Key findings

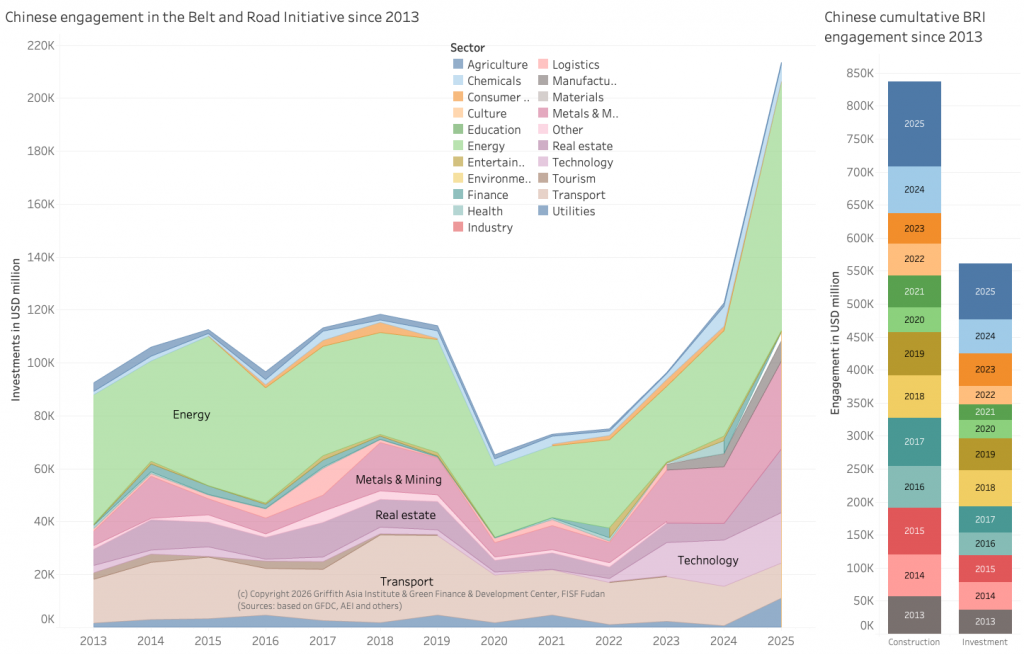

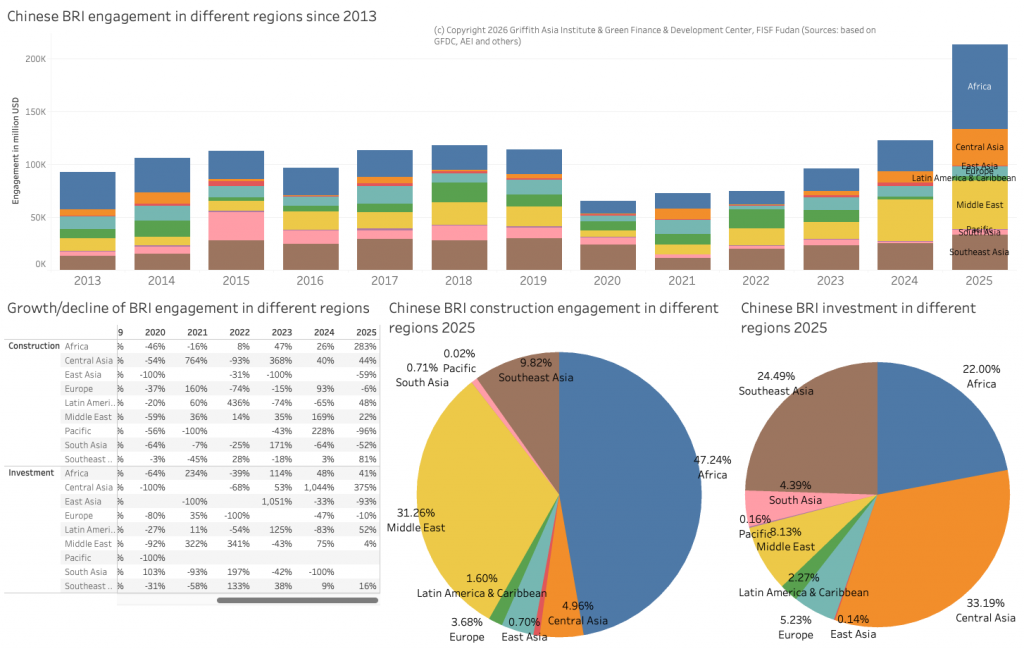

- 2025 saw the highest BRI engagement ever for any year, with USD 128.4 billion in construction contracts and about USD 85.2 billion in investments;

- China’s energy related engagement in 2025 were the highest in any period since the BRI’s inceptionreaching USD93.9 billion, more than double than in 2024;

- China’s 2025 BRI energy engagement was the dirtiest and greenest:

- Oil and gas engagement surged to about USD71.5 billion, more than triple the previous record year 2024;

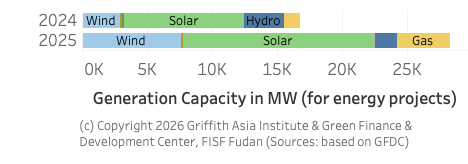

- Green energy engagement reached new records with USD 18.3 billion in wind, solar, and waste-to-energy projects and planned capacity of over 22 GW of green energy;

- China continued to invest in coal-related activities through various construction of coal mine infrastructure;

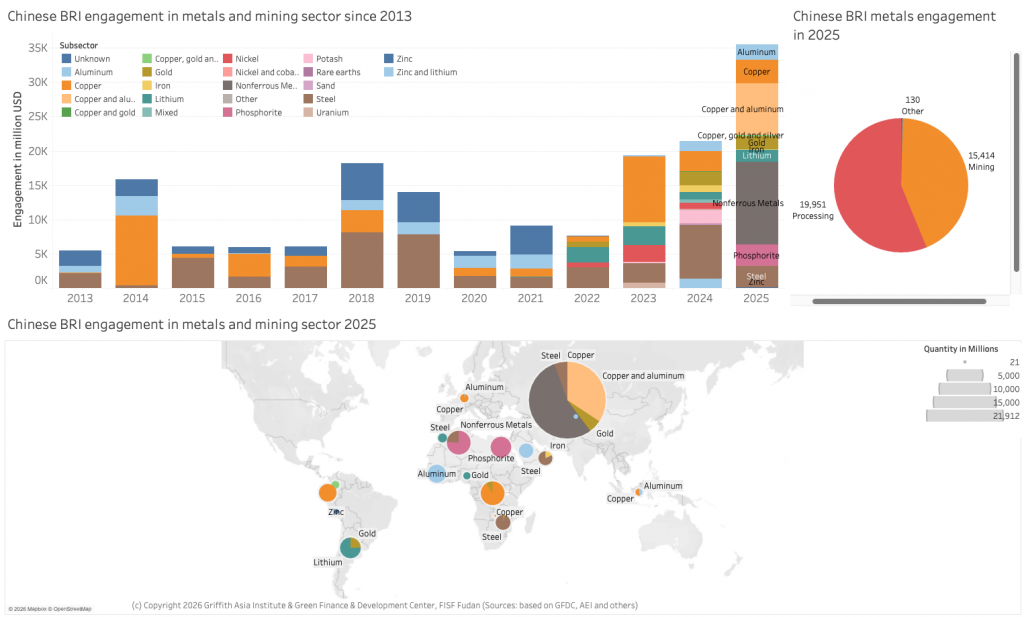

- Metals and mining sector reached new records surpassing 2024 (which itself was a record year) with about USD 32.6 billion – mostly through investments and in minerals processing (about USD 15 billion into mining) with a focus on Kazakhstan;

- Copper, in support of data centers, saw a significant surge of Chinese investment in the second half of 2025;

- The technology and manufacturing also broke records and reached almost USD 28.7 billion with high-tech engagements in data centers, EV batteries and in hydrogen (in Nigeria);

- Africa topped the rank of BRI engagement, reaching USD 61.2 billion, a plus of 283 percent; countries with the highest construction engagement were Nigeria (USD 24.6 billion), The Republic of Congo (USD 23.1 billion), Saudi Arabia (USD 19.8 billion), and Iraq (USD 4.5 billion);

- Part of Chinese Africa engagement may be explained by lower US tariffs in Africa compared to Asia;

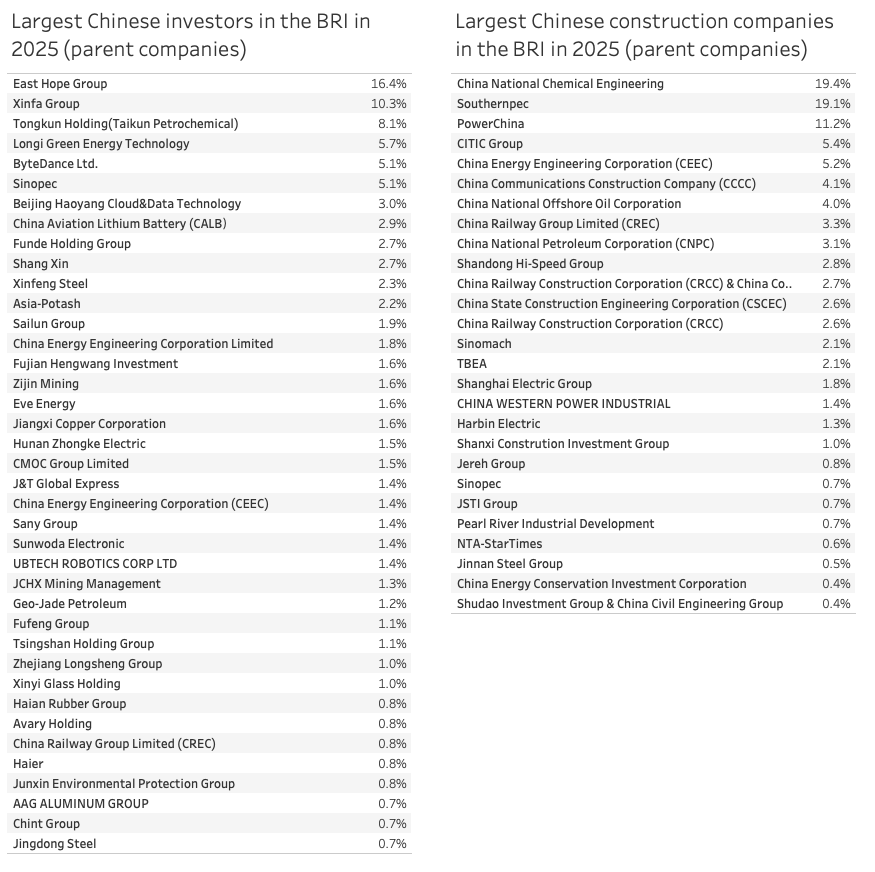

- BRI investments in 2025 were driven by private sector companies, dominated by East Hope Group, Xinfa Group and Longi Green Energy; construction dominated by SOEs;

- Since its establishment in 2013, cumulative BRI engagement reached USD 1.399 trillion, with about USD 837 billion in construction contracts, and USD 561 billion in non-financial investments;

- For 2026, I see continued expansion of Chinese BRI engagement with a focus on energy, mining, and new technologies;

- Global trade and investment volatility will potentially spur further investment for supply chain resilience and alternative export markets for Chinese companies.

China’s finance and investments in the Belt and Road initiative (BRI) in 2025

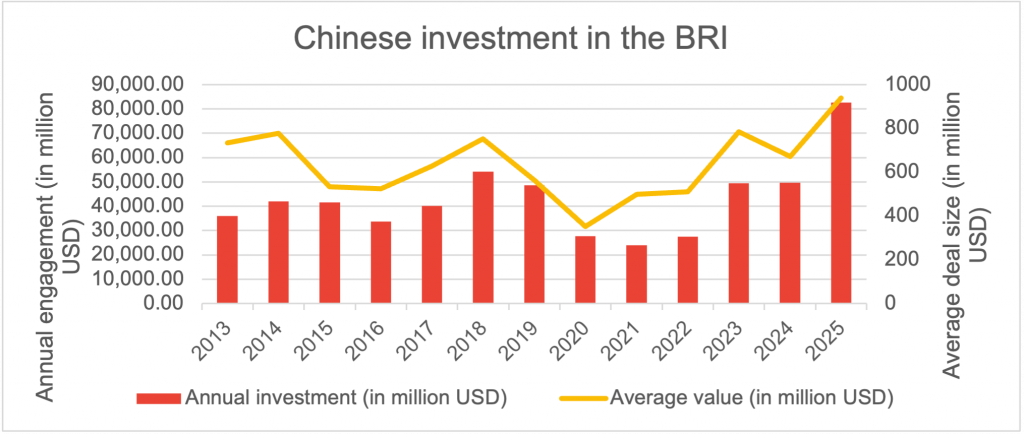

Preliminary data on Chinese engagement in the 150 countries of the Belt and Road Initiative through investments and construction contracts show record levels:

- USD 128.4 billion (+81% compared to 2024) in construction contracts

- USD 85.2 billion (+62% compared to 2024) in investment

This equals to a total engagement of USD 213.5 billion through construction contracts and investments in about 350 deals in 2025 (+19% in deal numbers compared to 2024) (see Figure 1).

Cumulatively, Chinese BRI engagement has reached USD 1.399 trillion since 2013 of which USD 837 billion in construction and USD 561 billion in investments.

| About the data and methodology: In December 2025, the Ministry of Commerce (MOFCOM) released new BRI engagement statistics covering the period of January to November 2025. According to these data, Chinese enterprises invested about USD 35.7 billion in non-financial direct investments in Belt and Road partner – an increase of 18.4%. At the same time, the value of newly-signed project contracts by Chinese enterprises in Belt and Road partner countries was USD 201.7 billion (an increase of 20.4%). While the MOFCOM data are relevant and confirm the trends, the granularity and definitions of BRI engagements are not transparent, including what counts as BRI countries. For this report, BRI engagements are defined as those Chinese construction and investment deals in countries that we have identified as having an active Memorandum of Understanding (MoU) with China to cooperate under the BRI at the time of the report. To stay consistent with data over time and avoid an inflation/deflation of the value of BRI engagement across time simply by adding/subtracting countries that enter or exit the BRI in each given year, the analysis counts Chinese engagement in all current BRI members across the whole time, no matter when they signed the MoU (thus, if the Syrian Republic signed a BRI MoU in 2022, the analysis counts all Chinese engagement since the initiation of the BRI in 2013 as BRI engagement in Syria). A similar approach is used for countries that exited the BRI (i.e., if Italy exited the BRI in 2023, the analysis does not count any Chinese engagement in Italy to the BRI engagement for any year). The definition of BRI countries currently includes 150 countries that had signed a cooperation agreement with China to work under the framework of the Belt and Road Initiative (BRI) by December 2025. Our data since 2024 are collected based on a rigorous independent collection process: we include projects with validated credible sources or two independent sources. We include projects with a signed contract for implementation or clear announcements of investments (e.g., stock market announcements). We consistently aim to include projects worth about USD20 million. The data until 2023 was reliant on the China Global Investment Tracker (CGIT), published by the American Enterprise Institute, which only include deals larger than USD 100 million. We have significantly expanded the original CGIT data based on our research also for the years until 2023. As with most data, they tend to be imperfect and need regular updating. |

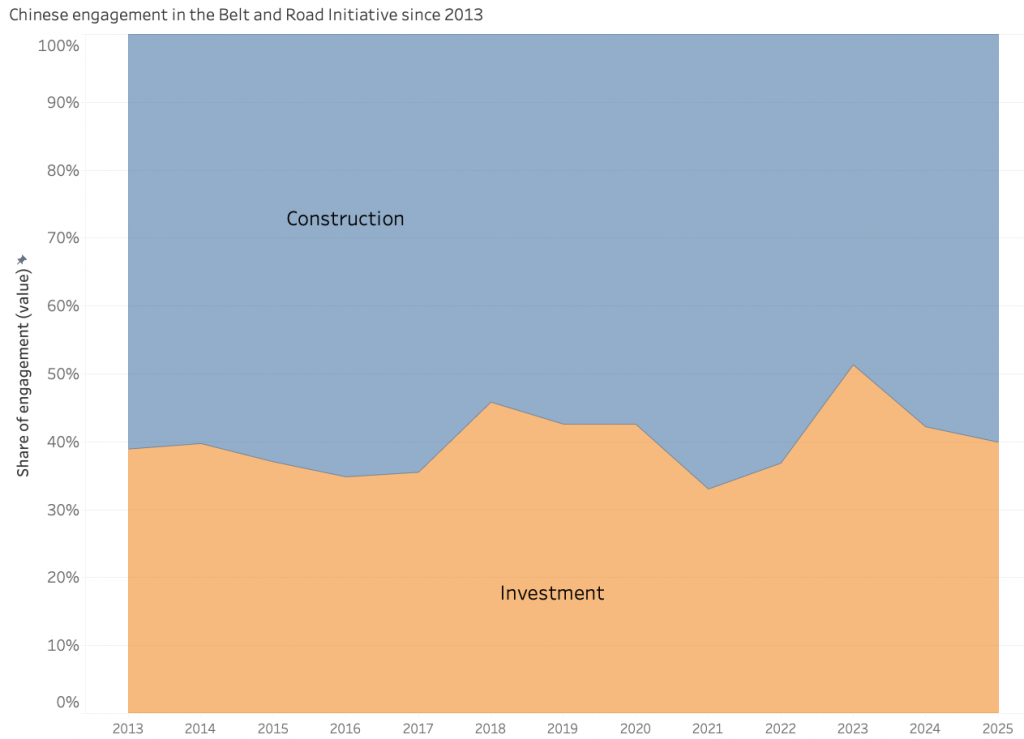

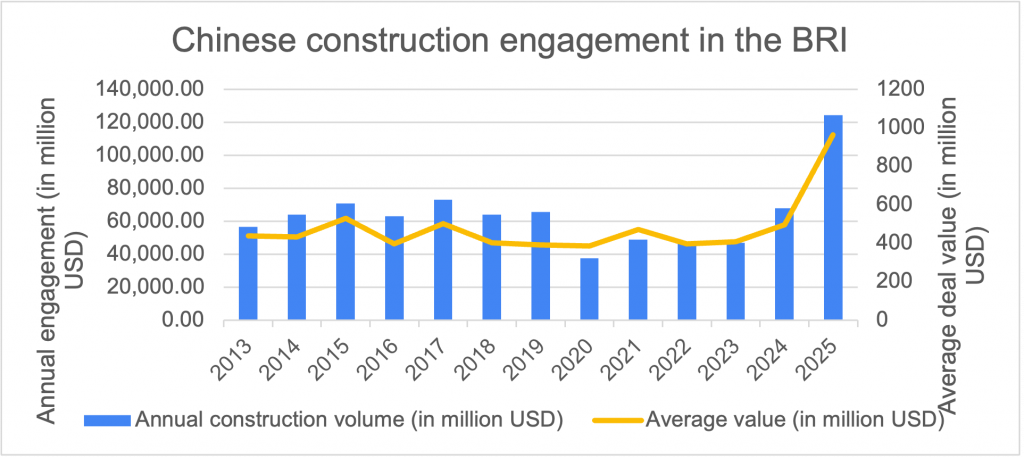

Share of construction in China’s BRI increases driven by high valued construction contracts

The share of Chinese engagement in the BRI through construction reached about 60% and increased compared to 2024 driven by high construction volume increases. This compares to about a share of 40% for investment of Chinese BRI engagement.

Construction contracts that are often financed through loans provided by Chinese financial institutions and/or contractors with the project sometimes receiving guarantees through the host country’s government institutions potentially backed up by resources (e.g., oil, gas) (see Figure 2).

Deal sizes are at record high levels for both investments and construction

The average deal size for investments with a value larger than USD 100 million grew to record levels of USD 939 million in 2025 (from USD 672 million in 2024). The value is about three times higher than in 2020 (during the first year of COVID).

For construction projects, the average deal size in 2025 increased to USD 964 million, up from USD 496 million in 2024 (see Figure 3a and Figure 3b).

Both developments are driven by single large projects, such as a USD 20 billion construction project in Nigeria and two investment projects valued at more than USD 5 billion, both in Kazakhstan.

With this, the “small yet beautiful projects”(小而美)in the BRI propagated through official channels during COVID should be seen as bygone.

It is important to note (as seen later in the report) that many large infrastructure projects are resource-backed deals (e.g., oil, gas) and thus revenue generating, as compared to fiscal spending in host countries (e.g., road construction). This provides relatively lower financial risks for Chinese counterparts in supporting and potentially financing these construction contracts.

Regional and country analysis of Chinese BRI engagement

Africa almost triples Chinese BRI engagement in 2025, Central Asia investment almost quadruples, Pacific engagement vanishes

Chinese BRI engagement was not evenly distributed among all regions . China’s construction engagement across multiple regions increased significantly compared to 2024

- Africa: plus 283% to USD 61.2 billion

- Southeast Asia: plus 81% to USD 12.7 billion

- Latin America: plus 48% to USD 2.1 billion

This compares to significant drops in the Pacific (minus 96%) and East Asia (minus 59%).

In Chinese BRI investment across the region, East Asia similarly dropped almost of the radar (minus 93%). This compares to an increase of 375% of Chinese investment in Central Asia (this is on top of a 1,044% (!) increase in 2024, mostly driven by metals and mining related investment, reaching a value of USD 28.3 billion.

The region with the absolute largest construction engagement was also Africa with Middle East coming in in second with USD 39.4 billion in engagement.

A reason for Africa’s strong engagement may be US tariffs which are lower in some parts of Africa compared to e.g., Vietnam. An example is the decision by Boway Alloys to scrap a plant in Vietnam to invest in Morocco instead – explicitly to take advantage of the 10% US tariff in Morocco.

For investment, Central Asia was also the largest recipient of Chinese money, followed by Southeast Asia (USD 20.9 billion) and Africa (USD 18.8 billion) (see Figure 4).

Pacific countries continue to see low Chinese engagement remaining at the lowest values in the past 10 years for investment and construction. Latin American countries, despite increases, continue to see little Chinese engagement (USD 2.1 billion in construction and USD 1.9 billion in investment). However, China is strongly engaged in Latin America with over USD 53 billion investment in Brazil in 2025, albeit Brazil is not a BRI country.

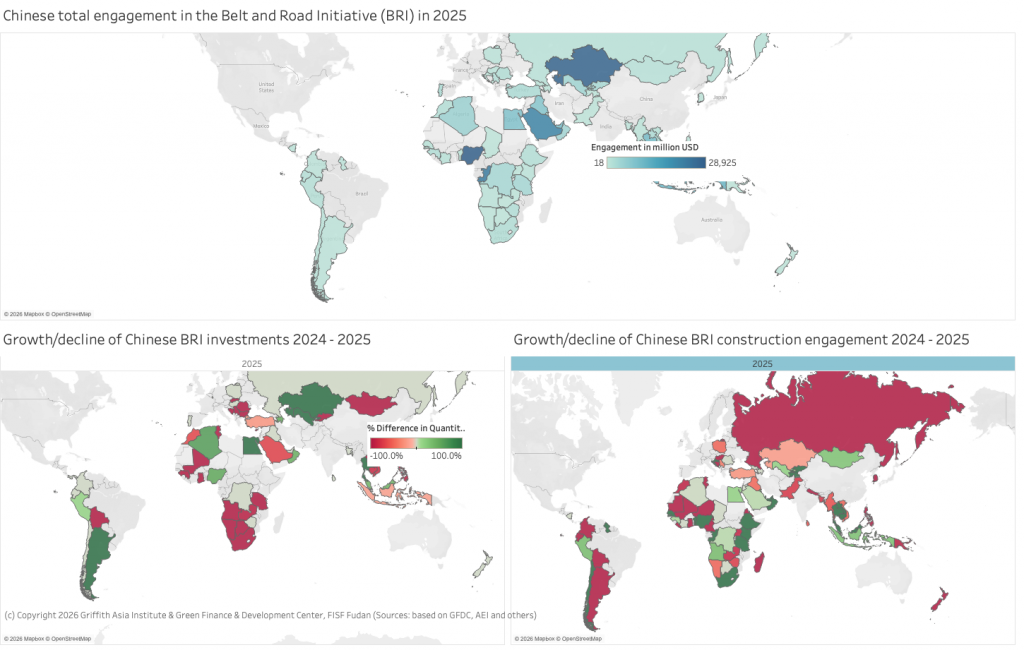

China’s financing and investment spread across 89 BRI countries in 2025 (up from 87 in 2024), with 57 countries receiving investments and 66 with construction engagement.

The country with the highest construction volume in 2025 was Nigeria with about USD 24.6 billion (up from 1.8 billion in 2024), followed by The Republic of Congo (USD 23.1 billion), Saudi Arabia (USD 19.8 billion), and Iraq (USD 4.5 billion). Other key BRI countries such as Indonesia and Pakistan gave USD 3.3 billion and USD 39 million in construction contracts, respectively.

Regarding BRI investments, Kazakhstan was the single largest recipient with about USD 25.8 billion in investments in 2025, followed by Egypt (USD 10.2 billion), and Thailand (USD 8.5 billion). Pakistan, a key partner of China in the first phases of the BRI, received no investment.

17 countries saw a 100% drop of BRI engagement compared to 2024, including Cameroon, Tunisia, Nepal, and Niger (Philippines saw a 96% drop). China’s engagement in Pakistan for the China Pakistan Economic Corridor (CPEC) dropped by 77% (see Figure 5).

The countries with the largest growth of BRI engagement were Ethiopia (+4,827%), Democratic Republic of Congo (+3,937%), Romania (+3,171%), Ecuador (+3,062%), and Sri Lanka (+1,590%).

Unlike in the years before, Russia received significant investment from China worth USD 674 million.

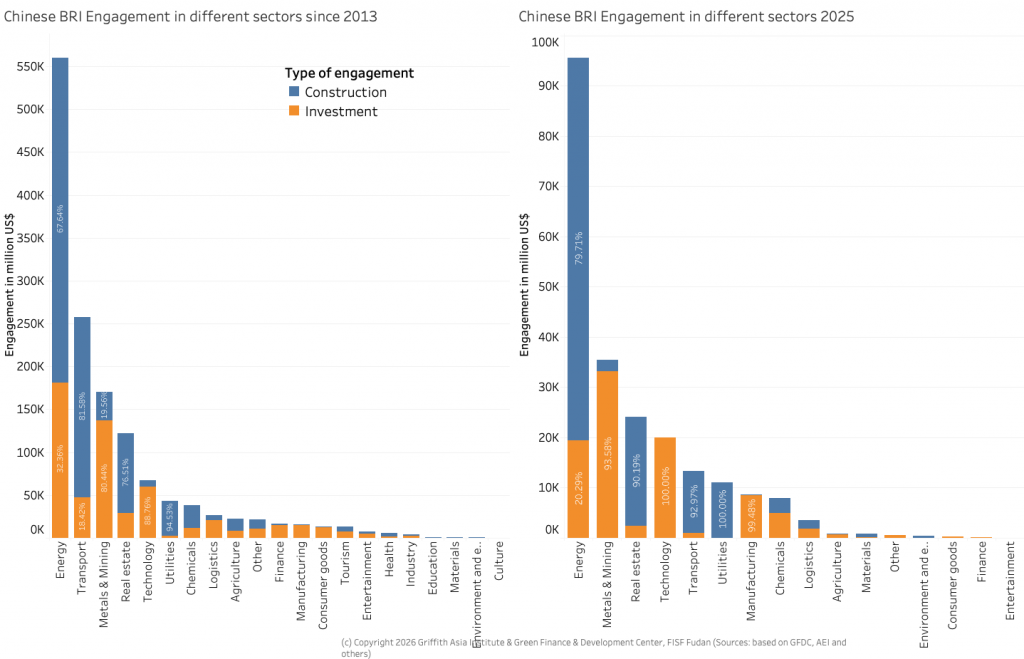

Sector trends of BRI engagement

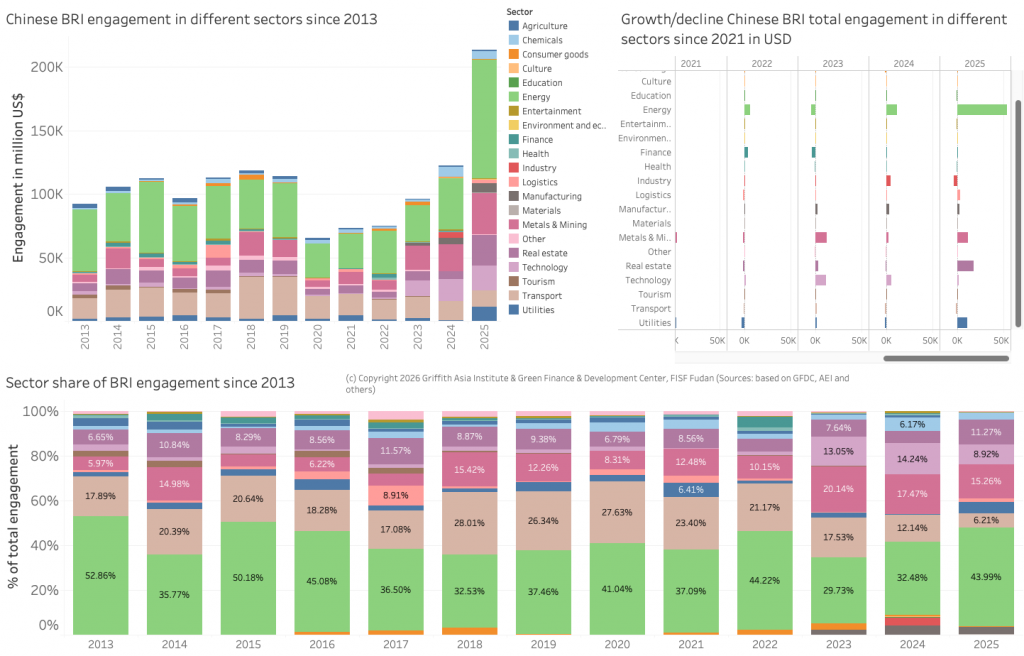

In 2025, particularly the energy sector (+ USD 54.1 billion), real estate (+USD 17.8 billion), metals & mining (+11.2 billion) and utilities (+USD 10,4 billion) grew compared to 2024.

The focus of China’s overseas BRI engagement continued to be in energy (43% of total, a growth from 32.5% in 2024). Compared to early years of the BRI, the transport sector dropped to its lowest level of only 6.2% share of BRI engagement (compared to e.g., 12% in 2024 and a high of 28% in 2018).

Meanwhile, the metals and mining sector kept its role as the second largest sector with about 15.3% of total, while the share of the technology sector contracted slightly to 9% (despite an absolute growth), giving way to the real estate sector reaching 11.3% of total engagement (see Figure 6).

When comparing construction and investment in different sectors, it becomes clear that in mining and technology, Chinese firms are prioritizing equity investments (94% in 2025); meanwhile, energy investments continue to be dominated by construction deals (80%) rather than equity-based investments. Similarly, real estate deals and utilities are predominantly construction deals (see Figure 7).

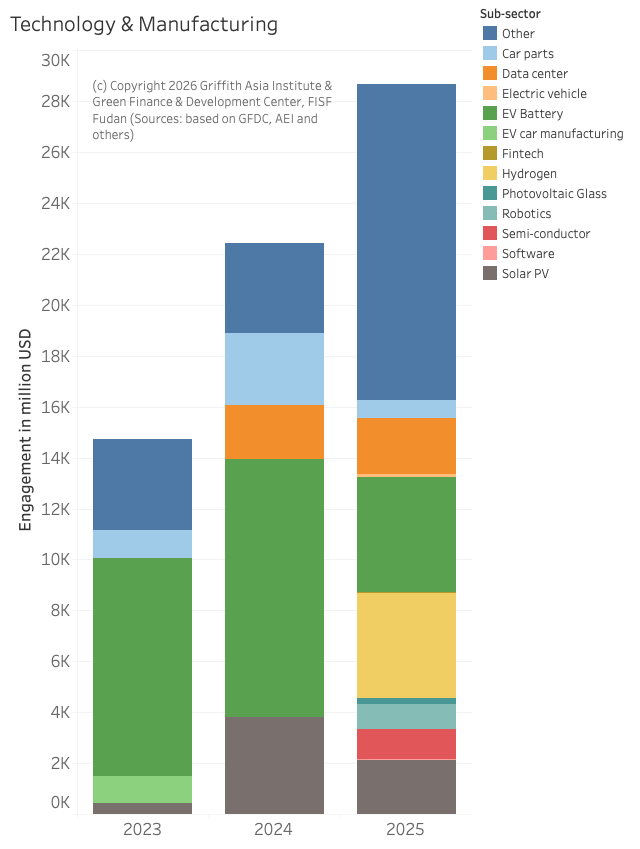

Technology and manufacturing

Technology and manufacturing remain key growth sectors, with Chinese engagement in BRI countries growing by about 27% compared to 2024 to USD 28.7 billion. Apart from general manufacturing, the technology investment saw strong increases is semi-conductor engagement, while solar PV manufacturing engagement dropped compared to 2024. A significant engagement by Longi in green hydrogen development was seen in Nigeria (see Figure 8).

Other notable engagements include a USD 2.1 billion investments by China Aviation Lithium Battery (CALB) in a lithium battery factory in Portugal or a USD 700 million solar PV glass production base in Egypt by Xinyi Glass Holding. As mentioned above, TikTok invested more than USD 37 billion in a data center in Brazil (outside of the BRI).

Metals and mining

China’s engagement in metals and mining reached a record high of USD 32.6 billion in 2025. Kazakhstan saw most important engagement through – USD 12 billion in aluminum and another USD 7.5 billion in copper. Compared to previous years, little Chinese engagement was seen in Indonesia, except for an aluminum-related and a copper related investment.

An interesting development is the focus on copper in the second half of 2025. An explanation can be the relation of copper to data centers for AI to support power networks, circuit boards, or cooling systems.

It is important to note that in 2025, the share of mining compared to processing facilities (e.g., smelters) was about 61%, with 39% of the investment (about USD 15 billion) went to exploitation/mining related activities (see Figure 9).

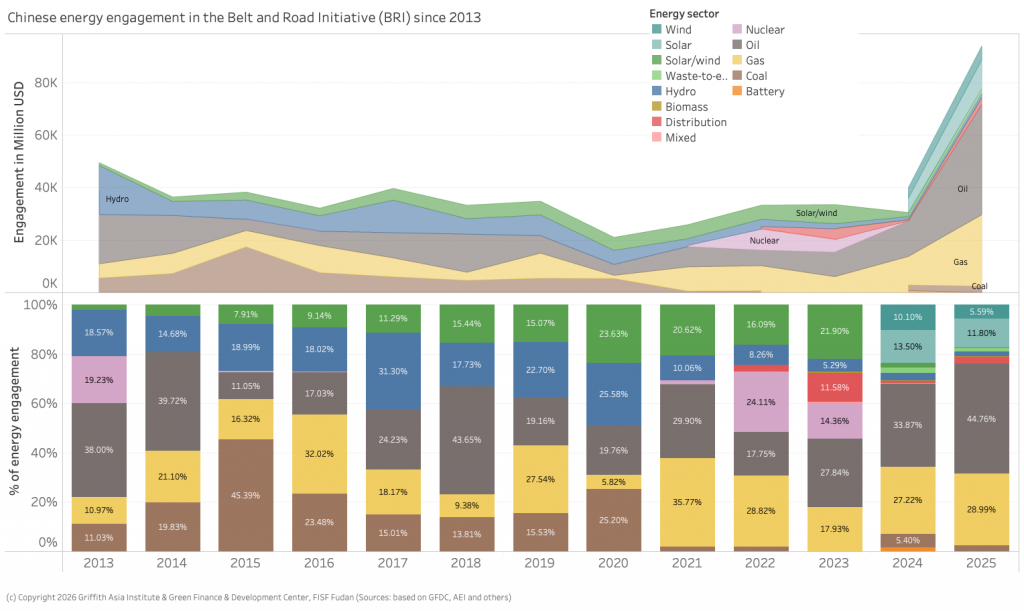

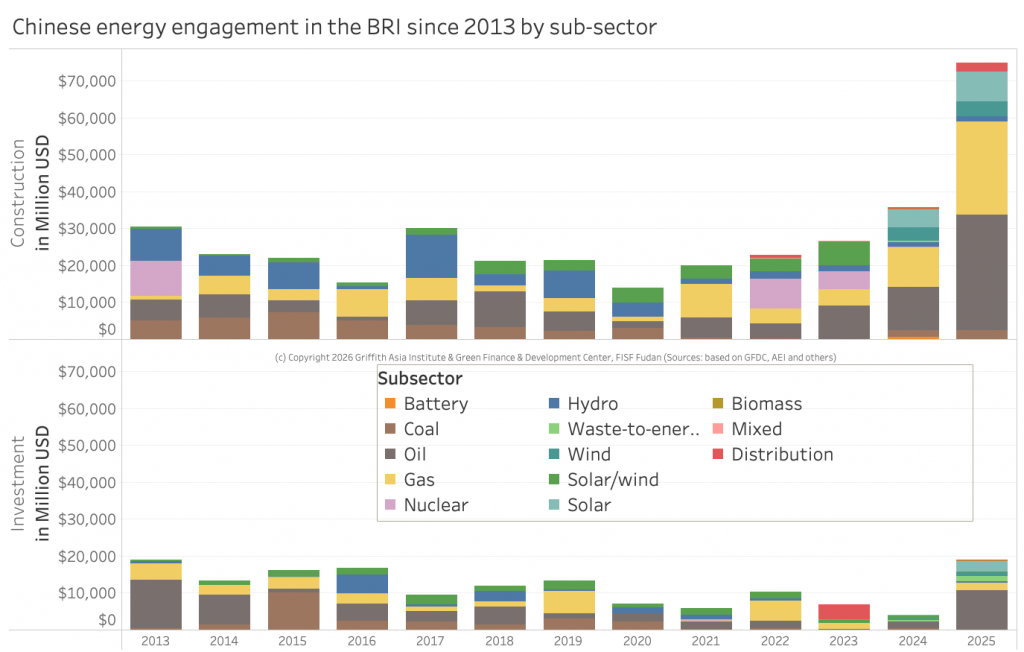

Energy-related engagement in the BRI at highest levels ever recorded – with increases in green, but faster increase in gas related engagement

China’s energy-related engagement in 2025 again set a record as the greenest and dirtiest since the BRI’s inception in 2013.

In 2025, China’s energy engagement was about USD93.9 billion, more than twice than in the previous full record year 2024.

China’s engagement in green energy has also seen the highest since 2013 – with USD 18.3 billion in wind, solar, and waste-to-energy plus USD 3.1 billion in hydro.

At the same time, China significantly expanded its engagement in fossil fuels, particularly gas, but also coal (through coal mining) to over USD 71.5 billion – almost triple the previous record year 2024.

Engagement in distribution systems (e.g., substations, power lines, storage) was about USD 2.5 billion (see Figure 10).

Cumulatively, since 2013, oil engagement topped gas engagement with USD 156 billion versus USD 113 billion. Solar and wind engagement with USD 72.9 billion has surpassed coal with about USD 64 billion (hydro adds another USD 69 billion).

The next paragraphs further analyze China’s energy engagement.

China’s BRI engagement in coal

Following China’s announcement in September 2021 to not to build new coal fired power plants, China continued to engage in new coal-fired power projects seem to progress (e.g., Indoneisa, Bangladesh Barisal 2, Gacko II in Bosnia).

2025 saw a continued engagement in coal-related engagement through mining operations. PowerChina was engaged in several projects in Mongolia and China Railway in Indonesia (all through construction contracts). Altogether, over USD 2.3 billion in contracts for coal-related activities were identified.

China’s BRI engagement in oil and gas

Oil and gas engagement rose significantly to over USD 42 billion and USD 27 billion, respectively, in 2025 (up from to USD 24.3 billion for both in all of 2024). In 2025, fossil fuel engagement constituted over 74% of Chinese overseas energy engagement. This is the highest share of fossil fuel engagement since 2014.

As for investments, a major deal was the USD 3.7 billion investment by Sinopec in Sri Lanka to build an oil refinery.

Meanwhile, most gas-related projects were related to construction projects – no gas-related investments were identified. This includes projects, such as the USD 20 billion Ogidibgon Gas Revolution Park in Nigeria and the USD 1.6 billion engagement by Harbin Electric in Saudi Arabia for a gas fired power plant.

China’s engagement in green energy/hydropower

China’s total engagement in green energy (solar, wind, waste-to-energy) and hydropower reached approximately USD21.4 billion in 2025, up from USD 12.3 billion in 2024.

Looking at investment only, Chinese green energy and hydropower investment increased to USD5.9 billion in 2025, up from USD1.5 billion in 2024. Meanwhile, construction projects related to green energy (including hydropower) increased to USD 13.7 billion in 2025 from USD10.3 billion in 2024 (see Figure 11).

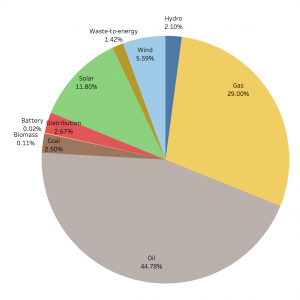

China’s BRI green energy sources varied

In 2025, a more detailed analysis of green energy sources revealed that China is engaging in a diverse range of energy projects. While solar and wind play absolutely a growing role, in 2025 the majority was fossil fuel related engagement with 29% gas, 45% oil, and 2.5% coal related engagement (see Figure 12).

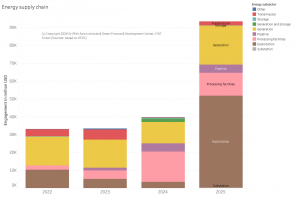

China’s BRI energy engagement across the supply chain

Since 2022, China’s engagement across the energy supply chain has evolved significantly. While energy generation remained the primary focus in both 2022 and 2023, since 2024 (including in 2025) fossil fuel related engagement in exploitation (USD 51.4 billion) processing facilities (USD 12.8 billion) and pipeline projects (USD 4.6 billion) were dominant (see Figure 13).

Energy Generation in the BRI

Looking at generation capacity only, Chinese engagement in 2025 almost doubled from 2024 in value (USD 25.8 billion). This allowed an addition of at least 28.2 GW of generation capacity: 14.6 GW in solar, 7.6 GW in wind, 1.6 GW in hydro, and 4 GW in gas projects (see Figure 14).

Energy engagement in different countries

An analysis of China’s energy engagement across BRI countries in 2025 reveals that Congo is the country with the highest Chinese energy engagement, driven by USD 23 billion oil and gas development agreement between the Republic of Congo (Brazzaville) and Southern Petrochemical Group Yonghua. The goal is to increase the oil production of three oil and gas blocks (Banga Kayo, Holmoni, and Cayo) to 200.000 barrels per day by 2030 . Meanwhile, in Nigeria, construction contracts in the Ogidigbon Gas Revolution Industrial Park by China National Chemical Engineering was worth about USD 20 billion. Saudi Arabia saw the largest Chinese engagement in green energy worth about USD 5.2 billion (see Figure 15).

Cumulatively since 2013, Pakistan is the country with the highest Chinese energy engagement worth over USD 41.5 billion followed by Saudi Arabia with about USD 40 billion and Nigeria (USD 28 billion).

Transport engagement in the Belt and Road Initiative

Transport-related engagement has long been a cornerstone of facilitating trade between China and the BRI countries, and trade is a core component of the BRI. To support this, China has invested in and developed projects in road, rail, aviation, shipping, and logistics across the world (see Figure 16).

However, over the past years, China’s engagement in transport-related projects has steadily decreased and in 2025 reached a low of USD 13.3 billion. Almost all transportation projects (93%) are done through construction contracts (rather than investment).

Aviation: One project was announced totaling USD152 million, which is the Punta Verte International Airport in Nicaragua.

Rail: Total rail engagement (including light rail and subway) was worth USD9.8 billion, where particularly the expansion of the Standard Gauge Railway in Tanzania stands out with involvement from China Railway Group Limited (CREC) and China Civil Engineering Construction Corporation (CCECC). In Mexico, China Railway Rolling Stock Corporation (CRRC) won the bid to supply 17 electric units for a light rail in Mexico City.

Road transport: China continues to engage in road construction projects across multiple BRI countries, with a total value of USD 3.2 billion in 2025. However, this marks the lowest volume of road-related engagement in BRI history.

Ports: No shipping project was found in the 2025 in BRI countries (outside of the BRI, projects include the acquisition of VAST Infra-crude oil port operator by China Merchants Group valued at USD 448 million in Brazil).

Major players in BRI investments

In 2025, Chinese private enterprises reclaimed a dominant role in investment from private enterprises, reversing the trend of the last year (see Table 1).

For investment projects, East Hope Group and Xinfa Group led ahead of Longi Green Energy and Bytedance (all private companies). Sinopec, a state-owned enterprise, ranked sixth.

The Chinese companies most prominently featured in construction projects in the BRI in 2025 was China National Chemical Engineering and followed by the leader in previous years PowerChina. Construction projects are all dominated by Chinese state-owned enterprises.

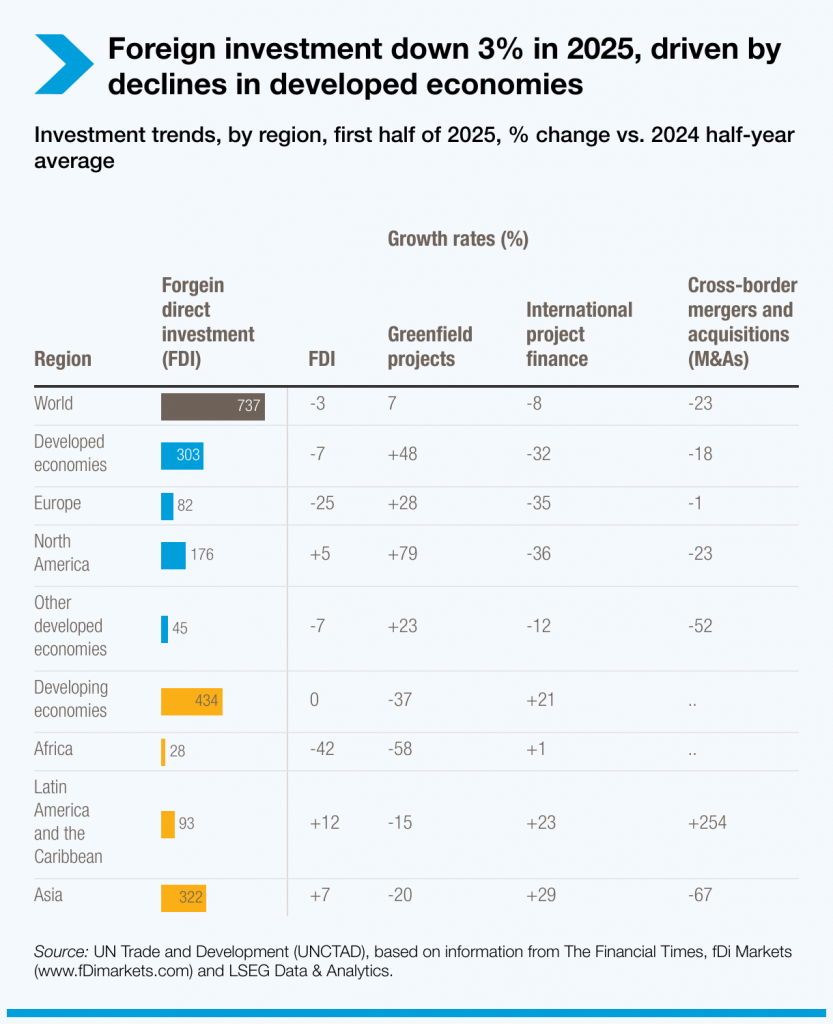

China’s BRI investments in a global comparison

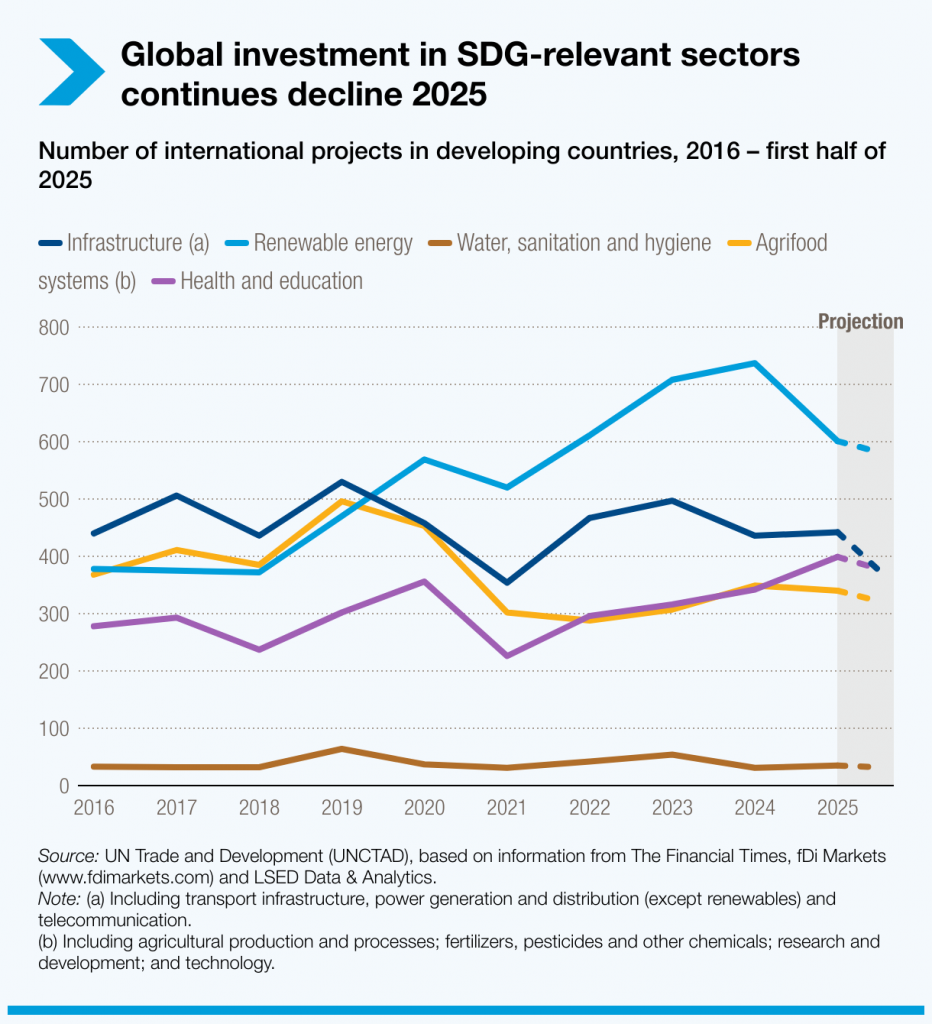

Latest reliable data on FDI in emerging economies encompasses the first half of 2025: fDi markets reports USD 700 billion in worldwide cross-border investment – the third highest capital expenditure figure in a half-year period since 2003. The data show an increase in projects worth over USD 1 billion with a focus on data centers, and semi-conductors projects (together worth nearly USD 300 billion). Meanwhile greenfield FDI in renewable energy shrank from USD 147 billion in the first half of 2024 to USD 83 billion in the first half of 2025.

OECD similarly identified USD 663 billion of FDI in the first half of 2025 , which is a decrease compared to the previous four years (the peak of FDI for a first half of a year was in 2022 and has almost halved since then).

UNCTAD similarly reports a 3% drop of FDI in 2025, driven by a 25% drop in Europe and a 42% drop in Africa . Overall, developing countries received about USD 434 billion in international FDI, similar to the year before. While renewable energy investments were the main source of FDI in emerging economies since 2020, their number dropped slightly in the first half of 2025 (see Figure 17).

Outlook for Belt and Road Initiative (BRI) Finance and Investments

Chinese finance and investments into the Belt and Road Initiative countries in 2025 have accelerated significantly.

For 2026, a further expansion of BRI investments and construction contracts seems possible despite (or because of) global economic headwinds driven by US-led trade impositions. On the one hand, there is clear need for investments to boost growth to support the green transition both in China and in BRI countries. This provides continued opportunities for mining and minerals processing deals, technology deals (e.g., EV manufacturing, battery manufacturing) and green energy (e.g., energy production and transmission). China refers to these industries (electric vehicles, batteries and renewable energy) as the “New Three”.

Furthermore, global trade volatilities and uncertainties can spur investments in supply chain resilience and exploration of new markets by Chinese companies. However, risks emerge due to uncertainty of possible activities by global financial institutions with strong US board presence (e.g., World Bank Group, Asian Development Bank), while China dominated development banks (e.g., AIIB, NDB) should provide infrastructure development opportunities for Chinese contractors.

Nevertheless, I expect Chinese BRI engagement to reach lower levels in 2026 with fewer megadeals.

With strong engagement in sectors requiring significant investment (e.g., mining, manufacturing), and increasing ability to scale energy investment as well as data centers, I expect deal size to also remain large.

About our partner Griffith Asia Institute

Griffith Asia Institute (GAI) at Griffith University, Brisbane, Australia, is an internationally recognized institute providing knowledge, and solutions for sustainable development in Asia-Pacific. With a history of over 20 years, GAI has forged strong partnerships with key decision-makers in business, policy and with research institutions across the region. With over 80 faculty members and 50 adjunct members, GAI works in multidisciplinary teams and draws on a wide range of technical expertise in energy, finance, policy, economics as well as in regional studies including a strong China component (https://www.griffith.edu.au/asia-institute).

GAI is organized in knowledge and regional hubs:

- The Green Transition and Sustainable Development Hub addresses major challenges and opportunities for Asian and Pacific economies in addressing SDGs related to climate, life on land, life in the sea, partnerships, infrastructure and energy.

- The Governance and Diplomacy Hub addresses major challenges and opportunities in the region for peaceful co-existence, diplomacy, inclusive governance, policymaking and institution building.

- The Inclusive Growth and Rural Development Hub addresses major challenges and opportunities in the region regarding currently underserved communities (eg, women, indigenous, youth, rural, or people with disabilities).

- The four regional hubs address major regional and country-specific challenges and opportunities in (1) Southeast Asia, (2) South Asia, (3) Pacific and (4) China and the Region, each with their own hub lead.

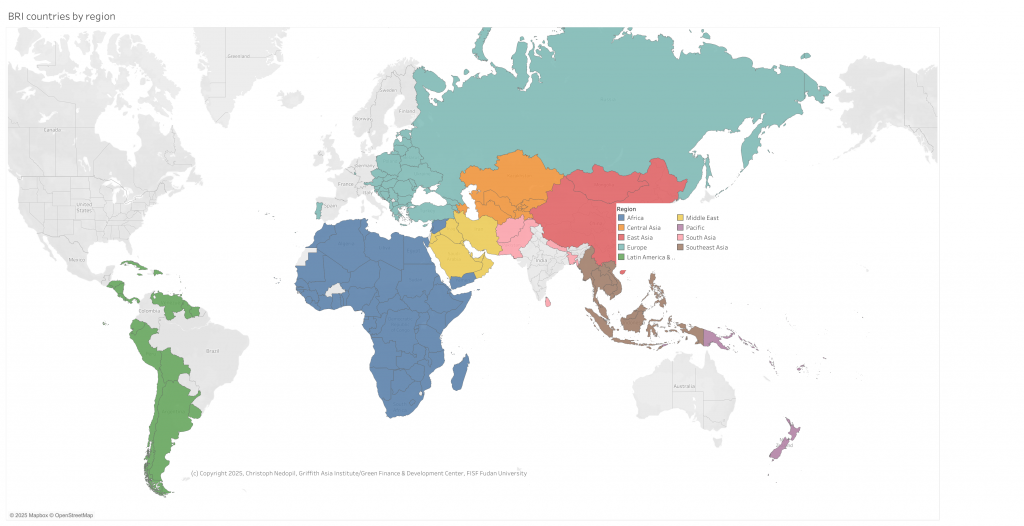

Belt and Road Initiative (BRI) countries by region

The following BRI map shows the list of countries that have signed MoUs or are said to be members of the BRI by region used in this report.

Dr. Christoph NEDOPIL WANG is the Founding Director of the Green Finance & Development Center and a Visiting Professor at the Fanhai International School of Finance (FISF) at Fudan University in Shanghai, China. He is also the Director of the Griffith Asia Institute and a Professor at Griffith University.

Christoph is a member of the Belt and Road Initiative Green Coalition (BRIGC) of the Chinese Ministry of Ecology and Environment. He has contributed to policies and provided research/consulting amongst others for the China Council for International Cooperation on Environment and Development (CCICED), the Ministry of Commerce, various private and multilateral finance institutions (e.g. ADB, IFC, as well as multilateral institutions (e.g. UNDP, UNESCAP) and international governments.

Christoph holds a master of engineering from the Technical University Berlin, a master of public administration from Harvard Kennedy School, as well as a PhD in Economics. He has extensive experience in finance, sustainability, innovation, and infrastructure, having worked for the International Finance Corporation (IFC) for almost 10 years and being a Director for the Sino-German Sustainable Transport Project with the German Cooperation Agency GIZ in Beijing.

He has authored books, articles and reports, including UNDP's SDG Finance Taxonomy, IFC's “Navigating through Crises” and “Corporate Governance - Handbook for Board Directors”, and multiple academic papers on capital flows, sustainability and international development.