The original article was published in Chinese by the International Institute of Finance (IIGF) here.

Passenger car sales in China have been declining over the past 12 months and experts expect “only” 22 million car sales in China in 2019. This is good news – but not good enough. Car sales in China could drop by 75% to about five million cars per year. This would provide people with better mobility, better lives and achieve the Chinese goal of achieving an ecological civilization and sustainable development that includes economic development.

In this article, I will lay out the arguments of how China should seize the opportunity to become the leader in sustainable passenger mobility development through its innovation power in the mobility ecosystem and how green finance can accelerate this development.

Sending the wrong signals – 600 million cars by 2050?

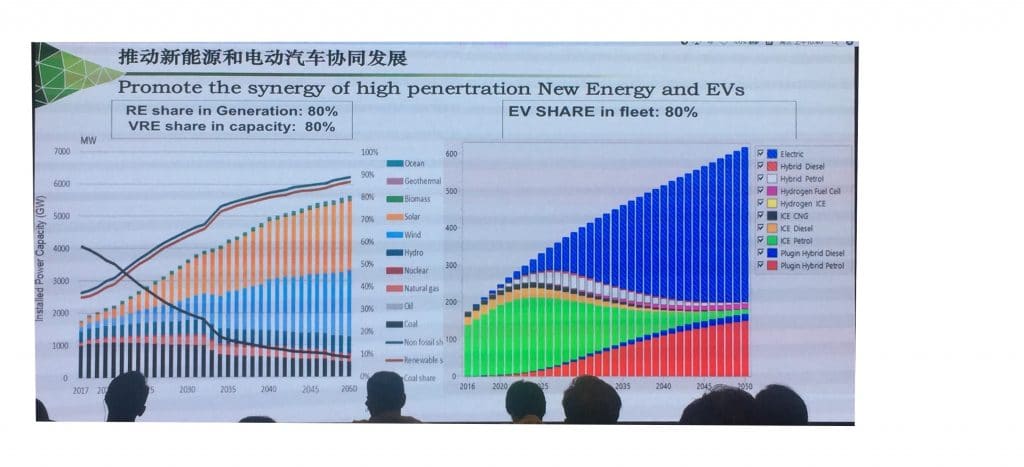

According to official statistics by the NDRC, China aims to triple its car stock from today’s 200 million cars to 600 million cars by 2050. That means a net addition of 13 million cars per year and sales of about 20 million cars per year. Although 80% or 480 million of those cars should be electric (see right side of Figure 2), there would be little change from today’s state of the use of combustion engine cars (about 120 million combustion engine cars – most of them hybrid).

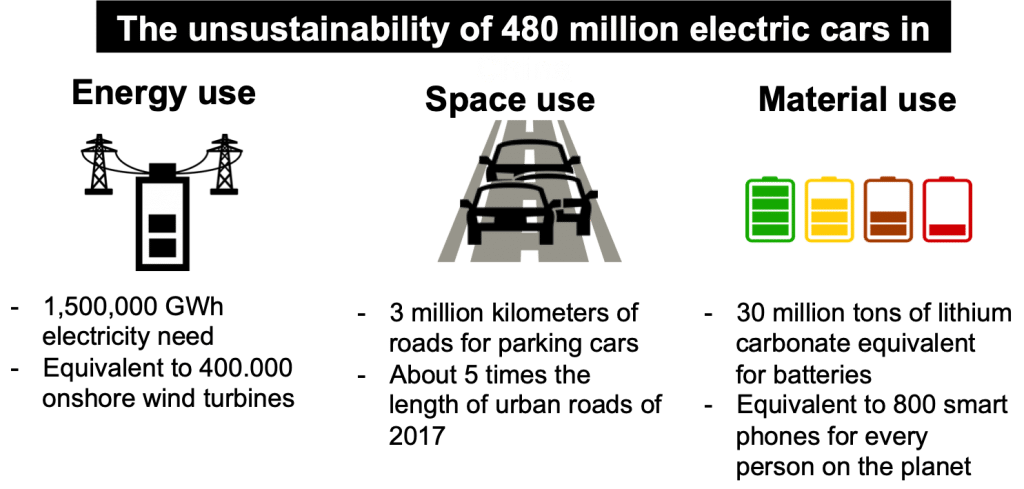

If this development were to become true, it would have highly unsustainable effects on China’s ecology:

- Energy use: even with electric cars, energy use for transportation would rise significantly. Efficient electric cars require about 15 kWh per 100 km. An average use of 20.000 km per year would therefore require 3125 kWh. For 480 million electric cars this would mean 1,5 million GWh of electricity per year – which in turn would require an equivalent of 400.000 onshore wind turbines (or alternatively solar energy) – each requiring space for installations. Most likely, energy production will also contribute to greenhouse gas emissions caused by the continued energy production with fossil fuels in 2050.

- Material use: Producing that many cars requires massive use of raw materials and produces waste – from metals for the frame to environmentally damaging lithium or lead-acid for the batteries. Producing batteries for 480 million electric cars would require about 30 million tons of lithium carbonate equivalent (which is equivalent to producing batteries for about 5 trillion smart phones, or 800 smart phones for every person on the planet) as well as about 26 million tons of graphite[1].

- Space use: if an average car requires 5 meters of space in the best case (that is, if it is parked), 600 million cars would require the equivalent of 3 million kilometers of road. As 70% of Chinese population will live in cities by 2030, just providing parking spaces would therefore require more than 2 million kilometers of urban roads. Yet, according to the Chinese National Bureau of Statistics, the total urban road network in China in 2017 was a “mere” 398.000 km – with little room to expand roads further. Tripling the car stock would most certainly add to congestion in Chinese cities, 9 of which are already counted among the 50 most congested cities worldwide. Alternatively, cities would have to seal more green space to construct roads, or build stacked roads above or tunnels below ground. Particularly more roads above ground would come at the cost of urban green spaces which are necessary for air quality and air flow and protecting against floods.

Continue the push for green mobility in China

China has been pushing green mobility solutions and developed a public transport and non-motorized transport ecosytsem that is unmatched by any country with a similar economic development level (in terms of GDP per capita) and few developed economies:

- China has 35 cities with subway systems, including the two cities with the longest subway systems in the world (Shanghai with 676 km and Beijing with 628 km)

- China has an extensive public bus system in all major cities, operating 99% of the global electric bus fleet with more than 430.000 electric buses;

- China’s Didi mobility on demand company is the world’s most used mobility app with 30 million rides per day in 400 Chinese cities and 21 million drivers (that compares to 15 million rides per day of the American Uber);

- China’s high-speed rail system covers about 30.000 km, connecting 200 Chinese cities and providing transport for 10 billion passengers in the first quarter of 2019 alone;

- China offers several million shared bikes to about 60 million active users every month.

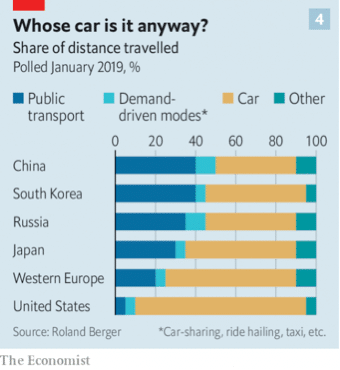

As a consequence, compared to most other countries, China’s urban population is often choosing more sustainable transport modes, such as public transportation and demand-driven modes (see Figure 1). In this case, we assume that demand-driven modes can be sustainable if they replace mostly private car trips and thus reduces private car ownership and space use for cars.

China also continues to invest in green transportation, such as railway, subway, and bus. In Beijing and Shanghai, for example, subway lengths are expected to almost double over the next 5 years. To finance public transport expansion, many urban mobility providers have issued green bonds (see Table 1).

| Issuer | Use of Proceeds | Amount (million RMB) |

| Beijing Infrastructure Investment Co. Ltd | Construction of several metro lines, such as New Airport Line, Metro lines 3, 6, 7, 12, 17, 19 | 3,900 (in two phases) |

| Urumqi City Traffic Investment Co. Ltd. | Construction and operation of several bus lines | 1,500 |

| Wuhan Metro Group | Construction and operation of several metro lines, such as Metro Line 2, 5, 8, Caidian | 5,600 (in three phases) |

| Yangzhou Transportation Industry Group Co. Ltd. | Payment and working capital of clean energy buses | 500 |

| Chengdu Metro Group Co. Ltd. | Payment of debts for Metro Lines 1, 2, 3, 4, 7, 10 | 2,000 |

Table 1: 2019 green bond issuances to finance green urban transport (Source: International Institute of Green Finance)

China should take a green leap and speed up green mobility development

If China wants to be a leader in sustainable mobility, the government needs to be more ambitious steps and move away from private car ownership.

Given the challenges that come with private car ownership (emissions, space use, noise, etc.), we suggest a model that enhances existing green mobility through a shift of modal share to more sustainable means (public transport, non-motorized transport, transport on demand) to satisfy mobility and economic growth needs with the following advantages:

- increase in property values due to higher living quality of spaces without roads and access to public transportation

- increase in mobility efficiency due to less congestion on the roads,

- improvement in air quality due to less energy consumption in passenger mobility

- lower noise emissions due to less motorized traffic

- better public health due to improved air quality and lower noise emissions

- more green space (because less space is required for roads),

- better air quality due to less mobility and more green space

- lower heat development (urban heat islands) due to less concrete and more green space

- better protection against floods (e.g. after rainfalls) due to increased green spaces, lowering insurance costs and economic losses.

- acceleration of technological development of green transport modes (e.g. public transport, autonomous buses, flexible bus routing, big data in ride hailing)

Indeed, several Chinese cities have already issued specific policies to enhance green transport:

- Tianjin Ecocity’s key performance indicator 12 requires a modal share of 30% walking and 60% public transport.

- Several Chinese cities (e.g. Beijing, Shanghai, Shenzhen, Guangzhou, Tianjin) offer very limited numbers of new license plates, requiring aspiring new car owners to go through a bidding process with a chance of 1% of obtaining a license.

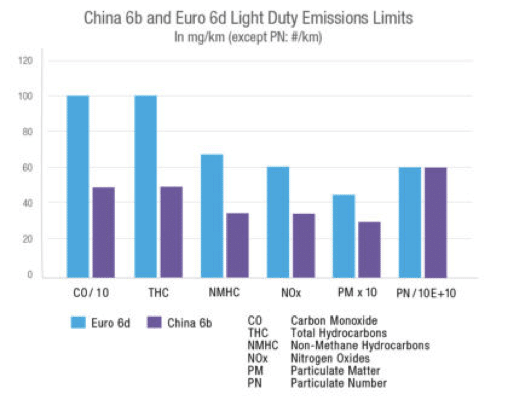

- The Chinese government is enforcing stricter rules on emissions (“China 6”) in specific cities, such as Beijing, that are stricter than the emission standards of all Western countries (see also Figure 3)

- The Chinese green bond catalogue does not include the construction of roads, while it includes the construction of public transport systems.

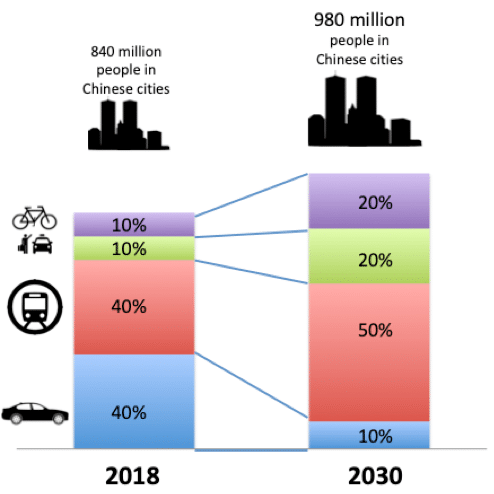

While not every city in China will reach such a high performing green transport, Chinese cities overall are already on a strong trajectory of moving to greener mobility, as discussed above: in 2018, 40% of trips of the 840 million people in Chinese cities were done using public transport, while biking and ride hailing each moved people about 10% of the distances. In 2030, with about 980 million people living in Chinese cities, we suggest to accelerate this development: in 2030, 50% of trips should be done by public transport, 20% by ride hailing, 20% by non-motorized transport (biking, walking) and 10% by private cars (see Figure 3).

This would allow cities to reduce the car use drastically, requiring about 3-4 million cars for private use per year in Chinese cities. In addition, with a 20% modal share of ride hailing (up from 10% in 2018), the distance travelled with ride hailing would increase from today’s 50 billion kilometers to 116 billion kilometers by 2030. Considering a lifetime runtime of about 150.000 km per car and a 30% extra capacity for peak times, ride hailing companies would have to acquire 1,1 million cars per year.

Next to the availability of alternative modes of transport (such as ride hailing, public transport, shared bicycles, high-speed trains), the Chinese government has also taken steps to curb cars in Chinese cities:

Opportunities for green finance

In order to achieve the shift to green urban passenger mobility, green finance plays a significant role. The transition has both significant need and provides significant opportunities for green finance for public and private developers:

- public transport: public transport (e.g. high-speed rail, subway, e-busses) needs to be expanded significantly, requiring green finance

- non-motorized transport: companies and service providers for non-motorized transport (e.g. biking, shared biking) need financing for sustainable operation of their businesses.

- Green mobility technology development, such as autonomous and electric mobility (e.g. for buses, ride hailing) requires further investments in R&D

- Green space, public space, alternative use development in places where roads are no longer necessary provide investment opportunities for green finance.

- Sponge city development that re-uses rain water (as exemplified by the Chinese city Wuhan) allows green finance to be applied to the city’s benefits

Depending on the sector, several business models are applicable to attract green finance:

- blended finance where private investors invest at market rates and public investors provide concessionary lending, e.g. in public transport

- usage fees, e.g. for roads, parking spots, that can even be dynamic (e.g. congestion charges)

- emission fees, e.g. for greenhouse gas emissions, noise emission

- shared benefits, e.g. by sharing the value increase in real estate

We need a leader in the sustainable mobility revolution – can China fill this role?

China has set its goal to develop a better world, set new governance standards and foster an ecological civilization through the Belt and Road Initiative. Can China accelerate the current trajectory of declining car sales and better mobility? Can China become a role model for BRI countries that still lack sufficient mobility solutions in all regards – from public transport, to ride hailing and modern non-motorized transport?

China has the unique window of opportunity to set a model of green economic growth for urban mobility as urbanization accelerates around the world. China should therefore support BRI countries through investments, technology and policy support to leapfrog BRI countries into a modern and green mobility era and help them avoid trying to catch-up to an outdated grey development model that is based on wide concrete roads and individual car ownership.

To this end, Chinese policy makers and investors should accelerate their engagement through following policies and activities:

- Beijing, Shanghai and Hangzhou should restrict private car use in cities, e.g. through dynamic road pricing, stricter parking rules and enforcement, limiting license plates by 2024 with other cities following by 2028.

- Chinese technology providers and private investors should accelerate technological development for autonomous, electric and digital mobility services, particularly in buses and shared mobility.

- Chinese development banks (e.g. CDB, Exim) and private investors (e.g. ICBC) should focus on public and private mobility providers to establish green mobility services in BRI countries to leapfrog beyond the grey development model while the construction of road infrastructure for private car use should be phased out.

- Chinese investors and BRI country regulators should agree on shared value creation models to share the benefits and risks from green mobility development such as increase in real estate values to attract more investment,

[1] This calculation uses battery data from the Tesla Model S: https://www.businessinsider.com/materials-needed-to-fuel-electric-car-boom-2016-10

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.