On September 22, 2020, Chinese President Xi Jinping announced that China aims to peak CO2 emissions before 2030 and achieve carbon neutrality before 2060 during the UN General Assembly.

One important partner for China to reach its ambitions is the European Union (EU). On September 14, Chinese President Xi, European Council President Michel, European Commission President van der Leyen, and European Council President German Chancellor Angela Merkel discussed shared ambitions for cooperation on increasing climate ambitions and established a High-Level Environmental and Climate Dialogue during the EU China Leaders Meeting.

This article highlights cooperation pathways for China and the EU for greening the financial system based on an analysis of current ambitions, strategies and benefits of EU and China’s coordinated green economic development.

Most importantly, both sides have to avoid “promise fatigue” and MoU signing “overdose”, but should work on and agree on concrete actions to deliver results on accelerating cooperation on climate finance and climate action.

China and the EU shared economic and ecological ambitions

The countries of the European Union and China have gone through similar economic and emission growth experiences at different times.

Economic developments

Countries of the EU rebuilt their economies after the second World War. In 1980, the year China started its opening up, the countries of the EU reached their emission peak with declining emissions since. In 1990 – 40 years after the beginning reconstruction of Europe, the EU reached a GDP per capita (PPP) of about 14.000 USD (similar to that of China in 2017) (see Figure 2). In 1990, the EU’s emission intensity was about 0.35 kg/2010 USD GDP.

From 1990 to 2018, the EU per capita GDP PPP grew about 300% to USD 46,000, while absolute carbon emissions declined by 23% in that period. In 2011, EU’s per capita emissions fell below those of China in 2011 and EU’s emission intensity by 2016 was reduced by about 50% to 0.185 kg/2010 USD GDP (see Figure 1).

China increased its GDP per capita (PPP) by 16 times from about 1.000 USD in 1990 to 16.700 USD in 2019. At the same time, China could reduce its emission intensity by 60% from about 2.6 kg to 1.04 kg/2010 USD GDP (see Figure 3).

Figure 1: GDP per capita (PPP) in China, the EU, the USA (Source: World Bank)

Figure 2 : CO2 emissions per capita in China, the EU, USA (Source: World Bank)

Figure 3: CO2 intensity (kg CO2/2010 USD GDP) (Source: World Bank)

Similar to the EU, China’s development is not evenly spread across the country. Some regions (in China the coastal regions, in the EU the northern countries) are more highly developed compared to other regions making differentiated treatment of countries of the EU similarly important as differentiated treatment of China’s provinces.

Sources of emissions in China and the EU

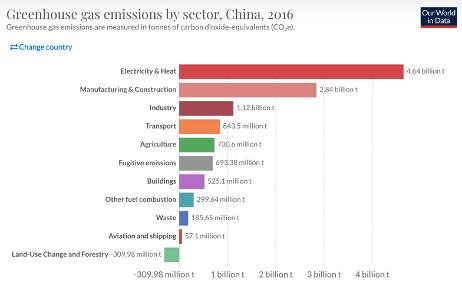

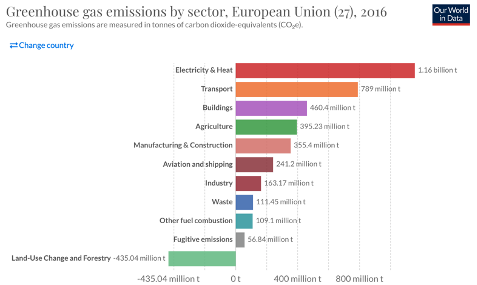

To understand sectors where green finance needs to make a contribution for decarbonization, the following two graphs show the composition of greenhouse gas emissions by sector. EU’s and China’s emissions are mostly driven by the energy sector; in the EU the transport sector is contributing the second most, while in China the manufacturing and construction sector is the second most relevant contributor to emissions. Both regions reduce greenhouse gas emissions through land use change (e.g. afforestation) (see Figure 4 and Figure 5).

Climate and green finance in the EU

One of the cornerstones of the EU’s combat against climate change has been the emissions trading system (EU ETS), which was set up in 2005. The EU ETS operates across all EU member states plus Iceland, Liechtenstein and Norway and covers about 45% of all EU greenhouse gas emissions. It works on a cap-and-trade principle with a constantly declining cap of greenhouse gas emission. The EU ETS is being further upgraded in its fourth phase (2021-2030), e.g. by accelerating the pace of annual emission allowance reductions to 2.2% per year.

To further accelerate EU’s green economic growth particularly in regard to financing climate adaptation and resilience, the EU agreed on three key policies over the past 12 months:

- the EU Taxonomy that defines which activities are eligible for green finance and some responsibilities of the financial sector

- the EU Green Deal with the aim to align all its programs to reach climate-neutrality by 2050 e.g. through green technologies;

- the EUR 750 billion recovery plan to support the economies post covid-19 that is based on the EU Green Deal

For future alignment with its green growth goals, the EU also launched the public consultations for a carbon border adjustment mechanism in July 2020. The proposal is planned to be adopted by the commission in February 2021. The mechanism aims to protect the EU against carbon leakage from international partners by introducing a carbon border adjustment mechanism that would ensure that the price of imports reflects the carbon content.

Furthermore, the European Commission works on a Climate Law to write into law the net zero greenhouse gas emissions for EU countries by 2050 and propose a new target for 2030 to reduce EU emissions by 55% compared to 1990.

Climate and green finance in China

China’s green finance development was kicked off in 2012, when the Chinese government approved a far-reaching policy goal of building an ‘ecological civilization’. Soon after, China’s banking regulator CBRC introduced the green credit guidelines and China’s Central Bank PBOC issued the green bond guidelines in 2016. Due to the size of its economy, it should be no surprise that China became the “largest” green finance market, with about 11 trillion RMB (about 1.8 trillion USD) in green credit and about RMB 1.2 trillion in green bonds (about 190 billion USD) by 2020.

Over the past 5 years, China made comprehensive progress in setting green financial standards (e.g. green bond catalogue), incentive mechanisms for green finance, environmental information disclosure requirements for ESG, product innovation and local pilot projects at home. This growth of green finance has allowed China to start controlling pollution and ecological damage of 40 years of break-neck GDP growth.

Internationally, China has also initiated and participated in many forums pushing green finance, such as the G20, the global central bank network for greening the financial system NGFS, the Sustainable Banking Network SBN.

Current development of China’s green finance include:

- the discussion of a new green bond catalogue published in May 2020 that excludes clean coal

- a green industry catalogue issued in 2019 by NDRC that continues to include clean coal

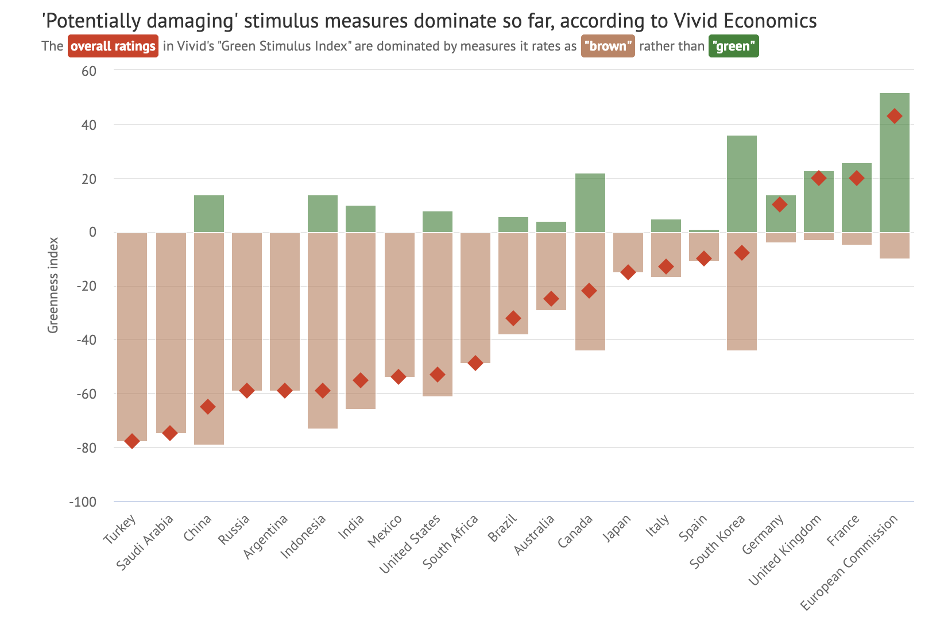

In July 2020, the People’s Bank of China issued the “Notice on the Issuance of Programme on the Evaluation of Green Finance Performance of Banking Depository Financial Institutions (Exposure Draft)” for public feedback. It also revised the “Programme on the Evaluation of Green Credit Performance of Banking Depository Financial Institutions (Trial)”, considering the development of a unified green finance market by combining green loan and green bond regulation and evaluating the development and assessment of green equity investment, green trust and other new formats. The drafts also suggest to improve the evaluation of financial institutions with green finance performance to be included into the central bank’s financial institutions rating. China has also engaged in funding a recovery after the covid crisis to become one of the few countries whose economy is expected to grow in 2020 (e.g. 3.75 trillion RMB in special bonds). The greenness of China’s recovery program has been less pronounced (see Figure 6).

China-EU Cooperation

China and the EU both understand that the battle against climate change needs international cooperation. Already in 2005, the EU-China Partnership on Climate Change has provided a high-level political framework for cooperation and dialogue. This commitment has been confirmed and enhanced at several occasions (e.g. 2010 Joint Statement, 2015 Joint Statement, 2018 Leaders’ statement).

The EU-China Summit in 2018 saw a confirmation of both sides’ commitment to the Paris Agreement and an agreement to strengthen bilateral cooperation, for example on

- long-term low greenhouse gas emission development strategies

- energy efficiency

- clean energy

- low-emission transport

- low-carbon cities

- climate-related technology

- investment in climate and clean energy projects, and

- cooperation with other developing countries.

A particular area of cooperation has been emission trading. From 2014 to 2017, the EU supported the design and implementation of emissions trading in China (based on the 2015 Joint Statement). The EU provided technical assistance for capacity building and supported the seven regional pilot systems as well as the establishment of the national emissions trading system. The project has been extended into the “Platform for Policy Dialogue and Cooperation between EU and China on Emissions Trading“ (2017-2020) that supports the Ministry of Ecology and Environment (MEE) in their efforts to implement and further develop China’s national ETS and established a policy dialogue between the MEE and the European Commission. China and the EU signed an MoU to enhance cooperation on emissions trading at the 2018 EU-China Summit.

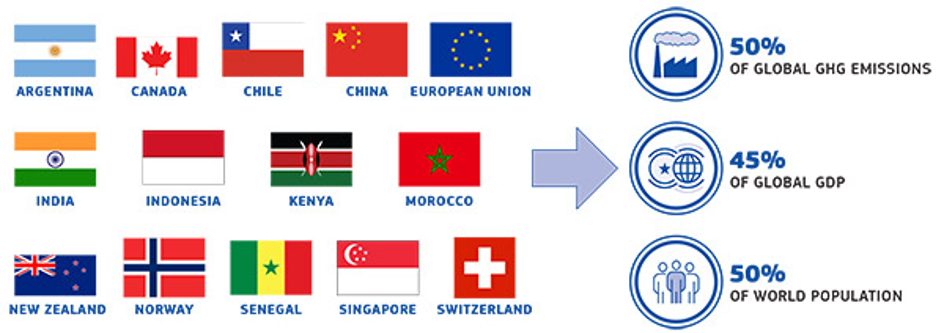

China and the EU together with relevant authorities from Argentina, Canada, Chile, India, Kenya and Morocco also launched the International Platform for Sustainable Finance (IPSF) in October 2019. The IPSF aims to scale up the mobilization of private capital towards environmentally sustainable investments and to offer a multilateral forum of dialogue between policymakers that are in charge of developing sustainable finance regulatory measures to help investors identify and seize sustainable investment opportunities that truly contribute to climate and environmental objectives. The IPSF now includes 14 members.

Future areas of Sino-European cooperation for climate finance

With China and the EU firmly committed to build a green economy, the cooperation potential between the two entities should be further utilized. Against the backdrop of challenges in reviving their economies after the covid-19 pandemic, increased uncertainty of international trade and other political challenges, combating climate change and accelerating green finance is a strategic and shared interest of all countries.

Both China and the EU are in the process of sharpening their climate targets for which cooperation on financing these ambitions is key. To fully understand cooperation potentials, it must be noted that differences between China and the EU exist both on economic development levels (see above) and for climate ambitions, in regard to the latter on the timeline (e.g. 2050 in the EU versus 2060 in China), the scope (e.g. climate-neutrality in the EU versus carbon-neutrality in China), and level of commitment (e.g. legal instruments in the EU versus a promise to raise ambitions in China).

China and the EU in their 2018 leaders statement underlined their “highest political commitment to the effective implementation of the Paris Agreement in all its aspects, including, inter alia, mitigation, adaptation, finance, technology development and transfer, capacity building and transparency of actions and support.”Stepping up cooperation and action will provide both sides with significant opportunities for modernizing their economies, enhancing competitiveness, and ensuring socio-economic benefits of increased clean energy access.

To fully utilize the cooperation potential both sides have expressed ambitions for cooperation based on win-win, reciprocity and promises-translated-into-action. Accordingly, the following areas of cooperation can contribute to this goal, particularly through

- green finance policy harmonization

- green finance harmonization

- green recovery

- ETS and other carbon markets

- Green technology finance

- Green urban finance

- Green overseas investment cooperation

- Nature Climate solutions (NCS)

Climate finance policy harmonization

China’s announcement of 2060 carbon neutrality has seen strong interest and support from the EU. To further clarify cooperation potentials, China and the EU should coordinate on the concrete definitions and meanings of this announcement which has direct impacts on climate finance policy and coordination:

- carbon neutrality versus climate neutrality

- domestic economy in China versus Chinese companies versus Chinese owned assets.

China and the EU should also coordinate on developing NDCs that are in line with the goals of the Paris agreement in regard to relative (e.g. tons of emissions per unit of GDP) versus absolute (tons of emissions) emission targets. China and the EU should also coordinate on the role of carbon stocks versus carbon emissions to achieve the Paris Agreement, with direct implications on climate finance and climate finance policy.

Green recovery

China and the EU both have announced massive government stimuli to boost economic development during the Covid-19 crisis. The EU Recovery program is valued at around EUR 750 billion and must be seen in addition to the national recovery programs of EU countries (e.g. Germany’s recovery program is valued at about EUR 250 billion). China has allotted a full year quota of RMB 3.75 trillion in local government special bonds (up from RMB 2.1 trillion in 2019). The EU has organized several workshops also with China to explain the EU ambitions in regard to green recovery with participation of the Chinese Ministry of Finance (e.g. on Sep 24-25 where a European delegation shared the ambitions to fully phase out coal and fossil fuel from the energy system).

To utilize these investments for employment maximization and to “build back better”, to use the momentum for greening the economy in regard to the 14th FYP, China and the EU should accelerate coordination in the following areas:

- sharing of experiences and lessons learnt of successful application of recovery funds for green recovery,

- increased transparency of financial flows of recovery funds to ensure level playing field and avoid trade and investment concerns,

- mutual procurement agreements of technologies and services from each other (e.g. EU buys Chinese green digital technologies, China buys energy efficiency procurements),

- mutual capacity building to allow for accelerated phase-out of polluting industries

Green finance harmonization

China and the EU have built extensive systems for green finance. The goal of both markets is to mobilize finance to contribute to a green economy by lowering transaction costs and increasing incentives for green finance. China and the EU already have established a platform for green finance harmonization which could be used to further accelerate green finance harmonization.

To allow more investors to benefit from both markets and thus expand investments into green economy, further harmonization efforts should be made between the two markets allowing more seamless and thus lower cost transactions for investors. This particularly includes efforts to

- harmonize definitions of green products and services in bonds, credit, equity, insurance, etc.

- harmonize procedures for verification of green finance products

- apply common standards for reporting (e.g. TCFD)

- open up of markets for easier access particularly for European investors to the Chinese market in addition to the Bond Connect program

- increase liquidity of Chinese bond markets

Green finance harmonization should also include cooperation on clear plans for phasing out “dirty finance”, particularly in regard to climate-harming subsidies and tax incentives e.g. for fossil fuels and agriculture with an announcement on a domestic coal-moratorium. The coordinated phase-out of dirty finance will also help investors lower stranded asset risks and thus increase overall financial stability for China and the EU in line with the concerns of the Network for Greening the Financial System (NGFS).

ETS and other carbon markets

The European Union continues to hope for the full launch of the national Chinese ETS, based on the commitment made by President Xi Jinping in 2017 and MoUs signed between the China and the EU. The EU also hopes to integrate the Chinese carbon market in bilateral, regional or possibly global markets in line with Article 6 of the Paris Agreement. China in addition to its national carbon market and regional pilots also evaluates other ways of pricing carbon emissions, such as carbon taxes.

While both systems have their advantages, the EU favors a market-based mechanism that encourages both divestments from emitting industries and investments into clean industries. The EU also hopes to create market incentives to invest into carbon sinks as part of a carbon market providing carbon credits.

Offering a carbon market including carbon credits would have two advantages for China’s economy: European companies operating in China, which by EU law and due to stakeholder pressure will have to become net-zero emission, will have an opportunity to offset their emissions in China rather than in the EU; Chinese companies exporting to the EU, which through the EU carbon border adjustment might face higher EU import prices, would be able to offset their emissions in China.

Accordingly, China and the EU can offer cooperation on:

- setting clear and transparent targets for the launch of a carbon market

- providing incentives for the creation of carbon sinks

- creating multilateral verification systems for carbon offsets

- share ambitions to create and participate in bilateral, regional and multilateral carbon markets

Green overseas investment cooperation

China is the largest overseas investor in many countries – particularly for infrastructure investments, e.g. through its Belt and Road Initiative (BRI). Countries of the European Union are together the largest investor across the world. Cooperation on overseas investment to support a global decarbonization efforts is paramount and would allow for more co-investments and thus overall higher financial returns, higher economic development effectiveness and lower pollution and waste. China and the EU should cooperate particularly on developing and applying common standards for green overseas finance:

- Implementation and application of green overseas finance taxonomies (e.g. such as the Green BRI Guidance “Green Light System” (“一带一路”项目绿色发展指南“交通灯“) that includes an evaluation of a moratorium or phase-out of coal and fossil fuel investments

- Implementation and application of common standards for environmental impact assessments (EIA) with requirements for financial institutions to be responsible for and safeguard EIAs

- Establishment of an EU-China green funds for overseas investments with private sector participation to accelerate cooperation (in addition to the government/MDB-led funds such as the MCDF)

- Support and coordinate capacity building for the development of green financial markets in third countries, in cooperation with international financial institutions, such as the sustainable banking network SBN, the Network for Greening the Financial System (NGFS), the International Development Finance Club (IDFC)

Furthermore, China and the EU should coordinate within the G20 and other frameworks possible debt-relief programs for highly indebted countries after the Covid-19 pandemic with a focus on both social and environmental considerations. Accordingly, China and the EU could cooperate on establishing debt-for-nature swaps.

Green tech finance

To build a zero-carbon or zero-greenhouse gas emission economy in China and the EU, financing new technologies is paramount, particularly in regard to energy generation, energy storage, transportation, agriculture and carbon capture and sequestration (CSS). By cooperation on green tech, China could further its technological capacities and European companies could benefit from scale and standardization across regions. Accordingly, China and the EU should cooperate and coordinate on

- setting up green technology funds for specific sectors (e.g. freight transport, public transport, green energy generation, green energy storage such as hydrogen, agriculture) to invest into R&D,

- creating a level playing field of subsidies and other government support to green technology in order to avoid violation of international trade and investment rules,

- the development and application of technologies for financing, such as crypto-currencies

- the development and use of digital ledgers to improve measurement-reporting-verification (MRV) of environmental impacts of investments.

Nature climate solutions

Climate and biodiversity are closely interlinked. China is the host of the 2021 Convention of Biological Diversity (CBD) COP in Kunming, and has gained substantial experience in applying nature-climate solutions (NCS) through the planting of “green belts” to reverse desertification, lower air pollution and provide carbon sinks. The EU has over the past years equally made big progress on applying nature-climate solutions, e.g. through re-wildering nature along coast lines and inland.

Along the High-Level Environmental and Climate Dialogue agreed between China and China and the EU should further strengthen cooperation to overcome specific challenges on combining nature and climate finance:

- Exchange of best practices on financing and maintaining nature-climate solutions that can become self-sustaining over a long time and are beneficial to the overall eco-system (e.g. to avoid mono-cultures and overuse of water, protect against infestation through insects)

- Develop and apply market-based financial solutions to finance nature-climate solutions that are less dependent on government funds, grants or donations as current NCS.

Green urban finance

Within the next 30 years, cities around the world are expected to grow by 2.5 billion people; and 68% of the global population will live in cities. Chinese cities are also continuing to grow and will be a major source of economic development with consequences for emissions and pollution. To build green low-carbon cities, green urban finance has special requirements and needs and China and the EU should

- Provide Green Urban Project Preparation Facilities for different sectors, e.g. green industry 4.0, green transport, green urbanization. The facilities should invest in green early stage projects with the potential to be transformative and that currently lack the data or bankability to attract later-stage and bigger investments of larger financial institutions.

- Improve capacity of integrated planning for green urban development to lower financing cost.

- Set up a Sino-European green city fund to pool private and public money, provide tradeable securities and localized expertise. A role model could be the Green Climate

- Fund (GCF) or the Shandong Green Development Fund.

- Increase use of blended finance instruments

- Establish an open platform for green urban projects to improve the investment pipeline, e.g. for sponge cities, green technology projects that is accessible to investors from China and the EU.

- Accelerate city-networks and city exchanges based on technology and finance cooperation which would allow European technologies to scale and Chinese cities to quickly apply green technologies

Outlook

Climate finance and climate ambitions of both China and the EU are evolving together with cooperation potentials. The recommendations for cooperation could allow China to work on peaking its emissions before 2025, 45 years after China’s opening up – a stated goal of the EU. This would give China 35 years until 2060 to fully de-carbonize its economy.

The upcoming EU China Leaders Statement offers an important opportunity to announce some of the shared ambitions and would further boost EU-China cooperation in an increasingly volatile world and allow for China to become a role-model in climate ambitions, and for multilateral cooperation for other countries to follow.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.

Comments are closed.