On September 21, 2020, the aerospace giant Airbus announced concept designs for “ZEROe”, a zero-emission, hydrogen-powered airplane that would enter service by 2035. While it might be difficult to imagine traveling on a hydrogen-powered plane, hydrogen as a fuel is not new: liquid hydrogen has served as a rocket propellant for decades; land-based forms of transportation powered by hydrogen fuel cells are also already in use, though in small scales.

The unprecedented momentum for hydrogen comes not only from the business world, but also from governments across the globe. In 2017, Japan set the goal of building a hydrogen-based society, followed by South Korea, who published a national roadmap on developing its hydrogen industry last year. In June, Germany released a long-term strategy for hydrogen as part of its efforts to cut GHG emissions and announced to established a national hydrogen council. By June 2019, countries around the world, including China, announced about 50 mandates or policies that support hydrogen , with the majority focused on transport.

Hydrogen better, cleaner and greener than batteries

Hydrogen enjoys such extensive attention for a good reason. Similar to batteries, hydrogen is mostly used as a form of energy storage. They both depend on primary energy such as solar and wind to charge or generate, and could be converted into electricity when needed. Nevertheless, hydrogen outperforms batteries in many ways: cleaner production process, zero pollution after disposal and higher energy density. While hydrogen can be produced with water and electricity, batteries often rely on toxic materials, such as zinc, nickel and manganese, that have adverse environmental impacts when they are mined in open pits or on seabeds and after they are disposed of. Hydrogen, when converted into electricity, produces only water and heat. Hydrogen also has a much higher energy density (33 kWh/kg) than batteries (about 1 kWh/kg) and than petrol and diesel (about 12 kWh/kg), making it particularly light for transport and as a mobile energy carrier (if compressed properly).

Accordingly, one of the major applications for hydrogen includes the transport sector that so far lacks clear solutions for an ecological future and in meeting ambitious climate goals. Yet, to reach that goal, huge research and development gaps need to be filled. This article provides an overview of China’s industry including policy, current status, players, financing and challenges, and discusses opportunities for hydrogen to accelerate a green Belt and Road Initiative.

Hydrogen: Basics, Production Pathways and Applications

Hydrogen (H) is the most abundant element on earth, but under normal (earthly) circumstances it is usually neither found as hydrogen H or hydrogen gas (H2). Due to its characteristics, it easily reacts with other organic compounds to form for example water (H2O). During this reaction of forming water from hydrogen and air, energy is released that can be used as electricity. In order to make this reaction useful for industrial electricity, hydrogen has to be produced, e.g. from water by splitting the atoms into oxygen and hydrogen through electrolysis. Other ways to create hydrogen are using leftover gases from chemical processes, for example methane, coal, petroleum and biomass. Accordingly, in order to produce hydrogen, different pathways exist that vary greatly in terms of both greenness and cost (Table 1).

| Grey Hydrogen | Blue Hydrogen | Green Hydrogen | |

| Main Production Routes | • Steam Methane Reforming (SMR) • Coal Gasification | • SMR + CSS • Coal Gasification + CSS | • Electrolysis Using Renewables |

| CO2 Emissions | High | Low | Zero |

| Current Cost | Low | High | High |

| Social Acceptance | Low | Mid | High |

About three quarters of the world’s hydrogen is produced as a by-product from natural gas via steam-methane reforming (SMR); coal comes next (e.g. gasification of coal). In general, hydrogen derived from coal, natural gas and other fossil fuels is termed as “grey hydrogen” for producing significant amounts of carbon emissions. Coal contributes to 62% of China’s total hydrogen production, compared with a global average of 18% and 6% in Japan.

A cleaner version to produce hydrogen is “blue hydrogen”, referring to hydrogen that comes from fossil fuels but reduces carbon emissions during production with the technology of carbon capture, utilization and storage (CCUS) . While blue hydrogen could serve as a transitional stage to green hydrogen, it bears several shortcomings, including the current low capture rates of CCUS technology, lack of monitoring for the use of captured CO2 and diverting investments from renewable energy back to fossil fuels.

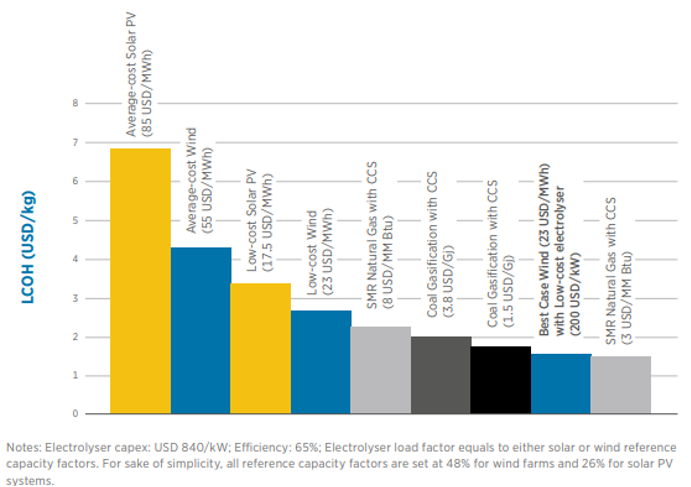

The cleanest type of hydrogen is “green hydrogen”, produced through the technology of electrolysis that splits water into oxygen and hydrogen using electricity produced by renewable energy. Green hydrogen has the greatest potential to accelerate carbon emissions goals. Though its average cost is high compared with other alternatives, green hydrogen produced from wind energy has already exhibited some cost advantages (Figure 1). As a majority of cost for electrolysis comes from electricity, the overall production cost for green hydrogen is expected to drop as the price of renewable energy continues to fall.

China’s Current Development on Hydrogen

a. Current Status

China is the largest hydrogen producer in the world. China produces over 20 million tons of hydrogen annually, about one third of the world’s total production. Most of China’s hydrogen comes from coal, and electrolysis contributed just 3% of the total hydrogen supply. While in theory this amount of hydrogen could cover about 10% of China’s energy needs, most of China’s hydrogen is currently used for industrial and chemical processes (e.g. for producing ammonia as agricultural fertilizer). Yet other applications are accelerating: By January 2020, China had 61 hydrogen refueling stations, compared with 81 in Germany and 116 in Japan to power fuel cell electric vehicles (FCEV). While currently FCEVs only accounts for about 0.1% of electric and hybrid vehicles in total, FCEV sale and production have seen an annual increase of about 60% in the past two consecutive years.

For other areas of hydrogen application, China has engaged in piloting several applications:

- Trams: As early as October 2017, CRRC Tangshan developed and put into commercial use the first fuel cell powered tram in Tangshan, Hebei province. In Nov 2019, another hydrogen-powered tram, built by CRRC Qingdao Sifang, was put into operation in Foshan,

- Guangdong Province. The tram developed by CRRC Qingdao adopts Ballard Power Systems’ FCveloCityTM fuel cell modules. Phase II, including 5 more trams and longer tram lines, is still under construction.

- Aviation: In Jan 2019, a manned aircraft powered by hydrogen was successfully tested in Shenyang. It was researched and developed by Dalian Institute of Chemical Physics, a branch of Chinese Academy of Science, and Liaoning General Aviation Academy. Previously, Dalian Institute of Chemical Physics developed China’s first hydrogen fuel cell airship in 2009 and the first hydrogen fuel cell drone in 2012.

- Ships: China’s 13th Five-year Plan and other policy documents from Ministry of Transport and China Classification Society encourage the adoption of green energy in shipping industry. However, due to the lack of subsidies and guidelines, fuel cells are currently used only in a few small and medium-sized yachts and military ships. In September 2020, it was announced that China would introduce a bulker power by hydropower in 2021.

- Heat and Power: Distributed fuel cell power stations can be used as a supplement to the main power grid. In 2016, a hydrogen fuel cell power station with a capacity of 2MW was delivered in Yingkou, Liaoning province by AkzoNobel, MTSA and NedStack, which generates 16 MWh of electricity per year. Emergency backup batteries are also used in the telecommunications industry, so far with relatively small capacity and scale.

- Logistics:Hydrogen logistics trucks were first introduced in June 2018 by JD to compensate for the increased demand during its “618” promotional events. These trucks were able to refill hydrogen fuels in three minutes and travel for over 350km. Other e-commerce and logistics companies followed suit, but only limited to regional transportation.

b. Policy Support

The last five years has seen increasing regulatory support for hydrogen industry in China at both national and local levels. In 2015, the State Council listed hydrogen as one of the key technologies in the Made in China 2025 Initiative, a national strategy to strengthen and upgrade China’s manufacturing sector. The Initiative laid out goals for fuel cell electric vehicles (FCEVs) by 2025 in three dimensions: first, domestic batch production of key materials and parts; second, improved overall performance and competitiveness of FCEVs compared with traditional and electric vehicles; finally, sound infrastructure for hydrogen production and refueling.

In the Government Work Report in March 2019, the Chinese government included “promoting the construction of electric vehicle (EV) charging stations and hydrogen fuel cell refueling stations”. It was the first time that hydrogen was written in China’s Government Work Report, sending a positive signal to markets and lower-level policy makers. Throughout 2019, 10 policy documents mentioning hydrogen were issued, including the Green Industry Guidance Catalogue (2019 Edition) by the National Development and Reform Commission (NDRC) and seven other ministries, Catalogue of Industries for Encouraing Foreign Investment (2019 Edition) by NDRC and the Ministry of Commerce, and the Work Focus of New Energy Vehicle Standardization (2019) issued by the Ministry of Industry and Information Technology (MIIT). In 2020, in the first half of the year alone, a total of six policy documents from the MIIT, the Ministry of Finance, the National Energy Administration, the Ministry of Science and Technology expressed support for the development of fuel cell vehicle standards, hydrogen production, storage and transportation, refueling services and fuel cell application in automobiles, ships and other transportation sectors.

Also, local governments of Chinese provinces and cities have competed with each other to bolster the entire hydrogen value chain in their jurisdictions. By the end of 2019, at least 10 provincial-level (including provinces like Sichuan and municipalities like Shanghai and Beijing) governments, 21 city-level governments and 5 county-level governments had released action plans dedicated to the hydrogen. Due to diverse industry structures and endowments of natural resources, current status of the hydrogen industry varies greatly across regions in China, with major hydrogen industry companies clustering in Beijing, Shanghai, Guangdong, Jiangsu, Shandong and Hebei.

c. Players

Currently in China, over 85% of total hydrogen is produced from fossil fuels by Steam Methane Reforming (SMR). For the upstream production of hydrogen, most players are power generators and fossil fuel developers, including State Power Investment Corporation (SPIC), China Energy (CEIC), Huaneng, Huadian, China National Nuclear Corporation (CNNC) and China Three Gorges Corporation (CTG). Among others, China Energy ranks first in terms of annual hydrogen output. With about 4 million tons of hydrogen output from coal, CEIC is capable of powering 40 million FCEVs every year. Sinopec ranks the second with an annual hydrogen output of 2 to 3 million tons, mostly derived from by-products of chemical processes.

Despite the minor role of electrolysis in China’s hydrogen production, current research and development is undergoing, led by institutes and companies such as Dalian Institute of Chemical Physics (oldest institute dedicated to electrolysis, especially PEM technology), the 718 Institute of China State Shipbuilding Corporation (possesses 65% of domestic electrolysis equipment market and advanced alkaline water electrolysis technology), Shanghai Shenli Technology and Chunhua Hydrogen Technology.

Many enterprises, such as the state-owned enterprises SPIC, China Energy, CSSC and Sinopec are also actively moving in the construction and operation of hydrogen refueling stations. Yet, two private companies, Shanghai Hyfun and Shanghai Sunwise, are most successful solution providers for hydrogen refueling stations so far. They both have constructed over 20 stations across the nation. The applications of hydrogen, especially fuel cell batteries and cars, attract the participation of companies from various sizes and background.

Meanwhile, major companies in the energy sector are teaming with governments or universities to establish industry funds, advance research and increase their industrial influence (see the table at the end of the article for an incomplete list of major players and recent activities in China’s hydrogen industry).

d. Financing

The Chinese government is pushing the development of hydrogen and its application in several areas and with several instruments. For example, the national government provides tax reduction and subsidies for FCEVs, ranging from RMB 20k to 50k depending on the type of the vehicles and the capacity of hydrogen fuel cells. Local governments could offer additional subsidies for FCEVs that do not exceed the national ones. The new national subsidy policy for hydrogen refueling stations has not been finalized, but many provincial and city governments offer subsidies of up to RMB 9 million for the construction of refueling stations.

In addition, a number of funds have been set up for investments. Industry funds, for example, combine public and private investments including state-owned companies, research institutions and universities (such as Tongji University, China University of Geoscience), local governments (such as Dalian, Wuhan), commercial institutions and private companies.For example, in June 2019, Dongfang Electric Group signed an agreement with Three Gorges Capital and Chengdu Innovation Ventures to initiate a hydrogen industry fund of RMB500 million (about USD73 million); in May 2020, China Energy signed a cooperation agreement with Donghu Development Zone and Wuhan ITRI of Geo-resoursces and Environment Co. to establish a hydrogen industry fund in Donghu (Wuhan province), with a size of RMB1 billion (about USD146 million)for the first phase.

Other less common tools include bank loans and bonds. In Dec 2019, Meijin Hydrogen Technology obtained a ¥98mn loan from Rural Commercial Bank, guaranteed by its parent company Meijin Energy. In September, Chengdu municipal government issued bonds of RMB224 million (about USD30 million) for a hydrogen industrial park, with an interest rate of 3.94% and maturity of 20 years.

Also, equity investments are becoming more common, even with public equity: In Aug 10, SinoHytec went public on Shanghai Star Market with a market value of over RMB10 billion (about USD1.5 billion). Previously in Oct 2019, Lopal bought a 10% share of the stocks of Mingtian Hydrogen Energy Technology, a total investment of RMB80 million (about USD13 million). Similarly, other fuel cell companies, such as Shanghai Re-fire, SinoSynergy and Wuhan Tiger FCV, have been invested by listed companies through a seasoned issue.

Opportunities for Hydrogen to Green the BRI and for the BRI to Improve Green Hydrogen

Green hydrogen could play a major role in greening the Belt and Road Initiative (BRI), especially for de-carbonising hard-to-abate sectors as transport. As many Chinese investments in Belt and Road countries go to transport infrastructure, and as one of the goals of the BRI is to accelerate trade, opportunities to incorporate hydrogen logistics in shipping, trains, trucks and buses could be abundant. Particularly, liquid hydrogen could become an option for container ships and green China’s “maritime silk road”, in which Chinese firms are involved in either building or operating 42 ports in 34 countries. The global shipping sector currently emits more of these gases each year than all but the top five emitting countries, at almost 1 gigatonne of CO2 equivalent. China’s 13th Five-year Plan and other policy documents from the Ministry of Transport and China Classification Society encourage the adoption of green energy in shipping industry.

While currently fuel cells are mostly used in a few small and medium-sized ships and military ships, it was found that for 99% of overseas shipping diesel could be replaced by hydrogen, by simply replacing 5% of cargo space with hydrogen fuel cell. By following the UN International Maritime Organizations’ (IMO) deal to at least halve global shipping emission by 2050, China as a major manufacturer of ships, owner of ports, operator of logistics should formulate an integrated hydrogen strategy for shipping industry. Furthermore, in the BRI, pilot projects should be set up, for example, in Sri Lanka’s Hambantota port, which is currently undergoing a shift to become an LNG storage facility.

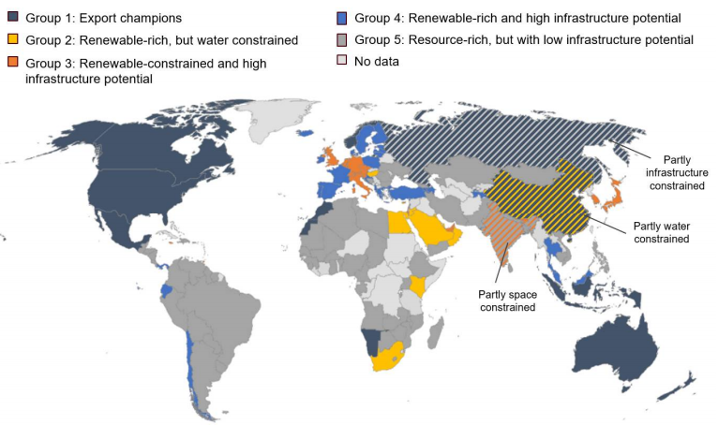

In terms of renewable energy resource endowment, renewable freshwater resource endowment, and infrastructure potential, some BRI countries, including Morocco, Indonesia, Chile, and Namibia are possible destinations for renewable hydrogen production (Figure 2). While Chinese companies makes efforts to divert investments from carbon-intensive projects to renewable ones overseas, it could also incorporate green hydrogen in these areas, both as a tool to improve renewable energy efficiency and as an opportunity to green the BRI.

Suggestions

While hydrogen as an energy storage has much potential and China has been able to show some initial progress, efforts would need to be accelerated for investors, governments, companies and in international cooperation to truly utilize hydrogen technologies:

Recommendations for national policy

First, Chinese policy makers, led by the Ministry of Industry and Information Technology (MIIT) and supported by NDRC and other relevant ministries (e.g. Ministry of Transport, State Council) should develop a comprehensive hydrogen strategy that addresses the whole lifecycle of hydrogen – from research, production, transportation, storage and application. This will signal the relevance of hydrogen to a broad stakeholder group of investors, companies and research organizations in China to accelerate efforts to develop and apply hydrogen as an energy source.

Second, recognizing the important role of green hydrogen in the future and China’s goal to become a zero-carbon economy by 2060, investments in alternative hydrogen production and storage facilities must be accelerated through the provision of monetary of tax incentives, as well as clear policy signals. The policy should include clear stipulations to accelerate and by 2030 exclusively use renewable energies for the production of green hydrogen to minimize negative climate impacts of blue and grey hydrogen. At the same time, innovation in grey hydrogen can be supported in limited ways to support carbon capture and sequestration (CSS) in difficult to abate carbon emission industries.

Recommendation for investments and green finance

The hydrogen industry offers many opportunities and requirements for investments. The research and development must be supported through existing industries that should accelerate a shift from brown to green energy as well as through government funds and programs (e.g. in universities and innovation zones). The infrastructure for hydrogen transport and storage could be financed by public-private partnerships as it can be understood as both public good and as it requires patient capital to pay off. Finally, the application of hydrogen technology in mobility or other sectors should be led by market forces that can apply finance instruments depending on the maturity and risk of the product, where higher risk products could use private equity and more established companies and products could tab the bond markets or obtain loans. The national or local governments should also (continue to) provide subsidies for the application of hydrogen technologies in order to overcome the current cost-disadvantage that hydrogen applications still have. The government funds could further accelerate when using revenues from emission trading systems (ETS) for hydrogen development funds or subsidies.

Recommendation for international cooperation

International cooperation in developing hydrogen technologies and applications are relevant, but must be handled with diligence. Many countries have developed national hydrogen strategies with ambitious goals and investments. As such, many core technologies will thus be seen as a source of competitive advantage for different countries. Yet, in order to ensure compatibility of hydrogen applications, it is of great importance to strengthen cooperation at minimum in setting standards and avoid similar difficulties as for example in the electric vehicle industry where standards for charging are still contentious. Besides, developing and adopting international standards with organizations like the Hydrogen Council and International Organisation of Standardization (ISO), it is essential to the guaranteeing the safety of hydrogen production, transportation and refueling. Furthermore, collaboration on technology and applications can be established in non-core areas.

Finally, to facilitate the application of hydrogen for greening the Belt and Road Initiative, especially in the transport sector, China through its policy banks and SOEs in transport should establish a green Maritime Silk Road by building pilot ports that provide hydrogen as a fuel and encourage Chinese shipping companies to switch to hydrogen fuels. Pilot ports could include Hambantota port in Sri Lanka, Piraeus Port in Greece and the Port of Djibouti in Ethiopia. China could also consider piloting green transport on the “Silk Road Economic Belt” – that is on overland routes by applying hydrogen pilots for rail and road cargo transport.

In conclusion, hydrogen as a form of energy has great potential to contribute to a zero-carbon economy and to unleash innovation in China and the Belt and Road Initiative. Hydrogen. Yet, the journey has just begun. Research, investments and strong policies paired with international cooperation and the willingness to think big are therefore critical for improving the efficiency of hydrogen production, storage and transportation and guaranteeing the long-term success of the industry.

Table: Major hydrogen players and activities in China

| Category | Name | Abbr. | Hydrogen-related Activities | |||

|---|---|---|---|---|---|---|

| Production | Storage/Refueling | Fuel Cells and Vehicles | Other | |||

| Power Generator-1st tier | State Power Investment Corporation | SPIC | -signed in 2019 to build a hydrogen industry base in Ningbo, Jiangsu -signed in May 2020 to build hydrogen industry bases in Wuhan, Hubei and Zhuzhou, Hunan | -started building a refueling station for buses in Yanqing, Beijing in 2019 | -cooperated with Beiqi and Sibohytec to develop fuel cell buses for 2022 Winter Olympics and Beijing's city transportation | - in 2017 set up hydrogen technology subsidiary -in 2017 set up £¤1bn industry investment fund with Tenghua and Boshi Asset - in 2018 set up group-level executive hydrogen task force led by president Qian Zhimin |

| China Energy (Shenhua) | -leading a wind/solar and hydrogen storage hybrid project in Zhangjiakou for 2022 Beijing Winter Olympics | -Completed and put into use the first commercial refueling station with international standards in Rugao, Jiangsu in 2019 -developing two refueling stations in Hebei | -developing hydrogen-powered heavy trucks (200 tonnage and up) with Weichai | -Led the foundation of China Hydrogen Alliance -participanted in the 2019 China fuel cell and hydrogen white paper |

||

| China Huaneng | -In 2019 developed and put into use a demo wind-to-hydrogen project in Baicheng, Jilin | -Signed cooperation agreements with Zhangjiakou, Hebei -in 2017 signed MoU with Beijing and others to develop hydrogen innovation center |

||||

| China Huadian | -in June 2020 signed strategic cooperation with Kohodo group to invest in a hydrogen generation project in Weifang, Shandong | |||||

| China Datang Corporation | -In April 2020 signed cooperation agreements with CR power on hydrogen energy development | |||||

| Power Grid | State Grid | SGCC | - In Aug 2019, signed contracts with Mingtian Hydrogen Energy Technology to develop a MW hydrogen storage power plant | |||

| China Southern Power Grid | CSG | -in Aug 2020 established a hydrogen research center in Guangzhou | ||||

| Power Generator-2nd tier | CR Power | -In April 2020 signed cooperation agreements with Datang Corporation on hydrogen energy development | ||||

| China General Nuclear | CGN | -in Apr 2019, established a fund with Narada Power on hydrogen power and fuel cell investment | -cofounded a hydrogen fund of £¤3bn in Guangdong in 2017 | |||

| China National Nuclear Corporation | CNNC | -in Jan 2019, signed cooperation agreements with Baowu Group and Tsinghua University on nuclear production of hydrogen | ||||

| China Three Gorges Corporation | CTG | -in 2018, signed cooperation agreements with Proton Energy System to build production and research center in Weifang, Shandong | -teamed with North China Electric Power University to established a hydrogen power lab in Dec 2019 | |||

| Fossil fuel developers-coal | Datong Coal Mine | -started a coal-to-gas hydrogen production project in 2019 | ||||

| Yankuang Group | -launched a FCV bus line in Jining, Shandong in 2019 | -initiated Shandong Hydrogen and Fuel Cell Alliance in 2019 -built a £¤400 mn research center |

||||

| Jincheng Anthracite Mining Group | JAMG | -signed MoU with AF Energy on hydrogen energy in 2019 | ||||

| Fossil fuel developers-oil | Sinopec | -maintains an annual production of 2-3 million tons of hydrogen as byproducts of industrial chemical process | -in 2018 started building a combined gas and hydrogen station in Yunfu, Guangdong (still in construction) -in Oct 2018 signed cooperation agreement with SinoHytec on hydrogen supply and refueling -in 2018 signed an MOU with JXTG Nippon Oil & Energy on hydrogen refueling stations in China and other countries -in July 2019 competed and put into use a combined gas, electricity and hydrogen station in Foshan, Guangdong | -joined Hydrogen Council in Sep 2018, the only Chinese petroleum company | ||

| China National Petroleum Corporation | CNPC | -built a refueling station in Wuhan in Sep 2018 - signed cooperation agreement in 2018 to develop hydrogen refueling network in Zhangjiakou | ||||

| SinoChem | -teamed with Tianjin University for research on fuel cell vehicles in April 2018 -established a hydrogen energy technolocy creativity center in Oct 2018 |

|||||

| Manufacturers-automobile | First Automobile Works | FAW | -launched the "hongqi" brand hydrogen fuel cell car in Jiaxing in Oct 2018 -acquired loans of £¤1015 bn from 16 banks to develop renewable energy cars and the brand "hongqi" | |||

| Dongfeng Motor Corporation | DFMC | -established a commercial hydrogen FCV production base in Yunfu, Guangdong in Feb 2018. | ||||

| CRRC | -launched and tested its 12-meter hydrogen FCVs with driver assistance system in May 2018 | -conducted research on FCVs in Zhuzhou, Hunan |

||||

| Manufacturers - iron & steel | Baowu Group | - has established sound hydrogen production and distribution system in East China, with over 270,000 m3/d capcacity for hydrogen production, sales and distribution | ||||

| China Iron and Steel Research Institute Group | CISRI | -signed cooperation agreements with Changzhou city on fuel cell production line in Jul 2018 -led in reseach in hydrogen fuel cells and hydrogen storage | ||||

| Manufacturers-others | Weichai | -Built 6 refueling stations in Shandong since 2019 | -launched 50 FCVs in 2019 and 150 in June 2020 in Shandong -its factory for hydrogen fuel cell engines production was put into use in Mar 2020, with a capacity of 20000 engines | |||

| Dongfang Electric | -Established fuel cell R&D team as early as 2010 -in 2018, ten hydrogen fuel cell buses with Dongfang-designed engines and control systems were put into use in Chengdu -in 2019, invested and put into use a hydrogen fuel cell automated production line in Chengdu, with a annual capacity of 1000 hydrogen fuel cell engines | |||||

| China State Shipbuilding Corporation | CSSC | -its 718 institute is the biggest electrolysis equipment research and production company in China, accounting for 65% of domestic market and exporting to over 20 countries and regions | - PERIC Hydrogen Technologies, a subsidiary of CSIC 712 institute, specializes in refueling stations and vehicle hydrogen system | -its 712 institute specialized in fuel cell motor system research and developmment | -signed cooperation agreements with SinoHytec on Zhangjiakou hydrogen fuel cell motors production base in Oct 2017 | |

Mengdi Yue is a visiting researcher at the Green Finance & Development Center and previously was a researcher at the Green BRI Center at IIGF. She holds a Master in International Relations from School of Advanced International Studies (SAIS) and has worked with the American Enterprise Institute (AEI), European Union Chamber of Commerce in China and the China-ASEAN Environmental Cooperation of the Ministry of Ecology and Environment. She is fascinated by green energy finance in China and the Belt and Road Initiative and data analysis.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.