On July 16, 2021, the Ministry of Commerce (MOFCOM) and the Ministry of Ecology and Environment (MEE) of China issued the “Green Development Guidelines for Foreign Investment and Cooperation” (hereinafter referred to as the 2021 Green Guidelines). The Guidelines focus on both investment and trade. With MOFCOM being responsible for regulating Chinese overseas projects including their environmental standards, while MEE is responsible for providing concepts and knowledge, this Guidelines must be considered highly influential in pushing for a green BRI where enterprises should “follow international green rules and standards” in their overseas economic activities.

By explicitly copying the two policy banks China Development Bank (CDB) and the Export-Import Bank of China (EXIM Bank), as well as China Export and Credit Insurance Corporation (Sinosure) in the document, also policy banks as the major sponsor of overseas investments are addressed. However, the Guidelines are only voluntary and apply only “to activities related to green development of Chinese businesses in outbound investment and cooperation” and mostly for enterprises (not commercial financial institutions).

The investment-related points in the Guidelines are highly congruent with the 9 recommendations of the Green Development Guidance for BRI Projects issued by the Belt and Road Initiative International Green Development Coalition (BRIGC) backed by MEE in December 2020. The Guidelines come only weeks after 29 BRI countries announced the Initiative for a Green BRI Partnership that emphasized the work of the BRIGC and the Green Investment Principles (GIP), which itself was following the announcement by the G7 to initiate the Build Back Better World (B3W) initiative focused on sustainable development.

1. Highlights of the Guidelines

The 2021 Green Guidelines premise that “only if overseas investment and cooperation adhere to the principle of green development, can it help China…seize the initiative in international cooperation and competition”. On this premise, the document outlines areas for Chinese enterprises to embed the “green development concept” throughout the entire process of foreign direct investment and cooperation (also Article 1).

The highlights of the Guidelines are:

- Chinese enterprises should adhere to “international green rules and standards”, where those are more stringent than “host country rules”;

- Chinese enterprises need to “green” their overseas investments across the whole project lifecycle – from planning and evaluation to implementation and reporting

- All three environmental aspects of pollution control (including solid waste, noise, waste gas), climate change, and biodiversity are building blocks for green development;

- Local stakeholder consultation and complaint mechanisms (i.e. grievance mechanism) is encouraged for better alignment with local needs;

- Specific industries are promoted, particularly clean energy (wind, solar, nuclear and biomass), better supply chain and green industry chains;

- Green technology innovation overseas is promoted, e.g. by setting up R&D centers, incubators, conducting joint research and attract overseas talents;

- China aims to pursue an open development model and take the lead in international cooperation and competition, including making Chinese companies “into world front-runners in green economy”

- The Guidelines are not limited to BRI cooperation, but to all overseas investment and cooperation activities with Chinese participation.

2. Green Guidelines relevant for the Project Lifecycle

By stipulating a whole green lifecycle approach, the document specifies activities and responsibilities, particularly of enterprises doing projects overseas:

- In the project planning and evaluation phase, Chinese enterprises shall actively fulfill their environmental responsibilities, including complying with the host countries’ laws and regulations, and promoting the coordinated development of the local economy, society, and ecological environment. Chinese enterprises are encouraged to follow international common practices for the Environmental Impact Assessment (EIA) and due diligence, and identify potential environmental risks (before an overseas investment decision is taken) (Article 2 – Promote green production and operation); If the host country lacks relevant laws and regulations, or the environmental standards are deemed lax and insufficient, Chinese enterprises are encouraged to adhere to international organizations/multilateral agencies’ common standards or Chinese standards for their overseas investments and cooperation (Article 7 – Prevent ecological and environmental risks).

- In the project execution and implementation phase, Chinese enterprises shall conduct ecological and environmental risk prevention measures and improve the capacity of ecological and environmental management. Chinese enterprises are stipulated to follow the host countries’ rules and standards and take reasonable and necessary measures to reduce or mitigate adverse environmental impacts. They are asked to enhance the early-warning mechanism for environmental risks, and formulate contingency plans for environmental accidents and emergencies (Article 7); They are also encouraged to communicate more and often with host country governments, media, local communities and environmental NGOs while fulfilling environmental and social responsibilities (Article 10 – Enhance the reputation of green development) (albeit, the goal of Article 10 is clearly to promote Chinese green business credentials and dispel any other information “eliminate the impact of bad press”).

- In the project reporting and disclosure phase, regulators will consolidate the monitoring and analysis of the green development and improve the information-based supervision (Article 9 – Optimize green regulatory services).

- Throughout the project lifecycle, Chinese enterprises are propelled to comply with international requirements, including but not limited to the United Nations Framework Convention on Climate Change (UNFCCC), the Convention on Biological Diversity (CBD)[1], the 2030 Sustainable Development Goals (SDGs), Green Investment Principles for BRI (GIP) (Article 8 – Comply with international green rules and standards).

3. Significance of the Guidelines

Compared with the previous policies, the 2021 Guidelines are significant for three reasons: first, the document clearly emphasizes “international green rules and standards”, driving Chinese overseas investments to go beyond “host country rules”; second, it is built on internationally consolidated guidelines; third, it expands from environmental protection and pollution control, now considered as the bare minimum, in the 2013 Guidelines, to include more climate- and biodiversity protective measures in the new version.

Beyond “Host Country Rules”

Over the past decades since China’s “going out” reform, Chinese enterprises were encouraged to comply with host country laws and regulations in order to obtain relevant local and Chinese permits and licenses. However, the robustness of the host countries’ regulatory environment and governance can vary. For certain countries with lax environmental regulations, virtually, no or minimal safeguard measures were demanded from project developers and investors in large-scale infrastructure projects. Due to the lack of incentives to comply to international laws in these cases, Chinese enterprises were often criticized by NGOs and media for their environmental and social impacts on the local ecosystems and communities. At the same time, the lack of environmental standard application has created financial risks for Chinese investors and tended to limit access to international financing sources, which usually come with higher E&S standards.

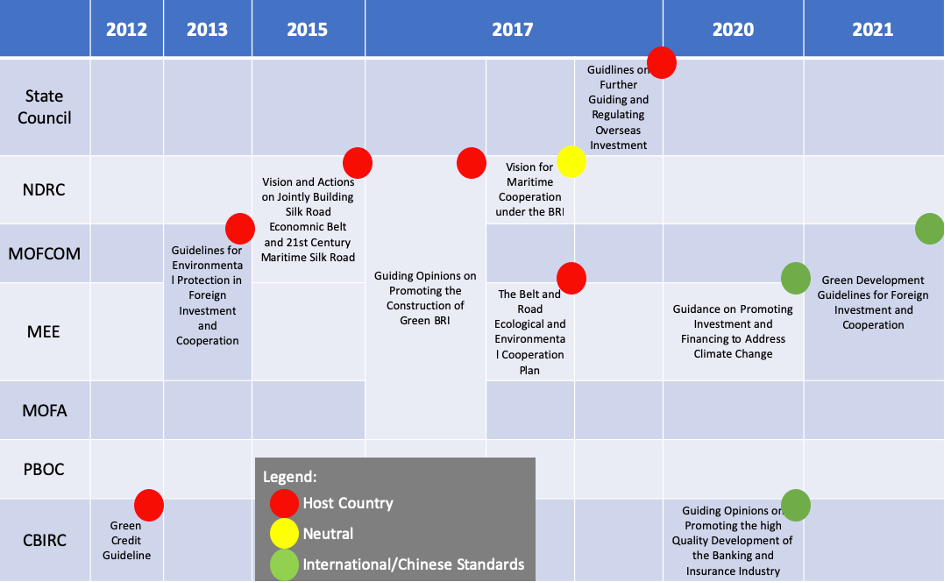

As an alternative, international rules (or in some cases, Chinese standards) serve as more stringent benchmarks. In previous policy documents, for example, in the 2013 “Guidelines for Environmental Protection in Foreign Investment and Cooperation” issued also by MOFCOM and MEE, Chinese enterprises were encouraged to “research and learn” from international organizations and multilateral financial institutions. In 2020, a deviation from “host country rules” started to emerge (see Figure 1): for example, the 2020 “Guidance on Promoting Investment and Financing to Address Climate Change” (hereinafter “2020 Climate Finance Guidance”) issued in October 2020 promotes the application of Chinese standards and is referencing alignment with Paris Agreement targets for the overseas investment.

The 2021 Guidelines stress that “If the host country lacks relevant laws and regulations, or the environmental standards are deemed lax and insufficient, Chinese enterprises are encouraged to adhere to international organizations/multilateral agencies’ common standards or Chinese standards for their overseas investments and cooperation”. Specifically, enterprises are encouraged to follow international common practices for their ESIA and E&S due diligence, for example, IFC’s Environmental and Social Performance Standards.

Figure 1: Evolution of the green guidelines relevant for Chinese overseas investment and financing: from “host country rules” to “international/Chinese standards” (Source: Nedopil, Christoph (forthcoming): “Green Finance for Soft Power: The (Special) Case of China’s Belt and Road Initiative (BRI)”, Environmental Policy and Governance)

Towards international cooperation

The 2021 Green Guidelines are congruent with many of the recommendations of the Green Development Guidance published by the BRICG and backed by various ministries, particularly the MEE in December 2020. With its 9 recommendations and 1 traffic light system, the GDG focused on the three environmental dimensions of pollution control, climate change and biodiversity protection, referencing the Paris Agreement, the Convention on Biological Diversity (CBD) and relevant international pollution frameworks. The Green Development Guidance was developed with international partners, such as World Resources Institute, ClientEarth, Habib Bank, AIIB (note of conflict of interest: Christoph Nedopil, IIGF Green BRI Center Director, was one of the lead researchers and authors of the Guidance).

The 9 recommendations are:

- Green overseas investment practices address all project phases, from project initiation through project evaluation, financing, construction, operation, reporting and transfer/closure;

- Provide exclusion list of projects not available for funding (e.g. similar to many developing finance institutions);

- Environmental (and Social) Impact Assessment (ESIA) depending on the project’s perceived risks, where “red”, “red-yellow”, “red-green”, and high-risk “yellow” projects should obtain an independent EIA assessment based on international best practices;

- Differentiated conditions, for example to reduce financing cost and approval times for “red-green” and “green” projects;

- Environmental and Social Management System for project company required to ensure mitigation measures are implemented and reported;

- Grievance redress mechanism provided by financial institutions for people and NGOs with easy-to-access to share violations of environmental agreements or laws with the financial sponsors throughout all project phases;

- Integration of covenants related to breach of environmental and social agreements between the financial institution and the project company to exercise remedies to rectify environmental management;

- Public reporting of environmental performance of project;

- International cooperation about environmental performance reporting.

Besides the Green Development Guidance, also the CCICED special policy studies on BRI and green finance have contributed knowledge and capacity. The new 2021 Green Guidelines follow many of these recommendations and explicitly ask Chinese enterprise to consider the requirements under international initiatives such as the Paris Agreement under the UNFCCC, UN Sustainable Development Goals (SDG) , Convention on Biological Diversity (CBD) and the Green Investment Principles (GIP).

Towards Positive Contributions for pollution, climate, and biodiversity

The 2021 Guidelines can be considered as an upgrade from its 2013 version. Evidently, the emphases have shifted from the bare minimum of pollution control that meets host countries’ standards towards the promotion of the “green development concept”. Across the three aspects, namely, climate, pollution, and biodiversity, the 2021 Guidelines improve through including specific climate-positive measures (e.g., support overseas clean energy investment). Furthermore, Chinese enterprises are asked to “conduct eco-environmental protection and restoration to prevent adverse impacts on biodiversity” according to host country laws or international practices in the new Guidelines while such practices were only “encouraged” to basically satisfy local laws in the 2013 version. The progress is built upon some of the policies issued in-between (e.g., 2020 Climate Finance Guidance). Finally, the guidance also promotes controlling the discharge of waste gas, water, noise and solid waste, enhance the integrated reuse of waste etc., and thus clearly focus on broader aspects of pollution control. Table 1 compares the two guidelines across climate, pollution, and biodiversity, highlighting the positive measures.

Table 1 Comparison between 2013 and 2021 Guidelines across climate, pollution and biodiversity

| Climate | Pollution | Biodiversity | |

| 2013 “Guidelines for Environmental Protection in Foreign Investment and Cooperation” | Enterprises shall develop low-carbon and green economy, and implement sustainable development strategies | Construct and operate pollution prevent installations, ensure the emission of exhaust gas, waste water, solid wastes or other pollutants meet the host country standards;Reduce generation and emission of pollutants in the course of production, service and product use … | Consider the ecological function of the area…. reduce adverse impacts on local biodiversity;Encouraged to carry out ecological restoration in accordance with requirements of laws and regulations of the host country or common practices in the industry |

| 2021 “Green Development Guidelines for Foreign Investment and Cooperation” | Promote effective control of carbon emissions;Support foreign investment in solar energy, wind energy, nuclear energy, biomass and other clean energy;Follow international green rules and standards – UNFCCC, SDGs, GIP | Reduce emission of pollutants, ensure a green and sustainable production cycle;Control gas emission, sewage, noise and solid waste pollutionFollow international green rules and standards … | Conduct ecological and environmental protection and restoration in accordance with the host country law or international practices to prevent adverse impacts on biodiversity; Follow international green rules and standards – CBD, SDGs, GIP |

4. Recommendations for next steps

To carry forward the momentum for a green BRI and green overseas project development, we see this document as a key green milestone. Several factors can contribute to its success:

- For Chinese enterprises (project developers, investors), they should use this guidance as the baseline and push green to a further application, and integrate E&S considerations throughout the investment decision-making and project lifecycle. In practice, they should e.g. hire independent ESIA consultants, and conduct rigorous ESIA according to, for example, IFC’s Performance Standards. The assessment process has to include meaningful consultation with local stakeholders early on, especially Indigenous communities. To address issues flagged in the ESIA, the project developers should develop and/or maintain an Environmental and Social Management System.

- Chinese financial institutions (commercial banks, CDB, EXIM Bank and Sinosure) should develop their own E&S policies in accordance with the Equator Principles (for commercial banks) or the OECD “Common Approaches” (for ECAs), both based on IFC’s Performance Standards in addition to the Green Investment Principles (GIP). To better guide their BRI financing and investment, they can follow the Traffic Light System, a two-tiered system that classifies BRI projects into three categories based on their environmental impacts. The financial institutions should also require transparent grievances mechanisms and relevant covenants in financial agreements (Green Development Guidance – Recommendation 6& 7).

- Regulators and financial institutions should formulate an exclusion list based on environmental criteria (e.g., coal) and a green/yellow/red taxonomy based on the Traffic Light System of the Green Development Guidance.

- To explore new opportunities through a green BRI, Chinese government can offer knowledge sharing and capacity building, for example, helping other BRI countries build sustainable roadmaps, through collaboration with multilateral development banks and other international organizations.

- To incentivize implementation of the 2021 Guidelines, Chinese government institutions and financial institutions (including the insurance companies) should provide financial and administrative incentives for green projects and dis-incentives for non-green projects according to Recommendation 4 of the Green Development Guidance (“differentiated treatment”).

- Policy-makers should provide specific guidance for investors and financiers on climate- and nature-positive measures (the current Guidelines is targeted at enterprises).

Read the Guidelines in Chinese.

Read our unofficial translation of the Guidelines here.

Comments are closed.