Key findings

- BRI finance and investments stabilized in 2021 at US$ 59.5 billion (compared to US$ 60.5 billion in 2020);

- No coal projects received financing or investments in 2021;

- Green energy finance and investments in the BRI slightly increased to a new high in 2021 at US$6.3 billion (compared to US$ 6.2 billion in 2020);

- Oil-related finance and investments in the BRI expanded from to US$ 6.4 billion in 2021 (compared to US$ 1.9 billion in all of 2020);

- Share of investments in China’s BRI engagement in 2021 shrank to low point, share of construction contracts (often financed with Chinese loans) increased;

- Strong shift of BRI engagement towards African and Middle Eastern countries

- Iraq was the largest beneficiary from China’s BRI in 2021, with about US$ 10.5 billion in construction contracts;

- Chinese BRI financing accelerated particularly in the health and utilities sectors (yet at low total levels);

- In global comparison, BRI investment trends underperformed global trends of FDI into emerging markets, which increased by 30% (including FDI into China);

- For 2022, we expect Chinese BRI engagement to accelerate with a focus on transport in Asia, resources and other strategic assets (e.g., ports);

- For 2022, we continue to see better opportunities in investing in smaller projects that are faster to implement (e.g., solar, wind) and an opportunity to scale back large and often loss-making projects (e.g., coal);

- For the 2022, we expect an acceleration of green projects, also due to the “Guidelines for Greening Overseas Investment and Cooperation” issued in July 2020, and the “Guidelines for Ecological Environmental Protection of Foreign Investment Cooperation and Construction Projects” issued in January 2022, both issued by the Ministry of Commerce (MOFCOM) and the Ministry of Ecology and Environment (MEE). Both Guidelines call for application of stricter and if necessary international environmental standards;

- For 2022, we see more competition for development finance through US-supported B3W and the EU’s “Global Gateway” strategies, which under certain circumstances can provide opportunities for tripartite cooperation and financing.

China’s engagement in the Belt and Road initiative (BRI)

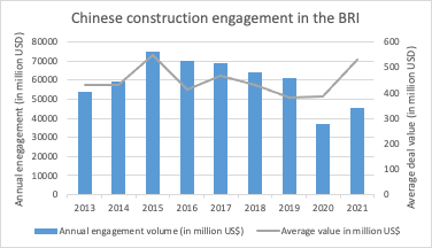

Chinese engagement through financial investments and contractual cooperation for the year 2021 in the 144 countries of the Belt and Road Initiative was about US$59.5 billion. Of this engagement, about US$13.9 billion was through investment, and US$45.6 billion through contracts (partly financed by Chinese loans). China’s overall engagement is a steady development compared to 2020, when Chinese engagement was about US$60.5 billion. In that time, contract volume rose from about US$37 billion, while investment shrank from US$23.4 billion. Compared to 2019, the year before the COVID-19 pandemic, Chinese engagement declined by about US$53 billion (about 48%). With COVID-19 ongoing, BRI investments were at their slowest pace since China’s overseas investment strategy was coined “Belt and Road Initiative” in 2013 when China became the major investor in many of the BRI countries (see Figure 1).

| About the data: On January 21, 2022, the Chinese Ministry of Commerce (MOFCOM) released its data for “China’s investments and cooperation in countries along the Belt and Road” covering the period of January to December 2021. According to these data, Chinese enterprises invested about US$20.3 billion in non-financial direct investments in countries “along the Belt and Road”. Furthermore, there were 560 newly signed projects with a contract value of over US$100 million. The MOFCOM data focus on 55 countries that are “along the Belt and Road” – meaning on a corridor from China to Europe including South Asia. For this report, the definition of BRI countries includes 142 countries that had signed a cooperation agreement with China to work under the framework of the Belt and Road Initiative by the end of 2021. To analyze investments in these countries, we base our data on the China Global Investment Tracker and our own data research at the Green Finance & Development Center affiliated with Fudan University, Shanghai. As with most data, they tend to be imperfect. |

Figure 1: China’s BRI construction engagement (top) and investments (bottom) 2013 – 2021

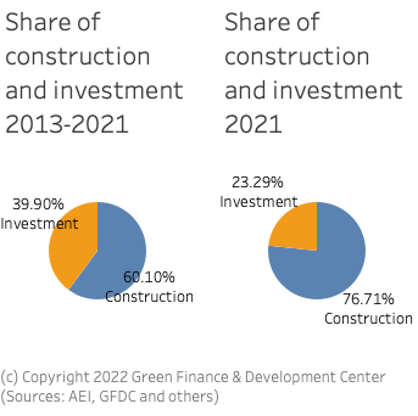

Share of investments in China’s BRI engagement decreasing, share of construction increasing

The share of Chinese investment over construction in the BRI has been decreasing since 2019, when investment had reached about 45% of BRI engagement. In 2021, Chinese investment share was 23% of total BRI engagement. Many of the construction contracts are financed through loans provided by Chinese financial institutions and/or contractors with the project often receiving guarantees through the host country’s government institutions (see Figure 2).

Figure 2: Share of construction and investment engagement in the BRI

Deal size is getting smaller

The average deal size has increased slightly from about US$444 million in 2020 to US$476million in 2021. Compared to 2015, the deal size in 2021 is 21% smaller. Particularly for construction projects, , the deal size in 2021 was larger than 2020, with about US$530 million in 2021 compared to US$386 million in 2020, while the deal size for investment went down from about US$585 to US$355 million. One reason might be more risk aversion by Chinese investors due to the COVID-19 pandemic, while several deals (see later section) have increased average construction deal size (see Figure 3).

Figure 3: Deal size of Chinese engagement in the BRI: left, for construction projects; right investments (Source: Green Finance & Development Center, FISF Fudan University, based on AEI data)

BRI countries saw more total Chinese engagement in 2021, but slower growth compared to non-BRI countries

Chinese construction and investment activities in the BRI in 2021 were about US$14 billion higher than in non-BRI countries, particularly in construction engagement. Chinese investments in non-BRI countries outpaced those into BRI countries for the first time since 2019. However, year-on-year growth of Chinese engagement in non-BRI was higher in 2021 compared to BRI countries.

Figure 4: Chinese overseas engagement 2018 – 2021 in BRI and non-BRI countries (Source: Green Finance & Development Center, FISF Fudan University, based on AEI data)

Regional and country analysis of Chinese BRI engagement

Strong shift of engagement to African and Arab countries, as well as more construction in South America

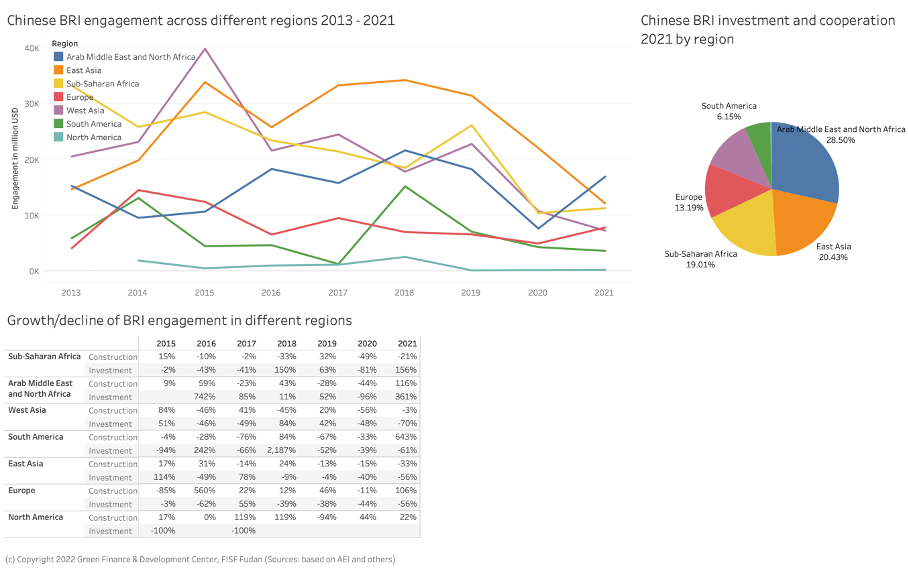

Chinese BRI engagement was not evenly distributed among all regions. Asian countries continued to receive the largest share of Chinese BRI investments (about 35% in 2021). However, African and Middle Eastern countries picked up an increasingly large share of Chinese engagement, up from 8% in 2020 to about 38% of BRI engagement in 2021. Investments into European BRI countries declined by 84% compared to the first six months of 2020. Particularly Arab and Middle Eastern countries increased investment by about 360% and construction engagement by 116% compared to 2020. Even more increase was observed in South America, where construction engagement shot up by 643% (see Figure 5).

Figure 5: Chinese engagement in different BRI regions

China’s financing and investment spread across 46 BRI countries, with 26 countries receiving investments and 37 with construction engagement. The country with the highest construction volume was Iraq, with about US$10.5 billion, followed by Serbia (about US$6.8 billion) and Indonesia (about US$2.4 billion). Tanzania, Egypt, the Russian Federation, and Singapore. Compared to 2020, construction engagement in Vietnam fell from US$3.1 billion to US$430 million. In terms of investments, Indonesia and Zimbabwe were the main host countries in 2021, followed by Vietnam and Chile. Particularly Laos, Sri Lanka and Singapore saw a drop in Chinese investment (see Figure 6).

Figure 6: Trends of Chinese BRI engagement across different countries 2020 –2021

Sector trends of BRI engagement

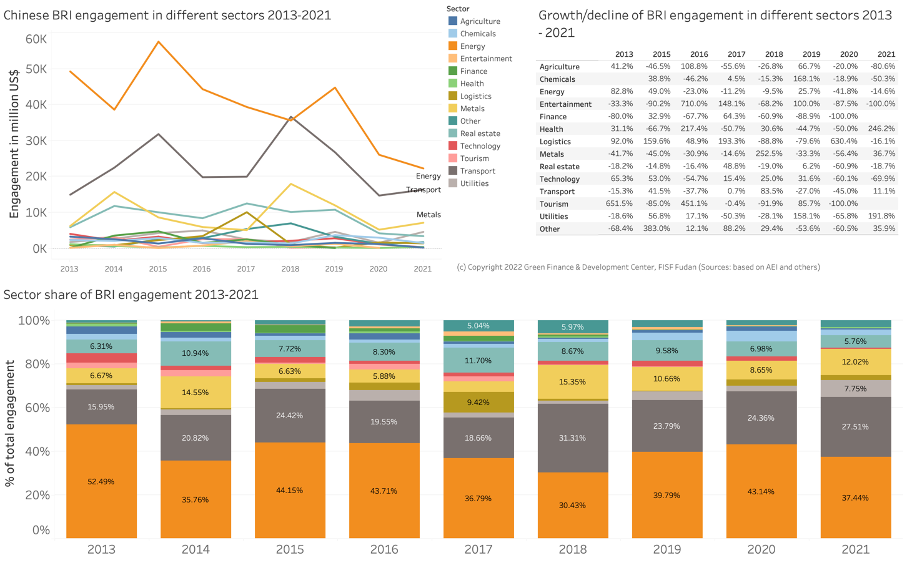

Chinese contractors and investors were engaged across most sectors in 2021. The focus of BRI continued to be in infrastructure, particularly energy and transport. The share of construction and investments in these two sectors, however, decreased slightly from about 67% in 2020 to 65% in 2021.

In 2021, particularly the health sector experienced a significant growth of engagement of 246% from about US$130 million to US$450 million, while sectors like entertainment, technology (despite some tech investments in Singapore, e.g., into the logistics provider Ninja Van by Alibaba Group) decreased (see Figure 7).

Figure 7: BRI investments in different sectors

When distinguishing Chinese investment and construction engagement, an important distinction can be found: while energy investments constitute about 40% of either investment and construction engagement, Chinese engagement in transport-related projects (e.g., road construction, airports, shipping), only 12% are through investments (e.g., ports), while metals would be the second largest investment sector for Chinese engagement in the countries of the BRI (see Figure 8).

Figure 8: Chinese BRI engagement in different sectors through construction and investment (2013-2021)

Energy-related engagement in the BRI

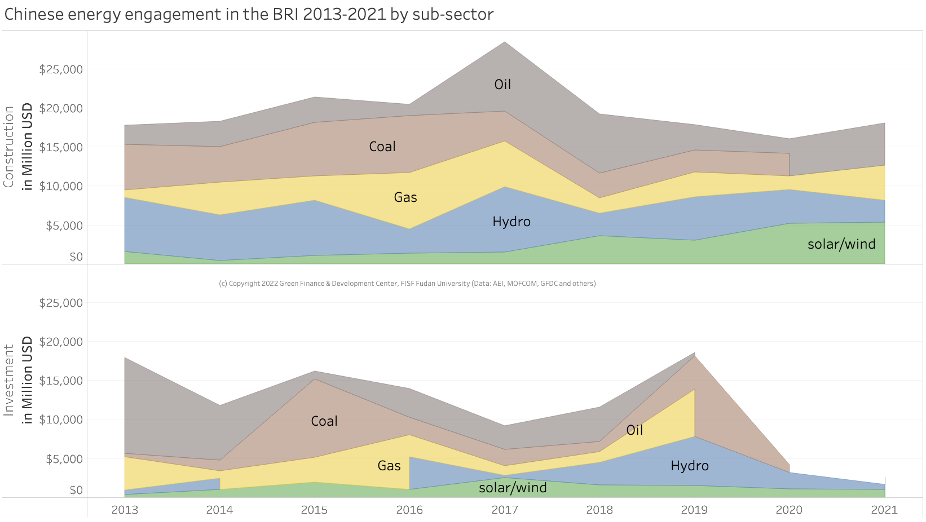

Chinese engagement related to the energy sector constitute the majority of China’s BRI engagement. In 2021, total engagement in the energy sector reached about US$22.3 billion. This compares to more than US$26.1 billion engagement in 2020 and almost US$44.8 billion in 2019.

In 2021, most energy engagement went into oil (31%), followed by solar and wind (31%) and gas (22%).

Figure 9: Chinese total energy engagement in the Belt and Road Initiative (BRI) 2013- 2021

Coal

China did not engage in investments or construction projects related to coal in 2021, as was the promise by China’s President to not build new coal-fired power plants overseas.

This is also in line our with previous analyses based on GEM data that no Chinese-financed coal fired power plant had been announced in 2020. However, 3 new coal-plants to be implemented by Chinese developers were announced in the first half of 2021: the 2×350 MW Ugljevik III coal-fired power plant in Bosnia, a 3×380 MW coal-fired power plant in Indonesia by Shanghai Electric, and a 110 MW coal-fired power plant in Vietnam.At this time, is unclear how or even whether these plants will be financed, for example with and relevant financial institutions actively backing away from overseas coal financing (e.g. ICBC backing away from a US$ 3 billion, 2.8GW coal plant in Zimbabwe in June 2021.). Similarly, in January 2022, the Chinese bank loan to the planned 700 MW Ugljevik III coal power plant in Bosnia was made unavailable.

Oil and gas

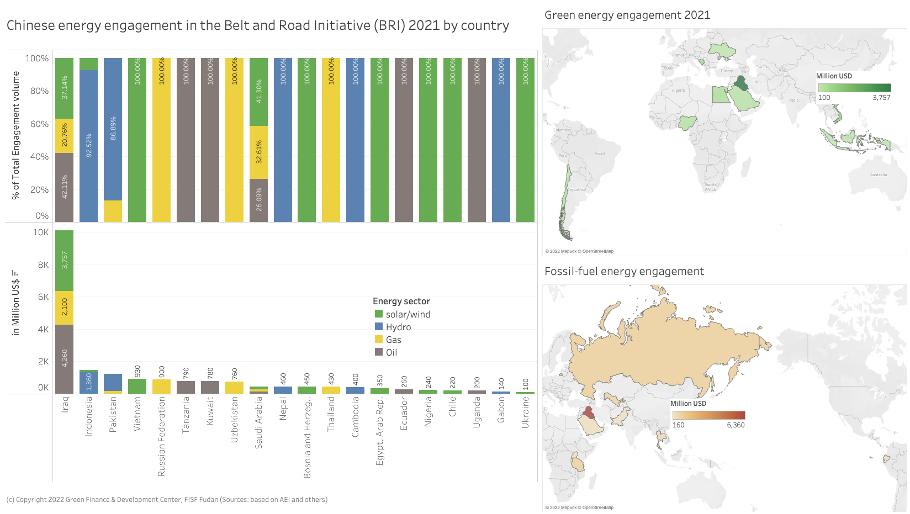

Oil engagements were higher than in previous two years: in all of 2021, the 10 oil engagements totaled US$6.4 billion, compared to US$1.9 billion in 2020 and US$3.7 billion in 2019. Main recipients were Iraq, Tanzania, Kuwait, Ecuador and Uganda.

China’s engagement in gas-related projects in the BRI amounted to about US$4.5 billion in 2021, up from US$1.8 billion in 2020. Most of these contracts were made in Iraq, Russian Federation, Uzbekistan and Thailand.

All of China’s gas engagements were construction engagements, e.g., for extension of gas fields. Chinese companies invested about US$1 billion in oil-related projects.

Green energy/hydropower

China’s engagement in green energy and hydropower amounted to about US$10 billion. This compares to US$12.5 billion engagement in 2020 and US$16.4 billion in 2019 (see Figure 9). Chinese green energy and hydropower investment decreased from US$8.8 billion in 2019, to US$3.1 billion in 2020 and US$1.6 billion in 2021. Construction projects increased from US$8.6 billion in 2019 to US$9.5 billion in 2020 to decrease slightly to US$8.1 billion in 2021.

Figure 10: Chinese energy engagement through investment and construction in the BRI 2013-2021 by subsector

Energy engagement in different countries

Analyzing Chinese energy engagement in different BRI countries, we find that Iraq was the country, which received by far the most energy investments from in 2021. followed by Indonesia. With the strong engagement in Iraq in 2021, Iraq moved up to the third most important partner in the BRI for energy engagement between 2013 and 2021 (the most important partner is Pakistan, followed by the Russian Federation). Iraq and China cooperate on oil (e.g., construction of the Al Khairat heavy oil power plant with a total value of about US$5 billion), gas (e.g., development of the Mansuriya gas field by Sinopec together with Iraq’s Midland Oil Company), as well as solar (e.g., a 2 GW power PV project, currently in permission stage developed and owned by power Construction Corporation of China valued at US$3.7 billion). However, with some of these projects, implementation remains to be seen, particularly where the price for the solar power project seems unusually high if no energy storage facility is included (a comparable 2.2GW solar plant completed in China’s Qinghai with 202 MWh storage was priced at US$2.2 billion) (see Figure 11).

Figure 11: Chinese energy engagement in the Belt and Road Initiative (BRI) by country in 2021

Transport engagement in the Belt and Road Initiative

Transport-related engagement is key to provide the means to trade between China and the BRI countries. Accordingly, China has invested in and constructed projects in road, rail, aviation, shipping, and logistics across the world (see Figure 12).

Aviation: Four aviation-related construction projects were announced in 2021 worth about US$810 million, such as the the rehabilitation of the Nassiryiah International Airport in Iraq.

Rail: Most rail projects with Chinese engagement in 2021 could be found in East Asia, including the continuation of the high-speed rail projects connecting China through Thailand and Malaysia to Singapore (Kunming-Singapore rail). The 422 km long railway connecting China and Laos had begun operating in December 2021. The project cost about US$6 billion, 70% of which financed through loans provided by Chinese financial institutions. China is also building a US$6 bn high-speed rail connecting 142 km between Jakarta and Bandung in Indonesia Furthermore, China has been engaged in building several railway projects on the African continent, such as a US$1.32 billion project in Tanzania to connect the 341 between Lake Victoria port city of Mwanza ultimately to the port of Dar es Salaam in Tanzania. Also the Budapest-Belgrade railway connecting the 350km between capital cities of Hungary and Serbia worth US$2.89 billion by highspeed train was begun in 2021. Total engagement in rail increased from about US$7.5 billion in 2020 to about US$10.6 billion in 2021 – all through construction contracts.

Road-transport: China engaged in road construction across many countries, such as in Thailand, Serbia and Kenya. The value of China’s engagement in 2021 financing and investments in road infrastructure decreased slightly compared to 2020 from around US$4.5 billion to about US$3.6 billion (which compares to about US$14 billion in 2019 and US$13 billion in 2018). All but one project were construction contracts, the exception being the upgrade of a 195km toll highway awarded to China Railway Construction Corporation (CRCC).

Ports: China continues to be an important investor in ports globally. In 2021, total engagement in overseas ports was about US$3.1 billion, with investments in Jeddah Islamic Port Saudi Arabia, a port in Thailand (together with Gulf Energy), and the modernization of Kalemie Port in the Democratic Republic of Congo. A US$3 billion agreement to commission Croatia’s largest port (Rijeka Port) to a consortium of three Chinese contractors has been cancelled at the beginning of 2021.

Figure 12: Chinese engagement in BRI transport infrastructure 2013-2021

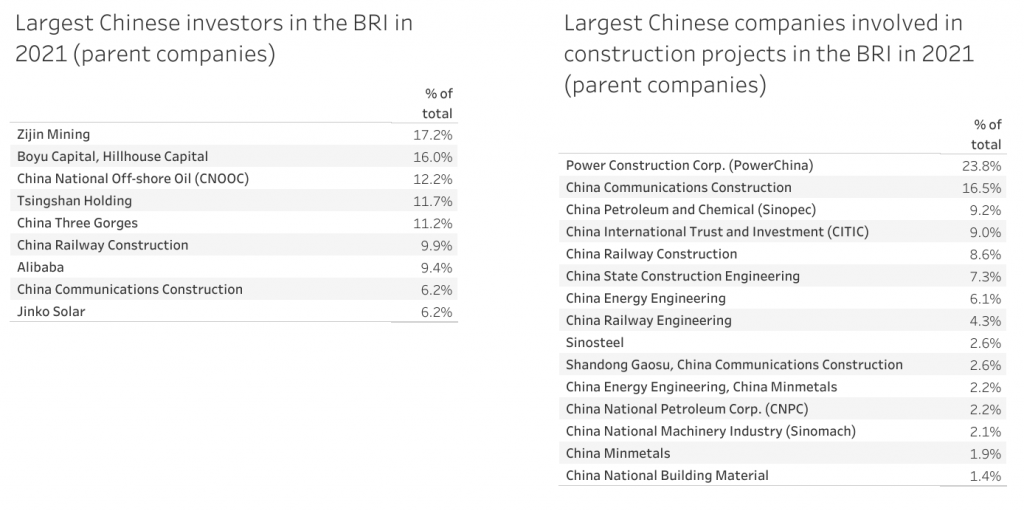

Major players in BRI investments

Among the major players for BRI investments in 2021 were a mix of Chinese SOEs and private companies (such as Boyu Capital, Alibaba, Jinko Solar) (see Table 1). The Chinese companies most prominently featured in construction projects in the BRI in 2021 were PowerChina, China Communications Construction and Sinpoec. Of the leading companies involved in construction projects, all were state-owned enterprises (SOEs).

Table 1: Major Players in BRI investments in 2021 (parent companies)

BRI investments in a global comparison

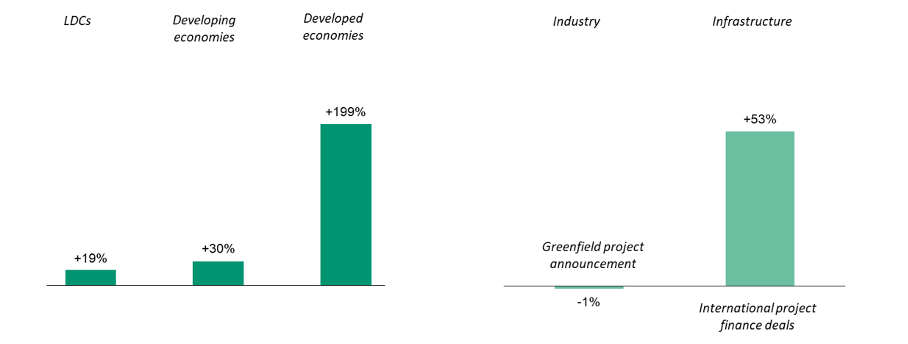

Globally, FDI in 2021 strongly rebound, up 77% to an estimated US$1.65 trillion (up from US$929 billion in 2020), as data released by UNDP on Jan 29, 2022 show.

This rebound of FDI was particularly strong in developed economies, which experienced an estimated US$777 billion of FDI (compared to US$259 billion in 2020). This was driven by doubling inflows into the US, particularly through cross-border M&A. Compared, however, inflows in developing countries (including many BRI countries) were US$870 billion in 2021, an increase of FDI by about 30%. Particularly countries in East and South-East Asia benefited (China saw a record US$179 billion of inflows, a 20% increase), while Latin American countries saw FDI levels similar to pre-pandemic levels. Least developed countries saw an increase of about 19%. (see Figure 13). FDI increase was driven exclusively by infrastructure project investments, which were up 53% in number and 91% in value. Comparatively, green-field project announcements remained flat.

Global FDI growth outperforms Chinese BRI investments

Global FDI increases of 77% (and 30% in developing countries) compares to a 40.8% decrease in Chinese BRI investments in 2021. Similar to BRI engagement trends, Africa saw the strongest increase in global FDI inflows and cross-border M&A in 2021, while global FDI into Asia grew by only 18%.

Chinese outward FDI ranks among top 5 globally

According to OECD data, China’s total outward FDI and M&A in the first half of 2021 amounted to US$55.7 billion. This compares to about US$44.2 billion from the Netherlands, about US$63.3 billion originating from Germany, US$88.5 billion from Japan, and about US$230.5 billion from the US (see Table 2). At this time, however, it is not clear where these investments went to.

Table 2: Largest sources of FDI in H1 2021 (Source: OECD)

| Country | Outward FDI, M&A in US$ billion |

| United States | 230.5 |

| Japan | 88.5 |

| Germany | 63.3 |

| China | 55.7 |

| Netherlands | 44.2 |

Most global project finance is in renewable energy

Among the most important sectors for international project finance deals are renewable energy projects, which in 2021 saw an increase of 121% compared to 2020 with a value of US$432 billion in 2021. Compared to that, however, oil and gas investments also grew by 115% to about US$110 billion, while global overseas transportation infrastructure investment shrank by 11% to about US$36 billion.

Figure 13: FDI inflows, global and by group of economies 2021 versus 2021 (Source: UNCTAD)

Outlook for 2021 foreign direct investments

According to UNCTAD, the outlook for FDI in 2022 is “positive”, although the rebound rate of 2021 will be unlikely to be repeated due to a higher baseline in 2021 (see Figure 14). International project finance in infrastructure sectors is expected to continue to provide growth momentum. However, both in emerging and developed economies, the ongoing COVID-19 pandemic with its repeated waves provides much uncertainty. The issue of lacking investments in various emerging economies countries can have a knock-on effect by increasing the technological gap, while slow growing or decreasing GDP raises the debt burden in several host countries (you can find detailed information and interactive graphics on this topic on our Brief on Debt in the Belt and Road Initiative). At the same time, particularly more FDI can lead to higher tax returns and thus an improvement of the overall economic situation.

Figure 14: World Foreign Direct Investment Outlook 2021 and beyond (Source: UNCTAD)

Outlook for Belt and Road Initiative (BRI) Finance and Investments

Chinese finance and investments into the Belt and Road Initiative countries in 2021 have stabilized.

For 2022, despite continued lockdowns particularly in China, with continued uncertainty of COVID-19, and continued issues of sovereign debt, we see important signs for further recovery. On the one hand, there is more need for investments to boost growth in the post-COVID19 world supported by global financial institutions, including developing finance institutions (such as the World Bank, Asian Development Bank, AIIB), from which Chinese contractors can benefit. On the other hand, we are already seeing several deals signed in 2022, such as the US$2.8 billion first phase of 565km Philippine Bicol rail scheme awarded to China Railway Group and others.

Nevertheless, we do not expect Chinese BRI engagement to reach levels as in the late 2010s. This is also a recognition of the Chinese Ministry of Commerce (MOFCOM), which put a break on fast overseas expansion in its 14th Five-Year Plan (FYP) for 2021 to 2025: it plans for China to invest US$550 billion (that includes non-BRI countries), down 25% from US$740 billion in the 2016-2020 period. Also, Chinese contracting volume is planned to decrease from US$800 billion in the previous FYP to US$700 billion in this FYP.

This does not necessarily mean that the deal number is decreasing. As we have been seeing in 2021 and have been arguing previously, many smaller projects can be financed even in more difficult economic circumstances and often provide both the means to boost sustainable economic development, provide employment and are better able to protect the environment. Nevertheless, we see that specific large strategic investments (such as in ports, resources). will continue to go ahead, while road and energy investments will focus on countries in where resources need to be transported as exports to China or imports from China.

To move the BRI investments forward, we expand our recommendations from the previous report:

Figure 15: 5-step framework for accelerating green BRI investments after COVID19

1. Focus on projects that are financially sustainable and cut losses in non-profitable projects

Investors in BRI projects within China and outside China should focus on smaller projects that are easier to finance and faster to implement. Particularly in infrastructure and energy investments, scalable solar and wind investments seem viable, as long as local conditions provide the relevant grids to handle renewable energy supply

With decreasing energy cost for renewable energy, we also see an opportunity to invest in early phase-out of existing older coal projects, which would be both economically and environmentally relevant.

2. Support partner-countries and partner businesses in dealing with (sovereign) debt-repayment of already invested BRI projects, e.g., through debt-for-nature swaps and nature performance bonds.

Debt is a major concern for future growth in many BRI countries. As we found in our in-depth analysis of debt in BRI countries, China has a unique opportunity to support BRI countries in dealing with their debt both bilaterally and multilaterally. Dealing with the debt issue is crucial for providing BRI countries with the necessary fiscal space for future investments.

While debt-for-resource or debt-for-equity swaps might seem beneficial for China in the short-term to reduce the debt burden in the BRI countries, these swaps tend to undermine future domestic growth opportunities for BRI countries. Rather, Chinese relevant stakeholders together with international partners through multilateral frameworks should support green recovery by swapping part of the debt for nature and providing necessary frameworks to increase transparency and accountability of the use of funds.

Furthermore, sustainable debt instruments could be applied to raise more funds, e.g., through nature performance bonds.

3. Increase international cooperation for BRI projects to allow existing and useful projects to go ahead also in difficult times.

Tripartite cooperation with international financial and implementation partners can support BRI projects through better access to financial resources, risk sharing and knowledge sharing. Particularly non-SOEs that often have a higher burden of accessing investments from Chinese large financial institutions could benefit through broader access to finance, as witnessed for example in the Zhanatas wind farm in Kazakhstan, co-financed by EBRD, AIIB, GCF and ICBC, while it was build and is operated by China International power Holding. Also, Chinese financial institutions could benefit to de-risk project finance by broaden their international cooperation. A new report “China Third-Party Market Cooperation for Infrastructure Finance Financing Mechanism Handbook” was released in September 2021 to accelerate tri-partite project finance.

In addition, with European Union (EU) launching its “Global Gateway” and the US pushing its “Build Back Better World” (B3W) initiative, competition for the BRI is increasing. However, if cooperation for project finance and development in emerging markets is the goal, Chinese investors and developers can accelerate their cooperation with both public and private financial institutions from various economies, particularly if they manage to share standards.

4. Increase use of common environmental and social standards in project evaluation (e.g., environmental impact assessment EIA) and for environmental and social risk management (ESMS)

In July 2021, the Ministry of Commerce (MOFCOM), together with the Ministry of Ecology and Environment, issued “the Guidelines for Greening Overseas Investment and Cooperation” and in January 2022, “the Guidelines for Ecological Environmental Protection of Foreign Investment Cooperation and Construction Projects”. Within these Guideline, Chinese developers are encouraged to adhere to international or Chinese environmental standards, particularly in countries whose domestic environmental standards and governance does not meet international standards.

This is a formalization of a number of previous Guidances, including the “Green Development Guidance for BRI Projects Baseline Study” and the “Application Guide for Enterprises and Financial Institutions” backed by various relevant Chinese ministries published by the BRI Green Development Coalition (BRIGC) in December 2020 and October 2021 respectively. These guidances calls for Chinese overseas investors to apply independent environmental impact assessments (EIA) and strict environmental and social risk management (ESMS) to ensure projects and investments are minimizing environmental harm and maximizing environmental benefits. Also, the Green Investment Principles (GIP) integrate sustainability into corporate governance, requiring boards to understand environmental, social and governance risks, as well as disclosing environmental information.

By applying international standards, Chinese financial institutions can more easily raise capital on the global capital markets, accelerate co-financing with international partners and take responsibility to fulfill the goal of building a “Green Belt and Road”.

5. Develop socially and environmentally conscious phase-out strategies for non-performing investments

Several investments in the Belt and Road Initiative have had to be stopped, mothballed or cancelled due to financial (e.g., difficulties in financing or servicing debt) and operational reasons (e.g. due to travel restrictions or problems in supply chains). According to our study, over 50% of announced coal fired power plants have been mothballed.

In order to avoid reputational, social and environmental risks arising from stopped, mothballed or cancelled projects, plans should be developed and implemented by financial institutions including insurance companies, developers, local governments and relevant Chinese authorities that compensate any losses to workers and companies up to a specific extent, and that ensure that nature around mothballed and particularly stopped projects can be remediated. This also helps avoid having skeleton constructions serve as a reminder of unfinished projects.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.