On June 1, 2022, the China Banking and Insurance Regulatory Commission (CBIRC) issued the “Green Finance Guidelines for the Banking and Insurance Industry”. The Guidelines consolidate the 2019 Guidelines on the high-quality development for the Banking and Insurance Industry and focus particularly on green banking (e.g., green loans, green credit) and insurance industry.

Five highlights of the new Guidelines:

- The Guidelines put the fight for the carbon-peak and carbon neutrality targets at the center of financial institutions that need to “ultimately achieve carbon neutrality in their portfolio”, in addition to pollution control;

- The Guidelines focus on green corporate governance and specify the responsibility of the senior management and the board to lead green finance from the top. It also ensures that there is at least one senior manager designated to lead the work in green finance and that internal control mechanisms should evaluate and audit the green finance mechanisms;

- The Guidelines stress environmental information disclosure, including disclosure on green strategy and policies, development of green finance ideally with reference to international standards and good practices;

- The Guidelines emphasize the responsibility of banks vis-à-vis their clients and customers to implement green development, including disclosure, risk management and policy systems and adds that banks should apply “differentiated management”, possibly depending on the client’s environmental performance

- The Guidelines stipulate that banks in a drive to support greening the Belt and Road Initiative (BRI) should require their clients in overseas projects to comply with relevant national environmental laws and follow international practices or guidelines, as well as that the project is substantially consistent with international good practices.

The short interpretation will provide a summary of the Guidelines and compare it to previous Guidelines. It will end with some recommendations for further alignment.

Overview of the Guidelines

The Guidelines addresses banking and insurance institutions “to prevent environmental, social and governance (ESG) risks” and “to strengthen ESG information disclosure and interaction with stakeholders”. The Guidelines describes how banking and insurance institutions should integrate the ESG requirements into management processes and risk management system. In particular, these institutions are required to

- establish a green finance organization and coordination mechanism and the board of directors are responsible for the green finance development strategy.

- promote carbon peaking and carbon neutrality and support key industries in energy conservation, pollution reduction, carbon reduction, green enhancement, and disaster prevention

- adopt differentiated management measures and urge clients to strengthen ESG risk management

- support the green and low-carbon development efforts under the Belt and Road Initiative.

- strengthen internal control management and information disclosure and establish a green finance assessment and evaluation system.

Compared to the 2012 Green Credit Guidelines, the 2022 Guidelines

- highlights the role of the Board of Directors in promoting green finance from a strategic standpoint, specifically appointing a special committee and a senior manager to take the lead in green finance work.

- extends the scope to insurance companies besides policy banks and commercial banks.

- emphasizes governance risk in addition to environmental and social risks, referring particularly to its corporate governance and management process and those of customers.

- offers to seek third-party verification or share ESG risks

- promotes alignment with the “Belt and Road” Initiative and requires the institutions to strengthen ESG risk management of overseas projects and follow international good practices.

| 2012 Green Credit Guidelines | 2022 Green Finance Guidelines for the Banking and Insurance Industry | |

| Organization and Management | The Board of Directors is responsible for building and promoting green credit concepts. | The Board of Directors is responsible for appointing a special committee to be responsible for green finance work. The banking and insurance institutions shall designate a senior manager to take the lead in green finance work. |

| ESG risks for institutions | Include domestic policy banks, commercial banks, rural cooperation banks and rural credit cooperatives. Banking institutions shall develop client environmental and social risk assessment criteria. The environmental and social risks is related to energy consumption, pollution, land, health, safety, resettlement of people, ecological protection, climate change, etc. | Include development bank, policy banks, commercial banks, rural cooperative banks, rural credit cooperatives, insurance group (holding) companies, insurance companies, reinsurance companies, insurance asset management company. Banking and insurance institutions shall formulate environmental, social and governance risk assessment standards for clients. The environmental, social and governance risks focuses on customers (financiers) and their main contractors and suppliers due to corporate governance deficiencies and inadequate management. |

| Differential risk management | Banking institutions shall adopt differentiated risks management measures concerning loan investigation, review and inspection, loan pricing, and economic capital allocation. The institutions shall require clients to find a third party to share risks. | Banking institutions should take differentiated risk management measures in terms of loan “three inspections”, loan pricing and economic capital allocation. The institutions shall seek third-party verification or share risks. Insurance institutions shall implement differential rates according to customer risk conditions. |

| International standards adoption | Lenders need to improve management of any overseas projects that they support, to ensure that the initiators of those projects comply with local environmental, land, healthcare and security legislation. | Banking and insurance institutions shall actively support the green and low-carbon construction of the “Belt and Road” and require project sponsors and their main contractors and suppliers comply with relevant laws and regulations on ecology, environment, land, health, safety. |

Increasing responsibility of Board of Directors

The 2022 Guidelines highlights the Board of Directors shall assume the main responsibility of green finance and establish a special committee for green finance work. It is also responsible for determining the green finance development strategy, supervising and evaluating the strategy implementation. The 2022 Guidelines are an upgrade from the 2012 Guidelines that addressed the Board of Directors to build and promote green credit concepts. The key role of Board of Directors in developing strategy and establishing mechanisms is put into perspective from strategic and organizational level.

ESG risks for institutions and clients

The 2022 Guidelines applies to more institutions compared to the 2012 version, including insurance companies and insurance asset management company in addition to development banks, policy banks, and commercial banks. The 2022 Guidelines addresses environmental, social and governance risk assessment standards for clients. The institutions shall urge clients to strengthen environmental, social and governance risk management by improving contract terms. It is congruent with the previous version, which also specifies developing client environmental and social risk assessment criteria and requiring clients to take risk mitigation actions. However, the 2012 Guidelines mainly refer to the environmental and social risks that is related to energy consumption, pollution, land, ecological protection, and climate change, while the latest version focuses on governance risks of customers and their main contractors and suppliers due to corporate governance deficiencies and inadequate management.

Differential risk management

The 2022 Guidelines requires banking institutions to take differentiated risk management measures in terms of loan “three inspections”, loan pricing and economic capital allocation, which is in alignment with the 2012 Guidelines. The latest version specifies that banking and insurance institutions shall seek third-party verification or share risks. Insurance institutions are also required to implement differential rates according to customer risk conditions. According to the Green Credit Key Performance Indicators introduced in 2014, the dynamic assessment is based on different environmental and social risks, specifically no adverse impacts and adverse impacts that are difficult to eliminate and can be eliminated through mitigation. The differentiated risk management measures apply to the clients with adverse impacts.

Adopting international standards

The 2022 Guidelines specifies that banking and insurance institutions shall actively support the green and low-carbon construction of the “Belt and Road”. The project sponsors and their main contractors and suppliers are required to comply with relevant laws and regulations on ecology, environment, land, health, safety and ensure the management of the project is substantially consistent with international good practices. It seeks alignment with the 2022 Guidelines for Ecological Environmental Protection of Foreign Investment Cooperation and Construction Projects and the 2021 Green Development Guidelines for Foreign Investment and Cooperation. Specifically, project stakeholders are encouraged to abide by the local environment laws and follow international common practices.

Lacks specific environmental risks

Contrary to the 2012 Guidelines, which addresses environmental and social risks related to climate, pollution, and biodiversity, the 2022 Guidelines does not specifically mention environmental and social risks. Rather, it stresses the governance risks of customers (financiers) and their main contractors and suppliers due to corporate governance deficiencies and inadequate management. The Green Credit Key Performance Indicators also lack specific environmental indicators related to climate, pollution, and biodiversity.

Interpretation and recommendations

China needs trillions of dollars to achieve the dual climate goals of carbon peaking before 2030 and carbon neutrality by 2060. While much attention is given to green bonds (which are regulated by the Central Bank PBOC) to mobilize finance, most of green finance will be driven by banks, through loans and credits. The development is due to China’s bank-dominated structure with strict state control that has continues to help China’s mobilization of capital for top-down goals (e.g., recovery during the COVID-19 pandemic). That’s why the new Guidelines are a very important signal for greening finance in China.

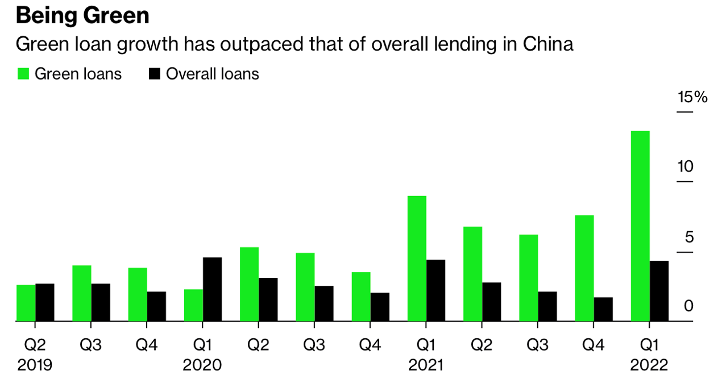

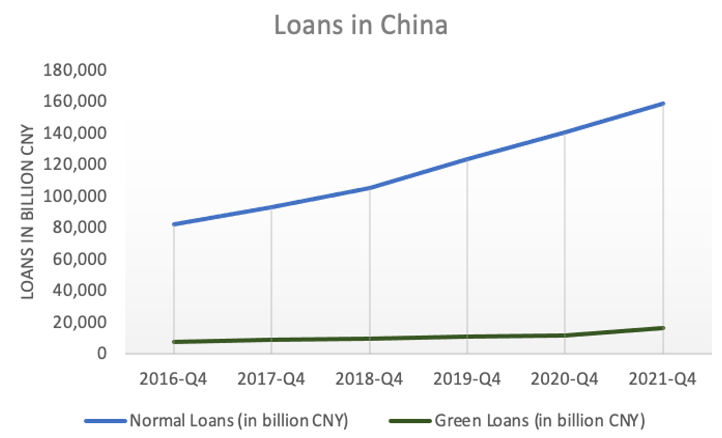

Indeed, since China’s banking regulator issued the green credit guidelines in 2012 and the green statistics system in 2013, China’s green loans grew to RMB18 trillion (about USD3 trillion) in March 2022 (this is about six times the amount of green bonds). Green loans’ growth with 14% in the first quarter of 2022 outpaced the overall loan growth at 4.3% growth (see Figure 1). Yet, green loans accounted for only about 10% of the total loan market (see Figure 2), indicating large untapped potential. The regulator claims that the green credit of the 21 major banks can save more than 400 million tons of standard coal and reduce carbon dioxide equivalent by more than 700 million tons each year.

Figure 1: Growth rate of loans and green loans in China (Data: People’s Bank of China, Source: Bloomberg)

Figure 2: Loans and green loans in China (Data: CBIRC, PBOC, Figure: Author)

- Chinese financial institutions should strengthen their participation in international standard setting. While international financial institutions equally struggle to decarbonize their portfolios, they have nevertheless achieved broader agreement on pathways to net zero (e.g., through the Glasgow Financial Alliance for Net Zero (GFANZ)), introduced broader environmental risk management frameworks (e.g., through Equator Principles) and provide standardized environmental disclosure (e.g., Principles for Responsible Investment (PRI); Global Reporting Initiative (GRI), Task-Force for Climate-related Financial Disclosure (TCFD); Task Force for Nature-related Financial Disclosure (TNFD)). Few Chinese financial institutions are currently supporting or subscribing to these international standards, leaving an opportunity to share and shape experiences on green finance.

- Provide coordinated guidance for economic actors that are key to green finance, such as financial institutions and developers engaged in energy, transport, mining both domestically and for overseas activities. For example, while China’s Ministry of Commerce (MOFCOM) together with China’s Ministry of Ecology and Environment (MEE) provided its Guidelines for Ecological Environmental Protection of Foreign Investment Cooperation and Construction Projects in January 2022 and its Opinions on promoting the green development of “One Belt, One Road” in March 2022, those stressed the role of developers and emphasized the role of international standards. The BRI Green Development Guidance published in December 2020 also emphasized the role of “differentiated management”. Guidance would be necessary whether these Guidelines and Opinions refer to the same standards, the same “differentiated management”. An example would be the Implementation Guide for the BRI Green Development Guidance published in September 2021 by BRIGC, that specifies these processes for both developers and financial institutions.

- Provide specifics for environmental risk and performance disclosure. In a recent interview with Governor YI Gang of the People’s Bank of China by China Global Television Network in June 2022, he warned against “moral hazards, such as green-washing, low-cost fund arbitrage, and green project fraud” and highlighted the need for “information disclosure and strict supervision”. While work is on the way for ESG disclosure standards, particularly for listed companies, more standardized and ambitious disclosure for banks could provide for relevant information and benchmarks while avoiding greenwashing.

- Specify those international standards that Chinese financial institutions should apply in international projects, which could include Equator Principles, TCFD, TNFD, PRI, etc. for various aspects of financial institutions’ governance processes.

- Ensure that biodiversity-related risk management and positive impact is part of the environmental agenda. With global understanding of biodiversity-related risks increasing and more central banks issuing guidances for financial institutions on improving nature-related stress testing, while associations provide more detailed risk management and disclosure frameworks for biodiversity (e.g., TNFD), the current Guidelines do not offer much impetus on biodiversity-related risks or impacts.

- Strengthen the role of mitigation finance as a strategic role in building resilience to deal with the consequences of climate change. This can be done through better taxonomies that include relevant infrastructure (e.g., ecosystem-based services, nature-based solutions) to reduce risks of extreme flooding or droughts.

Overall, this guidelines is another piece of the puzzle and an important update on previous work of the CBIRC to guide the banking and insurance sector to focus efforts on addressing climate emissions. While there are key elements that accelerate the green transition through green credit and insurance, implementation will be the challenging part. With the help of domestic institutions (e.g., China Banking Association – CBA), and international collaboration (e.g., through the Sustainable Banking Network – SBN) capacity can be strengthened throughout the financial sector. Yet, the key question remains: while frameworks to accelerate finance for the green transition are improving, how can we accelerate phasing out harmful activities?

Comments are closed.