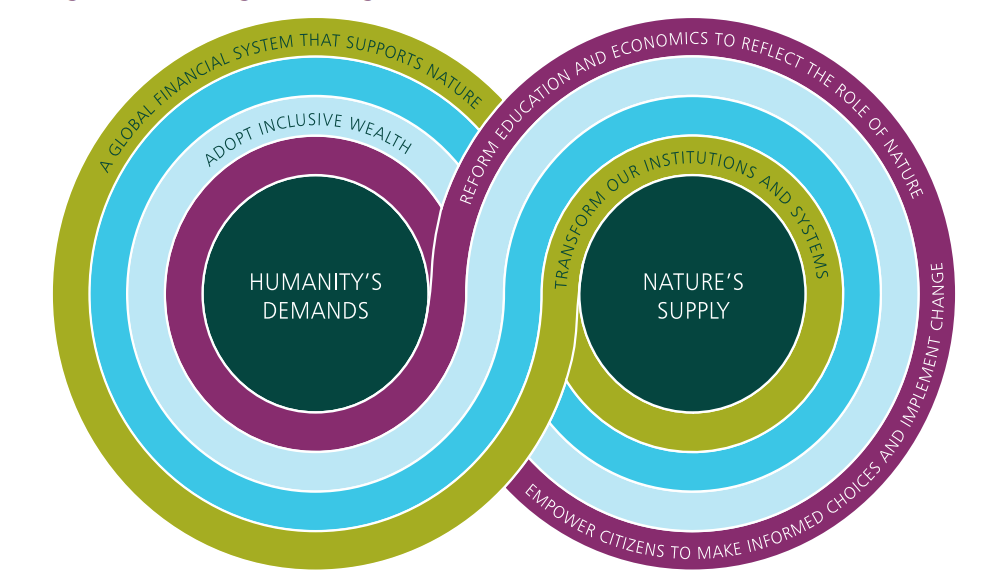

Accordingly, the authors call for the replacement of the traditional national capital accounting based on GDP by a calculation of economic well-being that takes into account the services provided by nature. In other words, the authors call for a rebalancing of the link between human beings and nature, by changing how we think, act and measure success.

They therefore recommend to:

(i) Ensure that our demands on nature do not exceed its supply, and that we increase nature’s supply relative to its current level.

(ii) Change our measures of economic success to guide us on a more sustainable path.

(iii) Transform our institutions and systems – in particular our finance and education systems – to enable these changes and sustain them for future generations.

Finally, the authors of the report call for the two important meetings of green diplomacy – COP15 on biodiversity taking place in Kunming, China and COP26 on climate taking place in Glasgow, scheduled for this year – to be used as levers to launch these transformations.

What does this mean for the BRI?

Biodiversity and nature protection also plays a crucial role for China and its economic activities through investments and trade in countries of the Belt and Road Initiative (BRI). Indeed, China is increasingly active in biodiversity conservation and will host the COP15 Biodiversity Conference. One of the goals of the conference is to set new global targets for biodiversity conservation, replacing the Aichi targets with the Post-2020 framework for biodiversity conservation.

But the paradox between pursuing economic development and conserving its environment is a difficult dilemma for China, even though the sustainability of its economy depends on its ability to protect the goods and services of its biodiversity in the long term. It is therefore becoming urgent for China to consider the impact of its biggest development project, the Belt and Road Initiative (BRI), on biodiversity.

The countries and corridors of the BRI countries overlap 27 of 35 recognized global biodiversity hotspots. In May 2017, WWF estimated that BRI’ trade corridors would encroach on the territory of 265 endangered species, including 81 endangered and 39 critically endangered.

Currently, a number of BRI investments still take place in biodiversity hotspots. According to the Green Development Guidance for BRI projects, investing in biodiversity hotspots should be avoided as environmental and financial risks are too high. For example, due to the resistance of local people fearing the environmental destruction of important habitat and thus their livelihoods, the construction of the USD 3.6 billion Myitkyina’ hydroelectric dam on the China Myanmar Economic Corridor had to be paused. Financial losses for Chinese developers, such as China Power Investment Corporation (CPI) and financial institutions, such as China Export-Import Bank, are increasing.

Recommendations for biodiversity conservation on the BRI

For the BRI to accelerate biodiversity protection and re-think development, we therefore recommend the following:

- China should use the power of its green financial market to mobilize private capital for green development that takes biodiversity considerations at the core. The capital can be used for both biodiversity protection and conservation, as well as for ensuring that projects are implemented in a green and sustainable way;

- Relevant financial stakeholders need to apply existing frameworks of biodiversity protection, such as the Green Development Guidance for BRI projects with its 9 recommendations, the Green Investment Principles (GIP) of the Belt and Road Initiative, as well as local and international standards for biodiversity protection (e.g. IFC Performance Standard 6);

- China should use the power of big data and sensing to ensure that no investments are encroaching on key biodiversity areas;

- China should use the power of smart contracts, tracing technology through blockchain to better trace origins of products from mining and agriculture to ensure green supply chains that do not source from illegal or ecologically risky operations;

- China can share its experiences in redlining to increase protected areas and their governance;

- China can also apply debt-for-nature swaps in BRI countries that have high debt burden due to the COVID-19 crisis to exchange debt for the protection of nature. Learn more about how could China implement such tool on the BRI on our website.

Download the full Dasgupta Review report in English.

Comments are closed.