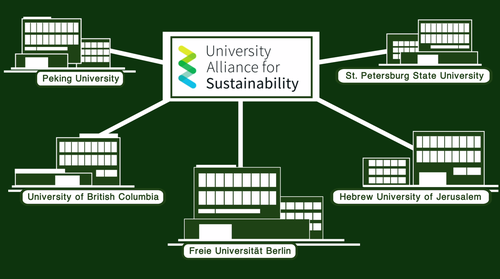

On October 20, the University Alliance for Sustainability held its online workshop on “Financial Markets and Sustainable Development in Times of Climate Change”, organized by Free University Berlin and University of British Columbia (UBC).

Among the few selected presentations, IIGF Green BRI Center Director Christoph Nedopil Wang presented the development and structure of the SDG Finance Taxonomy (you can find the SDG Finance Taxonomy here). The SDG Finance Taxonomy is an innovative taxonomy for financial institutions, regulators and verifiers to easily identify projects aligned with the 17 SDGs to contribute to sustainable development. The development of the SDG Finance Taxonomy was initiated by the UNDP and the Chinese Ministry of Commerce (MOFCOM) and the Taxonomy was launched in June 2020.

The SDG Finance Taxonomy is the first comprehensive taxonomy that enables easy selection of projects to lower transaction costs for investors as well as relevant indicators to measure outcomes. Its application potential has been accelerated in the economic recovery packages during the Covid-19 pandemic, in China, the countries of the Belt and Road Initiative (BRI) and in developed countries.

Besides Christoph Nedopil, Berthold Kuhn of the Free University presented on “Sustainable Finance in Germany on Discourses, Stakeholders and Policy Initiatives”, Claudia Tober – an Independent Sustainable Finance Expert – on “Sustainable Investment – Spotlights on Risks and Stranded Assets” and Dr. Florian Egli from the University in Zurich (ETHZ) on “Who divests from fossil fuels”.

More information on the workshop with access to pre-recorded sessions can be found here.

Comments are closed.