On October 26, 2020, five Chinese government ministries/regulators jointly issued the “Guidance on promoting investment and financing to address climate change” (find original here and an unofficial English translation here) – in short “Climate Finance Guidance”. The Climate Finance Guidance came weeks after Chinese President Xi’s announcement at the United Nations’ General Assembly to strengthen ambitions for China to become carbon-neutral by 2060 and peak carbon emissions before 2030.

The involved ministries/regulators that published the Climate Finance Guidance include:

- the Ministry of Ecology and Environment (MEE)

- the National Reform and Development Commission (NDRC)

- the People’s Bank of China (PBoC) – China’s Central Bank,

- China Banking and Insurance Regulatory Commission (CBIRC) – China’s banking regulator, and

- China Securities Regulatory Commission (CSRC)

Relevance of the Climate Finance Guidance for the Belt and Road Initiative (BRI)

While the focus of the guidance is on domestic climate finance including a timeline for having relevant policies for investment ready by 2025 and even the ambition of advancing the construction of a market mechanism for carbon-emission trading through China’s ETS, the guidance also stresses important aspects of climate finance in the Belt and Road Initiative (BRI).

For the Belt and Road Initiative, the guidance

- promotes “the active integration of climate investment and financing into the “Belt and Road” construction”,

- addresses ambitions to “formulate and revise international standards on climate investment and financing”, and

- promotes “the application of Chinese standards in overseas investment and construction.”

- encourages financial institutions “to support the low carbon development of the Belt and Road and South-South cooperation”,

- promotes the acquisition of “climate mitigation and adaptation projects outside of China”,

Importantly, the document also states that China aims to “regulate offshore investment and financing activities” and manage climate risks. This might be an allusion to the Greenlight System of the Belt and Road Initiative, which has pushed for a regulatory approach to manage ecological risks in financial decision-making.

The document furthermore emphasizes China’s ambition to engage in research and international cooperation on climate investment and financing standards. One such cooperation mechanism that could be strengthened includes the Belt and Road Initiative Green Coalition (BRIGC).

Interpretation of the Climate Finance Guidance for the Belt and Road Initiative

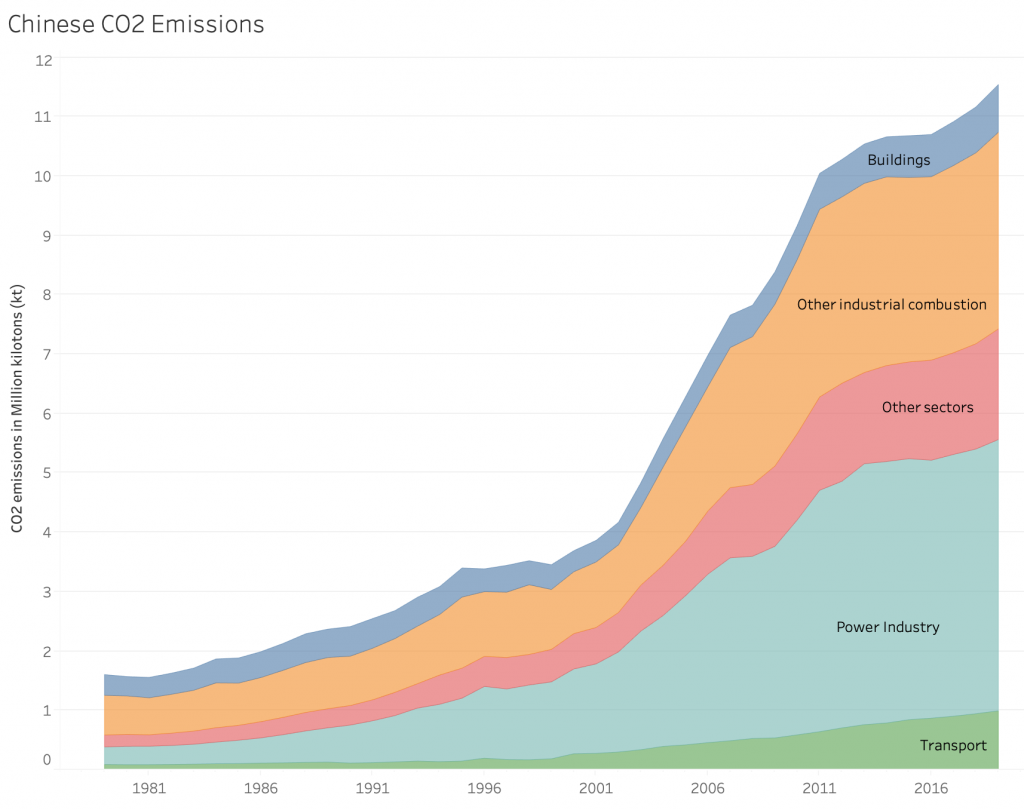

The Climate Finance Guidance at this stage is another step for aligning financial flows with ecological and climate ambitions of China. In some ways it is similar to previous developments: After China signed the Paris Accord in 2015, and committed to limit global warming to well below 2°C, which effectively means a climate-neutral economy by 2050, seven Chinese ministries issued the “Guidelines for Establishing the Green Financial System”. While China has since then become one of the largest green financial markets in the world with about 11 trillion RMB (about 1.8 trillion USD) in green credit and about RMB 1.2 trillion in green bonds (about 190 billion USD), absolute greenhouse gas emissions in China have been accelerating again since 2016.

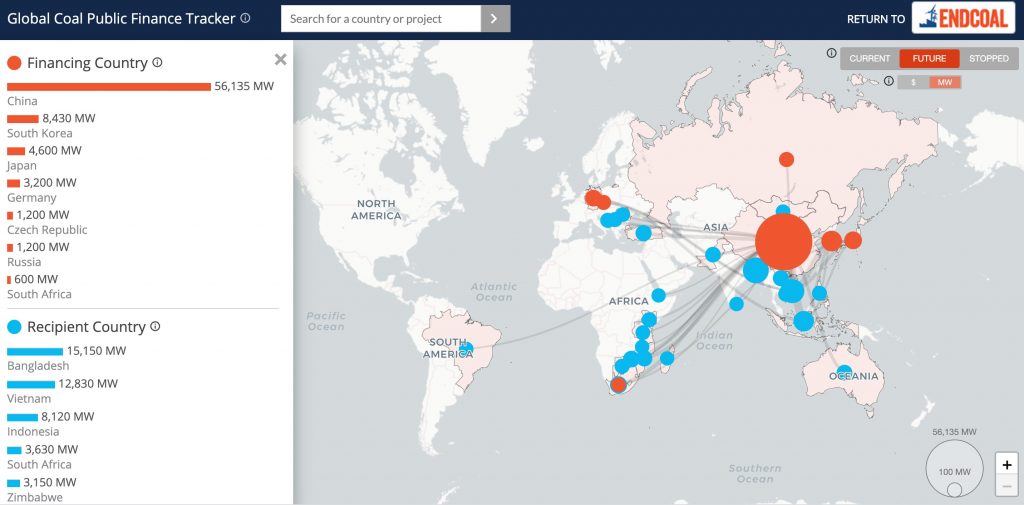

A similar picture emerges for climate-related investments in the Belt and Road Initiative (BRI). While overall Chinese investments, particularly energy-related BRI investments, have become greener overall (and in the first half of 2020 become predominantly non-fossil-fuel related energy investments), China continues to be the largest overseas sponsor of current and future coal-fired power plants.

Therefore, guidance towards climate-positive finance is important for China’s domestic and overseas investments. Accordingly, while this ‘guiding opinion’ is not a law and thus has little direct legal weight, it is important for greening the Belt and Road Initiative for the following reasons:

- The Guidance demonstrates how multiple relevant Chinese ministries are aiming to build consensus around the need to transition to climate-friendly overseas investments.

- The Ministry of Environment and Ecology (MEE) has taken a leadership role in aligning finance with climate ambitions.

- The Guidance identifies financial institutions as a key lever for climate change. The Chinese policy banks China Development Bank (CDB) and China Exim Bank are certain to take note, and will place a higher priority on tackling climate risks.

- The Guidance mentions regulations for overseas investments in line with climate targets, which would be a clear deviation from all previous guidances on greening the Belt and Road Initiative that emphasized the “host country principle”.

- The Guidance sets the ambition for China to apply and set international standards for overseas investments.

Next steps for climate-finance in the Belt and Road Initiative

While this guidance is a first step, its de-facto impact so far must be seen as limited, particularly for the Belt and Road Initiative. To further support climate-friendly BRI development, a few next steps will be crucial:

- The launch of the “Green Development Guidance for BRI Projects” in the next months will be important. The Guidance should give a clear signal to what projects are aligned with “greening the Belt and Road Initiative” and which projects are not.

- The coordination of the different ministries that are relevant for determining BRI investments (e.g. NDRC, MEE, MOFCOM, MOFA, MOF, CBIRC, State Council) will be crucial to align on climate-finance initiatives and regulations. Without a common framework, loopholes will easily be exploited.

- The phase-out of current investments and ideally a moratorium on non-finished coal-fired power plants in the BRI should be considered. This would give China’s pledge more credibility with its BRI and non-BRI partners.

- International cooperation for alignment of goals and ambitions are crucial for accelerating climate-friendly development of the BRI. While China is an important investor in the BRI for climate-friendly investment, many other investors have been more forward in addressing climate finance in the BRI, particularly multilateral development banks (MDBs), such as the World Bank, the IFC, EBRD, bilateral development banks including the Japanese development bank JICA, the German development bank KfW as well as private financial institutions.

Overall, the Guidance is an important step, but – as always – the question is whether it is ambitious enough and how it can be accelerated. The financial risks caused by the climate emergency will only accelerate the slower the financial system adapts.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.